Georgia Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors

Description

How to fill out Sample Common Shares Purchase Agreement Between Visible Genetics, Inc. And Investors?

Have you been inside a situation where you will need paperwork for both business or personal functions almost every day? There are a variety of legitimate record web templates accessible on the Internet, but discovering versions you can rely is not easy. US Legal Forms delivers a huge number of kind web templates, just like the Georgia Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors, that happen to be created to fulfill state and federal needs.

Should you be previously familiar with US Legal Forms website and get a merchant account, just log in. Next, you are able to obtain the Georgia Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors format.

Should you not come with an bank account and want to begin using US Legal Forms, follow these steps:

- Obtain the kind you require and ensure it is to the proper town/region.

- Use the Review button to check the form.

- Read the outline to ensure that you have selected the appropriate kind.

- When the kind is not what you`re looking for, make use of the Look for area to obtain the kind that meets your needs and needs.

- When you find the proper kind, click Acquire now.

- Pick the costs strategy you desire, fill in the necessary info to create your account, and pay money for the transaction using your PayPal or credit card.

- Pick a hassle-free document file format and obtain your duplicate.

Discover every one of the record web templates you have purchased in the My Forms menus. You can obtain a further duplicate of Georgia Sample Common Shares Purchase Agreement between Visible Genetics, Inc. and Investors anytime, if needed. Just go through the required kind to obtain or produce the record format.

Use US Legal Forms, probably the most extensive selection of legitimate types, to save lots of some time and stay away from errors. The assistance delivers skillfully made legitimate record web templates that you can use for a range of functions. Produce a merchant account on US Legal Forms and start creating your daily life easier.

Form popularity

FAQ

It contains language to the effect of ?the Seller will sell and transfer to the Purchaser, and the Purchaser will purchase and acquire from the Seller, all of the Shares.? It also sets forth the purchase price, any purchase price adjustments (such as an adjustment to account for variations in target net working capital ...

The first drafts of such documents are usually prepared by counsel to the buyer, except in the context of an auction, in which case it is more usual for counsel to the seller to prepare the first drafts of these documents. The disclosure schedule is prepared by the seller. 2.

The buyer's lawyers will generally prepare the first draft of the share purchase agreement (SPA). However, in addition to precedents which assume that the drafter is acting for the buyer, we also provide precedents for drafters acting for the seller (either preparing a first draft or marking up the buyer's draft).

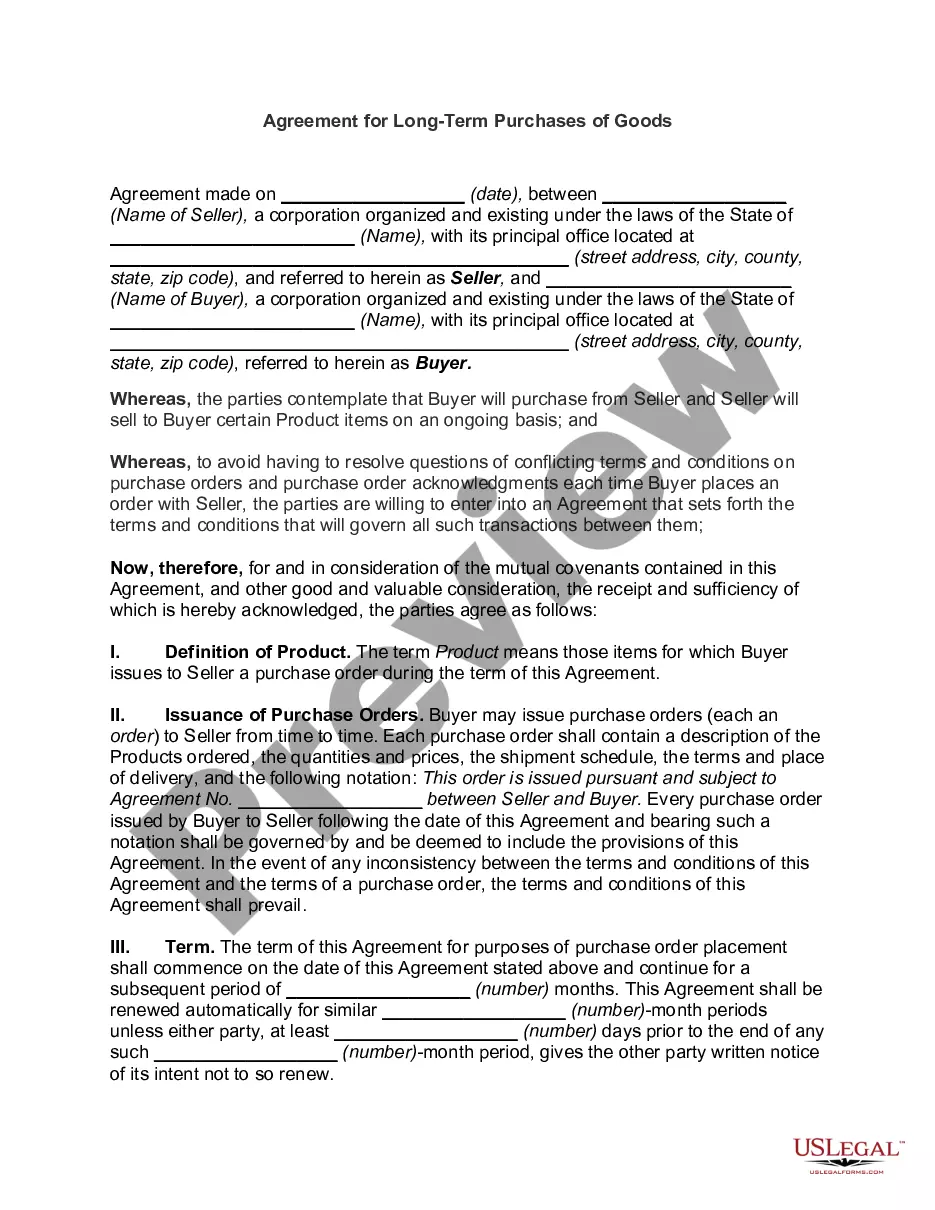

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

The following are listed in a share purchase agreement: Name of the company. Par value of shares. Name of purchaser. Warranties and representations made by seller and purchaser. Employee benefits and bonuses. Number of shares being sold. Details of the transaction. Indemnification agreement for unforeseen costs.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

How to draft a purchase agreement Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

A Share Purchase Agreement generally includes information about: The person selling the shares. The person buying the shares. The number of shares being sold and their value. The company the shares are being transferred from. The number of shares being sold and their value.