Have you ever found yourself in a scenario where you require paperwork for business or personal needs almost daily.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast selection of templates, such as the Georgia Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing that Nonpayment of any Debt Will Result in the Arrest or Imprisonment of any Person, designed to comply with state and federal regulations.

Once you find the correct form, click Acquire now.

Select the pricing plan you prefer, enter the required information to create your account, and complete the purchase using your PayPal, Visa, or Mastercard. Choose a convenient document format and download your copy. Access all of the document templates you have purchased in the My documents list. You can obtain an additional copy of the Georgia Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing that Nonpayment of any Debt Will Result in the Arrest or Imprisonment of any Person anytime, if needed. Just click on the desired form to download or print the template. Utilize US Legal Forms, the largest collection of legal templates, to save time and prevent errors. The service provides professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Georgia Letter Informing Debt Collector of False or Misleading Misrepresentations in Collection Activities - Falsely Representing that Nonpayment of any Debt Will Result in the Arrest or Imprisonment of any Person template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and verify it is suitable for the correct city/state.

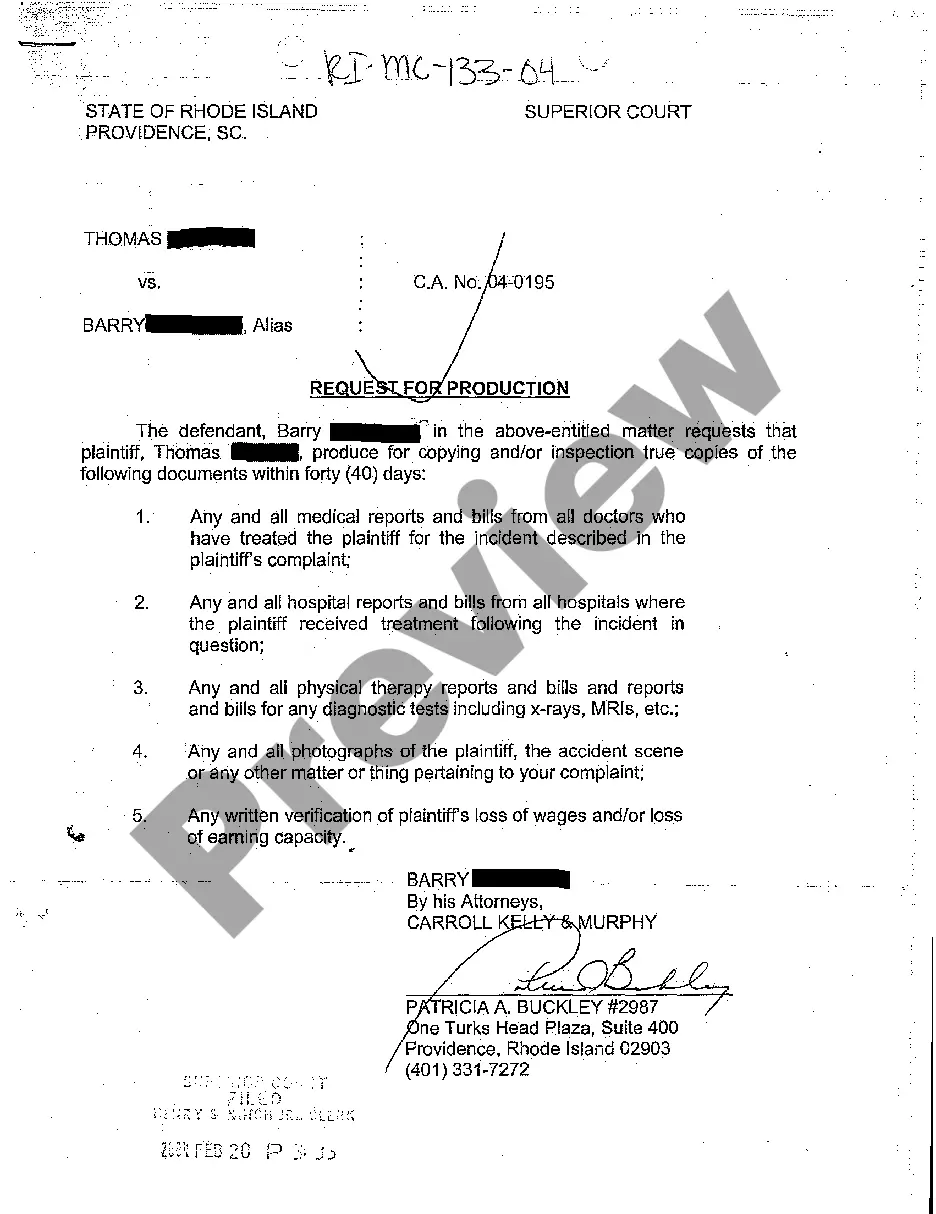

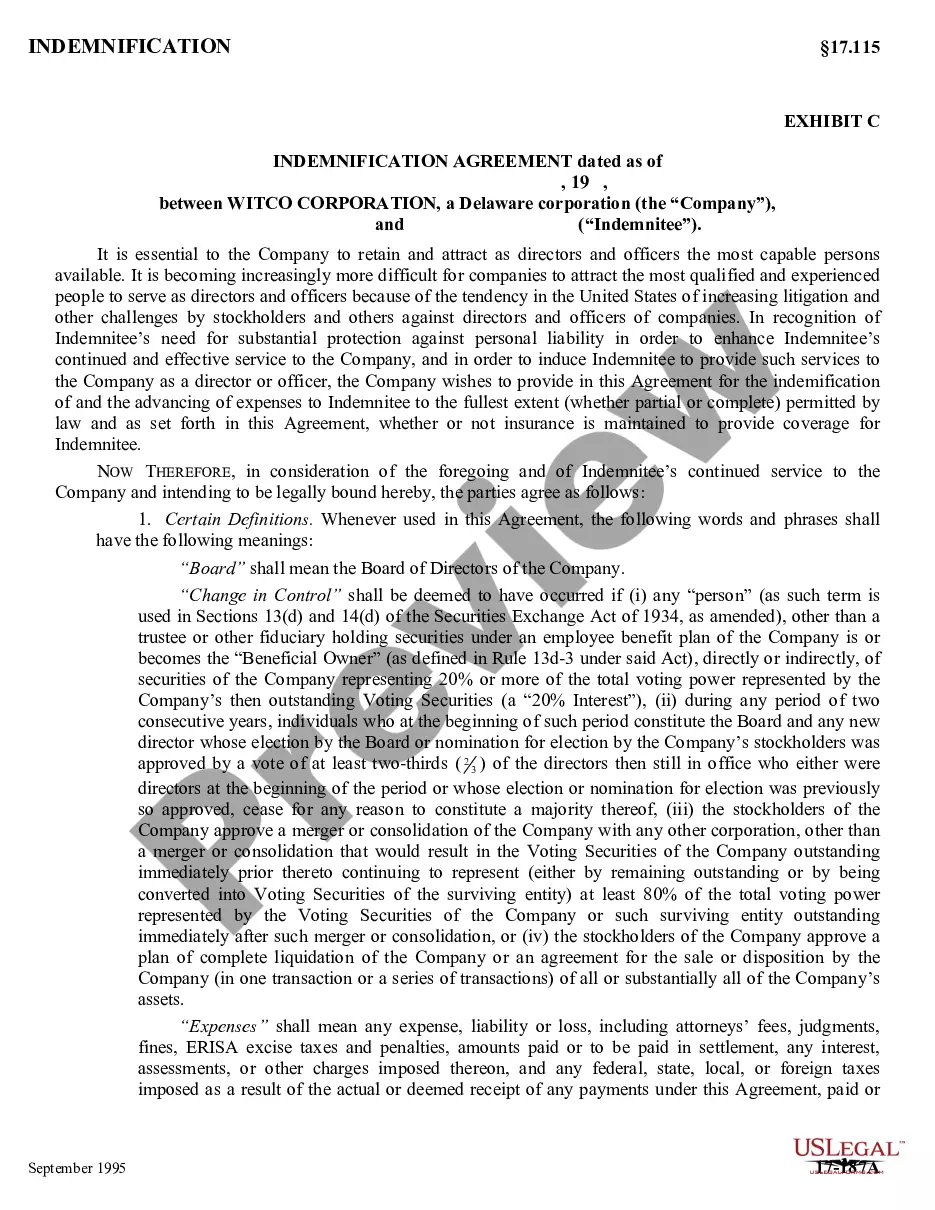

- Utilize the Preview button to view the form.

- Examine the description to ensure that you have selected the correct form.

- If the form does not meet your needs, use the Search area to find the form that suits your requirements.