Georgia Sample Proposed purchase of 300,000 shares with copy of Agreement

Description

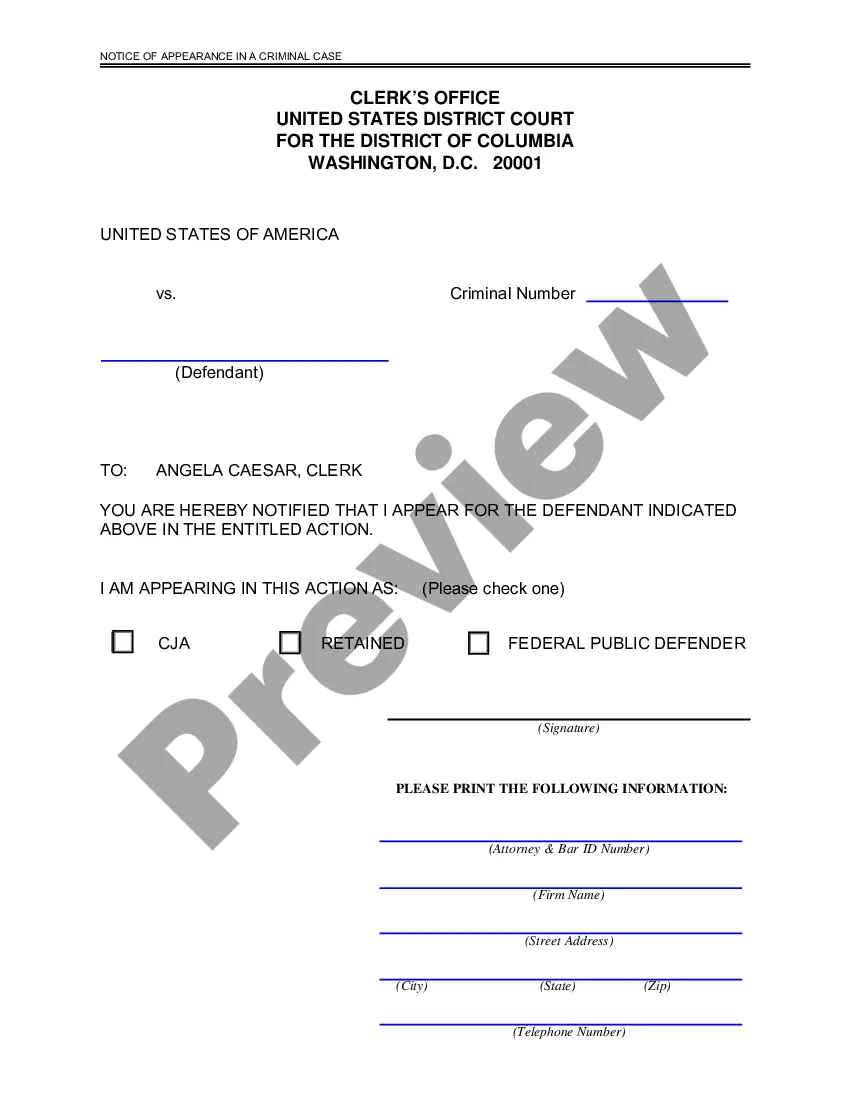

How to fill out Sample Proposed Purchase Of 300,000 Shares With Copy Of Agreement?

If you need to comprehensive, download, or print out lawful file templates, use US Legal Forms, the largest selection of lawful forms, that can be found on-line. Take advantage of the site`s simple and convenient lookup to find the documents you need. Different templates for organization and specific uses are sorted by classes and states, or key phrases. Use US Legal Forms to find the Georgia Sample Proposed purchase of 300,000 shares with copy of Agreement in just a couple of click throughs.

If you are previously a US Legal Forms client, log in in your bank account and click on the Acquire key to get the Georgia Sample Proposed purchase of 300,000 shares with copy of Agreement. Also you can accessibility forms you previously saved inside the My Forms tab of the bank account.

If you are using US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have selected the form for the correct town/land.

- Step 2. Make use of the Preview solution to look through the form`s articles. Do not overlook to read the outline.

- Step 3. If you are not satisfied using the kind, utilize the Lookup discipline near the top of the screen to locate other variations from the lawful kind template.

- Step 4. After you have discovered the form you need, go through the Acquire now key. Pick the pricing program you choose and include your qualifications to sign up on an bank account.

- Step 5. Procedure the purchase. You may use your Мisa or Ьastercard or PayPal bank account to accomplish the purchase.

- Step 6. Find the formatting from the lawful kind and download it on your gadget.

- Step 7. Complete, change and print out or signal the Georgia Sample Proposed purchase of 300,000 shares with copy of Agreement.

Every lawful file template you purchase is the one you have eternally. You possess acces to each and every kind you saved inside your acccount. Click on the My Forms portion and decide on a kind to print out or download again.

Compete and download, and print out the Georgia Sample Proposed purchase of 300,000 shares with copy of Agreement with US Legal Forms. There are millions of specialist and status-specific forms you can use for your organization or specific requires.

Form popularity

FAQ

A share purchase agreement is a formal contract or an agreement that sets out the terms and conditions relating to the sale and purchase of shares in a company. The share purchase agreement should very clearly set out what is being sold, to whom and for how much, as well as any other obligations and liabilities.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

A share purchase agreement typically covers the following key areas: Purchase Price: The price the buyer will pay for the shares. Payment Terms: How and when the buyer will pay for the shares. Representations and Warranties: Statements made by the seller about the company's financial, legal, and operational status.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

Scope of a share purchase agreement The parties to the agreement. Information on the company selling shares. Purchase price of the shares. Title. Timetable for completion. Warranties. Restrictions following completion. Confidentiality requirements.

Here are 11 things to include in a stock purchase agreement. Buyer and Seller Information. The stock purchase agreement opens with an introduction of the buyer and seller. ... Transaction Date and Time. ... Value of Shares. ... Number of Shares Being Sold. ... Representations and Warranties. ... Payment Terms. ... Due Diligence. ... Indemnification.

What Are the Components of a Share Purchase Agreement 1.Name of the company. Par value of shares. 3.Name of purchaser. Warranties and representations made by seller and purchaser. Employee benefits and bonuses. Number of shares being sold. Details of the transaction. Indemnification agreement for unforeseen costs.