Georgia Annual Incentive Compensation Plan

Description

How to fill out Annual Incentive Compensation Plan?

Discovering the right authorized file format might be a have difficulties. Needless to say, there are a lot of layouts available on the Internet, but how can you discover the authorized develop you need? Take advantage of the US Legal Forms web site. The assistance provides thousands of layouts, such as the Georgia Annual Incentive Compensation Plan, that can be used for business and private requires. All of the types are inspected by experts and fulfill state and federal requirements.

In case you are presently authorized, log in for your accounts and then click the Download option to get the Georgia Annual Incentive Compensation Plan. Utilize your accounts to appear with the authorized types you possess ordered formerly. Go to the My Forms tab of your accounts and get yet another copy from the file you need.

In case you are a new end user of US Legal Forms, listed here are easy recommendations that you should stick to:

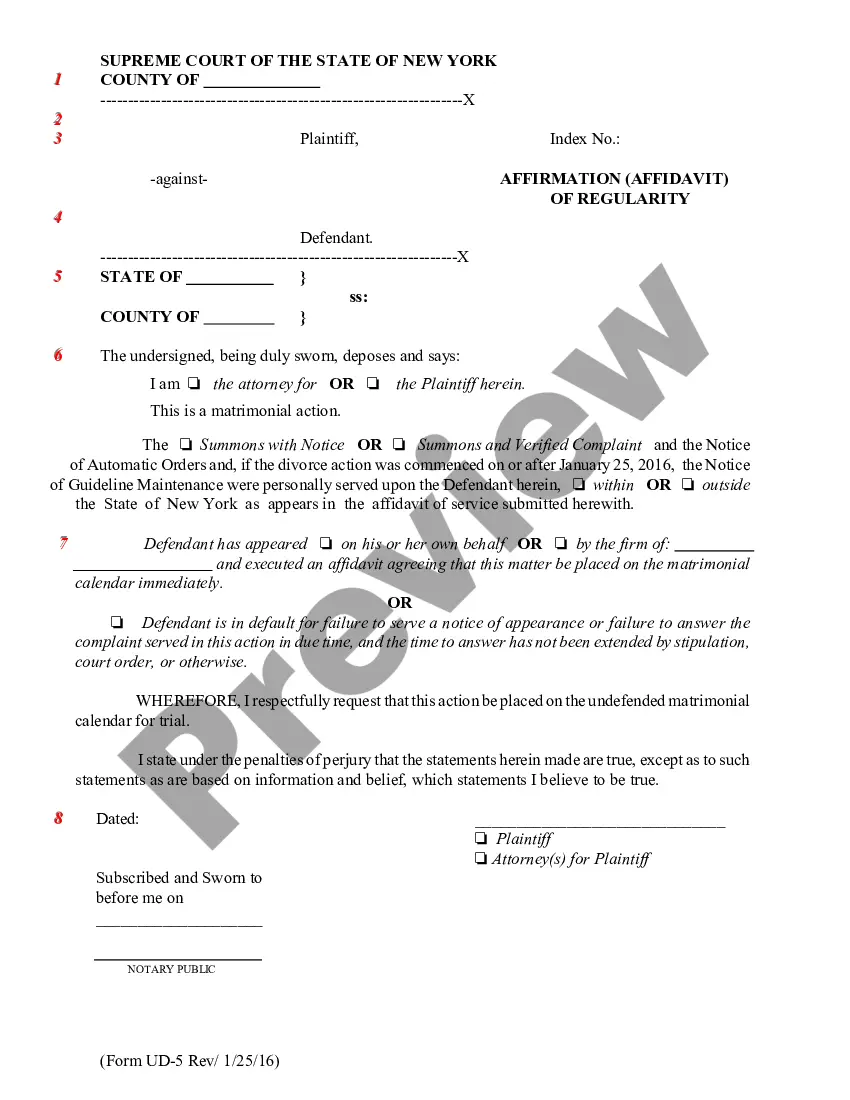

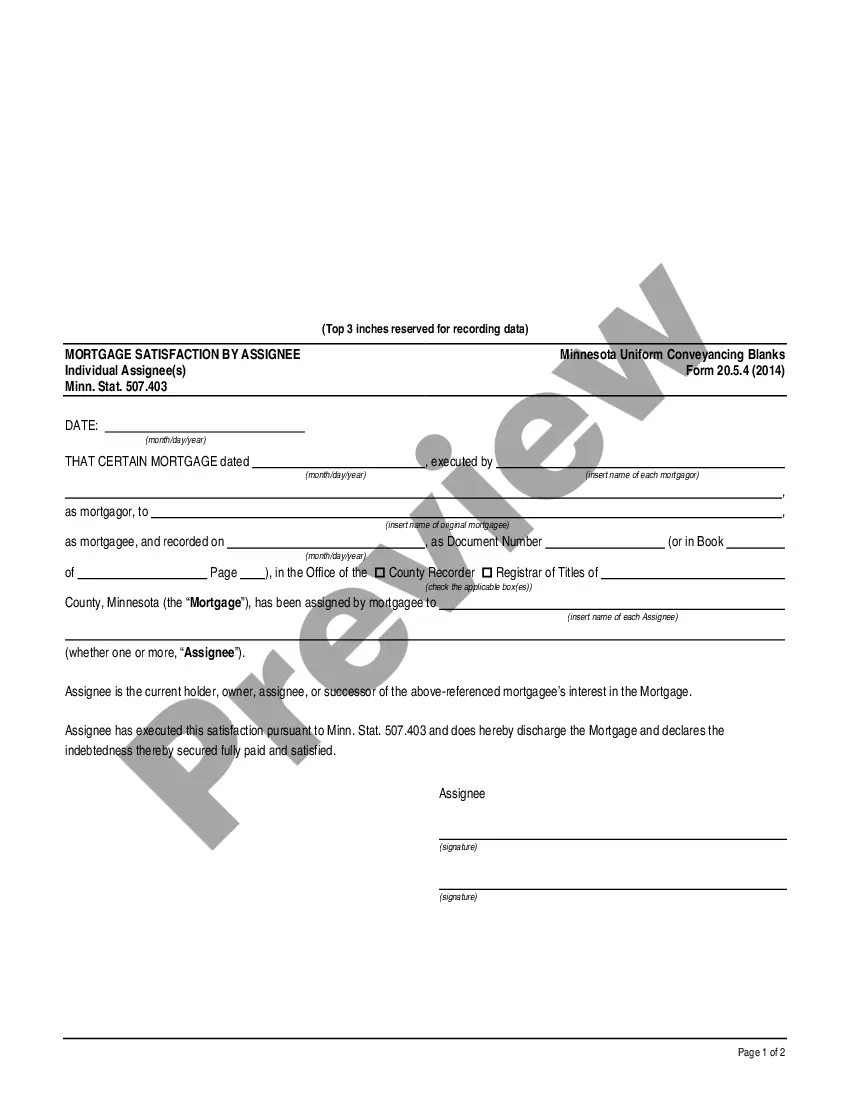

- Initial, ensure you have chosen the right develop for your personal metropolis/region. You can look through the form utilizing the Review option and browse the form explanation to guarantee this is basically the best for you.

- In case the develop will not fulfill your needs, utilize the Seach area to find the proper develop.

- When you are certain that the form is proper, go through the Purchase now option to get the develop.

- Pick the prices plan you desire and enter the needed information and facts. Create your accounts and pay for an order making use of your PayPal accounts or charge card.

- Pick the file formatting and download the authorized file format for your product.

- Full, change and printing and signal the acquired Georgia Annual Incentive Compensation Plan.

US Legal Forms will be the largest local library of authorized types for which you can see a variety of file layouts. Take advantage of the company to download skillfully-manufactured papers that stick to express requirements.

Form popularity

FAQ

Brian P. Kemp's proposed $32.5 billion budget for Fiscal Year (FY) 2024 offers a muted response to deep deficits in the capacity of state government to meet Georgians' needs. The governor forecasts a sharp drop in tax collections from FY 2022 to 2023, and a relatively flat budget in 2024.

Incentive compensation is a form of variable compensation in which a salesperson's (or other employee's) earnings are directly tied to the amount of product they sell, the success of their team, or the organization's success.

The base salary for FY 2024 is $41,092 for 10 months of employment. Governor Kemp has made teacher pay raises a primary education policy goal and successfully led the General Assembly in allocating raises of $3,000 in FY 2020, $2,000 in FY23 and $2,000 for this next year's budget.

With an annual incentive pay plan, employees earn a payout, often expressed in terms of percentage of salary, when they achieve performance-related goals. This payout is in addition to their base pay.

The $2,000 COLA salary increase applies for all active, regular, benefits-eligible faculty and staff at Georgia State. The increase will be prorated based on full-time equivalency (FTE).

Cost of Living Adjustment - Effective 7/1/2023 The 1.5% increase is effective 7/1/2023. Current recipients will see this change on the payment issued on the last banking day of July 2023.

The $32.4 billion total represents a 7% uptick from the 2023 budget of $30.2 billion. Gov. Brian Kemp's budget includes a $2,000 pay raise for state employees and a $500 cost-of-living increase for retirees.

To calculate a sales-based incentive payment, multiply the total sales profit times the percentage of commission. For example, Kiera is responsible for $80,000 in sales for this year. Her sales incentive is 10%, therefore her incentive payment would be $8,000.