Georgia Disclosure of Compensation of Attorney for Debtor - B 203

Description

How to fill out Disclosure Of Compensation Of Attorney For Debtor - B 203?

Choosing the right legal record design could be a have a problem. Obviously, there are plenty of templates available on the net, but how would you find the legal type you want? Take advantage of the US Legal Forms site. The assistance delivers thousands of templates, including the Georgia Disclosure of Compensation of Attorney for Debtor - B 203, that can be used for organization and personal demands. All of the forms are inspected by professionals and meet up with state and federal specifications.

Should you be presently authorized, log in for your profile and then click the Download option to have the Georgia Disclosure of Compensation of Attorney for Debtor - B 203. Use your profile to check through the legal forms you possess purchased in the past. Visit the My Forms tab of the profile and have yet another version of the record you want.

Should you be a fresh user of US Legal Forms, listed below are easy instructions so that you can follow:

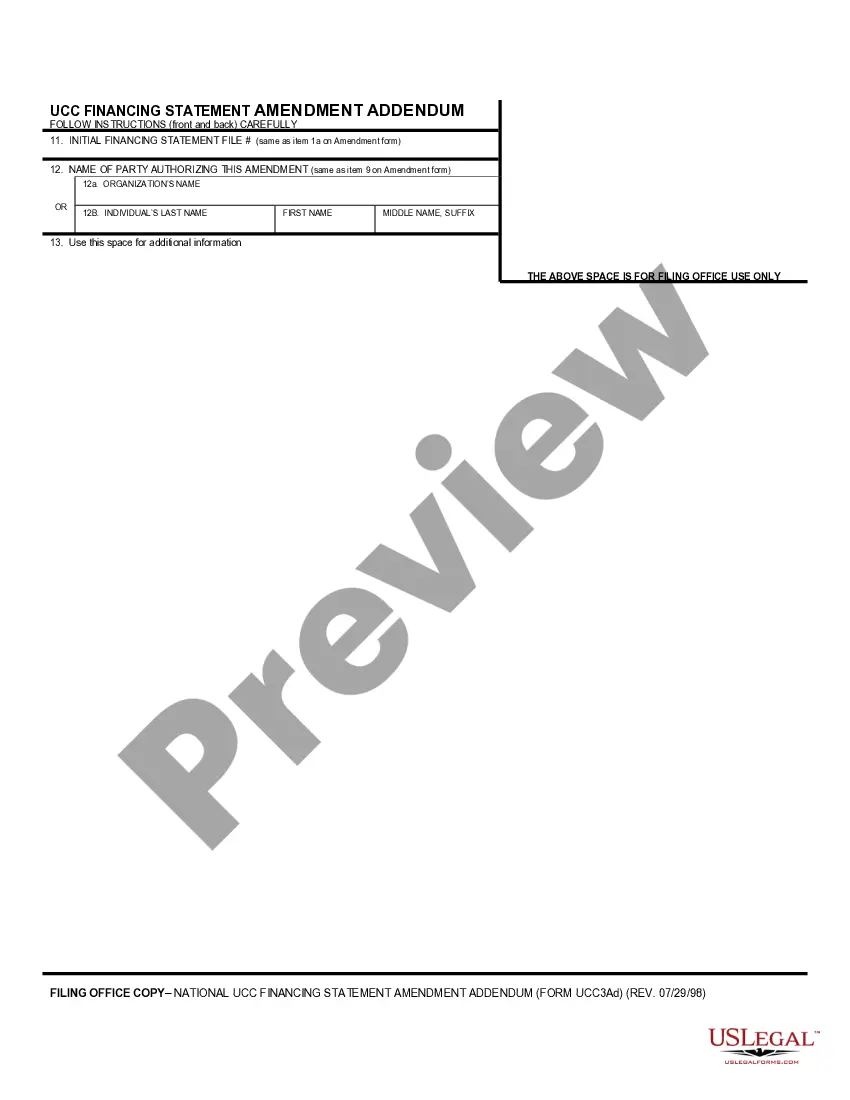

- Very first, make certain you have chosen the right type for the area/county. You can look over the form utilizing the Review option and read the form outline to guarantee this is the right one for you.

- In case the type will not meet up with your expectations, utilize the Seach area to get the right type.

- Once you are certain the form is suitable, select the Buy now option to have the type.

- Choose the costs prepare you would like and enter in the necessary info. Design your profile and buy the order making use of your PayPal profile or bank card.

- Opt for the file format and down load the legal record design for your product.

- Full, modify and printing and indicator the received Georgia Disclosure of Compensation of Attorney for Debtor - B 203.

US Legal Forms is definitely the most significant collection of legal forms in which you can discover a variety of record templates. Take advantage of the service to down load appropriately-created documents that follow status specifications.

Form popularity

FAQ

The general steps to filing a Chapter 7 bankruptcy are: Within 180 days before filing for bankruptcy, you must participate in credit counseling. ... File a petition with the bankruptcy court where you live. ... You must pay the filing fees ($245 case filing fee, $75 administrative fee and a $15 trustee fee).

Usually, most Chapter 7 bankruptcy cases in Georgia are closed and discharged within 4 to 6 months, which means that your unsecured debt can be liquidated in a few months and you can begin to live your life debt free.

There are certain things you cannot do after filing for bankruptcy. For example, you can't discharge debts related to recent taxes, alimony, child support, and court orders. You may also not be allowed to keep certain assets, credit cards, or bank accounts, nor can you borrow money without court approval.

Exemptions During a Chapter 7 Bankruptcy in Georgia When you file for Chapter 7 bankruptcy, the state of Georgia allows a $5,000 car exemption. This means that if you have less than $5,000 of equity in your car, you will be able to keep it. In addition, Georgia allows a wild card exemption of up to $5,000.

How To File Chapter 7 Bankruptcy in 10 Steps Collect Your Documents To Assess Your Finances & Debts. Take the Required Credit Counseling Course From an Approved Provider. Complete the Required Bankruptcy Forms. Get Your Filing Fee. Print and Double-Check Your Bankruptcy Forms.