Georgia Receipt and Withdrawal from Partnership

Description

How to fill out Receipt And Withdrawal From Partnership?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast array of legal templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Georgia Receipt and Withdrawal from Partnership within moments.

If you have a monthly membership, Log In to download the Georgia Receipt and Withdrawal from Partnership from the US Legal Forms library. The Download button will appear on each form you view.

Once you are satisfied with the form, confirm your choice by clicking the Get now button. Then, choose your preferred payment plan and provide your information to create an account.

Complete the process by making the payment using a credit card or PayPal account. Select the format and download the form to your device. Make adjustments as needed. Fill out, edit, print, and sign the downloaded Georgia Receipt and Withdrawal from Partnership.

Every document you add to your account has no expiration date and is yours permanently. Therefore, to download or print another copy, simply go to the My documents section and click on the form you require. Access the Georgia Receipt and Withdrawal from Partnership with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements.

- Access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple steps to begin.

- Ensure you have selected the correct form for your city/county.

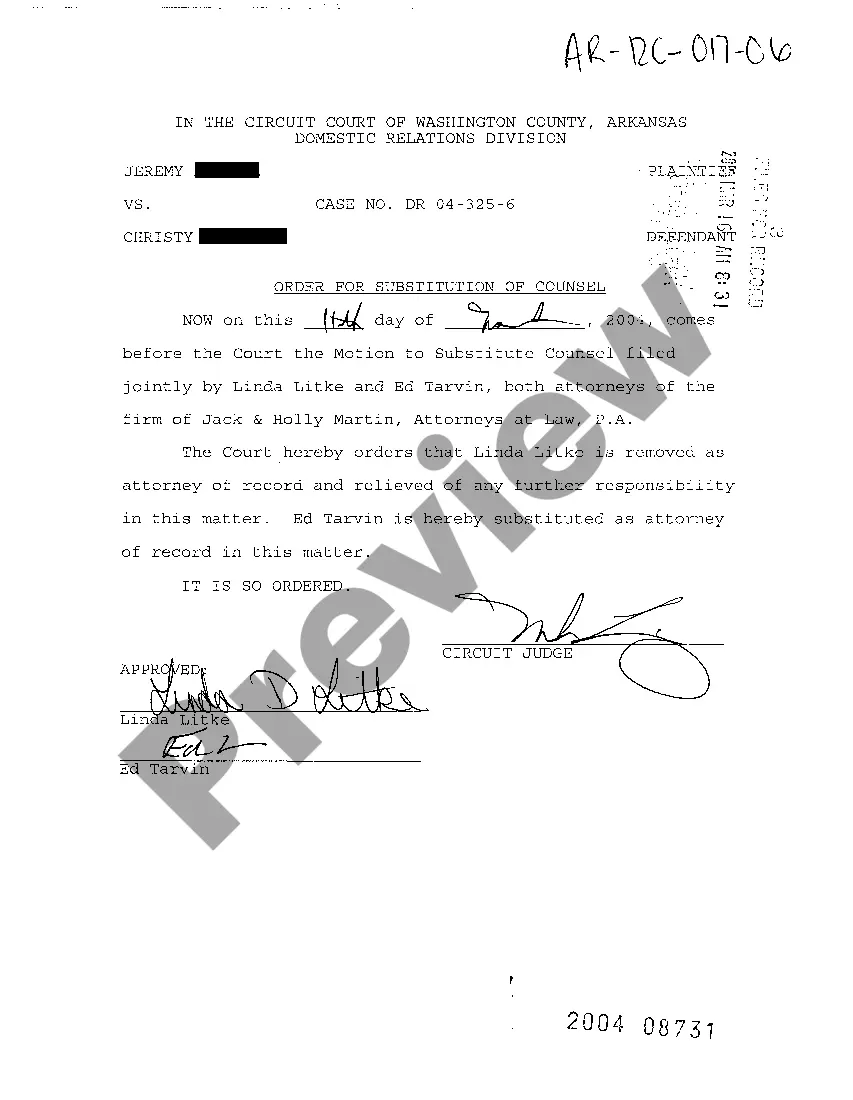

- Click the Preview button to review the contents of the form.

- Read the form description to confirm that you have chosen the correct document.

- If the form does not fit your needs, use the Search box at the top of the screen to find one that does.

Form popularity

FAQ

In a normal partnership, when one partner withdraws, or leaves the company, the partnership dissolves.

Georgia law gives you the option to file a statement of winding up with the Secretary of State ("SOS"). This can be a very simple document providing the name of the LLC and a statement that the company has dissolved and commenced winding up activities.

(d) Except as otherwise provided in the articles of organization or a written operating agreement, a member may withdraw from the limited liability company at any time by giving written notice to the other members at least 30 days in advance of his or her withdrawal or such other notice as is provided for in a written

To resign, the Georgia registered agent must give written notice to the company from which they are resigning. Then, the agent must submit a Statement of Resignation of Registered Agent in-person, online or by mail to the Georgia Secretary of State, Corporations Division.

As the owner of a single-member LLC, you don't get paid a salary or wages. Instead, you pay yourself by taking money out of the LLC's profits as needed. That's called an owner's draw. You can simply write yourself a check or transfer the money from your LLC's bank account to your personal bank account.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.

In California, a general partnership is an association of two or more persons, acting as co-owners of a business for profit. Any partner in a partnership is free to dissociate, or leave the partnership, at any time.

Withdrawal from a partnership is achieved by serving a written notice ending the involvement of a particular partner in the partnership for one reason or another. There are two kinds of withdrawals: Voluntary withdrawal is when a partner chooses to leave the partnership and is serving notice on the other partner(s).

When one partner wants to leave the partnership, the partnership generally dissolves. Dissolution means the partners must fulfill any remaining business obligations, pay off all debts, and divide any assets and profits among themselves. Your partners may not want to dissolve the partnership due to your departure.

To dissolve a partnership, four accounting steps must be executed: the sale of noncash assets; allocating profits or losses on the sale; paying off liabilities; distributing remaining cash to partners according to their account balances at the end of the relationship.