This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Georgia Notice of Non-Responsibility of Wife for Debts or Liabilities

Description

How to fill out Notice Of Non-Responsibility Of Wife For Debts Or Liabilities?

It is feasible to spend hours online looking for the authentic document template that meets the federal and state requirements you will require.

US Legal Forms provides a vast array of authentic forms that are assessed by professionals.

You can easily download or print the Georgia Notice of Non-Responsibility of Wife for Debts or Liabilities from our service.

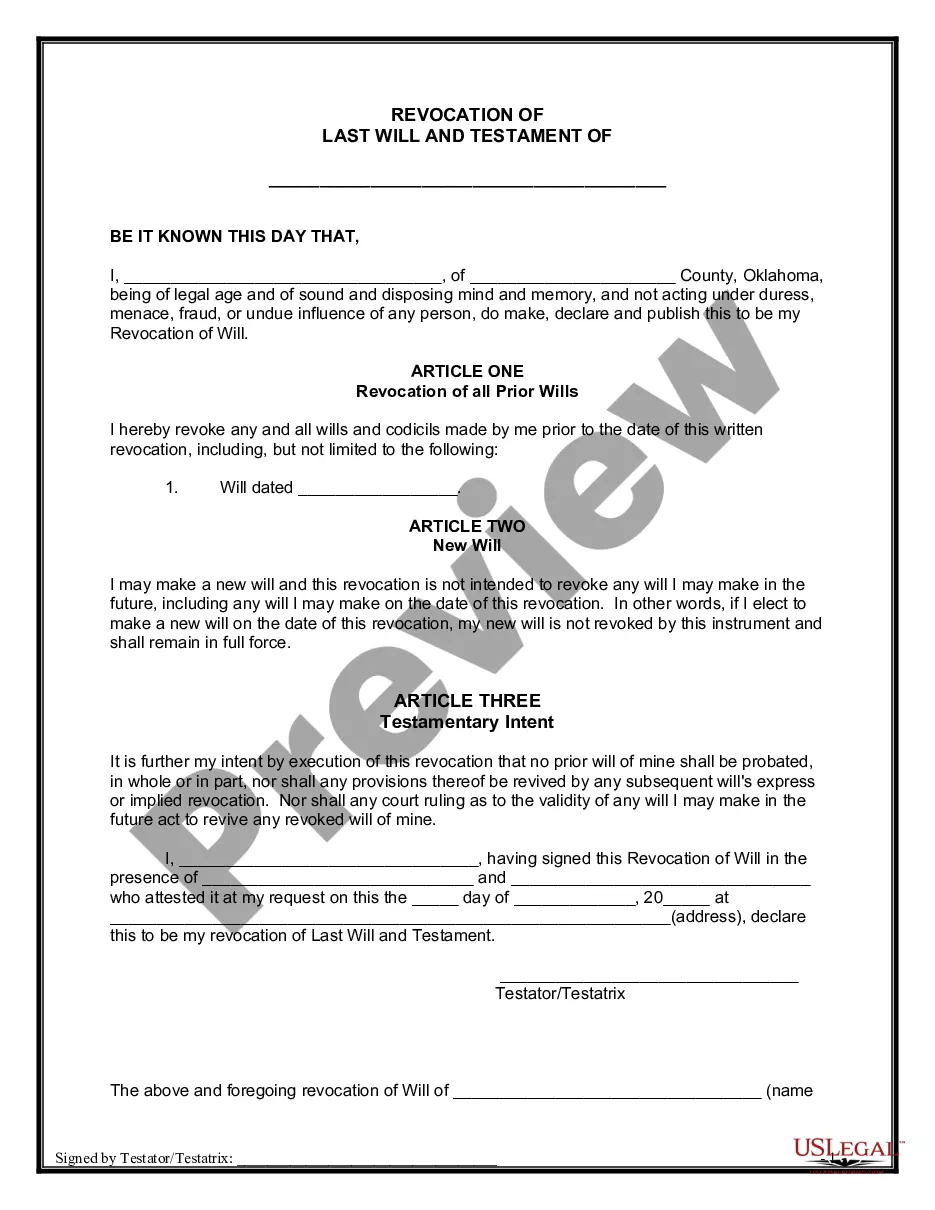

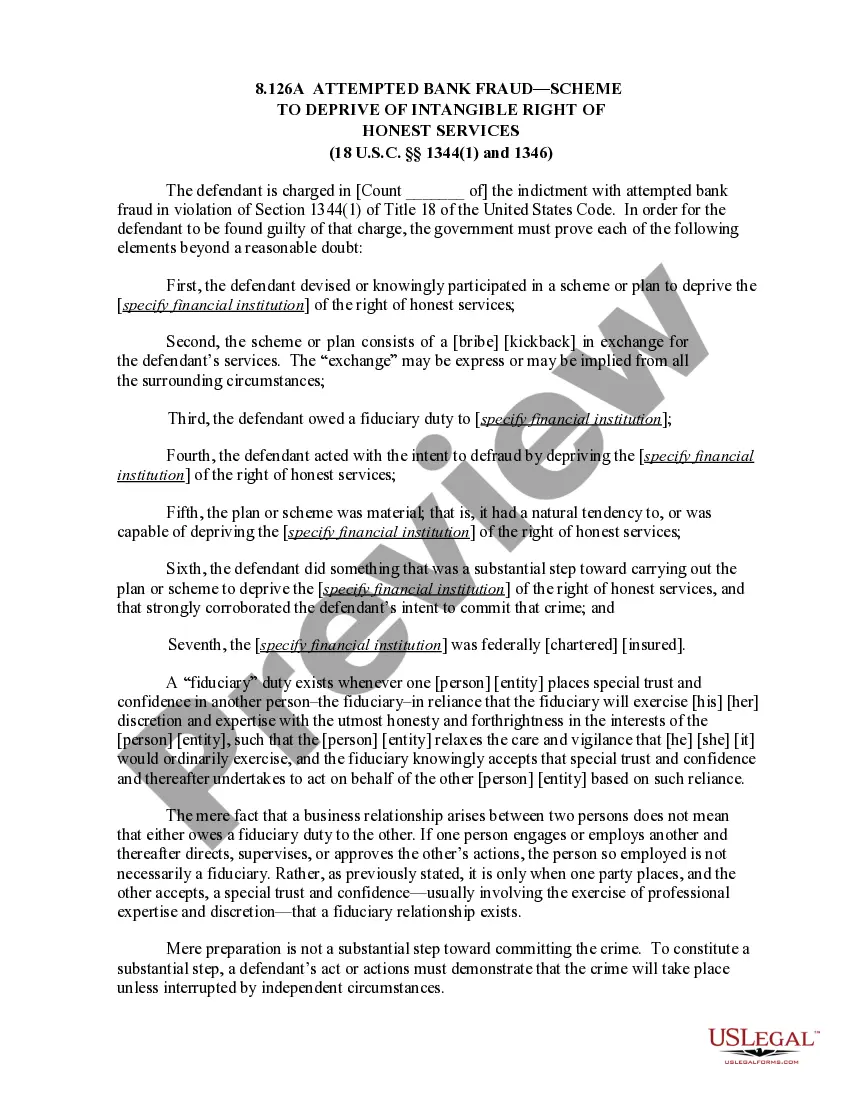

If available, use the Review button to browse the document template as well.

- If you have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Georgia Notice of Non-Responsibility of Wife for Debts or Liabilities.

- Each authentic document template you purchase is your property forever.

- To obtain an additional copy of a purchased form, go to the My documents tab and click the related button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for your state/city.

- Examine the form description to verify you have chosen the appropriate form.

Form popularity

FAQ

In Georgia, a wife is typically not responsible for her husband's debts, thanks to the Georgia Notice of Non-Responsibility of Wife for Debts or Liabilities. This document allows a wife to formally declare that she is not liable for any debts her husband incurs. By filing this notice, a wife can protect her financial interests and personal credit. If you are navigating these complexities, consider utilizing US Legal Forms to access templates and guidance tailored to your needs.

In most cases, you cannot be held liable for your spouse's debt if you have filed a Georgia Notice of Non-Responsibility of Wife for Debts or Liabilities. By taking this action, you effectively distance yourself from any financial obligations your spouse may have. It’s wise to stay informed about your rights to secure your financial well-being.

You are not legally responsible for your wife's debt if you have appropriate protections in place, such as filing a Georgia Notice of Non-Responsibility of Wife for Debts or Liabilities. This legal tool helps clarify that you do not accept any liability for debts incurred by your spouse. Always consult with a legal expert to ensure that you are adequately protected.

Creditors typically cannot collect from you for your wife's debt if you have filed a Georgia Notice of Non-Responsibility of Wife for Debts or Liabilities. This document serves as an important legal statement that declares you are not liable for your wife's financial obligations. It's essential to understand your rights and take proactive steps to protect them.

Generally, a debt collector cannot pursue you for your spouse's debt due to the protections offered under the Georgia Notice of Non-Responsibility of Wife for Debts or Liabilities. This notice can effectively safeguard you from assuming responsibility for your spouse's obligations. However, it is crucial to ensure that the proper notice is filed to establish your non-responsibility clearly.

The term non-liable spouse describes a partner who does not have legal responsibility for debts, debts that are solely attributed to their spouse. The Georgia Notice of Non-Responsibility of Wife for Debts or Liabilities reinforces this concept, aiding in the protection of financial interests. This clarification can be vital in managing personal and joint finances. For peace of mind, ensure you have the necessary legal documents in place.

liable spouse refers to a partner who is not responsible for certain debts incurred by the other spouse. In Georgia, under the Georgia Notice of NonResponsibility of Wife for Debts or Liabilities, your legal status can shield you from such liabilities. This designation is crucial for financial independence and security. To ensure your rights are protected, it's advisable to document your nonobligated status formally.

Typically, the IRS cannot pursue your spouse for your personal tax debts, especially if they have not signed joint tax returns. The Georgia Notice of Non-Responsibility of Wife for Debts or Liabilities can further reinforce this separation of financial responsibilities. It's important to maintain clarity regarding tax obligations to protect your spouse. If issues arise, consulting a tax professional can provide guidance.

obligated spouse is someone who is not legally responsible for their partner's debts. In Georgia, the Georgia Notice of NonResponsibility of Wife for Debts or Liabilities helps clarify this status. It allows individuals to protect themselves from their spouse's financial liabilities. Understanding your obligations can lead to better financial planning and reduce stress.

In Georgia, you are not automatically responsible for your spouse's debts incurred before your marriage. Under the Georgia Notice of Non-Responsibility of Wife for Debts or Liabilities, you can assert your non-obligation for your spouse's financial responsibilities. This can be particularly helpful if your spouse accumulates significant debt. However, joint debts or debts incurred during the marriage may still affect both parties.