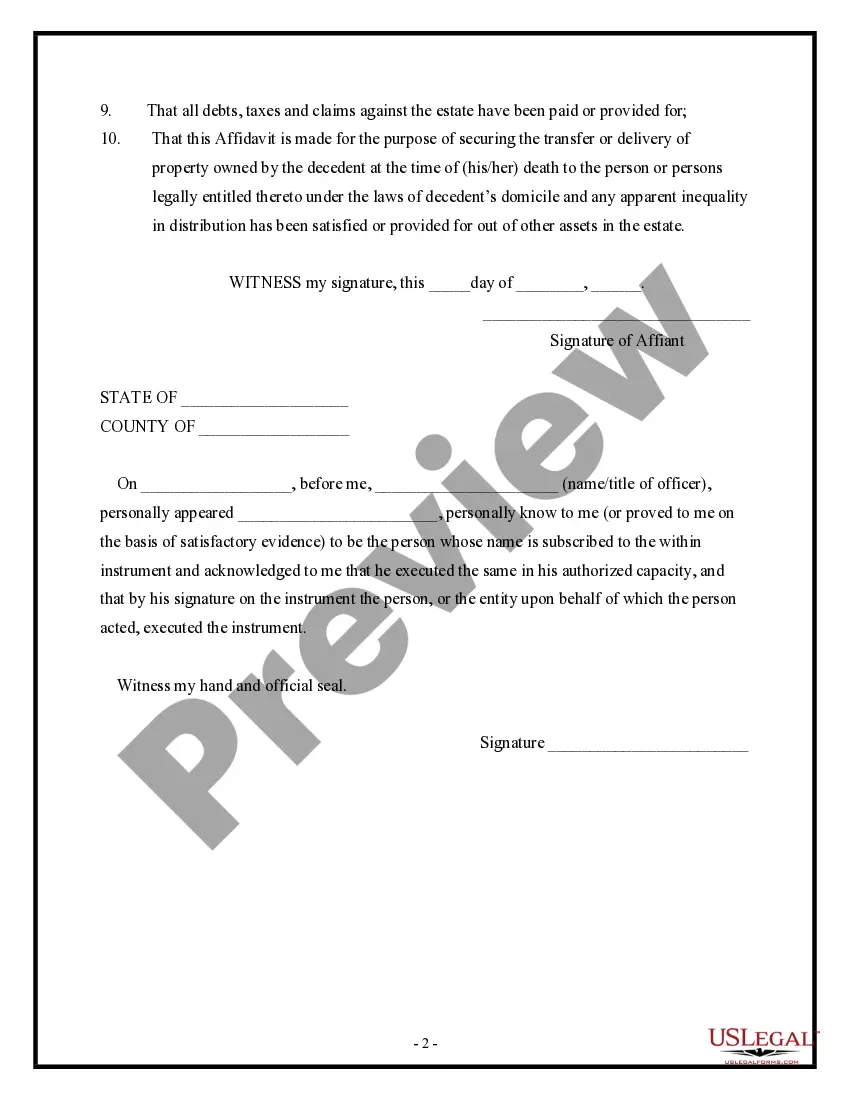

Georgia Affidavit of Domicile

Description

How to fill out Affidavit Of Domicile?

Choosing the best legal record template might be a struggle. Needless to say, there are a lot of layouts available on the net, but how would you get the legal form you want? Use the US Legal Forms website. The services delivers a large number of layouts, including the Georgia Affidavit of Domicile, which you can use for company and personal demands. All the forms are checked out by professionals and satisfy federal and state demands.

Should you be currently authorized, log in in your accounts and click on the Download switch to obtain the Georgia Affidavit of Domicile. Make use of your accounts to look with the legal forms you might have ordered earlier. Check out the My Forms tab of your respective accounts and acquire yet another backup in the record you want.

Should you be a brand new end user of US Legal Forms, listed here are easy instructions for you to follow:

- Very first, ensure you have selected the right form for your area/state. You are able to look through the form making use of the Preview switch and browse the form description to ensure it will be the right one for you.

- If the form does not satisfy your expectations, make use of the Seach discipline to discover the correct form.

- When you are sure that the form is proper, go through the Acquire now switch to obtain the form.

- Opt for the pricing plan you desire and enter the necessary info. Make your accounts and pay money for the order utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the submit format and acquire the legal record template in your gadget.

- Comprehensive, edit and produce and signal the acquired Georgia Affidavit of Domicile.

US Legal Forms will be the most significant catalogue of legal forms in which you can find different record layouts. Use the service to acquire appropriately-manufactured papers that follow state demands.

Form popularity

FAQ

Am I a resident of Georgia? Residents are individuals who have lived in Georgia for the entire year.

Under the Official Code of Georgia (OCGA) 9-14-48, affidavits are documents that contain statements that are sworn to be true.

A foreign citizen can become a permanent resident by investing at least $300,000 in Georgia by purchasing non-agricultural land, apartment, commercial area, etc. The duration of this residence permit is five years.

A notarized affidavit of residence is a legal document completed by an affiant and signed by a notary. This document is typically requested by various agencies to indicate your current place of residence.

An individual is recognised as a tax resident of Georgia if one was actually located in Georgia for 183 days or more in any continuous 12-month period ending in the current tax year. The status of resident or non-resident is established for each tax period.

If a person resided in Georgia for 183 days or longer over any consecutive 12-month period concluding in the current tax year, they are recognized as Georgia tax residents. For each tax period, the resident or non-resident status is determined.

The domicile of every person who is of full age and is laboring under no disability is the place where the family of the person permanently resides, if in this state. If a person has no family or if his family does not reside in this state, the place where the person generally lodges shall be considered his domicile.

You must spend 183 total days physically present in Georgia in any 12 month period. After that you are automatically a tax resident of Georgia for the whole year.