Georgia Line of Credit Promissory Note

Description

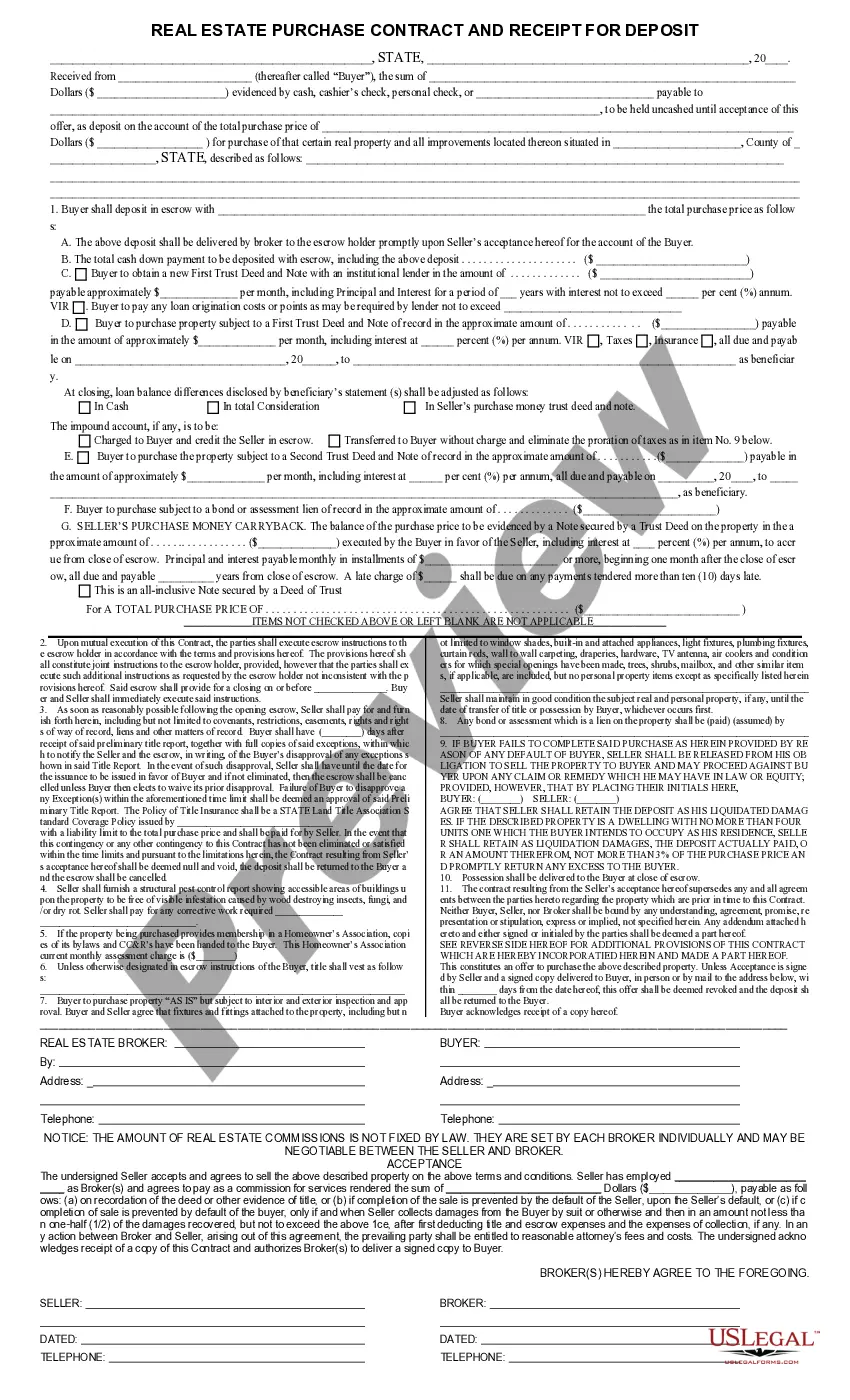

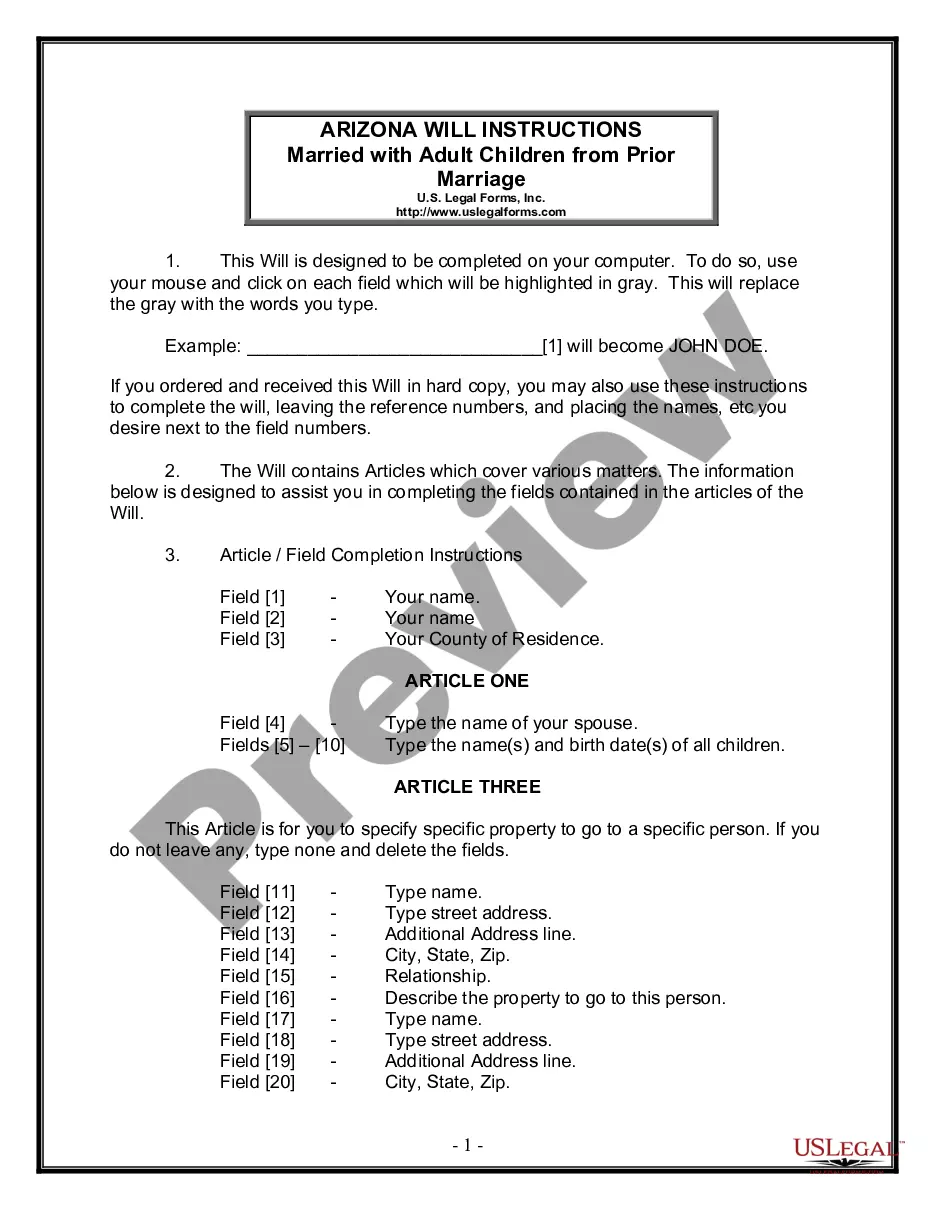

How to fill out Line Of Credit Promissory Note?

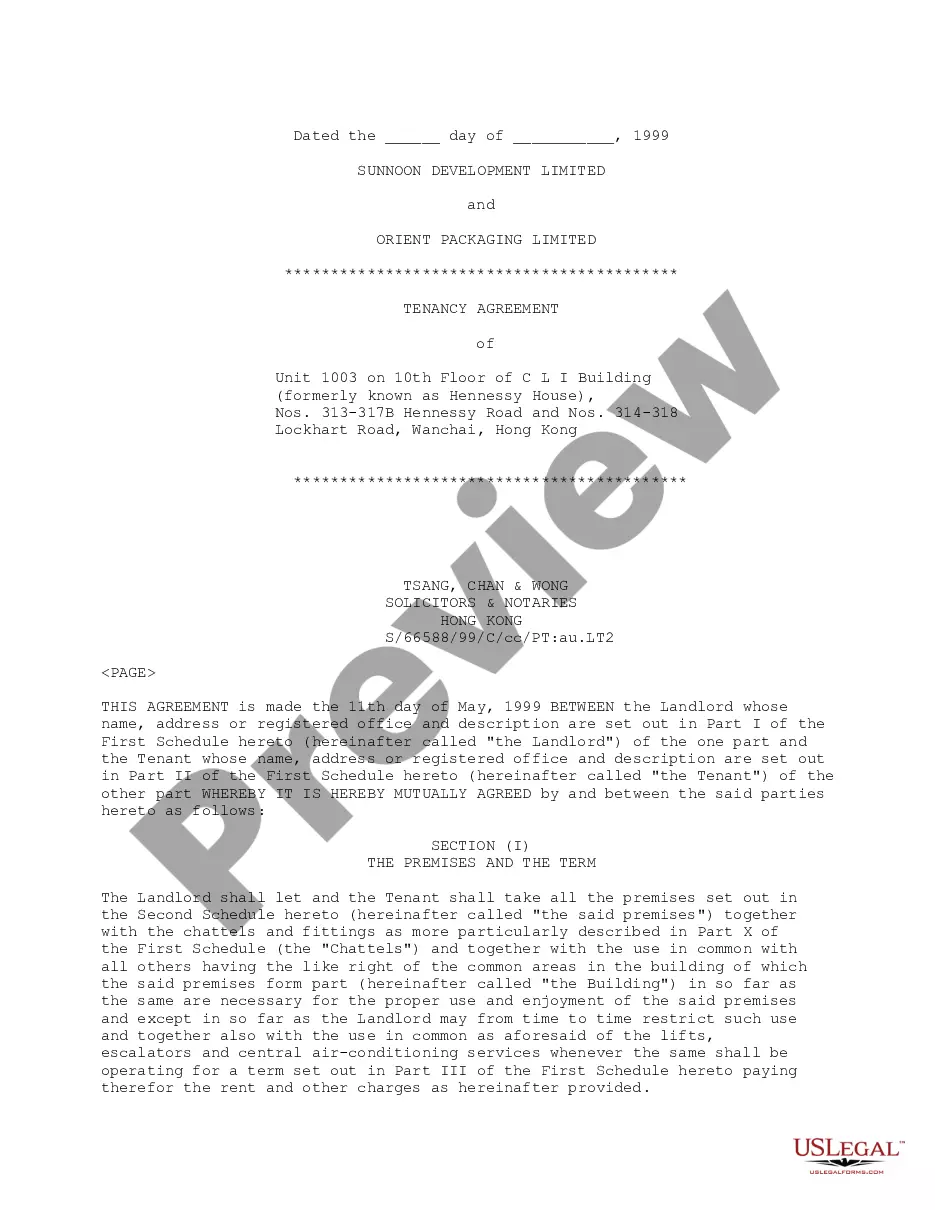

Are you currently in the position that you will need paperwork for both business or personal functions virtually every day? There are a lot of legitimate papers layouts available on the net, but locating versions you can trust isn`t straightforward. US Legal Forms gives thousands of type layouts, like the Georgia Line of Credit Promissory Note, that happen to be published to fulfill federal and state demands.

Should you be presently acquainted with US Legal Forms web site and also have an account, just log in. Following that, it is possible to down load the Georgia Line of Credit Promissory Note format.

Should you not offer an profile and want to begin using US Legal Forms, abide by these steps:

- Find the type you will need and make sure it is to the correct city/region.

- Take advantage of the Preview option to examine the shape.

- See the description to actually have chosen the appropriate type.

- In the event the type isn`t what you are searching for, make use of the Search industry to find the type that meets your needs and demands.

- When you obtain the correct type, simply click Acquire now.

- Select the prices prepare you desire, submit the desired details to make your account, and pay for the order making use of your PayPal or Visa or Mastercard.

- Select a convenient paper formatting and down load your duplicate.

Get every one of the papers layouts you may have bought in the My Forms food list. You can obtain a extra duplicate of Georgia Line of Credit Promissory Note at any time, if necessary. Just go through the required type to down load or produce the papers format.

Use US Legal Forms, by far the most considerable assortment of legitimate kinds, to conserve efforts and prevent errors. The assistance gives skillfully manufactured legitimate papers layouts that you can use for a variety of functions. Make an account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

What is a HELOC note? It's a promissory note, which creates a legal agreement obligating a borrower to repay a debt to a lender. Signing off on a HELOC promissory note conveys responsibilities to you as the borrower and extends rights to the lender. Both are important if you're considering a home equity line of credit.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

You'll get a statement showing the amount owing on your line of credit each month. You must make a minimum payment each month. Usually, this payment is equal to the monthly interest. However, paying only the interest means that you'll never pay off the debt that you owe.

A line of credit is a flexible loan from a bank or financial institution. Similar to a credit card with a set credit limit, a line of credit is a defined amount of money that you can access as needed and use as you wish. Then, you can repay what you used immediately or over time.

A letter of credit is also sometimes called a documentary credit. It is a promissory note provided by a financial institution, such as a bank or Non-Banking Financial Company (NBFC). It assures sellers that their payment will be paid on time and in full.

Understanding Credit Lines All LOCs consist of a set amount of money that can be borrowed as needed, paid back, and borrowed again. The amount of interest, size of payments, and other rules are set by the lender.

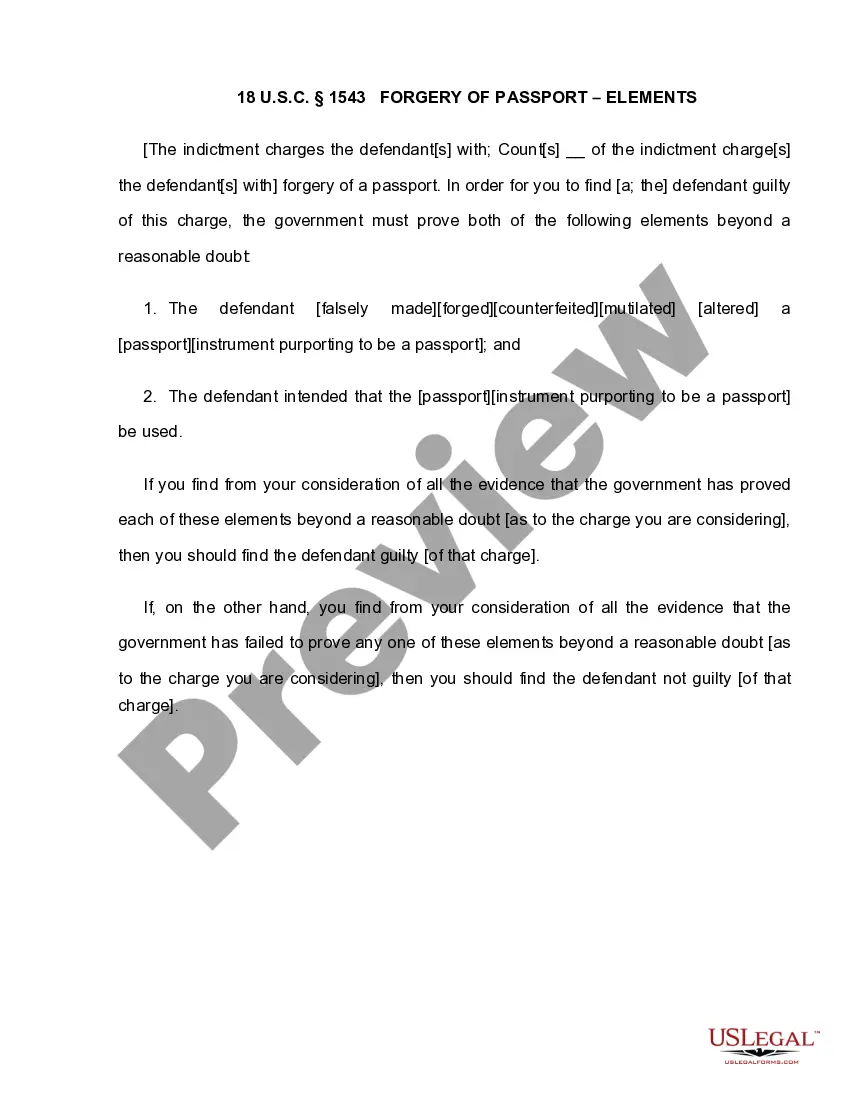

A promissory note could become invalid if: It isn't signed by both parties. The note violates laws. One party tries to change the terms of the agreement without notifying the other party.

A home mortgage secures a promissory note with the title to the property as collateral. This is done in case the lender ever needs to foreclose and sell the property because the homeowner didn't make their loan payments. Your lender will keep the original promissory note until your loan is paid off.

A form of promissory note to be used to evidence advances under an uncommitted line of credit when the lender uses a line of credit confirmation letter instead of a separate line of credit agreement and the parties are not contemplating a negotiable instrument.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.