Georgia Right of First Refusal Clause for Shareholders' Agreement

Description

How to fill out Right Of First Refusal Clause For Shareholders' Agreement?

Are you in the location where you sometimes need documents for either business or personal activities almost every time.

There are numerous valid document templates accessible online, but finding reliable ones is not straightforward.

US Legal Forms provides thousands of form templates, like the Georgia Right of First Refusal Clause for Shareholders' Agreement, which can be drafted to comply with state and federal standards.

Once you find the suitable form, click on Buy now.

Select the payment plan you prefer, complete the required details to create your account, and process the payment using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterwards, you can download the Georgia Right of First Refusal Clause for Shareholders' Agreement template.

- If you do not have an account and wish to utilize US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to your specific city/state.

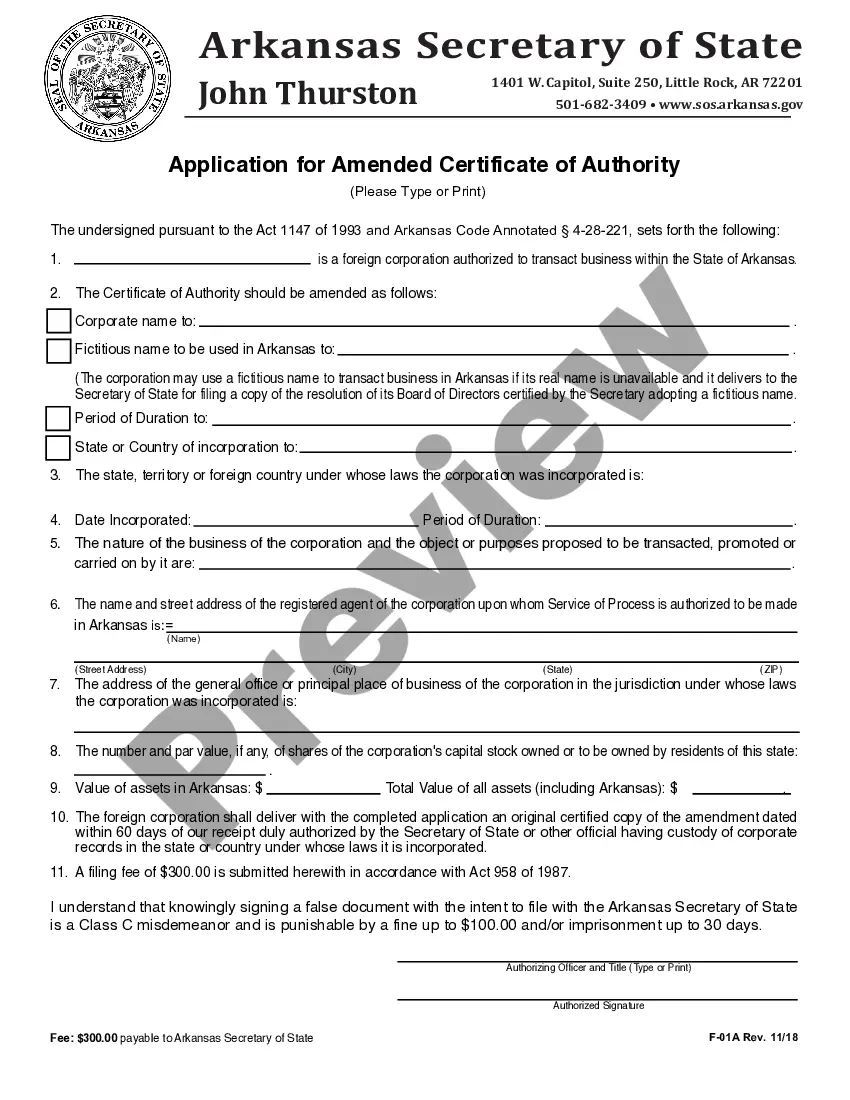

- Use the Review button to scrutinize the document.

- Check the description to confirm that you have selected the correct form.

- If the form isn’t what you are looking for, use the Look for field to find the form that meets your needs and requirements.

Form popularity

FAQ

A right of first refusal is a fairly common clause in some business contracts that essentially gives a party the first crack at making an offer on a particular transaction.

Once that is done the ROFR holder has the option of purchasing the property instead or waiving their ROFR and allowing another sale to go through. To get to closing, a title company has to have a signed Waiver of Right of First Refusal document in the file before funding can occur.

Right of first refusal (ROFR), also known as first right of refusal, is a contractual right to enter into a business transaction with a person or company before anyone else can. If the party with this right declines to enter into a transaction, the obligor is free to entertain other offers.

Most of us are familiar with the right of first refusal (ROFR) but not with the right of first offer (ROFO). Generally, a ROFR is advantageous to the purchaser and the ROFO is advantageous to the seller.

Rights of first refusal clauses are similar to options contracts as the holder has the right, but not the obligation, to enter into a transaction that generally involves an asset. The person with this right has the opportunity to establish a contract or an agreement on an asset before others can.

A contractual right that requires an asset holder in a company to offer to sell its asset to the right holder before offering to sell it to third parties.

A right of first refusal, different from a right of first offer, gives the right holder the option to match an offer already received by the seller. A right of first offer is said to favor the seller, while a right of first refusal favors the buyer.

A right of first offer (ROFO) allows someone the opportunity to make the first move when a homeowner is looking to sell. Unlike a right of first refusal where an owner may be obligated to sell to the potential buyer under the original contract's terms, the seller is still free to market the property for sale to others.

Written agreement that allowed a right of first refusal to be assigned only with the written con- sent of the grantor, a college). 49 31111 2d 620,203 NE2d 411 (1964). At the other extreme, the parties' contract might expressly de- clare that the right of first refusal is personal, and courts will usually agree.

When some of the shareholders wish to sell their share, a clause in the shareholder's agreement should state that the shareholders who wish to sell their shares have to show the right to match an offer received from a third party. This is known as the right of first refusal.