An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Georgia Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage

Description

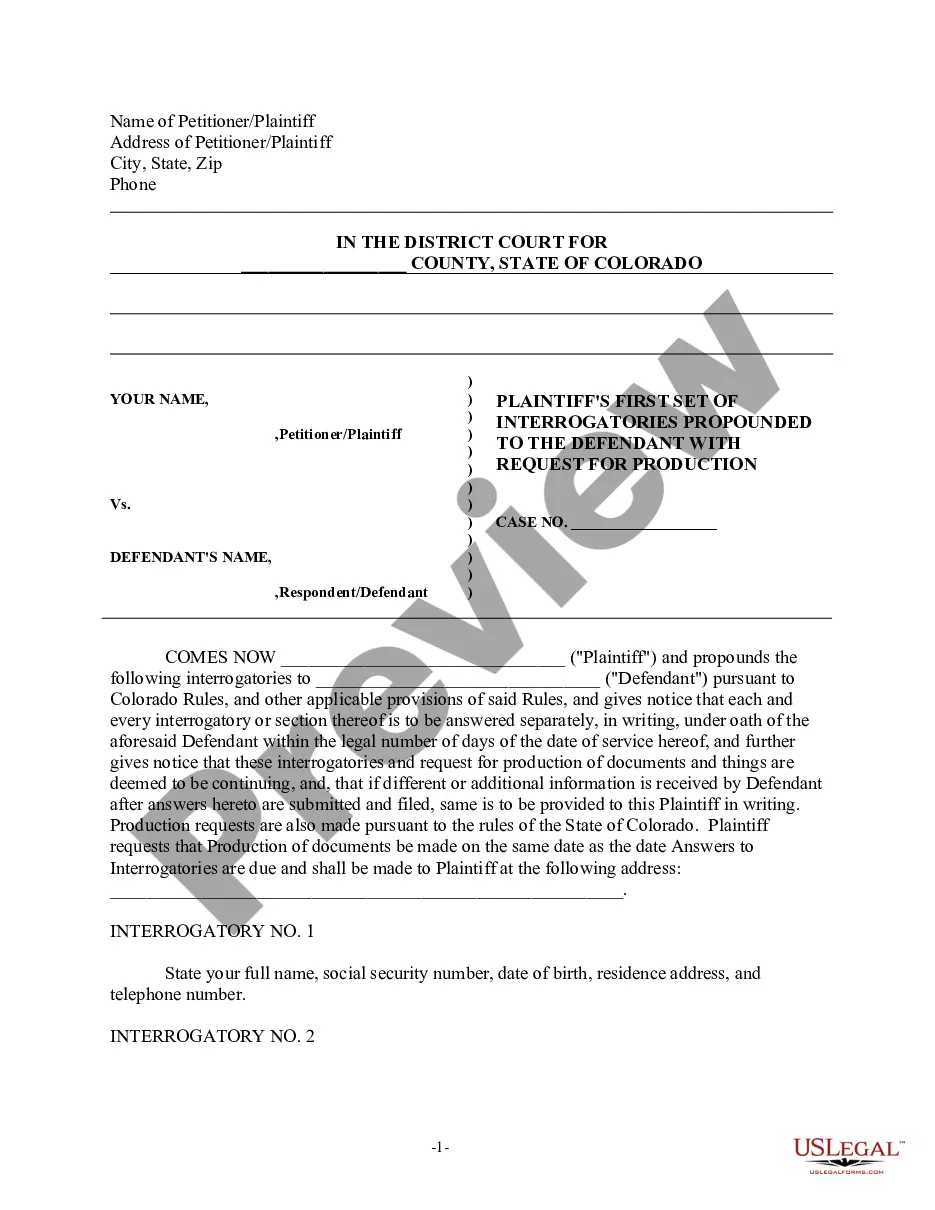

How to fill out Agreement To Modify Interest Rate On Promissory Note Secured By A Mortgage?

Have you been inside a placement that you need files for either organization or individual uses nearly every day? There are a lot of legal record templates available on the Internet, but locating ones you can rely on isn`t easy. US Legal Forms gives thousands of develop templates, just like the Georgia Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage, that are published to satisfy state and federal specifications.

Should you be previously knowledgeable about US Legal Forms internet site and also have your account, basically log in. Following that, you may obtain the Georgia Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage design.

If you do not have an profile and wish to begin using US Legal Forms, adopt these measures:

- Get the develop you need and ensure it is to the right metropolis/area.

- Make use of the Review button to analyze the shape.

- See the information to ensure that you have selected the appropriate develop.

- In the event the develop isn`t what you are trying to find, make use of the Look for discipline to get the develop that suits you and specifications.

- When you get the right develop, just click Buy now.

- Opt for the prices prepare you need, fill out the desired information and facts to create your money, and purchase the order using your PayPal or credit card.

- Pick a handy file format and obtain your duplicate.

Locate all of the record templates you might have bought in the My Forms food selection. You can obtain a extra duplicate of Georgia Agreement to Modify Interest Rate on Promissory Note Secured by a Mortgage any time, if necessary. Just select the essential develop to obtain or print out the record design.

Use US Legal Forms, probably the most substantial assortment of legal varieties, in order to save time and stay away from errors. The service gives skillfully produced legal record templates that you can use for a range of uses. Produce your account on US Legal Forms and start producing your life easier.

Form popularity

FAQ

An amendment to a promissory note is a legal document that makes changes to the original promissory note in a legal manner. The original contract may be restated in order to include the new changes that were made by the amendment to the promissory note.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

The borrower will then review and sign the document, thus making the Promissory Note legally binding and enforceable. Depending on the agreement, the lender may wish to have the document signed before a witness or notary public.

If you lend money to someone and the borrower later wants more time to pay, or lower monthly payments, you can use this form to make changes to the original promissory note.

A "loan modification" is a written agreement that permanently changes the promissory note's original terms to make the borrower's mortgage payments more affordable. A modification typically lowers the interest rate and extends the loan's term.

Borrower's promise to pay is secured by a mortgage, deed of trust or similar security instrument that is dated the same date as this Note and called the ?Security Instrument.? The Security Instrument protects the Lender from losses, which might result if Borrower defaults under this Note.

If you lend money to someone and the borrower later wants more time to pay, or lower monthly payments, you can use this form to make changes to the original promissory note.

Mortgage Note: --is a type of promissory note that is secured by a mortgage loan. --provides security for the loan held by the promissory note. --agreements between the borrower and lender that allow the lender to demand full repayment of a loan should the borrower default on the loan.