Georgia Personal Property Lease

Description

Article 2A of the UCC governs any transaction, regardless of its form, that creates a lease of personal property. Article 2A has been adopted, in different forms, by the majority of states, but it does not apply retroactively to transactions that occurred prior to the effective date of its adoption in a particular jurisdiction.

How to fill out Personal Property Lease?

Are you presently in a scenario where you need documentation for various business or personal purposes almost every day.

There are numerous credible document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms offers a vast collection of template forms, such as the Georgia Personal Property Lease, which can be tailored to meet federal and state requirements.

Once you find the appropriate form, click on Get now.

Choose the pricing plan you prefer, complete the required information to create your account, and process the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Georgia Personal Property Lease template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/state.

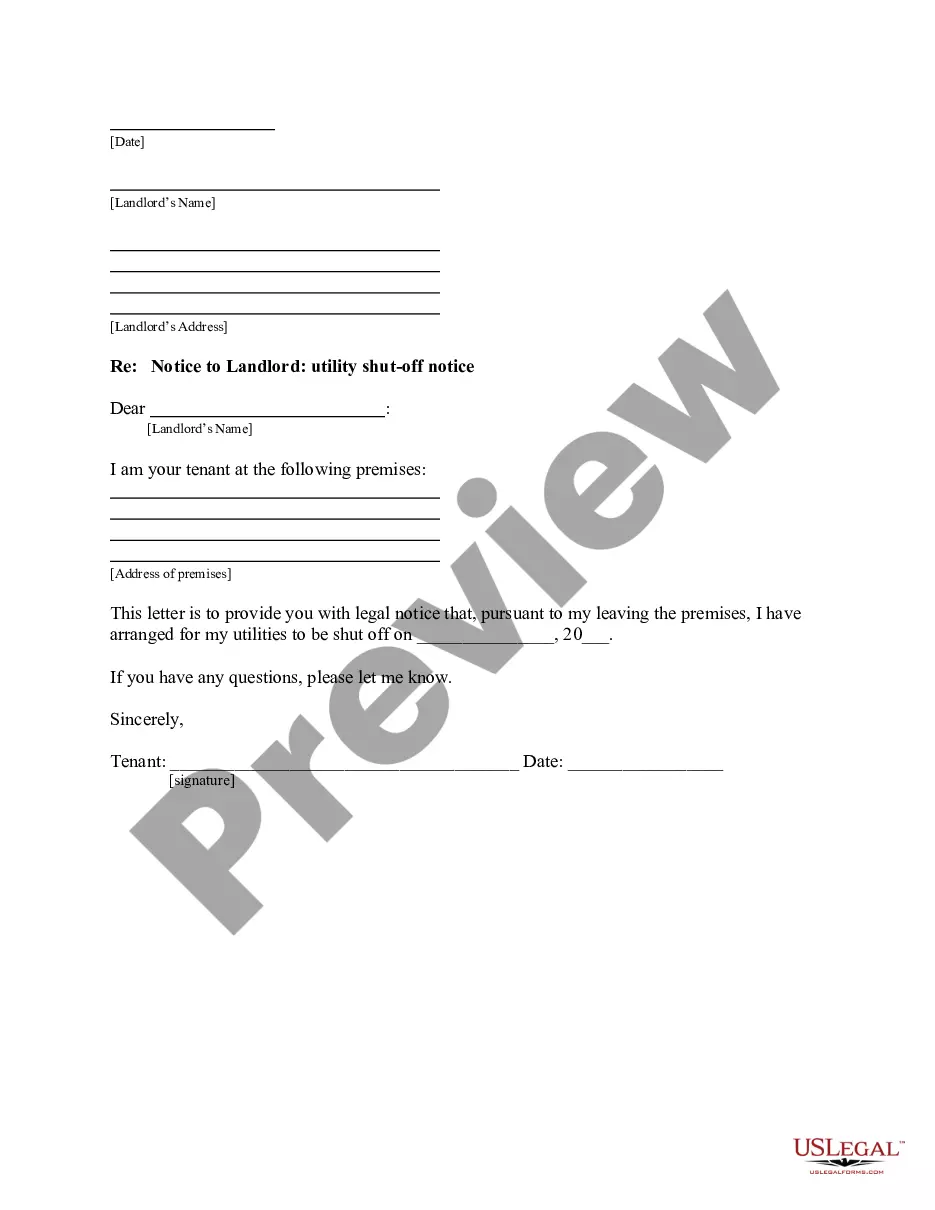

- Use the Review button to examine the form.

- Check the summary to confirm you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that fits your needs.

Form popularity

FAQ

Yes, Georgia does allow a transfer on death deed, enabling property owners to transfer real estate directly to beneficiaries upon their passing. This deed eliminates the need for probate, simplifying the transfer process. If you're considering a transfer on death deed, it's wise to consult legal resources or platforms like uslegalforms to ensure your intentions align with Georgia’s laws. Additionally, a Georgia Personal Property Lease can complement this arrangement, protecting your personal belongings.

Private property in Georgia refers to land or belongings that are owned by individuals or entities, as opposed to the government. This type of property includes homes, vehicles, and personal effects. Understanding your rights as a property owner in Georgia is crucial, especially when it comes to leases. A Georgia Personal Property Lease can help you safeguard your private property and establish clear legal agreements.

Texas does not specifically allow for a personal property memorandum in the same way as other states. However, in Georgia, a personal property lease can be structured to outline how personal belongings are managed after death. This arrangement provides clarity and ensures your wishes are respected. If you want to create a seamless transition for your belongings, consider exploring options with a Georgia Personal Property Lease.

The tangible personal property tax exemption in Georgia allows certain businesses to exclude specific types of personal property from taxation. This exemption can benefit companies that lease property as it reduces their overall tax burden. Understanding how this exemption relates to your Georgia Personal Property Lease can be complex, so utilizing tools like US Legal Forms can help clarify your eligibility and maximize your savings.

A business personal property tax return in Georgia is a report that businesses must file annually to declare their tangible personal property. This property includes items like equipment, furniture, and machinery used in business operations. By accurately completing this return, businesses ensure compliance with state tax laws related to Georgia Personal Property Lease. If you need assistance, consider using US Legal Forms to simplify the preparation process.

Leasing personal property to your business is a common practice in Georgia. This arrangement allows you to use assets without the burden of outright ownership. A well-structured Georgia personal property lease can provide financial flexibility for your business. It is always best to consult legal resources to ensure compliance with state regulations and to optimize your lease terms.

Yes, Georgia offers various property tax exemptions for individuals and businesses. These exemptions can help reduce the taxable value of personal property and can vary by county. To benefit from these exemptions, understanding the specific details of your Georgia personal property lease is crucial. Consider using resources like uslegalforms to find forms and guidance to secure these exemptions.

In Georgia, the personal property tax rate varies based on the location and type of property. Generally, the tax is assessed at a percentage of the property's fair market value. Knowing the implications of your Georgia personal property lease can help you prepare for any tax liabilities. It is advisable to consult your local tax authority for the most accurate rate information.

Personal property in Georgia includes items that are movable and not fixed to land. This typically encompasses furniture, tools, vehicles, and equipment owned by individuals or businesses. Understanding what qualifies as personal property is vital for managing your Georgia personal property lease effectively. If you have questions about specific items, consulting with a legal expert can clarify your situation.

In Georgia, the personal property exemption allows individuals to protect certain personal assets from taxation. This exemption can apply to items such as vehicles, household goods, and equipment used for business. By understanding how the Georgia personal property lease affects exemptions, you can better navigate your financial planning. It is essential to stay informed about any changes in the law to maximize your benefits.