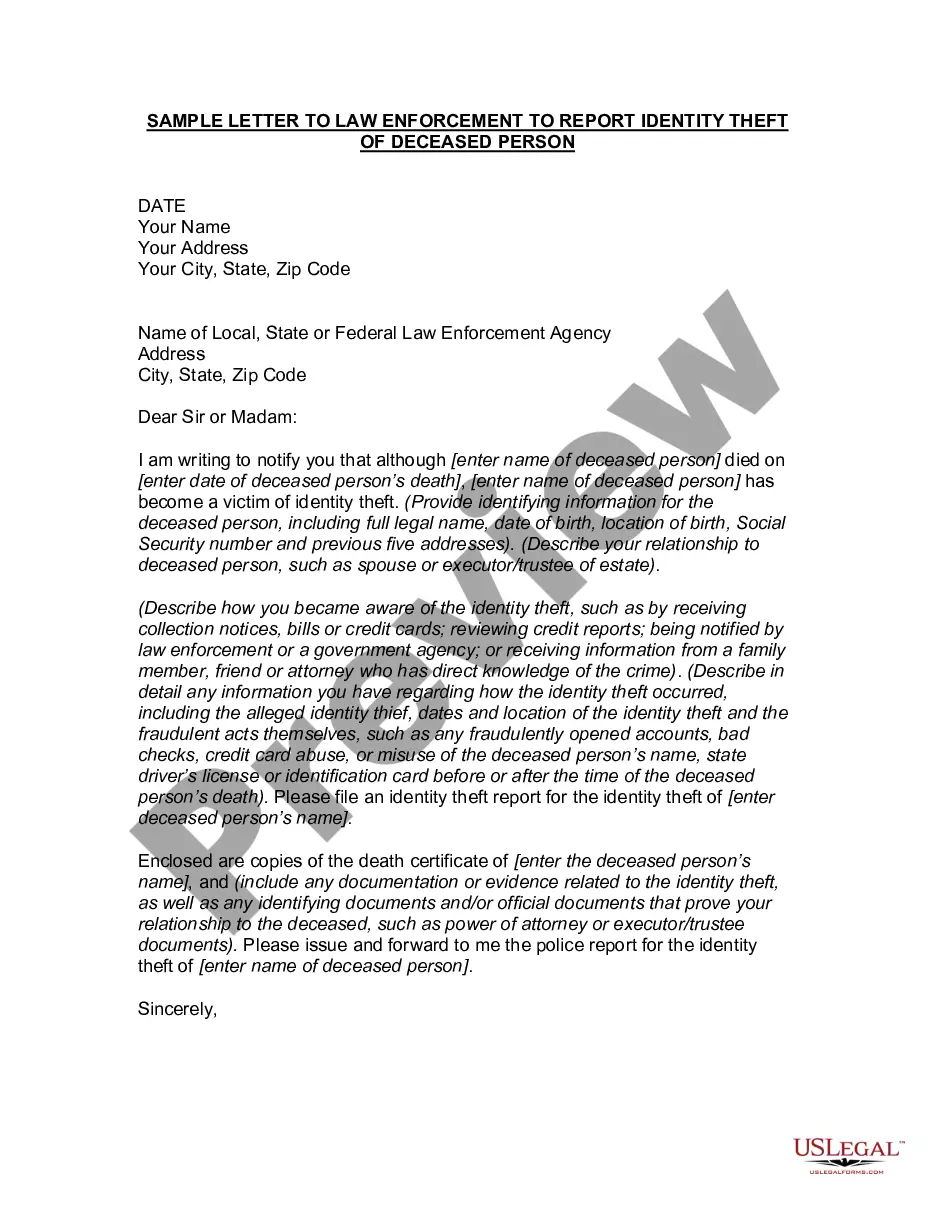

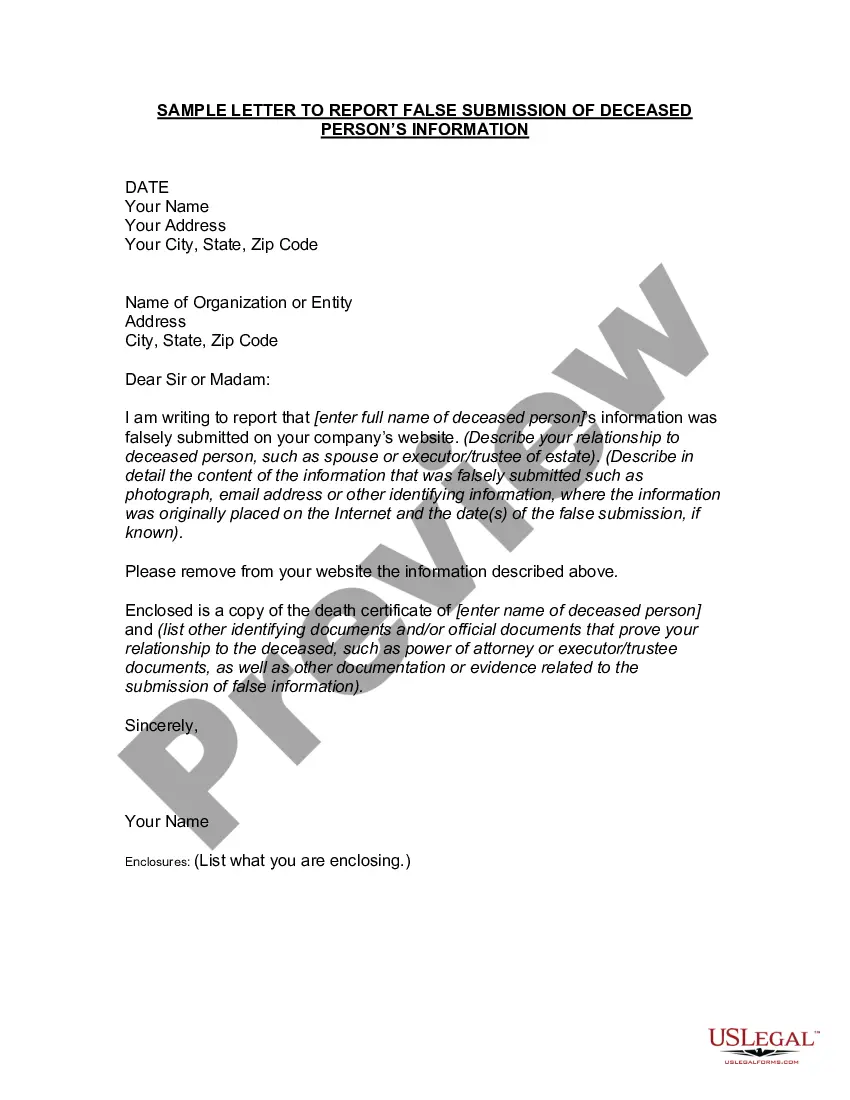

Georgia Letter to Report False Submission of Deceased Person's Information

Description

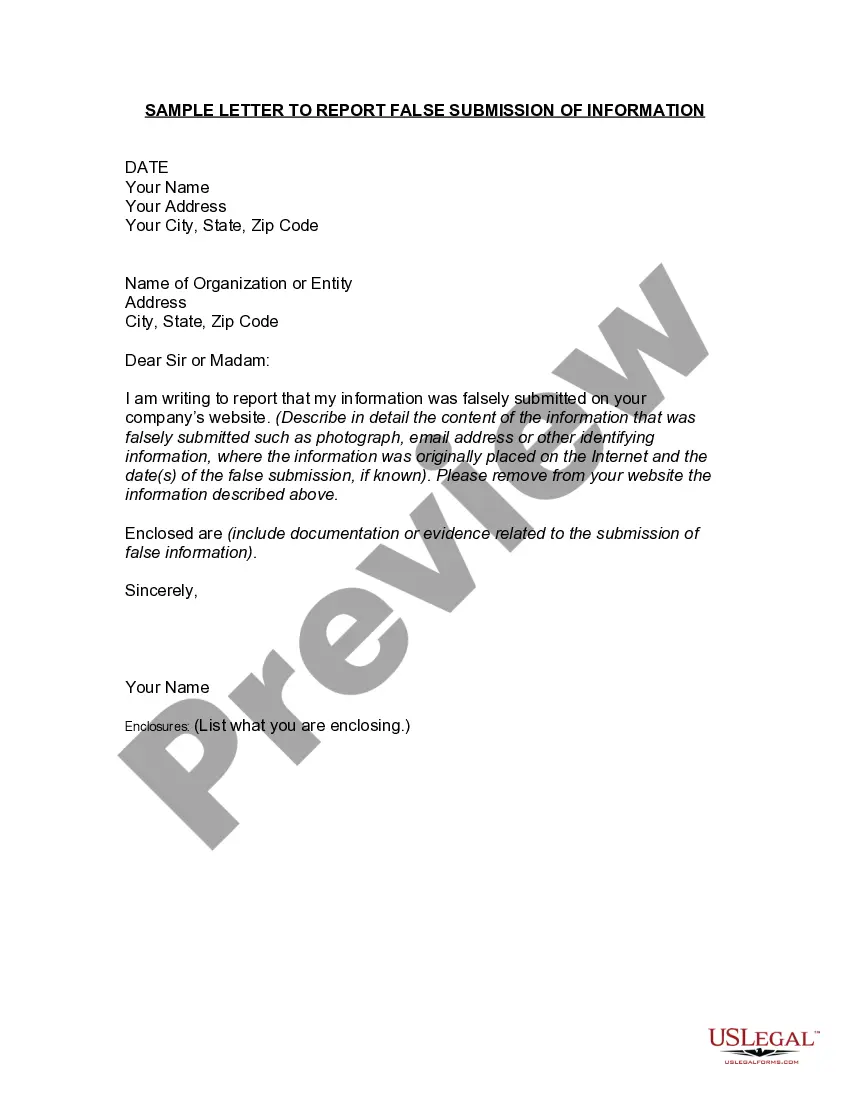

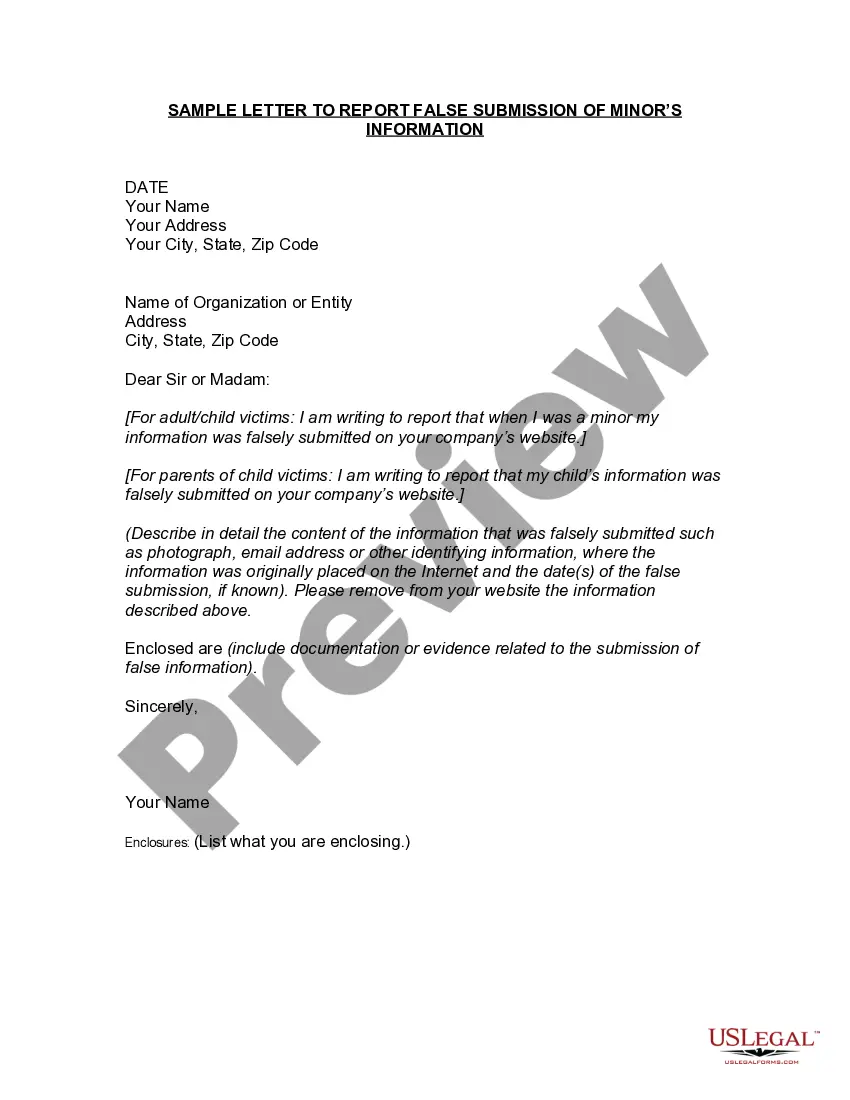

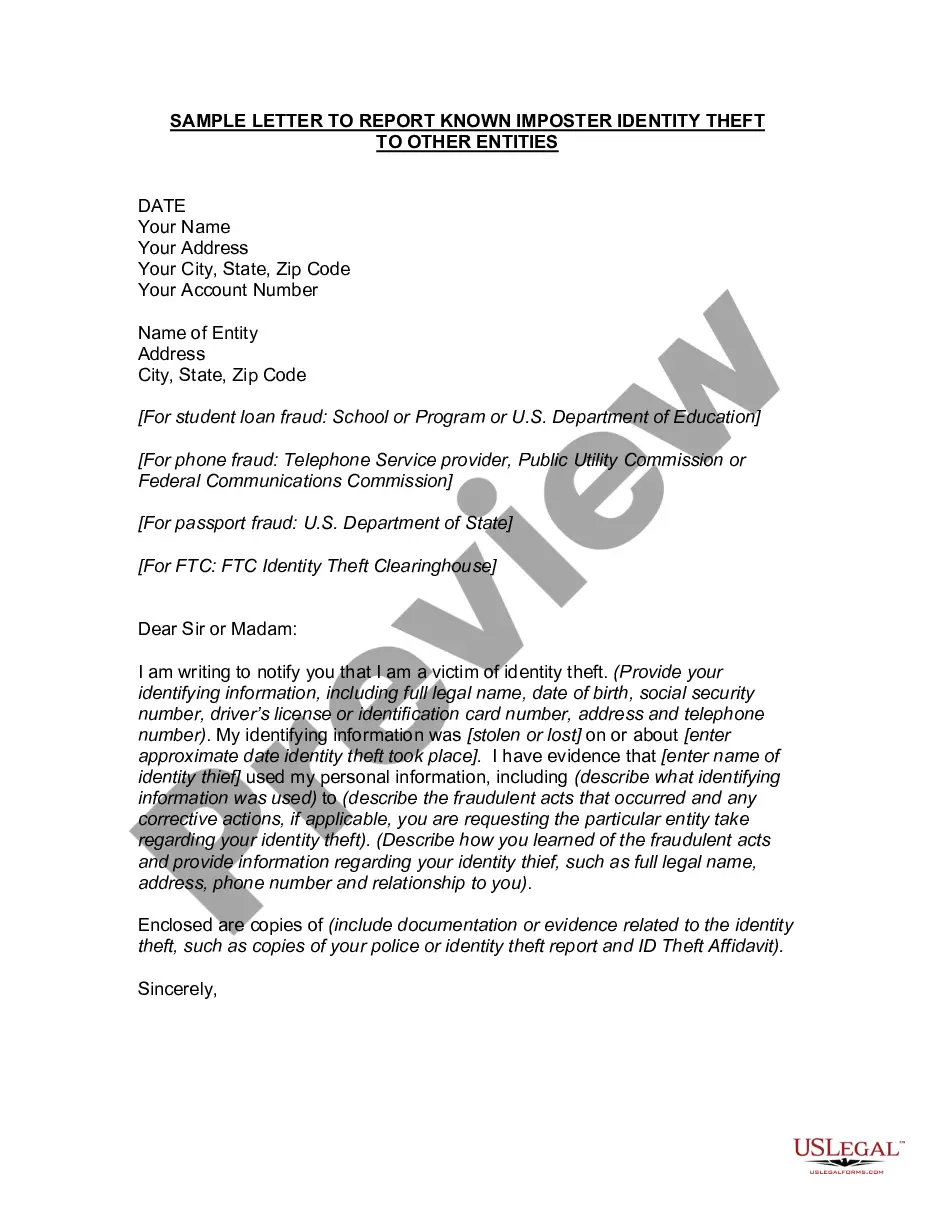

How to fill out Letter To Report False Submission Of Deceased Person's Information?

If you need to total, acquire, or printing legal document layouts, use US Legal Forms, the greatest selection of legal varieties, that can be found on the Internet. Use the site`s basic and hassle-free look for to obtain the papers you want. Numerous layouts for company and personal uses are categorized by categories and states, or keywords and phrases. Use US Legal Forms to obtain the Georgia Letter to Report False Submission of Deceased Person's Information with a handful of click throughs.

If you are already a US Legal Forms buyer, log in for your accounts and then click the Obtain switch to find the Georgia Letter to Report False Submission of Deceased Person's Information. Also you can accessibility varieties you previously acquired in the My Forms tab of your accounts.

Should you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have selected the shape for your right area/region.

- Step 2. Use the Review option to examine the form`s articles. Don`t neglect to read through the information.

- Step 3. If you are unhappy with the type, utilize the Research area on top of the display screen to get other variations in the legal type template.

- Step 4. Once you have located the shape you want, go through the Acquire now switch. Opt for the costs strategy you favor and add your qualifications to register on an accounts.

- Step 5. Method the deal. You may use your charge card or PayPal accounts to accomplish the deal.

- Step 6. Pick the format in the legal type and acquire it in your gadget.

- Step 7. Complete, edit and printing or sign the Georgia Letter to Report False Submission of Deceased Person's Information.

Every single legal document template you get is the one you have permanently. You possess acces to every single type you acquired in your acccount. Click the My Forms area and select a type to printing or acquire yet again.

Compete and acquire, and printing the Georgia Letter to Report False Submission of Deceased Person's Information with US Legal Forms. There are thousands of professional and state-specific varieties you can use for the company or personal requirements.

Form popularity

FAQ

Even if the executor is discharged from personal liability, the IRS will still be able to assess tax deficiencies against the executor to the extent the executor still has any of the decedent's property.

Form used to claim a refund on behalf of a deceased taxpayer.

A person who knowingly and willfully falsifies, conceals, or covers up by any trick, scheme, or device a material fact; makes a false, fictitious, or fraudulent statement or representation; or makes or uses any false writing or document, knowing the same to contain any false, fictitious, or fraudulent statement or ...

Generally, the IRS can include returns filed within the last three years in an audit. If we identify a substantial error, we may add additional years. We usually don't go back more than the last six years.

How Long Do Audits Last? In most cases, the statute of limitations ? the time in which the IRS can conduct and complete an audit ? is three years from the filing date.

Income tax on income generated by assets of the estate of the deceased. If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

The IRS has a statute of limitations of six years for tax audits. As a result, the IRS may send an audit notice for income the decedent reported in the years leading up to their death. You or the decedent's administrator will be responsible for providing the requested information to the IRS.

If a deceased person owes taxes the Estate can be pursued by the IRS until the outstanding amounts are paid. The Collection Statute Expiration Date (CSED) for tax collection is roughly 10 years -- meaning the IRS can continue to pursue the Estate for that length of time.