Georgia Revocable Trust Agreement - Grantor as Beneficiary

Description

How to fill out Revocable Trust Agreement - Grantor As Beneficiary?

If you want to finalize, download, or print legal document templates, utilize US Legal Forms, the foremost repository of legal forms, which can be accessed online.

Employ the site’s user-friendly search function to locate the documents you need.

Various templates for business and personal uses are organized by categories and jurisdictions, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

Step 4. Once you have found the form you need, click the Purchase now button. Select the payment plan you prefer and input your information to create an account.

- Utilize US Legal Forms to obtain the Georgia Revocable Trust Agreement - Grantor as Beneficiary in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Obtain button to access the Georgia Revocable Trust Agreement - Grantor as Beneficiary.

- You can also retrieve forms you have previously saved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Verify that you have selected the form for the correct city/state.

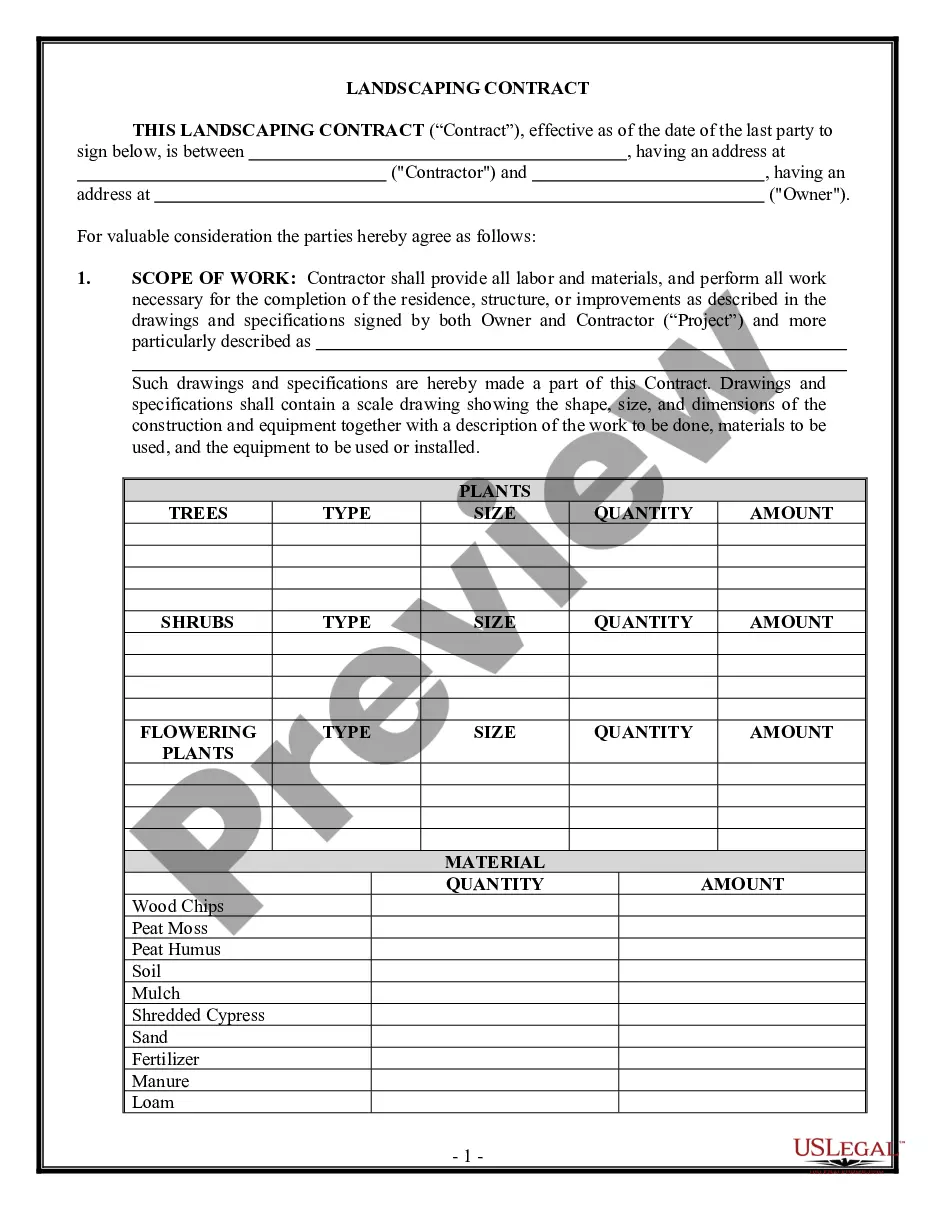

- Step 2. Use the Preview option to review the form’s details. Do not forget to read the information.

Form popularity

FAQ

The beneficiary of a trust is an individual or entity that benefits from the trust's assets. In a Georgia Revocable Trust Agreement - Grantor as Beneficiary, the grantor can also serve as the beneficiary, receiving assets while retaining control of the trust. Identifying beneficiaries clearly in the trust documents is vital for ensuring proper distribution and management.

Yes, a grantor trust can distribute income or assets to beneficiaries. When taking a Georgia Revocable Trust Agreement - Grantor as Beneficiary approach, the grantor has the authority to dictate distributions. This provision allows the grantor to support beneficiaries during their lifetime while retaining overall control of the trust's assets.

One significant mistake parents make when establishing a trust fund is failing to communicate their intentions clearly to their heirs. In a Georgia Revocable Trust Agreement - Grantor as Beneficiary, transparency helps prevent misunderstandings and conflicts. Taking the time to discuss the trust's purpose can lead to smoother transitions and less emotional strain for families.

To list a trust as a beneficiary, you should provide the full name of the trust and specify relevant details, such as the date of its creation. In the context of a Georgia Revocable Trust Agreement - Grantor as Beneficiary, ensure that the trust document is accessible and clear. You may find it beneficial to consult with a legal expert to guarantee accurate documentation.

In most contexts, the terms grantor and settlor are used interchangeably and refer to the same individual who creates the trust. In a Georgia Revocable Trust Agreement - Grantor as Beneficiary, the grantor typically establishes the trust's terms and conditions. Understanding these roles is important for effective trust management and compliance.

Yes, the grantor can be the beneficiary of a trust, specifically in a Georgia Revocable Trust Agreement - Grantor as Beneficiary. This arrangement offers flexibility, allowing the grantor to receive benefits from the trust while retaining control over the assets. However, it is crucial to understand the implications for estate taxes and trust administration.

Naming a trust as a beneficiary can lead to potential tax implications and complexities in management. In the case of a Georgia Revocable Trust Agreement - Grantor as Beneficiary, it may prevent some assets from easily passing to heirs. Additionally, the trust may be subject to more stringent rules and regulations which can complicate distribution.

Yes, a trust can distribute stock to a beneficiary if the trust agreement outlines this. In a Georgia Revocable Trust Agreement - Grantor as Beneficiary, the grantor can specify the type of assets, including stocks, to be distributed. This option provides great flexibility in asset management, allowing beneficiaries to benefit directly from investments. For straightforward guidance on distribution terms, US Legal Forms offers a range of templates and support to help you create your trust.

A revocable trust in Georgia offers several advantages, including avoiding probate and ensuring privacy regarding asset distribution. With a Georgia Revocable Trust Agreement - Grantor as Beneficiary, the grantor retains control over their assets, allowing for modifications as circumstances change. This type of trust can simplify the transition of wealth, making it easier for beneficiaries to receive assets. For effective trust management, consider utilizing resources like US Legal Forms for your legal needs.

Yes, a grantor trust can make distributions to beneficiaries as specified within the trust document. A Georgia Revocable Trust Agreement - Grantor as Beneficiary facilitates these distributions, allowing for tax flexibility and ease of management. This control benefits the grantor by enabling them to allocate assets as desired during their lifetime or upon their passing. For personalized solutions, explore services like US Legal Forms that streamline the creation of such trusts.