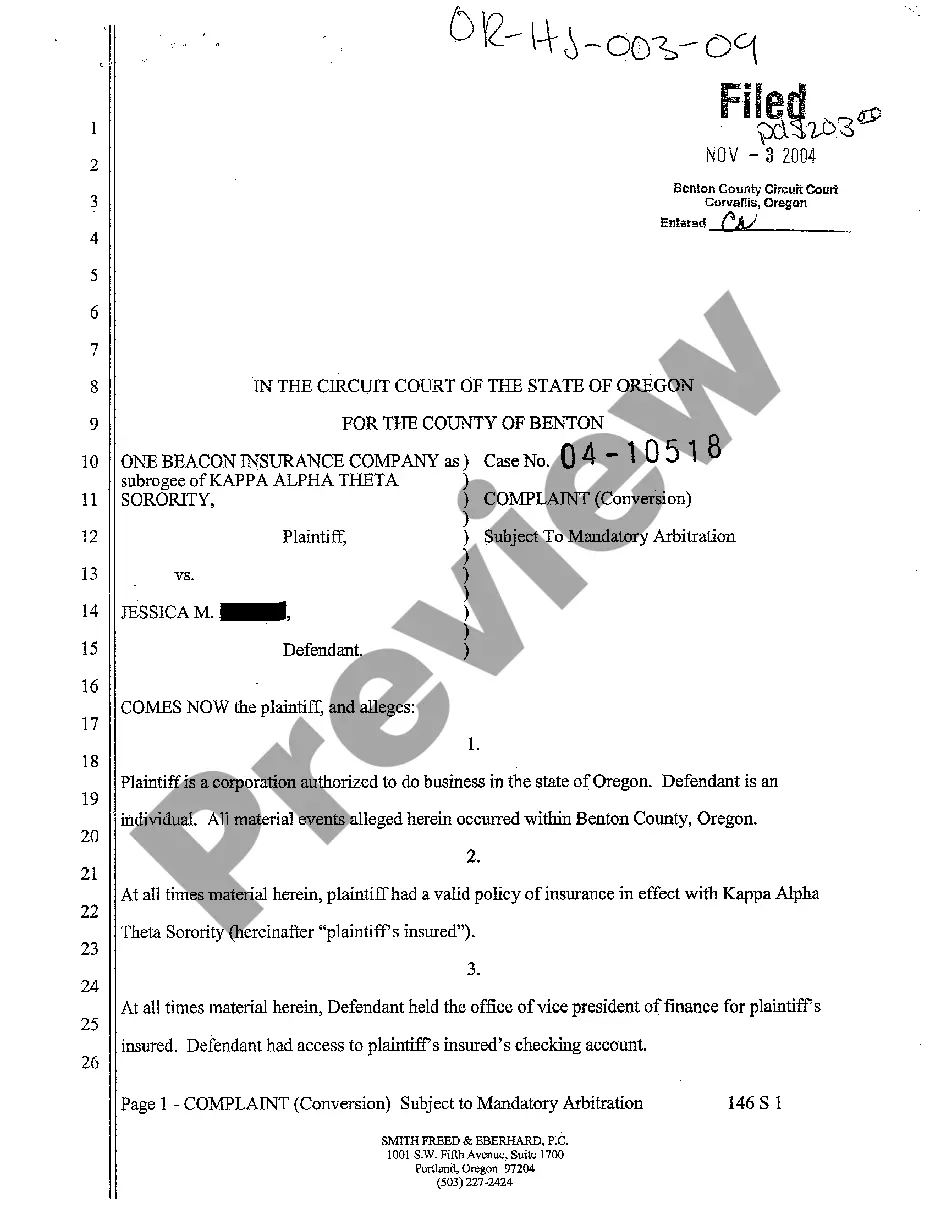

Georgia Foreclosure Summons is a legal document issued by a court when a lender or creditor begins the process of foreclosure. The Summons informs the borrower that a foreclosure lawsuit has been filed and that they have a certain period of time to respond. There are two types of Georgia Foreclosure Summons: Non-Judicial and Judicial. The Non-Judicial Foreclosure Summons is issued by the lender and requires the borrower to respond within 20 days. The Judicial Foreclosure Summons is issued by the court and requires the borrower to respond within 30 days. Both types of Foreclosure Summons will contain important information about the foreclosure process, including the date, time, and location of the hearing.

Georgia Foreclosure Summons

Description

How to fill out Georgia Foreclosure Summons?

If you’re looking for a method to properly prepare the Georgia Foreclosure Summons without engaging a legal expert, then you’ve come to the right destination.

US Legal Forms has established itself as the most comprehensive and esteemed collection of official templates for every individual and business circumstance.

Another fantastic aspect of US Legal Forms is that you will never lose the paperwork you have purchased - you can access any of your downloaded templates in the My documents tab of your profile whenever required.

- Make sure the document you see on the page aligns with your legal requirements and state legislation by reviewing its text description or browsing through the Preview mode.

- Input the form title in the Search tab at the top of the page and select your state from the dropdown to locate an alternative template in case of any discrepancies.

- Repeat the content review and click Buy now when you are satisfied with the paperwork's compliance with all the stipulations.

- Log in to your account and select Download. If you are not yet registered for the service, choose the subscription plan.

- Utilize your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will become available for download immediately afterward.

- Select the format in which you wish to save your Georgia Foreclosure Summons and download it by clicking the corresponding button.

- Incorporate your template into an online editor to fill out and sign it promptly or print it out to prepare your hard copy manually.

Form popularity

FAQ

If you don't respond to a Georgia Foreclosure Summons, the court may issue a default judgment against you. This means that the lender can proceed with the foreclosure process without your input. Not responding can also limit your options for negotiating with the lender or contesting the foreclosure. To protect your rights, it is crucial to take any summons seriously and consider using platforms like US Legal Forms, which provide resources and guidance to help you navigate this challenging situation.

The 120-day rule in Georgia stipulates that a lender can only initiate foreclosure proceedings after the borrower has defaulted on payments for at least 120 days. This rule aims to provide homeowners a fair timeline to resolve their defaults with their lender. Understanding this rule is essential, especially when you receive a Georgia foreclosure summons, as it impacts your response time and options.

While the Georgia foreclosure process generally adheres to a 120-day rule, exceptions can apply. Situations involving abandoned properties or when the mortgage is in default for over 30 days may expedite the process. Additionally, a borrower filing for bankruptcy can stall or alter the timeline. Being aware of these exceptions is critical when addressing a Georgia foreclosure summons.

Responding to a Georgia foreclosure summons involves several important steps. First, review the summons thoroughly to understand the allegations. You can then file an answer with the court where the case is filed, addressing each claim. It is wise to seek legal advice or consult resources like USLegalForms to ensure you meet all necessary requirements effectively.

Typically, a foreclosure in Georgia can take anywhere from 90 to 120 days, depending on various factors. The timeline includes the notice period and the auction proceedings. However, if complications arise, such as disputes or court involvement, it may take longer. Staying informed of your status and understanding the Georgia foreclosure summons can make navigating this process easier.

The Georgia foreclosure process involves five key stages: Pre-foreclosure, Notice of Default, Auction, Redemption Period, and Post-Foreclosure. During pre-foreclosure, the lender sends a notice to the borrower about missed payments. Next, if payments are not made, a Notice of Default is issued. The auction follows, where the property can be sold to the highest bidder. Afterward, there may be a redemption period that allows the borrower to reclaim their home by paying the debt before final ownership transfers.

Responding to a court summons for foreclosure is crucial to protect your rights. You should file an answer with the court within the designated timeframe, typically 30 days. In your response, address the claims made in the summons and include any defenses you may have. Utilizing resources like US Legal Forms can assist you in crafting a powerful response to a Georgia Foreclosure Summons, ensuring that you meet all legal requirements.

The 120 day rule in Georgia refers to the minimum period a lender must wait after sending a notice of default before initiating foreclosure proceedings. This rule aims to give borrowers time to address their financial issues and find potential solutions to avoid foreclosure. By understanding this rule, you can better tackle any disputes or considerations related to a Georgia Foreclosure Summons. It is vital to stay informed during this period.

The foreclosure process in Georgia typically involves several key steps. First, a lender must issue a default notice when the borrower falls behind on payments. Next, the property goes into the foreclosure auction process, which must be advertised publicly for four consecutive weeks. Finally, if the property does not sell, the lender may take possession. Familiarizing yourself with Georgia Foreclosure Summons will help you navigate this process effectively.

To evict a previous owner after foreclosure in Georgia, you first need to obtain a judgment from the court. This judgment will allow you to proceed with the eviction process. After securing the judgment, you can file a writ of possession with the local sheriff's office, which will enable law enforcement to remove the previous owner from the property. Remember, understanding the nuances of a Georgia Foreclosure Summons can streamline this process.