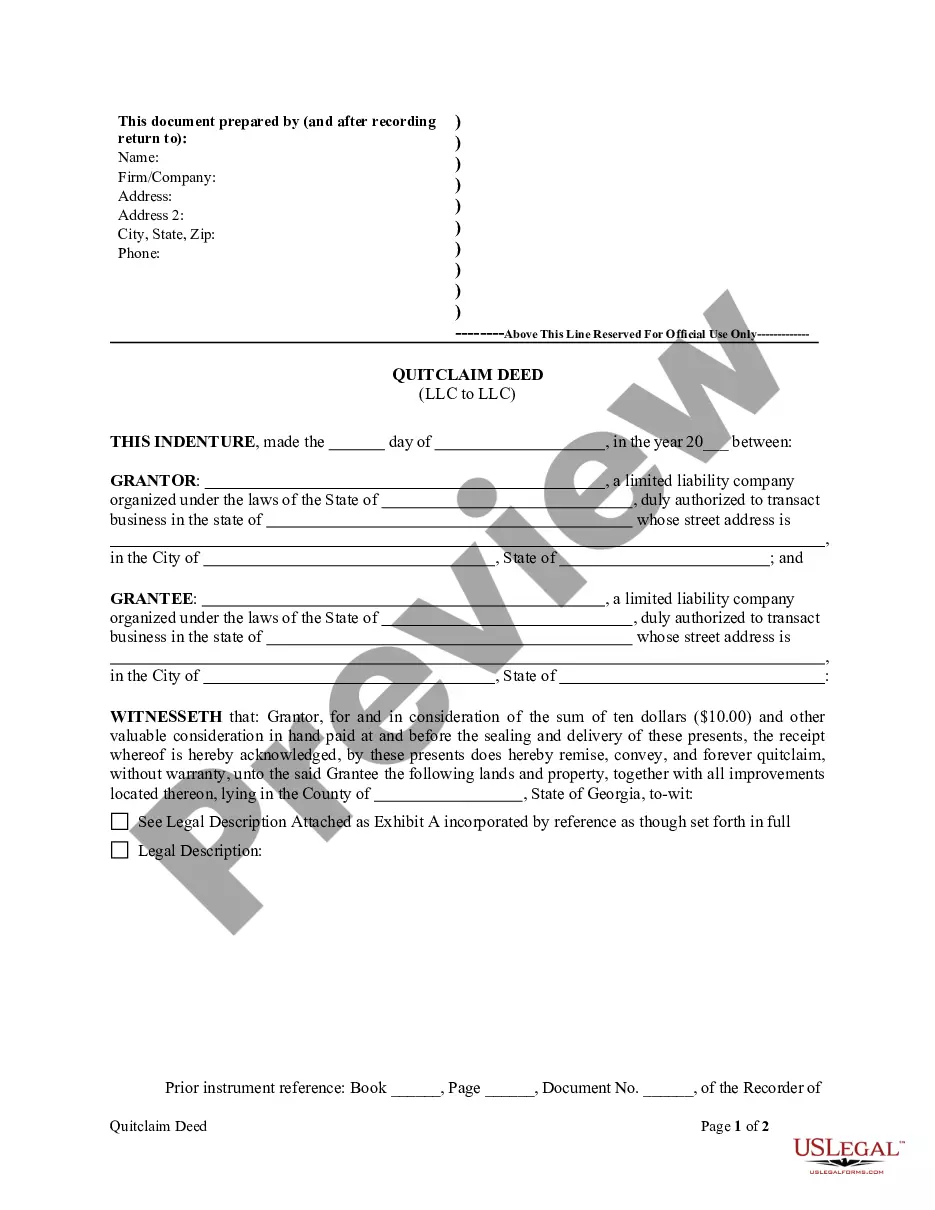

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is also an LLC. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Quit Claim Deed To Llc

Description

How to fill out Georgia Quitclaim Deed From LLC To LLC?

Access the most comprehensive catalogue of authorized forms. US Legal Forms is really a platform where you can find any state-specific form in clicks, even Georgia Quitclaim Deed from LLC to LLC samples. No reason to waste hrs of the time searching for a court-admissible sample. Our licensed specialists make sure that you receive updated samples all the time.

To make use of the forms library, select a subscription, and create your account. If you already registered it, just log in and then click Download. The Georgia Quitclaim Deed from LLC to LLC file will immediately get stored in the My Forms tab (a tab for every form you download on US Legal Forms).

To create a new profile, look at brief guidelines listed below:

- If you're proceeding to utilize a state-specific example, ensure you indicate the correct state.

- If it’s possible, look at the description to learn all the ins and outs of the document.

- Make use of the Preview function if it’s available to take a look at the document's content.

- If everything’s correct, click on Buy Now button.

- Right after choosing a pricing plan, make an account.

- Pay out by card or PayPal.

- Save the document to your device by clicking on Download button.

That's all! You ought to complete the Georgia Quitclaim Deed from LLC to LLC template and check out it. To make certain that things are accurate, call your local legal counsel for help. Join and simply browse above 85,000 valuable samples.