Florida Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool

Description

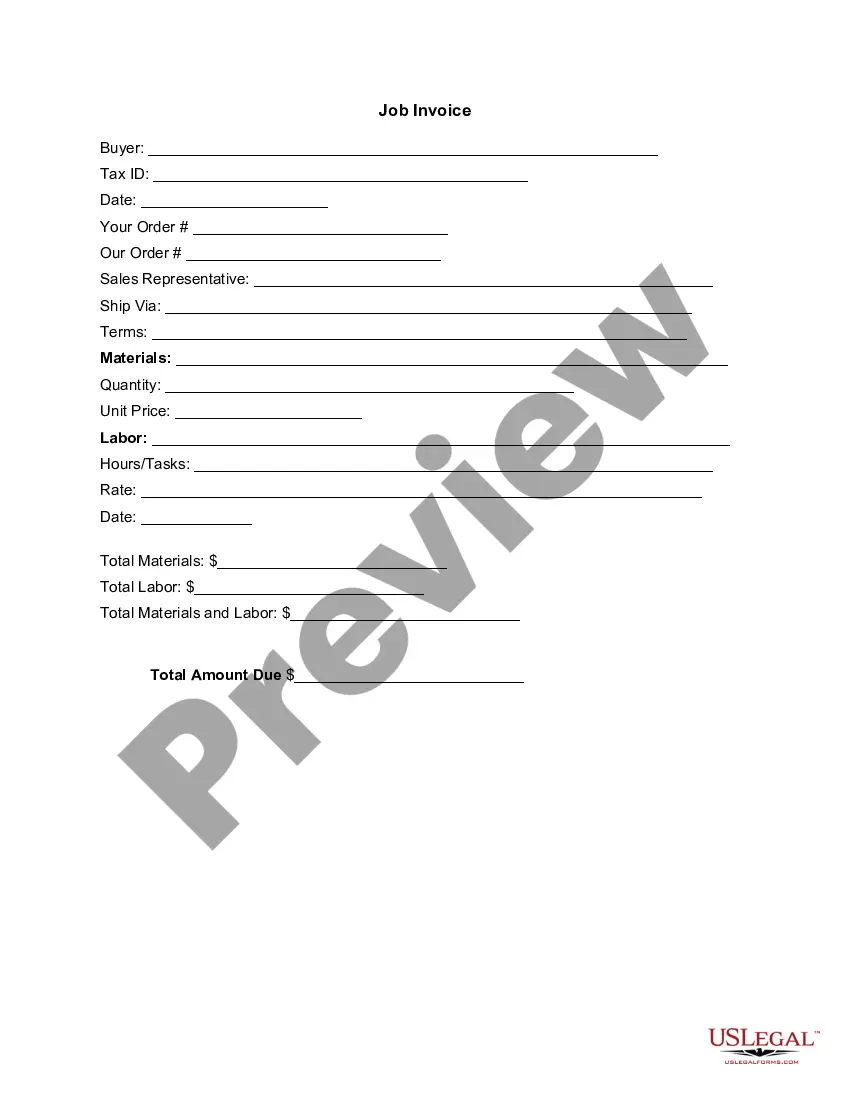

How to fill out Assignment Of Overriding Royalty Interest With Multiple Leases That Are Non Producing With Reservation Of The Right To Pool?

US Legal Forms - one of several most significant libraries of authorized varieties in the United States - gives a wide range of authorized file web templates it is possible to acquire or printing. While using site, you can get a large number of varieties for enterprise and individual uses, categorized by groups, states, or search phrases.You will find the newest variations of varieties such as the Florida Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool in seconds.

If you already possess a monthly subscription, log in and acquire Florida Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool in the US Legal Forms local library. The Acquire key can look on each type you look at. You gain access to all formerly acquired varieties from the My Forms tab of the bank account.

If you would like use US Legal Forms the first time, listed below are easy guidelines to help you get began:

- Ensure you have picked the best type for the metropolis/region. Go through the Review key to review the form`s content material. Read the type outline to actually have selected the right type.

- When the type does not suit your specifications, take advantage of the Search area towards the top of the screen to discover the the one that does.

- Should you be happy with the shape, confirm your selection by simply clicking the Buy now key. Then, pick the pricing prepare you favor and provide your qualifications to sign up on an bank account.

- Procedure the purchase. Use your Visa or Mastercard or PayPal bank account to accomplish the purchase.

- Choose the formatting and acquire the shape on your own device.

- Make alterations. Fill up, modify and printing and sign the acquired Florida Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool.

Each and every web template you included in your money lacks an expiry time and it is your own property eternally. So, if you wish to acquire or printing yet another version, just check out the My Forms area and click in the type you require.

Get access to the Florida Assignment of Overriding Royalty Interest with Multiple Leases that are Non Producing with Reservation of the Right to Pool with US Legal Forms, one of the most substantial local library of authorized file web templates. Use a large number of expert and status-distinct web templates that satisfy your company or individual requirements and specifications.

Form popularity

FAQ

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

The value of a royalty interest is derived from expected future revenues generated by leasing and/or production, which are largely determined by oil and gas market prices and the current drilling environment.

Royalty Clause: The Lessor's only right to receive payments in addition to the Bonus Payment is through Royalties. Royalties are calculated as a percentage of the value of all minerals produced, typically 25%.

Royalty interest in the oil and gas industry refers to ownership of a portion of a resource or the revenue it produces. A company or person that owns a royalty interest does not bear any operational costs needed to produce the resource, yet they still own a portion of the resource or revenue it produces.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

It really comes down to your personal decision. Figuring out whether to sell oil and gas royalties can be challenging for some. Here are some of the most common reasons for selling an oil and gas royalty: Taxes: You will save substantial money if you inherited mineral rights by selling your oil royalties.

Royalties on private lands are influenced by state rates. They generally range from 12?25 percent. Before negotiating royalty payments on private land, careful due diligence should be conducted to confirm ownership. Mineral ownership records are often outdated.