Florida Outside Project Manager Agreement - Self-Employed Independent Contractor

Description

How to fill out Outside Project Manager Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a vast selection of legal form templates available for download or printing.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Florida Outside Project Manager Agreement - Self-Employed Independent Contractor in minutes.

If you already have a subscription, Log In and download the Florida Outside Project Manager Agreement - Self-Employed Independent Contractor from your US Legal Forms library. The Download button will be available on every form you view. You have access to all previously saved forms in the My documents section of your account.

Complete the transaction. Use Visa, Mastercard, or PayPal to finalize the payment.

Download the form to your device. Edit. Fill in, modify, print, and sign the saved Florida Outside Project Manager Agreement - Self-Employed Independent Contractor. Each template you add to your account has no expiration date and belongs to you indefinitely. So, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Gain access to the Florida Outside Project Manager Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

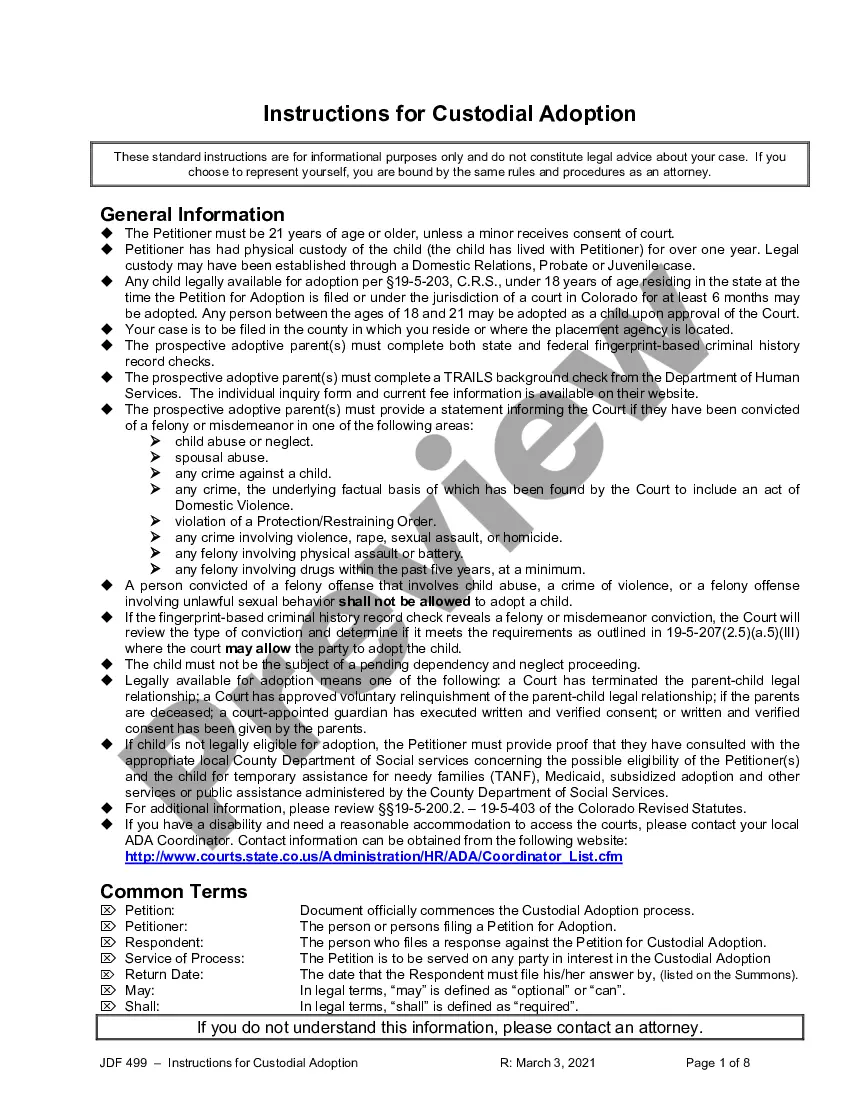

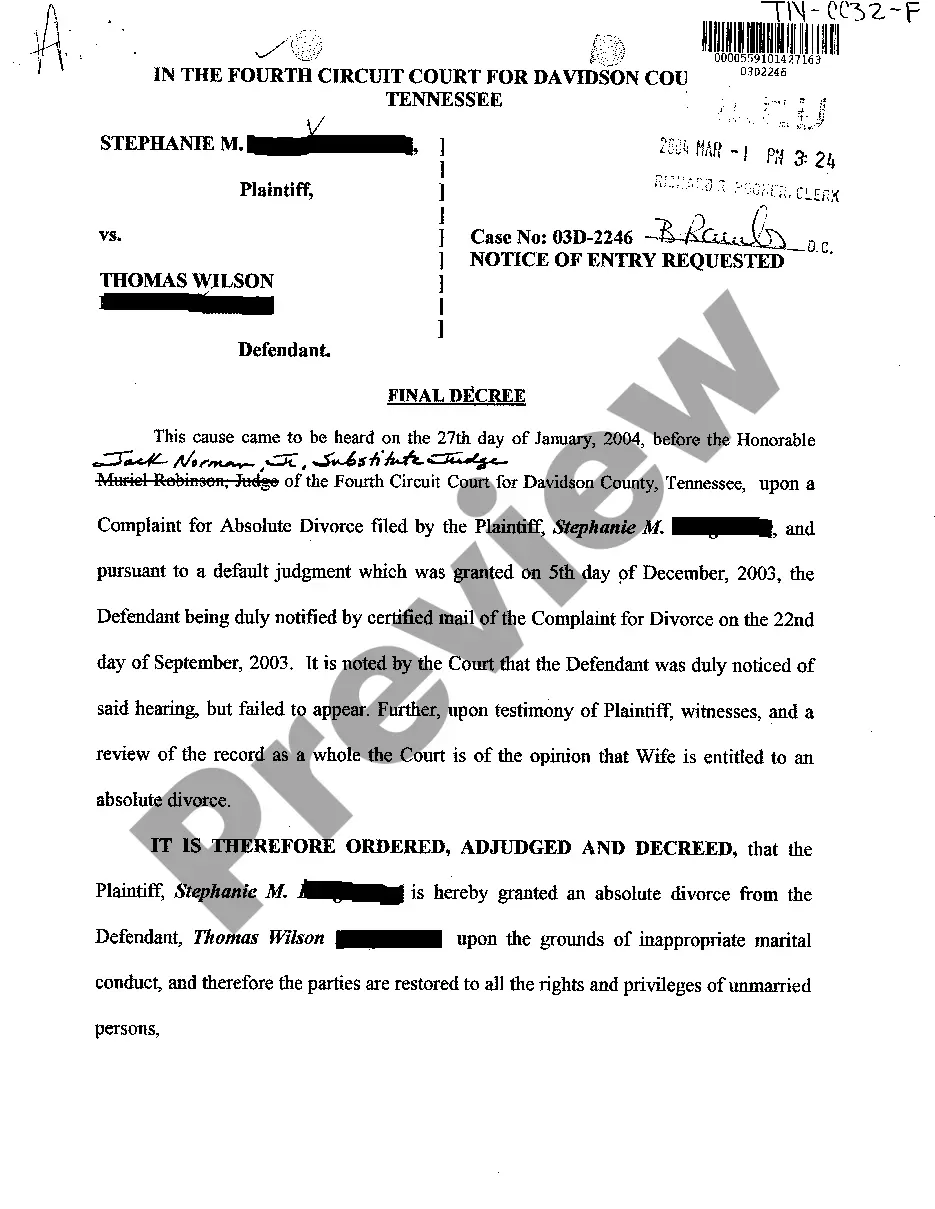

- Ensure you have selected the correct form for your municipality/state.

- Click the Preview button to review the form's content.

- Check the form summary to confirm that you have chosen the right document.

- If the form does not match your requirements, use the Search field at the top of the page to find the form that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select the payment plan you wish and provide your details to sign up for an account.

Form popularity

FAQ

Filling out a Florida Outside Project Manager Agreement - Self-Employed Independent Contractor involves several important steps. Begin by reviewing the agreement template to understand each section, and then provide the required information, such as the contractor's details, payment schedule, and specific project duties. Make sure to double-check for accuracy to avoid future disputes. USLegalForms offers guidance and resources to assist you in completing this agreement effectively.

To write a Florida Outside Project Manager Agreement - Self-Employed Independent Contractor, start by identifying the parties involved and defining the scope of work. Clearly outline the payment terms, project timeline, and any confidentiality or non-compete clauses. It's essential to ensure that both parties understand their roles and responsibilities. Utilizing USLegalForms can simplify this process by providing customizable templates specifically designed for independent contractor agreements.

In Florida, enforcing a non-compete agreement on an independent contractor is possible, but it requires careful consideration. The Florida Outside Project Manager Agreement - Self-Employed Independent Contractor must specify reasonable terms that protect legitimate business interests. Additionally, courts will look at the agreement's duration, geographic scope, and whether it is fair to the contractor. It’s essential to draft this type of agreement correctly to ensure it holds up in court, and USLegalForms offers templates that can help you create effective agreements.

In Florida, non-compete agreements can be enforceable for independent contractors if they meet certain legal criteria. According to Florida law, these agreements must be reasonable in time, geographic area, and must serve a legitimate business interest. Therefore, if you are working under a Florida Outside Project Manager Agreement - Self-Employed Independent Contractor, it's vital to ensure that any non-compete you sign aligns with these factors. For clarity and security in your agreements, consider using uslegalforms to draft and review your contractual obligations.

To protect yourself as an independent contractor, consider using a solid contract like a Florida Outside Project Manager Agreement - Self-Employed Independent Contractor. This contract should clearly outline your rights, obligations, and the scope of work. Additionally, establish clear communication with your clients and seek legal counsel if you encounter any ambiguities. Being proactive in understanding your rights can prevent misunderstandings and protect your interests.

Yes, it is possible for someone to be misclassified as an independent contractor while functioning as an employee. This misclassification can lead to legal complications for both parties, particularly regarding taxes and benefits. It is essential to examine the nature of the work relationship closely. A clear Florida Outside Project Manager Agreement - Self-Employed Independent Contractor can help define the roles and expectations accurately.

Yes, a 1099 employee can be subject to a non-compete clause. Similar to independent contractors, these agreements can limit where and how they work after their contract is over. The key is that the agreement must be reasonable and not overly restrictive. Make sure any Florida Outside Project Manager Agreement - Self-Employed Independent Contractor you consider clearly outlines these terms.

Yes, an independent contractor can have a non-compete agreement. This agreement restricts them from working with competitors for a specified time after the contract ends. However, its enforceability can depend on state laws and the agreement's specific terms. Consulting with a legal expert is wise to ensure that any Florida Outside Project Manager Agreement - Self-Employed Independent Contractor incorporates fair and enforceable clauses.