Florida Fireplace Contractor Agreement - Self-Employed

Description

How to fill out Fireplace Contractor Agreement - Self-Employed?

Have you ever been in a circumstance where you require documents for either business or personal purposes almost every day.

There is a multitude of official document templates accessible on the web, but locating ones you can trust is not easy.

US Legal Forms provides a vast array of template formats, such as the Florida Fireplace Contractor Agreement - Self-Employed, that are designed to meet state and federal regulations.

Once you find the correct form, click Acquire now.

Select the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess a free account, simply Log In.

- After that, you can download the Florida Fireplace Contractor Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for your specific region/area.

- Utilize the Review button to examine the form.

- Read the summary to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

Writing an independent contractor agreement involves outlining essential elements clearly. Start with the basic information about both parties, followed by project details, payment terms, and timelines. Be sure to include clauses related to confidentiality and termination. Utilizing the Florida Fireplace Contractor Agreement - Self-Employed format from uslegalforms can help ensure you include all necessary components and stay compliant with legal standards.

Yes, independent contractors file as self-employed individuals when it comes to taxes. You must report your income and expenses on Schedule C of your tax return. This classification allows you to manage your finances effectively while benefiting from the Florida Fireplace Contractor Agreement - Self-Employed structure. Resources and guidance from uslegalforms can help you understand this process better.

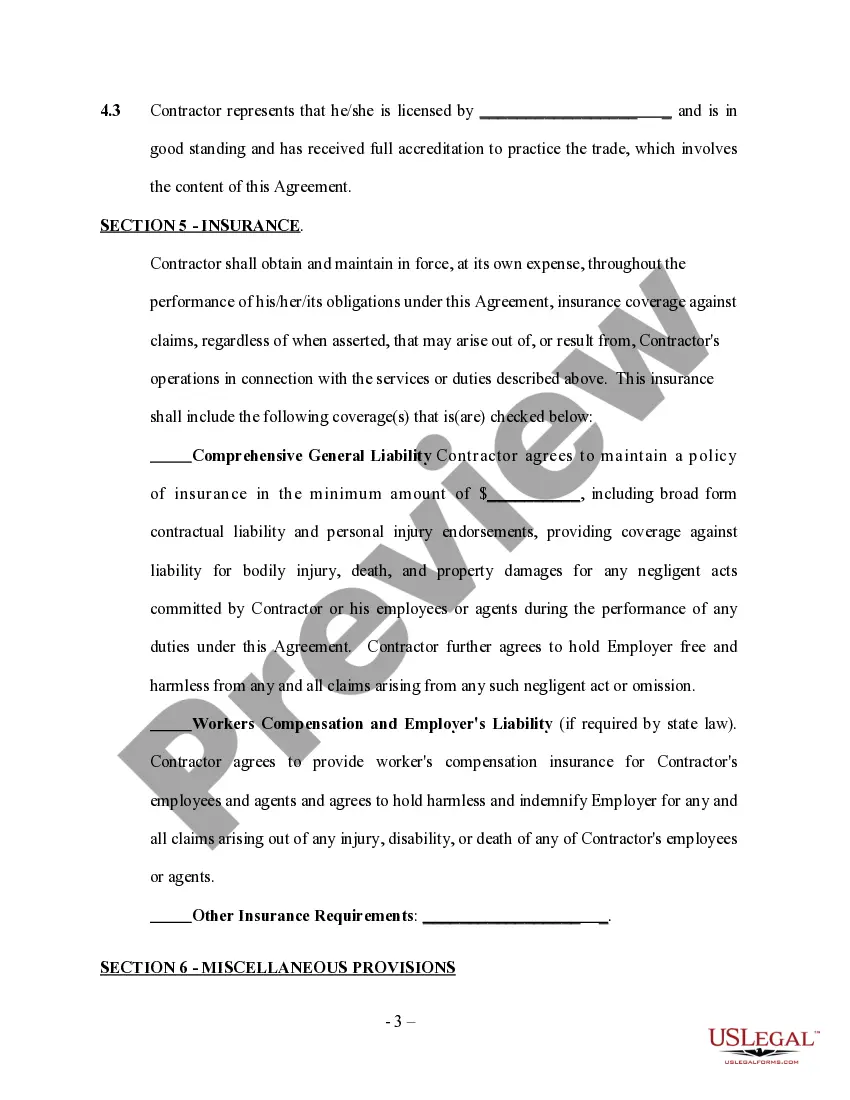

Filling out an independent contractor agreement requires clarity and precise language. First, you need to state the terms of the agreement, including the scope of work and deadlines. Additionally, specify payment details and conditions for termination. The Florida Fireplace Contractor Agreement - Self-Employed template available on uslegalforms is a great way to ensure you do this correctly and legally.

To fill out an independent contractor form, start by entering your personal information, including your name, address, and contact details. Next, provide details about the work you will perform, as well as the payment terms. Ensure that you also review and acknowledge any important clauses related to the Florida Fireplace Contractor Agreement - Self-Employed. Using platforms like uslegalforms can simplify this process and provide you with accurate templates.

employed contract, such as the Florida Fireplace Contractor Agreement SelfEmployed, should clearly outline the scope of work, payment terms, deadlines, and responsibilities of both parties. Additionally, it’s important to include clauses on termination, dispute resolution, and confidentiality. This clarity helps set expectations and protects both you and the contractor in the working relationship.

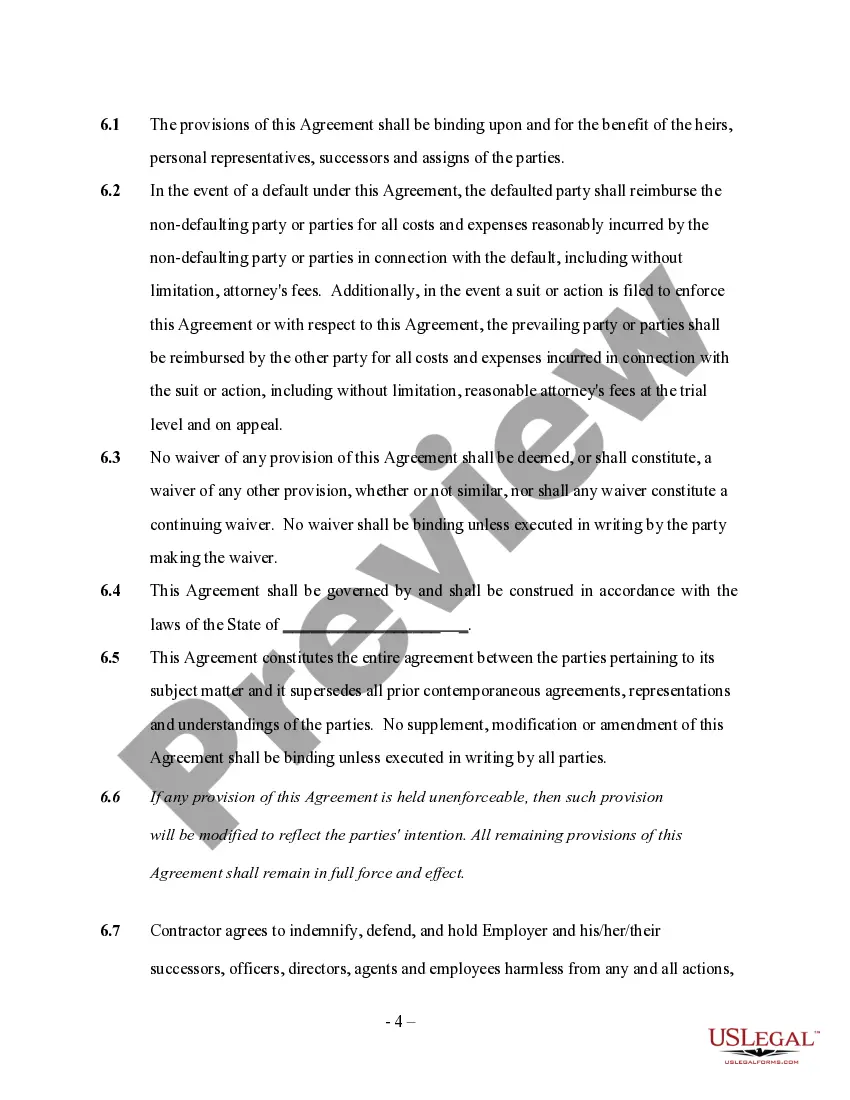

Firing an independent contractor involves clear communication and proper documentation. First, review the terms laid out in the Florida Fireplace Contractor Agreement - Self-Employed to ensure compliance with the contract. Notify the contractor in writing about the termination and include the reasons for your decision. This helps maintain professionalism and protects you if any disputes arise later.

Creating an independent contractor agreement involves outlining the scope of work, payment terms, and project timelines. To ensure clarity, include terms related to termination and confidentiality. This document should protect both parties and lay down clear expectations. For a comprehensive approach, consider using platforms like USLegalForms that provide templates tailored for a Florida Fireplace Contractor Agreement - Self-Employed.

If you want to fire an independent contractor without a written contract, ensure you have valid reasons based on performance or conduct. Open communication is key; discuss your concerns clearly with the contractor. Document your interactions, as this will help in case of disputes. Lastly, consider drafting a simple termination notice to formalize the termination while reflecting the principles of a Florida Fireplace Contractor Agreement - Self-Employed.

Firing a 1099 contractor is possible, but the process differs from that of terminating an employee. Since independent contractors operate under the terms agreed upon in their Florida Fireplace Contractor Agreement - Self-Employed, it's essential to follow those terms closely. If you decide to end the contract, ensure that you adhere to the guidelines outlined within the agreement.

The new independent contractor law in Florida provides clearer guidelines on how workers are classified. This law emphasizes that independent contractors retain the right to work for multiple clients and maintain control over their work. Reviewing your Florida Fireplace Contractor Agreement - Self-Employed will help you navigate these changes effectively.