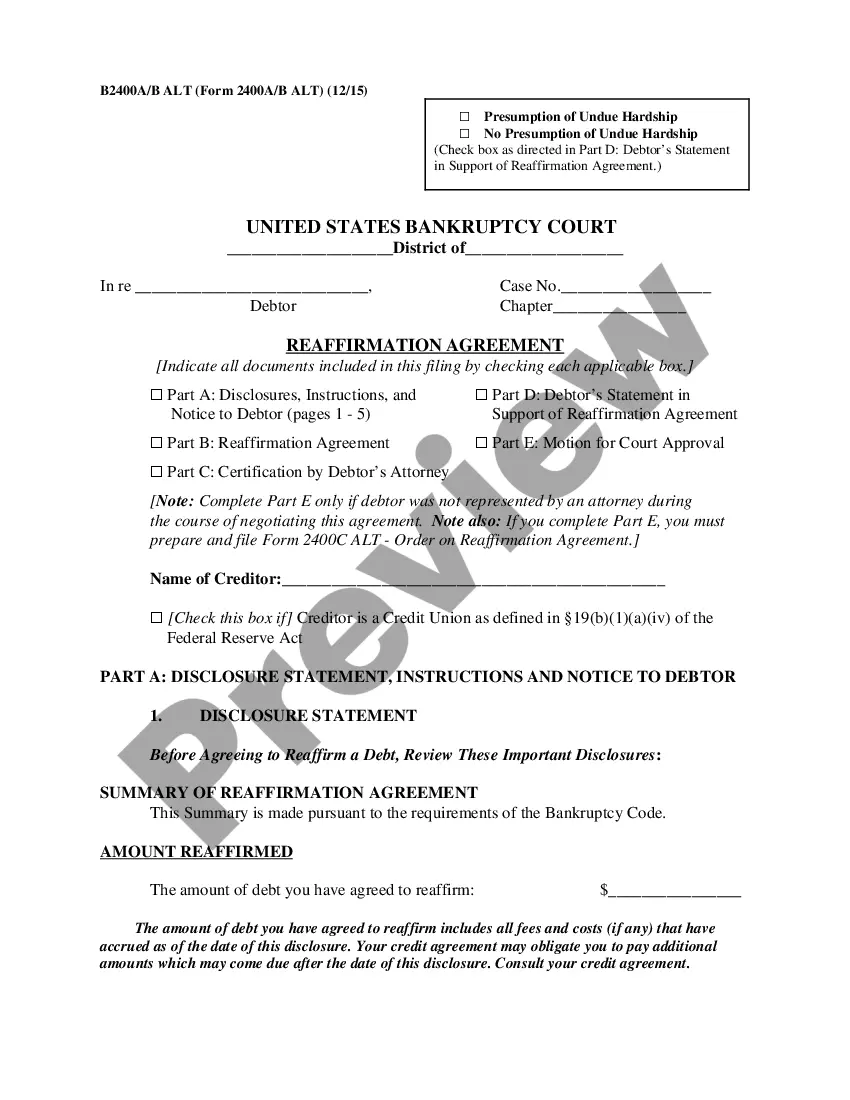

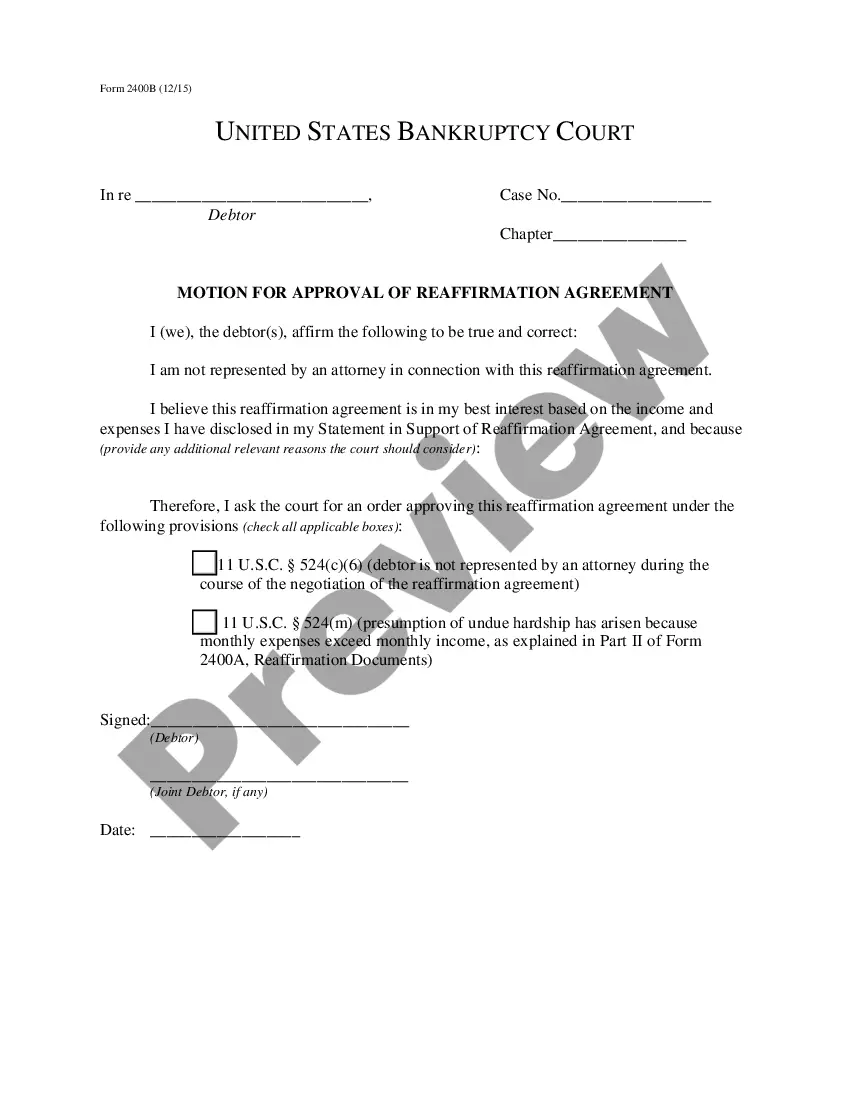

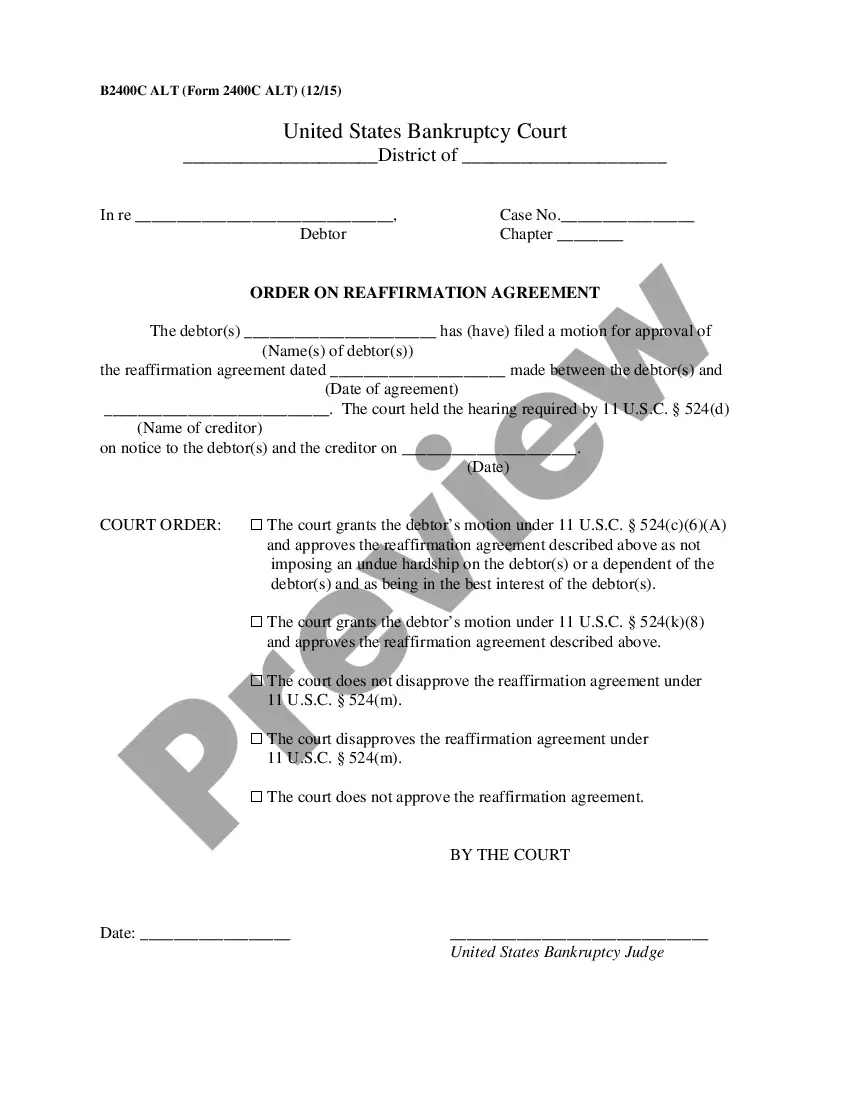

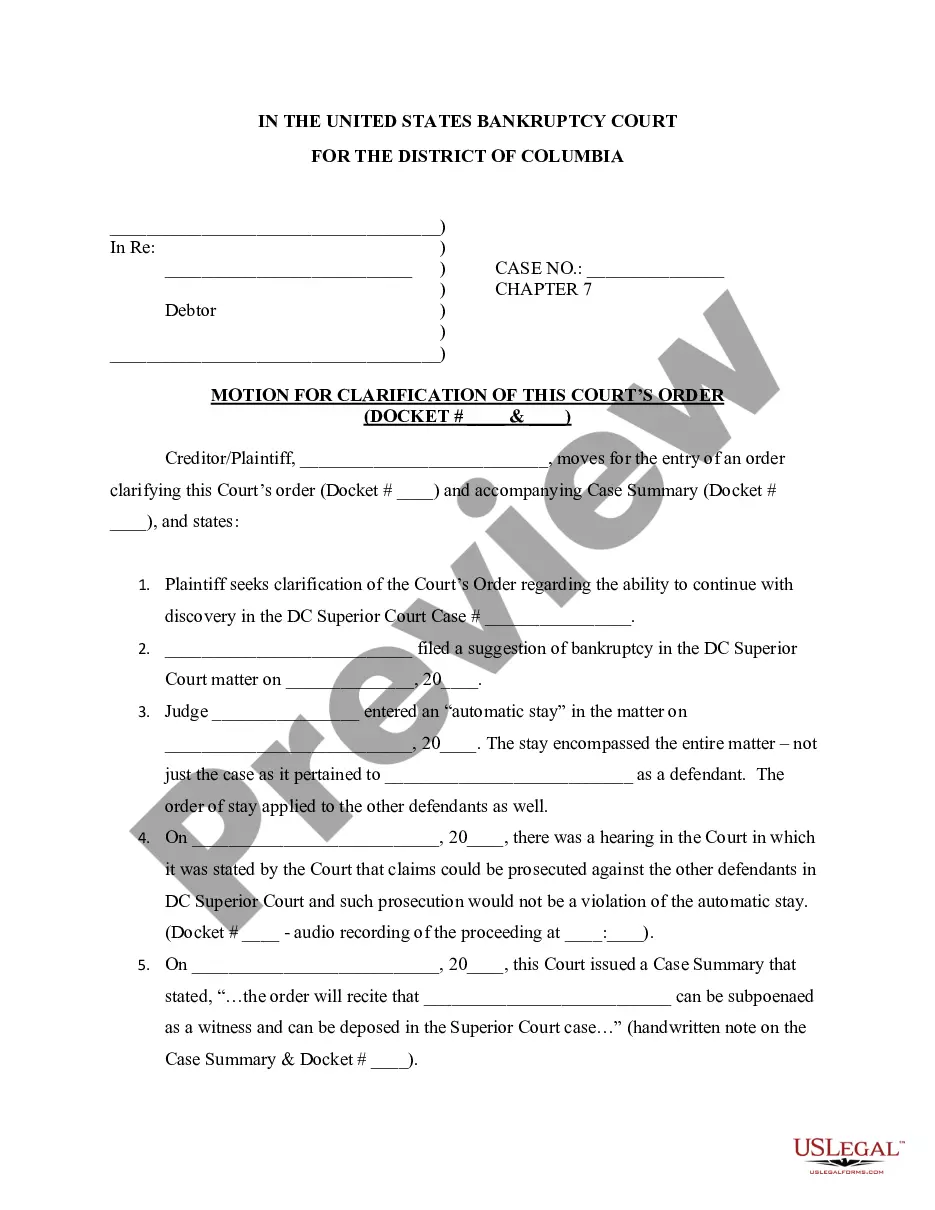

Florida Reaffirmation Agreement, Motion and Order

Description

How to fill out Reaffirmation Agreement, Motion And Order?

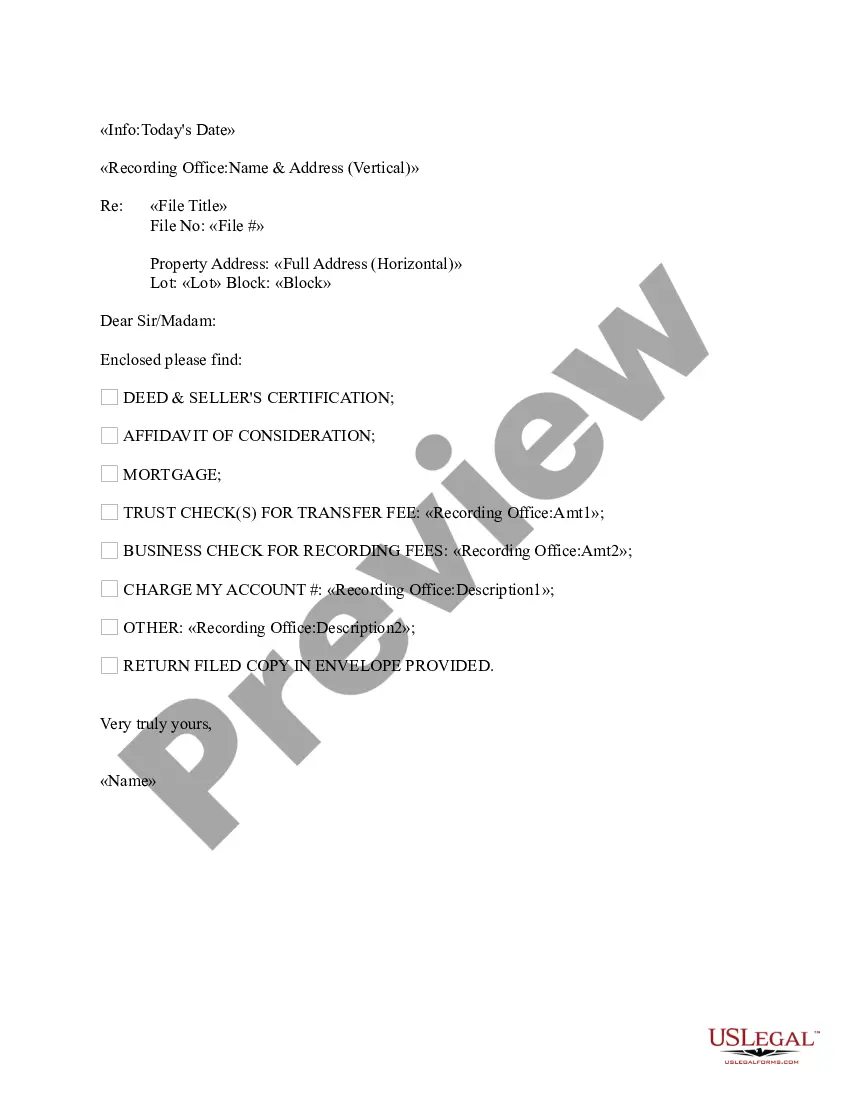

Finding the right legal papers design might be a battle. Obviously, there are tons of web templates available online, but how do you find the legal kind you want? Utilize the US Legal Forms website. The assistance offers a huge number of web templates, for example the Florida Reaffirmation Agreement, Motion and Order, that you can use for business and personal needs. Each of the types are checked out by professionals and meet up with state and federal specifications.

When you are previously authorized, log in to the account and click the Obtain key to have the Florida Reaffirmation Agreement, Motion and Order. Use your account to appear with the legal types you might have bought earlier. Visit the My Forms tab of the account and have another duplicate in the papers you want.

When you are a whole new user of US Legal Forms, here are basic guidelines that you can comply with:

- Initially, ensure you have chosen the right kind to your area/area. You can examine the form utilizing the Review key and browse the form description to make certain it is the right one for you.

- In the event the kind is not going to meet up with your needs, utilize the Seach industry to get the appropriate kind.

- Once you are positive that the form is proper, click on the Buy now key to have the kind.

- Opt for the pricing strategy you need and enter the required info. Design your account and buy your order utilizing your PayPal account or charge card.

- Opt for the submit format and down load the legal papers design to the product.

- Comprehensive, modify and printing and indicator the received Florida Reaffirmation Agreement, Motion and Order.

US Legal Forms may be the greatest catalogue of legal types in which you can discover different papers web templates. Utilize the service to down load appropriately-manufactured files that comply with status specifications.

Form popularity

FAQ

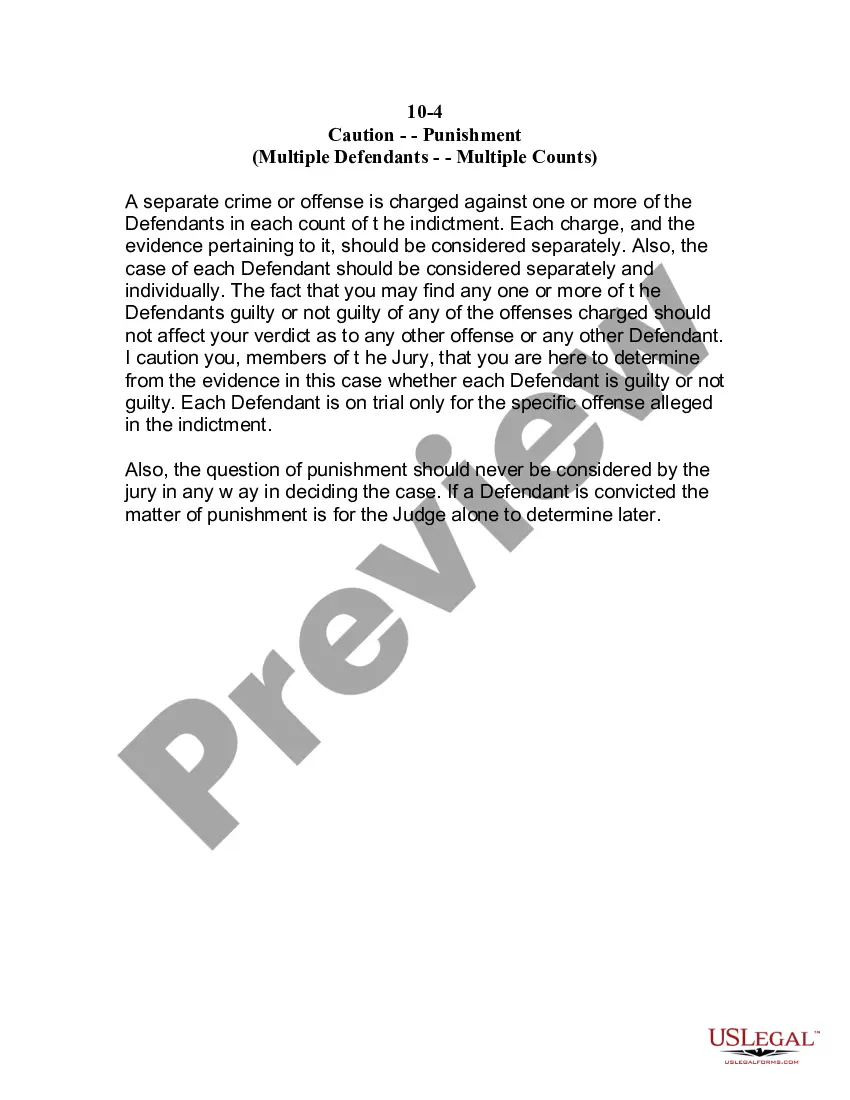

Bottom line. If you're going through bankruptcy, a reaffirmation agreement allows you to agree to pay on certain debts. This process will remove that balance from your discharge, but it can help mitigate the damage of the bankruptcy by allowing you to hold onto the collateral on the loan.

Agreeing to repay the excess loan amount in ance with the terms of the promissory note is called ?reaffirmation.? You can reaffirm an excess loan amount by signing a reaffirmation agreement with your loan servicer.

Reaffirming a debt informs the lender that you intend to continue to pay the loan. Generally, the lender will continue to report the loan and all payments made on that loan to the credit reporting agencies, which may help improve your credit score after bankruptcy, provided timely payments are made on the loan.

Creditors holding a security interest that they want to protect post-bankruptcy will request that a Reaffirmation Agreement is signed. They will prepare it and provide it to your attorney's office for review.

Reaffirmation agreements can be rescinded any time before the Court issues the discharge, or within 60 days after the agreement is filed with the Court, whichever is the later. Notice of the rescission must be given to the creditor.

In this article, you'll learn that lenders sometimes agree to new terms when completing a reaffirmation agreement, including lowering the amount owed, interest rate, or monthly payment. A local bankruptcy lawyer can help you with the negotiation process.

A reaffirmation agreement is an agreement between a chapter 7 debtor and a creditor that the debtor will pay all or a portion of the money owed, even though the debtor has filed bankruptcy. In return, the creditor promises that, as long as payments are made, the creditor will not repossess or take back its collateral.

After you have entered into a reaffirmation agreement and all parts of this form that require a signature have been signed, either you or the creditor should file it as soon as possible.