Florida Software Equipment Request

Description

How to fill out Software Equipment Request?

If you need to compile, acquire, or create sanctioned document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Take advantage of the website's user-friendly and accessible search function to find the documents you require.

A variety of templates for business and personal purposes are organized by categories and states or keywords.

Step 4. Once you have located the form you require, click the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to retrieve the Florida Software Equipment Request in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download button to obtain the Florida Software Equipment Request.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

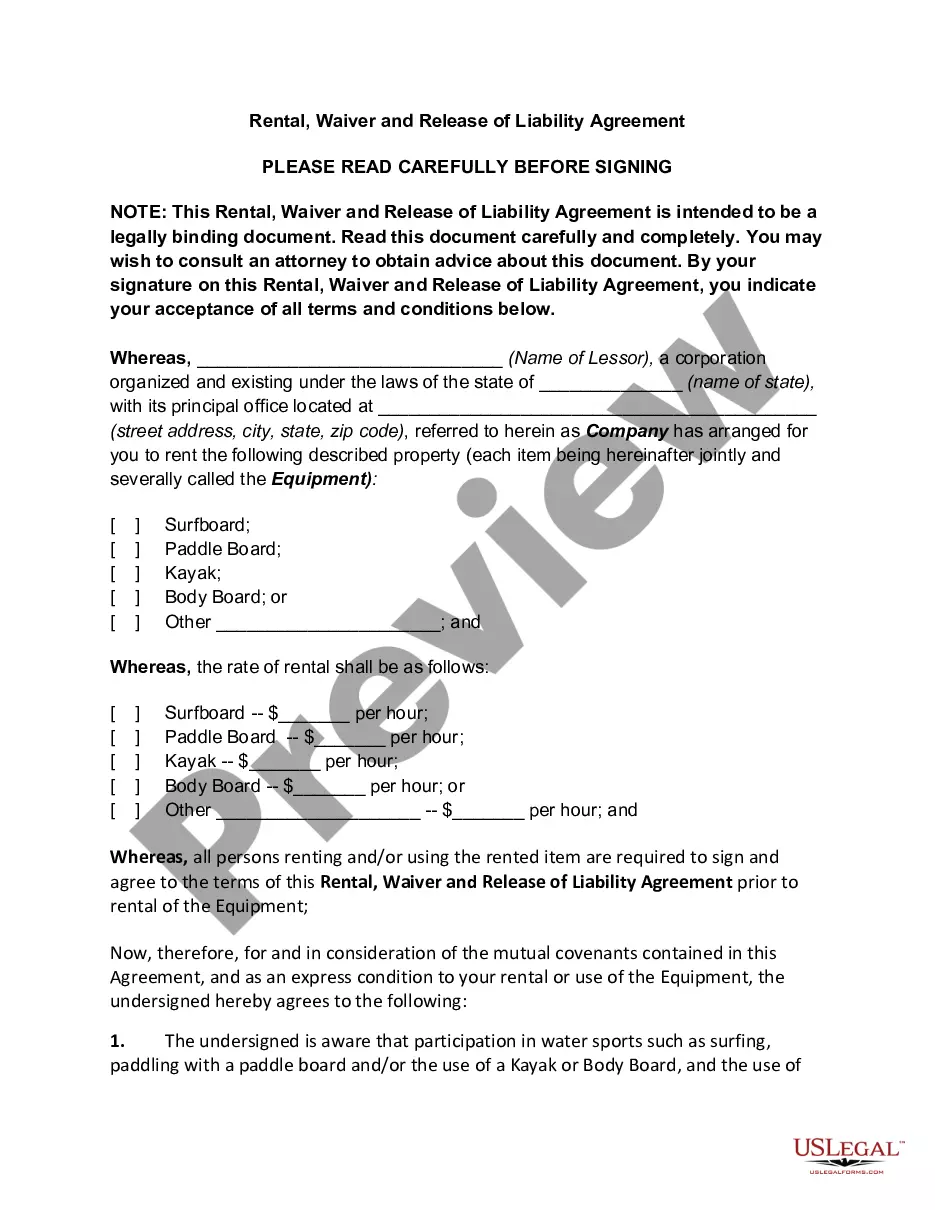

- Step 2. Use the Preview option to check the form's details. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Florida Sales Tax Exemptions for HealthcareChemical compounds and test kits.Hypodermic needles & syringes.Medical gases.Medical services.Prescription drugs.Prosthetic and orthopedic appliances.Single-use medical products.

The majority of states which have addressed the issue and have concluded that software (at least unbundled software) is not tangible personal property for ad valorem tax purposes and therefore is generally not taxable.

The majority of states which have addressed the issue and have concluded that software (at least unbundled software) is not tangible personal property for ad valorem tax purposes and therefore is generally not taxable.

Software" is defined as "personal property," but not as either tangible or in- tangible personal property. 46 In the same statutory section, the Florida Sta- tutes define tangible and intangible personal property, whose definitions fail to include "computer software.

While software is not physical or tangible in the traditional sense, accounting rules allow businesses to capitalize software as if it were a tangible asset. Software that is purchased by a firm that meets certain criteria can be treated as if it were property, plant, & equipment (PP&E).

In other words, Software-as-a-Service as a cloud-computing program that is only accessed remotely without delivery of a tangible media and does not include the user taking possession of the program is not subject to sales or use tax.

Florida doesn't tax SaaS, cloud computing or electronically downloaded software because the state doesn't define any of them as tangible personal property.

Florida does not directly address the taxability of digital goods in statute. Even though Florida defines tangible property very broadly, (it even includes electricity), the Florida Department of Revenue has ruled items electronically delivered and lacking physicality are not taxable.

Sales of custom software - downloaded are exempt from the sales tax in Florida. Sales of customization of canned software are exempt from the sales tax in Florida. Sales of digital products are exempt from the sales tax in Florida.

Sales of custom software - downloaded are exempt from the sales tax in Florida. Sales of customization of canned software are exempt from the sales tax in Florida. Sales of digital products are exempt from the sales tax in Florida.