Florida Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

How to fill out Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

You can devote time online searching for the legal document format that complies with the state and federal criteria you need.

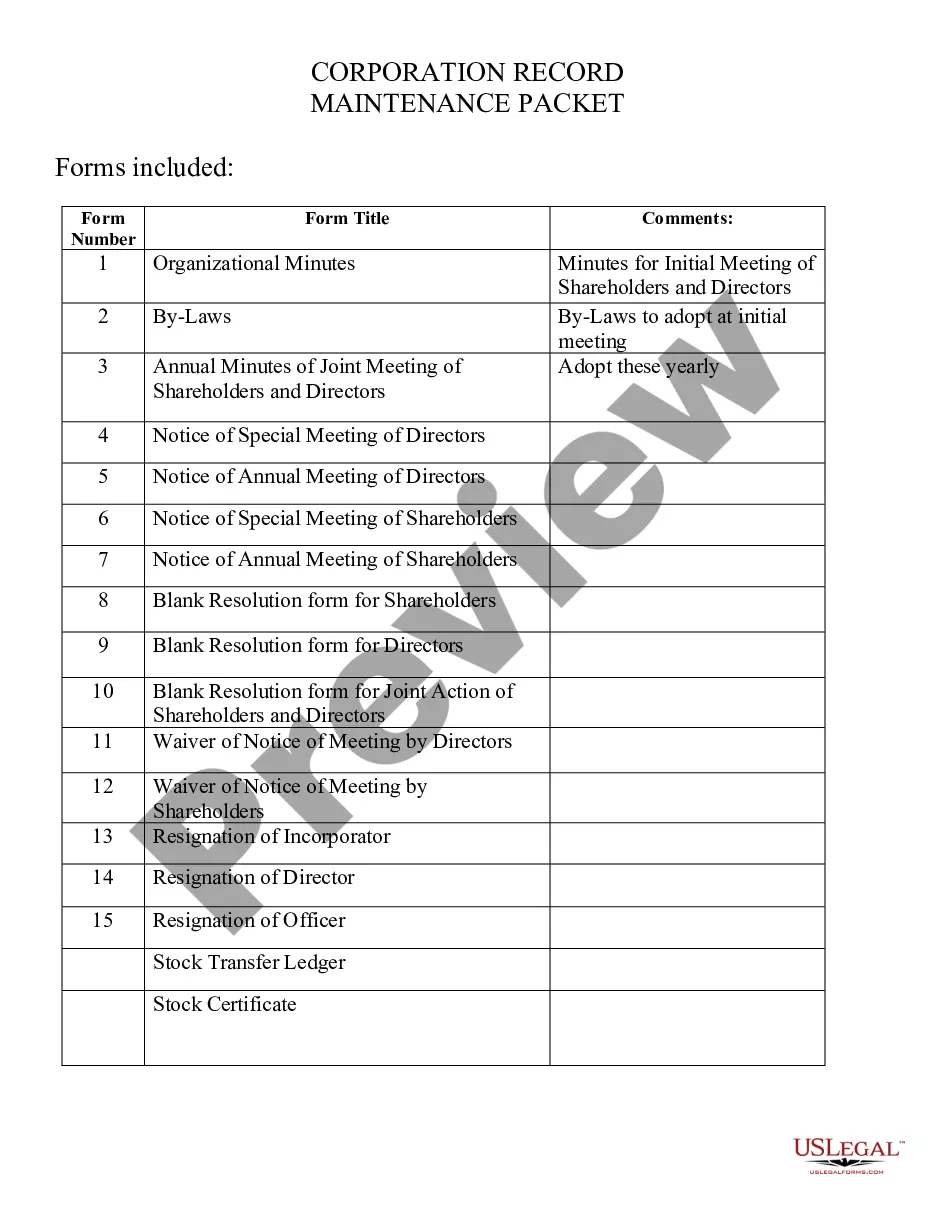

US Legal Forms offers thousands of legal documents that are reviewed by specialists.

You can conveniently download or print the Florida Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase from the platform.

Once you have found the format you want, click Purchase now to proceed. Select the pricing plan you prefer, enter your information, and create an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Locate the format in the file and download it to your device. Make edits to your document if needed. You can complete, modify, and sign the Florida Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. Access and create thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and select the Obtain option.

- Then, you can complete, modify, print, or sign the Florida Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase.

- Every legal document you acquire is yours indefinitely.

- To get another copy of the purchased document, navigate to the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple steps below.

- First, ensure that you have chosen the correct document format for the location/city that you select.

- Examine the document description to ensure you have selected the correct template.

- If available, utilize the Review option to preview the document as well.

- If you wish to find another version of the document, use the Search field to locate the format that suits your needs and requirements.

Form popularity

FAQ

In Florida, lease agreements, including the Florida Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, do not need notarization to be valid. However, notarizing can provide extra assurance of authenticity and protect against disputes down the line. It's a good practice to consider, especially for high-value leases.

A lease becomes legally binding in Florida when both parties agree to the terms and sign the document. Specific features, like the Florida Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, often enhance clarity and enforceability. Compliance with relevant laws also helps to establish its binding nature, protecting both parties.

For a lease agreement, such as a Florida Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, to be valid, it must include certain elements. These include mutual consent by both parties, clear terms regarding the property and lease duration, and reasonable consideration. Ensuring these components are in place will support the validity of your lease.

Florida does not have a single standard lease agreement. Instead, the law provides guidelines that lease agreements, including those for Florida Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, must follow. You can find customizable templates online that meet these legal requirements.

Yes, you can write your own lease in Florida. However, it is crucial that the lease complies with state laws to be enforceable. Using a template for a Florida Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase can simplify the process and ensure you include necessary legal terms.

To exit an equipment lease, start by reviewing your original lease agreement closely. Look for clauses regarding early termination or penalties involved in ending the Florida Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. It may be in your best interest to negotiate with the lessor for a mutually agreeable solution. You can also consult professionals or legal platforms like uslegalforms for guidance tailored to your situation.

There are three main types of net leases: single net leases, double net leases, and triple net leases. When a tenant signs a single net lease, they pay one of the three expense categories: taxes, maintenance, and insurance fees.

Gross leases are commonly used for commercial properties, such as office buildings and retail spaces. Modified leases and fully service leases are the two types of gross leases. Gross leases are different from net leases, which require the tenant to pay one or more of the costs associated with the property.

The term "net lease" is distinguished from the term "gross lease". In a net lease, the property owner receives the rent "net" after the expenses that are to be passed through to tenants are paid.

Most financial leases are "net" leases, meaning that the lessee is responsible for maintaining and insuring the asset and paying all property taxes, if applicable. Financial leases are often used by businesses for expensive capital equipment.