Florida New Employee Survey

Description

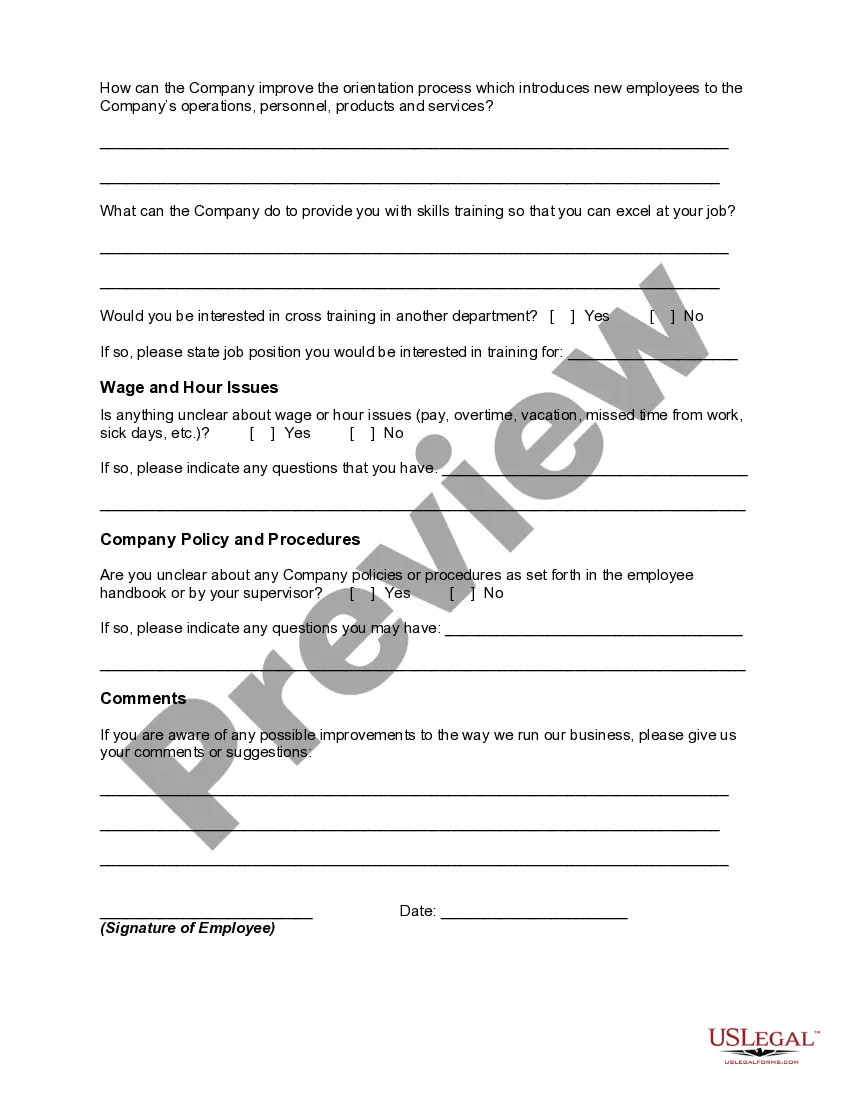

New employee surveys can be done for many purposes. One of them is the new employee orientation survey. This survey is generally done after a few days of orientation to determine any potential issues relating to productivity, turnover, attitudes and other aspects. It would also help the management to understand the productivity of the orientation or training program that the new employee went through in the initial days. The employee's experiences in the early days of employment are also important determinants, since they represent the company's image through the eyes of a new person.

Another kind of new employee survey can be undertaken to know whether the employee has completely understood all the aspects of the new job or not. This can include the job analysis and description, the basics of the job, the most enjoyable and least enjoyable parts of the job, and so on. New employee survey can include information relating to corporate culture, training, supervisor relations, work environment, pay and benefits, communications, feedback, leadership, corporate vision, and overall satisfaction.

How to fill out New Employee Survey?

It is feasible to invest time online looking for the authentic documents template that fulfills the state and federal regulations you require.

US Legal Forms provides thousands of authentic forms that are vetted by experts.

You can easily download or print the Florida New Employee Survey from your service.

If you wish to obtain another version of the form, use the Lookup field to find the template that meets your needs and requirements.

- If you have a US Legal Forms account, you can Log In and then click the Obtain button.

- After that, you can fill out, modify, print, or sign the Florida New Employee Survey.

- Each authentic document template you acquire is yours indefinitely.

- To get another copy of any downloaded form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your area/town that you choose.

- Review the form description to verify that you've chosen the right form.

- If available, utilize the Preview button to view the document template as well.

Form popularity

FAQ

The W-4 form is used by employees to inform their employer of their tax withholding preferences, impacting their paycheck and tax liability. The I-9 form verifies a new employee's identity and eligibility to work in the United States. Completing these forms is crucial during the onboarding process, and they are often addressed in the Florida New Employee Survey to ensure that new hires understand their importance.

Steps to Hiring your First Employee in FloridaStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Steps to Hiring your First Employee in FloridaStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

You can call the Florida New Hire Reporting Center toll-free at or 888-854-4791....Florida New Hire Reporting FormNew Employees. Employers must report all employees who reside or work in the State of Florida.Re-Hires or Re-Called Employees.Temporary Employees.

Effective October 1, 2021, all Florida employers (regardless of size) are required to report new hires and rehires to the State Directory of New Hires within 20 days of hire. The amendment is a significant change for Florida businesses and imposes new requirements for employers who were not previously affected.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Required Employment Forms in FloridaSigned Job Offer Letter.W2 Tax Form.I-9 Form and Supporting Documents.Direct Deposit Authorization Form (Template)Federal W-4 Form.Employee Personal Data Form (Template)Company Worker's Compensation Insurance Policy Forms.Company Health Insurance Policy Forms.More items...?

Federal PostersUniformed Services Employment and Reemployment Right Act (USERRA) Poster.Family and Medical Leave Act (FMLA) Poster.Fair Labor Standards Act (FLSA) Minimum Wage Poster.Equal Employment Opportunity Is The Law Poster.Job Safety and Health: It's the Law Poster.

You can call the Florida New Hire Reporting Center toll-free at or 888-854-4791. You can also visit newhire.state.fl.us to find more detailed information and download forms.

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.