Florida Sample Letter for Writ of Garnishment

Description

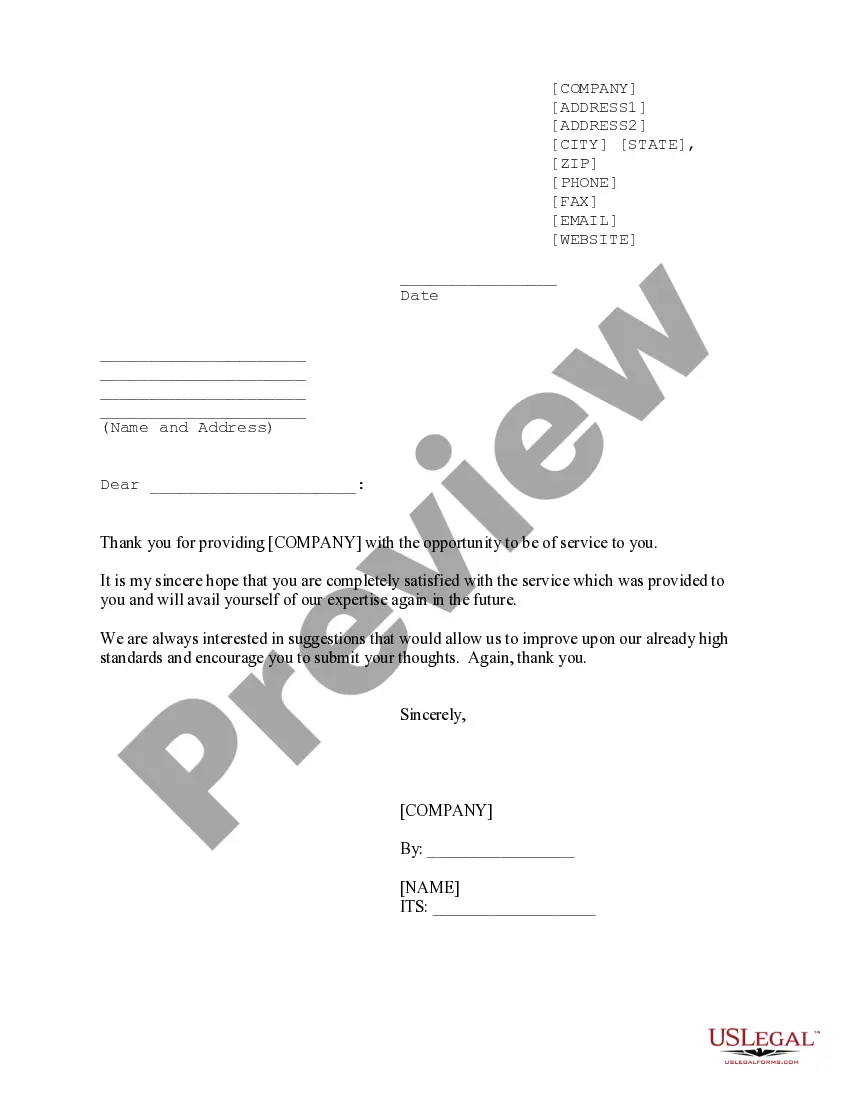

How to fill out Florida Sample Letter For Writ Of Garnishment?

Choosing the best legitimate papers web template can be a battle. Of course, there are a lot of themes available online, but how would you obtain the legitimate type you will need? Utilize the US Legal Forms website. The support provides 1000s of themes, like the Florida Sample Letter for Writ of Garnishment, that you can use for enterprise and private needs. Each of the forms are checked out by experts and satisfy federal and state demands.

Should you be already registered, log in in your bank account and click the Down load switch to have the Florida Sample Letter for Writ of Garnishment. Use your bank account to appear through the legitimate forms you may have bought previously. Go to the My Forms tab of the bank account and get an additional version of your papers you will need.

Should you be a fresh consumer of US Legal Forms, listed below are easy recommendations so that you can comply with:

- Initially, ensure you have selected the proper type for the metropolis/county. You may look over the form utilizing the Preview switch and browse the form explanation to make sure this is the best for you.

- If the type fails to satisfy your expectations, use the Seach discipline to get the proper type.

- Once you are certain the form would work, select the Purchase now switch to have the type.

- Opt for the rates program you desire and enter in the needed information and facts. Design your bank account and pay for your order utilizing your PayPal bank account or bank card.

- Select the data file structure and down load the legitimate papers web template in your device.

- Complete, change and print out and indicator the attained Florida Sample Letter for Writ of Garnishment.

US Legal Forms is the greatest local library of legitimate forms that you can find a variety of papers themes. Utilize the service to down load professionally-created paperwork that comply with status demands.

Form popularity

FAQ

Florida garnishment law requires the creditor to provide the debtor with a copy of the creditor's motion, a copy of the Writ of Garnishment issued by the clerk of the court, and a Claim of Exemption form within five days of the clerk's issuance of the writ, or within three days of service onto the garnishee, whichever ...

Particularly with a continuing writ of garnishment, in Florida the withholdings will continue automatically until the judgment is PAID IN FULL including all assessable interest, costs, and fees. Depending on the scenario, this process can persist for YEARS. Yes, that's years, plural.

§§ 1671-1673) limits the amount to be withheld from salary or wages to no more than 25% of any individual defendant's disposable earnings (the part of earnings remaining after the deduction of any amounts required by law to be deducted) for any pay period or to no more than the amount by which the individual's ...

Dollar Limits to Head of Household Exemption There are no dollar limits to Florida's head of household exemption. The debtor who qualifies as a head of household may exempt unlimited amounts of earnings from garnishment. The exemption is also not limited by the amount of the civil judgment.

Here are the rules: A creditor can garnish 25% of your disposable income or the amount by which your disposable income exceeds 30 times federal minimum wage, whichever is less. In Florida, if your disposable income is less than 30 times federal minimum wage, your wages can't be garnished at all.

At a minimum, your written objection to the garnishment should include the following information: the case number and case caption (ex: "XYZ Bank vs. John Doe") the date of your objection. your name and current contact information. the reasons (or "grounds") for your objection, and. your signature.

Upon service of the Writ of Garnishment, the Garnishee will "hold" those assets in the Garnishee's possession at the time of service of the Writ or at any item between the service of the Writ of Garnishment and Garnishee's Answer until there is an Order directing the Garnishee to disburse the funds.

How do you stop wage garnishment in Florida? A Chapter 7 or Chapter 13 case will put an immediate stop to a wage or bank account garnishment. In some cases, a head of household exemption may also stop a garnishment.