Florida Employment Verification Letter for Contractor

Description

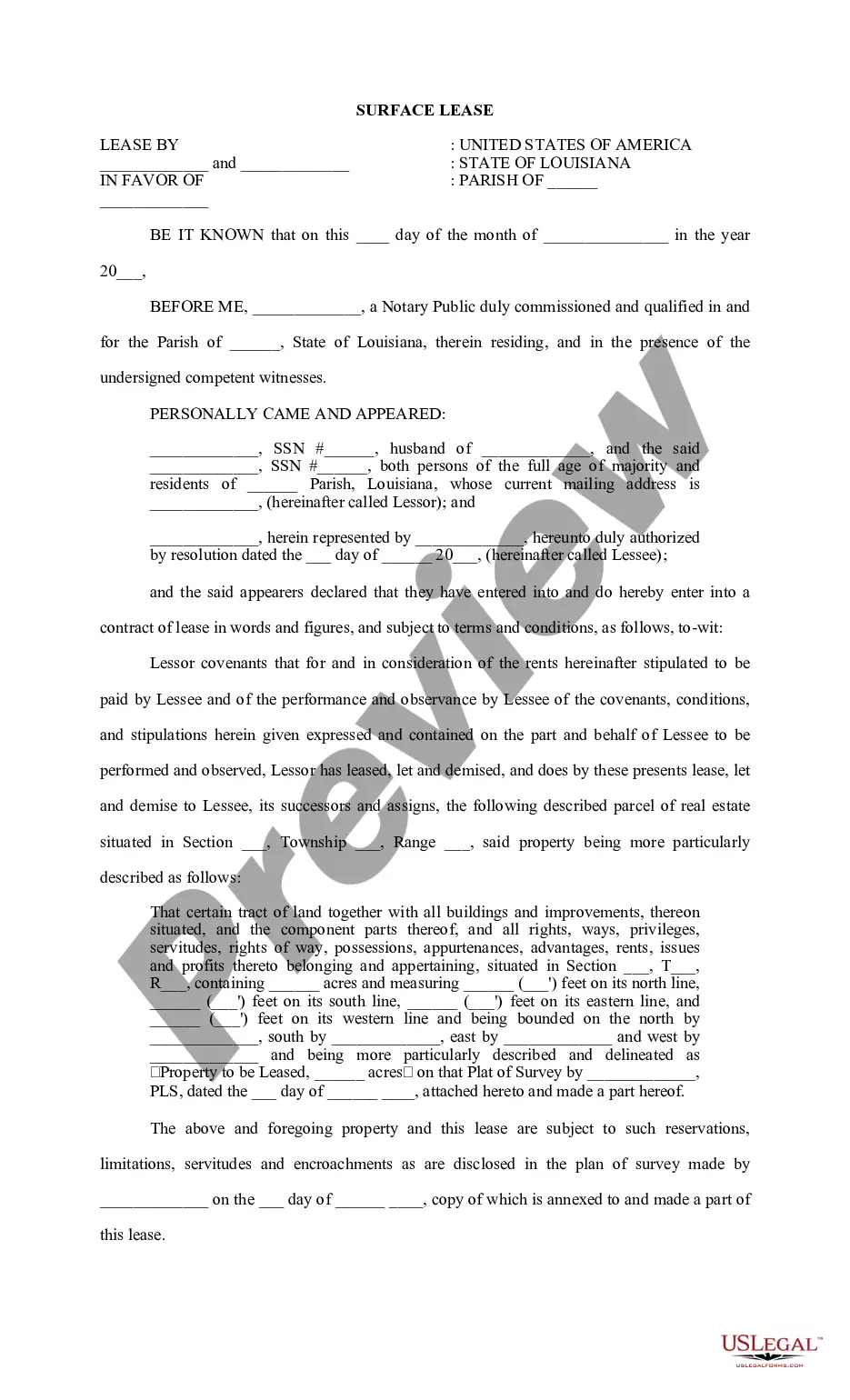

How to fill out Employment Verification Letter For Contractor?

You can spend multiple hours online searching for the legal document format that meets the federal and state requirements you require.

US Legal Forms provides thousands of legal templates that can be reviewed by experts.

You can effortlessly download or print the Florida Employment Verification Letter for Contractor from the platform.

If available, use the Preview button to browse through the document format as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, edit, print, or sign the Florida Employment Verification Letter for Contractor.

- Every legal document format you obtain is yours forever.

- To get another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document format for the region/city of your choice.

- Review the form description to ensure you have chosen the right one.

Form popularity

FAQ

Begin a Florida Employment Verification Letter for Contractor by formatting it with your company’s letterhead at the top. Open the letter with the date and recipient's details, followed by a clear introduction stating the letter's purpose. Remember to address the contractor respectfully and highlight their employment details in the body. Craft it in a straightforward manner to ensure clarity and professionalism.

If you are self-employed and need to provide proof of employment, consider utilizing a Florida Employment Verification Letter for Contractor format to create one. Include details about your business, your role, and client contracts that demonstrate your work history. Additionally, attach tax returns or bank statements showing income to enhance your credibility. These documents combined serve as solid proof of your employment status.

To report 1099 contractor income, you need to fill out a Schedule C or Schedule C-EZ form as part of your tax return. Ensure you properly account for all income documented on your 1099 forms. Utilizing a Florida Employment Verification Letter for Contractor can also support your reporting by affirming your contractor status and the nature of your work.

You can show proof of income with your 1099 forms, which summarize your earnings for the year. Alongside these forms, consider including a Florida Employment Verification Letter for Contractor to substantiate your work's legitimacy. This combination of documents effectively presents your financial status to banks or other institutions.

To prove your income as a 1099 contractor, gather your 1099 forms, bank statements, and invoices that show the payments you received. Additionally, a Florida Employment Verification Letter for Contractor can provide a formal acknowledgment of your earnings and work status. Having these documents ready can make it easier for you when applying for loans or financial assistance.

To prove you are an independent contractor, you should maintain records of your contracts, invoices, and payment receipts. It's beneficial to have a Florida Employment Verification Letter for Contractor that confirms your status and details your work relationship with clients. Additionally, providing a copy of your business license or tax identification can strengthen your claim.

Independent contractors do not typically receive formal offer letters like employees. Instead, they often work under contracts that outline the terms of their engagement. In situations where a verification is required, having a Florida Employment Verification Letter for Contractor can be beneficial, confirming the details of their working relationship.

Yes, you can be hired without a formal offer letter as an independent contractor. Many contractors work based on verbal agreements or contracts instead. However, it is advisable to secure documentation that outlines your work terms, and a Florida Employment Verification Letter for Contractor can complement this arrangement.

To provide proof of employment as an independent contractor, you can present a signed contract or agreement detailing the work performed. Additionally, a Florida Employment Verification Letter for Contractor can be an effective document to share with potential clients or organizations needing verification of your contractor status.

Independent contractors typically do not require an offer letter in the same way employees do. However, having a clear agreement or contract can outline expectations and responsibilities. A Florida Employment Verification Letter for Contractor can serve as proof of the relationship and work performed, which may be beneficial.