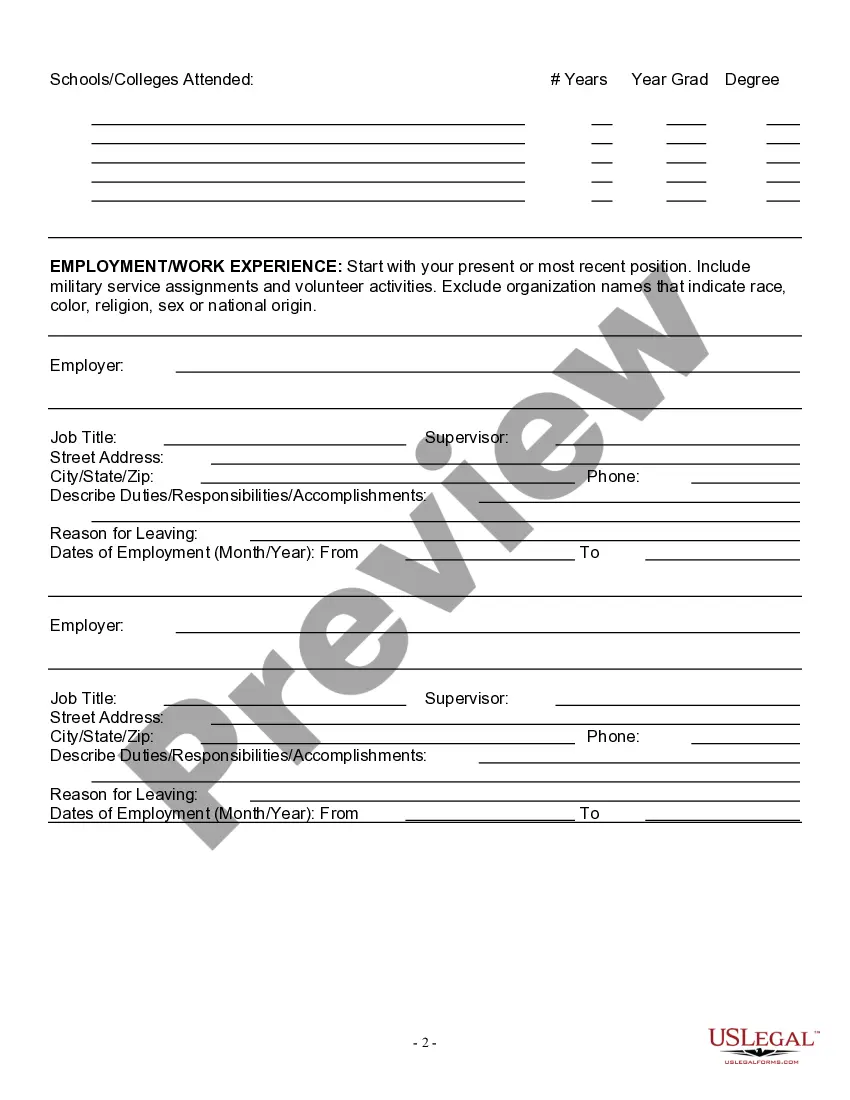

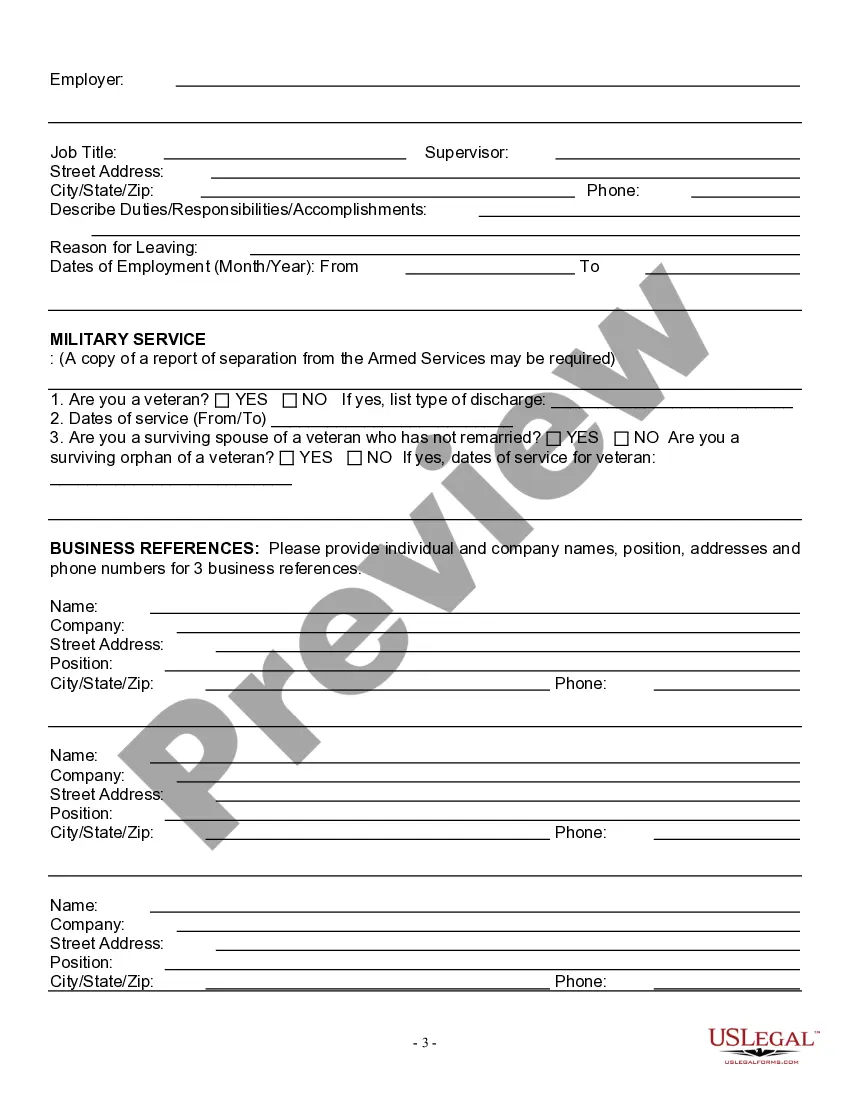

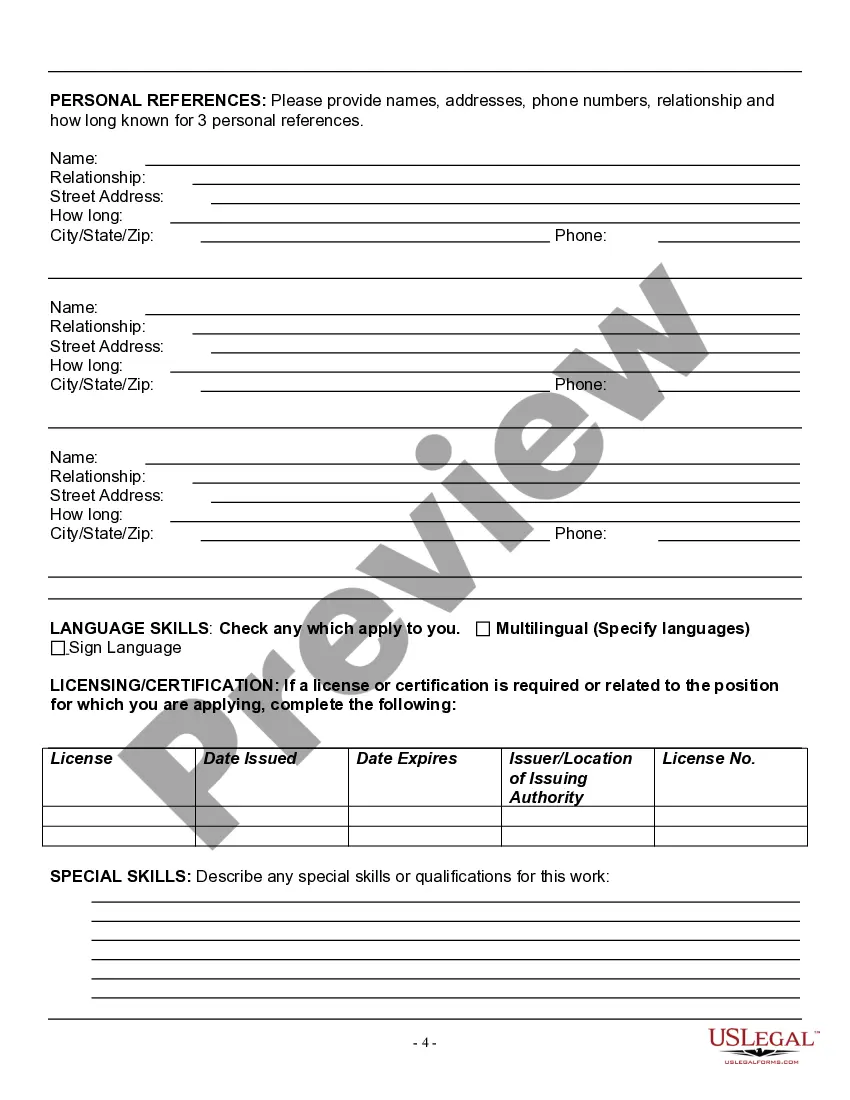

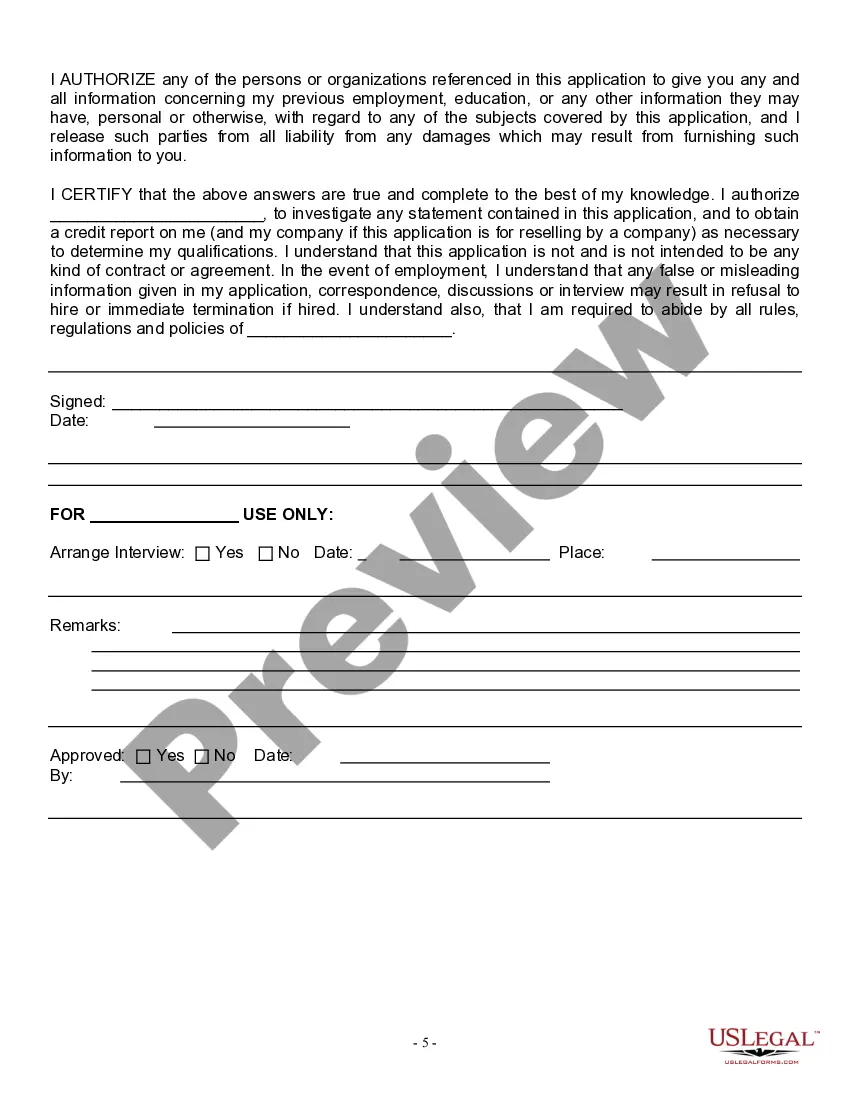

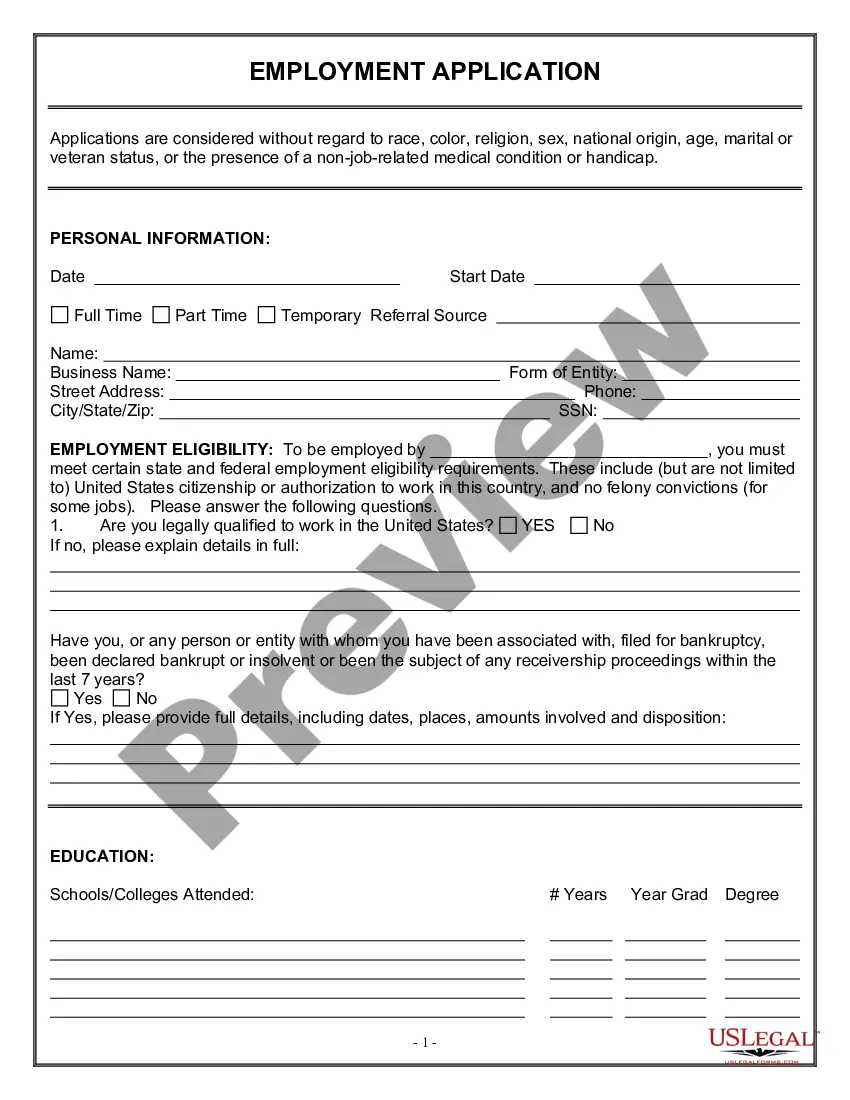

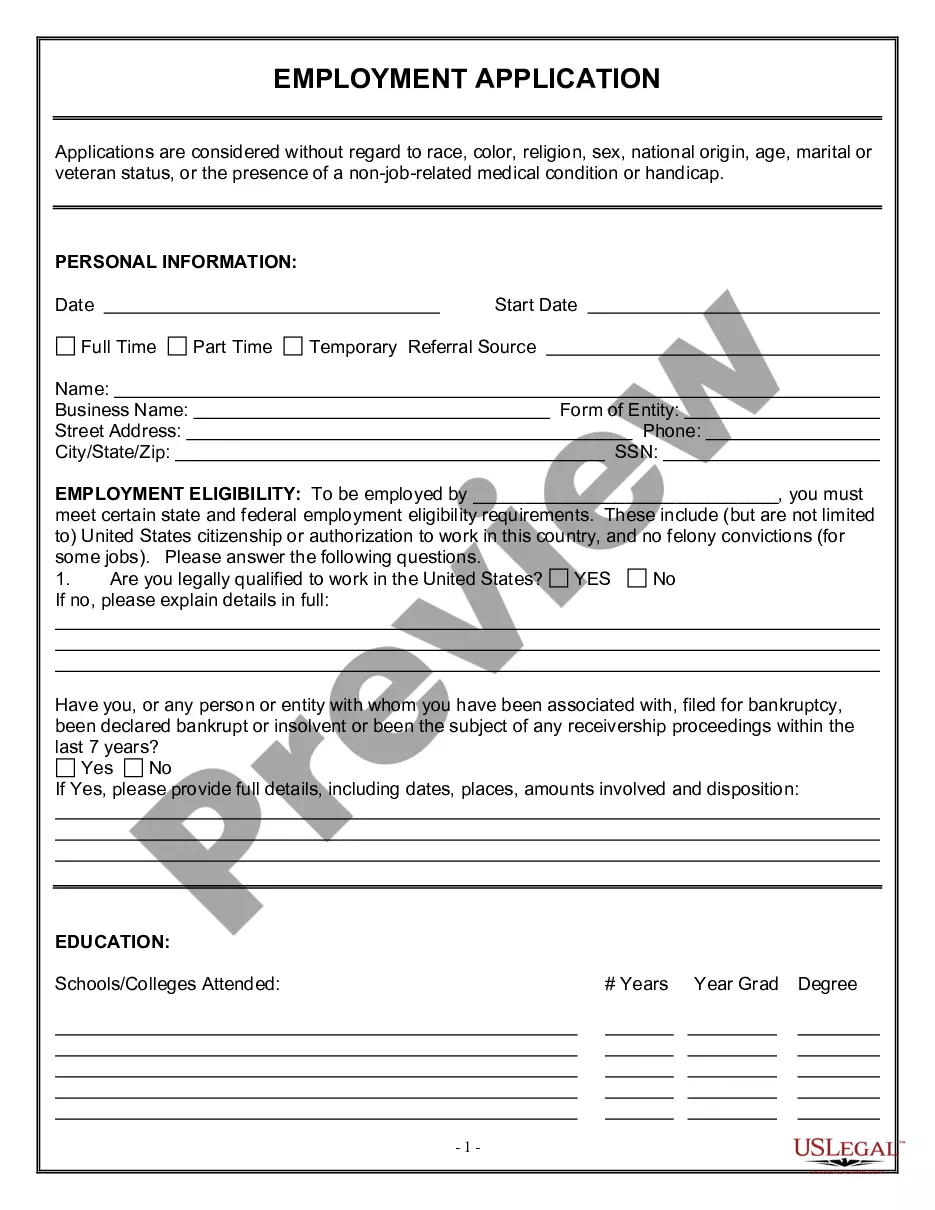

Florida Employment Application for Sole Trader

Description

How to fill out Employment Application For Sole Trader?

If you want to finalize, retrieve, or produce authentic document templates, utilize US Legal Forms, the most significant assortment of authentic forms accessible online.

Take advantage of the site's effortless and straightforward search feature to acquire the documents you require.

A selection of templates for professional and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to carry out the purchase.

- Utilize US Legal Forms to obtain the Florida Employment Application for Sole Trader with just a few clicks.

- If you are an existing US Legal Forms user, sign in to your account and select the Download option to get the Florida Employment Application for Sole Trader.

- You can also access forms you previously saved from the My documents section of your account.

- If you're utilizing US Legal Forms for the first time, adhere to the steps below.

- Step 1. Ensure you have selected the form for the correct area/state.

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, utilize the Search field at the top of the screen to find additional forms in the legal form category.

Form popularity

FAQ

If you obtain, purchase or convert ferrous or nonferrous metals into raw material products, in addition to registering for sales and use tax, you must also complete the Registration Application for Secondhand Dealers and/or Secondary Metals Recyclers (Form DR-1S).

Yes! Many self-employed individuals, especially those who work from home, do not obtain a business license from the state or local government in Florida. If the state discovers that you are working in an occupation without a license, there are a number of bad things that can happen.

If you're filing a use tax return to the Florida DOR, you can do that online or by completing ands submitting Form DR-15, Florida Sales and Use Tax Return, along with your use tax payment.

A sole proprietorship in Florida is the least complex and cheapest form of doing business. It is different from other businesses in the following ways: It requires no formal paperwork to set up. It doesn't need to be registered with the state.

The number will be located on the back of your certificate of registration. To make reporting and paying sales and use tax for your registered business easier, you may obtain a county control reporting number.

Form DR-1, Florida Business Tax Application, is a form that must be completed by the owners of different business entities to register, file, and pay Florida taxes, surcharges, and fees. This form must be filled in by individuals before beginning to perform activities in Florida, subject to taxes and fees of the state.

There are four simple steps you should take:Choose a business name.File a trade name with the Department of State.Obtain licenses, permits, and zoning clearance.Obtain an Employer Identification Number.

Florida law requires Reemployment Assistance claimants, unless otherwise exempt, to complete the work registration process in Employ Florida prior to requesting benefit payments.

How to Open a Sole Proprietorship Business in FloridaChoose a business name.Find a domain name.File a trade name and advertise the business.Obtain licenses and permits.Obtain an employer identification number, if applicable.Submit a new hire report, if applicable.Open a bank account.Purchase insurance.

You must submit an SS-4 form to the Internal Revenue Service to obtain a Federal Employer Identification Number or determine if your business entity is required to have one. You may reach the IRS by calling 1-800-829-4933 or visiting their web site .