A Florida Corporate Ownership Statement, also known as a Domestic Corporation Statement of Information, is a form filed with the Florida Department of State, Division of Corporations. The Statement is used to update the state on changes in the corporate ownership of a Florida corporation. It must be filed within 90 days of the anniversary of the corporation's formation date, and every two years thereafter. The Florida Corporate Ownership Statement includes the following information: the corporate name; the Florida filing number; the current registered agent and registered office address; the names and addresses of the corporate officers and directors; the names and addresses of the corporate shareholders; the date of incorporation; and the type of business the corporation is engaged in. There are two types of Florida Corporate Ownership Statement: the Original Statement of Information and the Amended Statement of Information. The Original Statement of Information is used to update the state on changes in the corporate ownership of a Florida corporation within 90 days of the corporation's formation date. The Amended Statement of Information is used to update the state on changes in the corporate ownership of a Florida corporation every two years thereafter.

Florida Corporate Ownership Statement

Description

How to fill out Florida Corporate Ownership Statement?

Drafting official documents can be quite stressful unless you have accessible fillable models ready to use. With the US Legal Forms online repository of formal papers, you can trust the forms you acquire, as all of them adhere to federal and state regulations and have been reviewed by our experts.

Obtaining your Florida Corporate Ownership Statement from our platform is as simple as 1, 2, 3. Previously registered users with an active subscription need only Log In and click the Download button after identifying the appropriate template. Subsequently, if necessary, users can retrieve the same form from the My documents section of their account. However, even if you are new to our service, registering with a valid subscription will take just a few moments. Here’s a brief guide for you.

Haven’t you explored US Legal Forms yet? Subscribe to our service now to access any official document swiftly and effortlessly whenever you require it, and maintain your paperwork orderly!

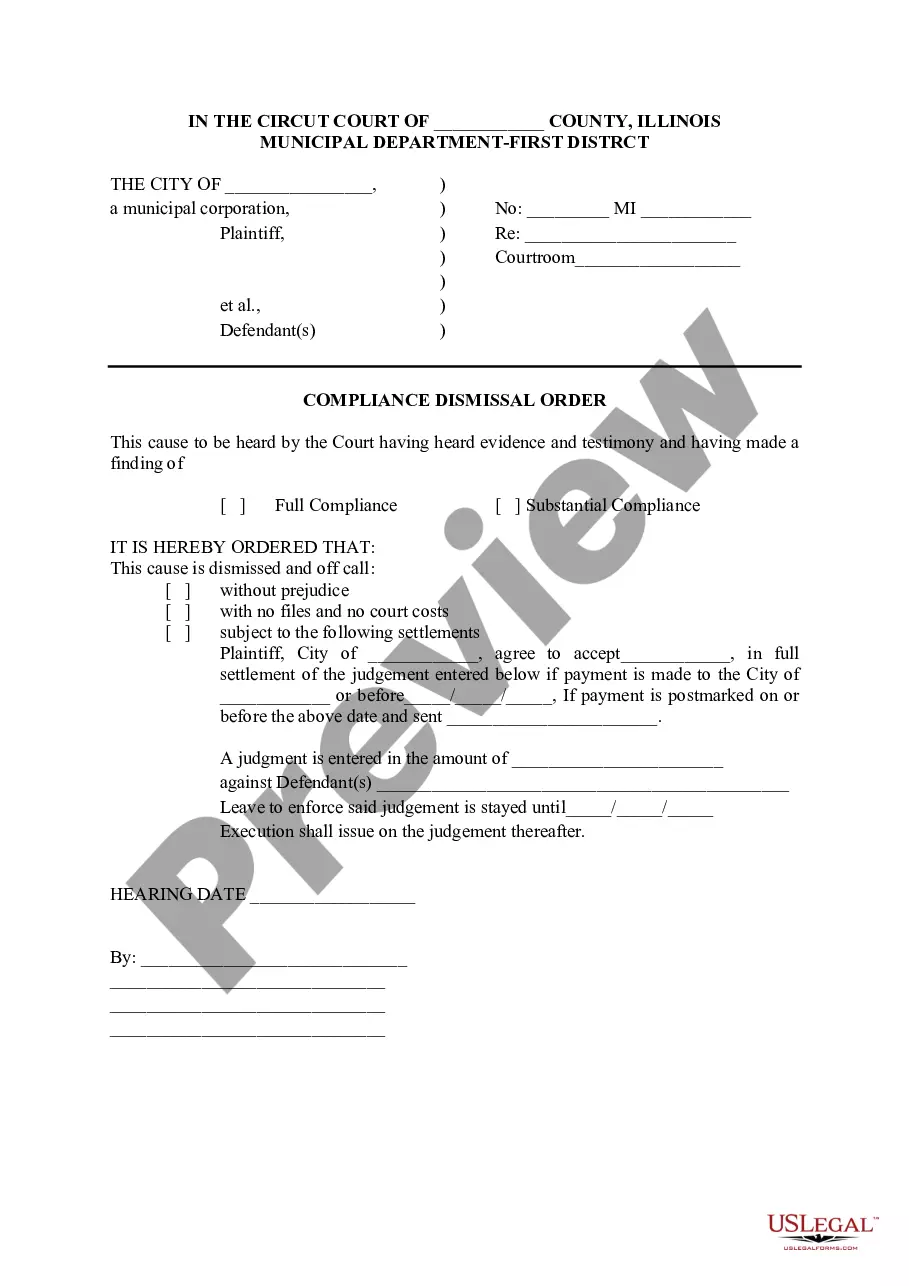

- Document compliance verification. You should carefully review the contents of the form you wish to ensure it fulfills your requirements and complies with your state regulations. Previewing your document and examining its general description will assist you in doing that.

- Alternative search (optional). If you encounter any discrepancies, navigate through the library using the Search tab at the top of the page until you discover a suitable form, and click Buy Now once you find the one you need.

- Account setup and form acquisition. Create an account with US Legal Forms. After your account is verified, Log In and choose your desired subscription plan. Proceed with payment (PayPal and credit card options are available).

- Template download and additional usage. Choose the file format for your Florida Corporate Ownership Statement and click Download to save it on your device. Print it out for manual completion, or use a comprehensive online editor to prepare an electronic version more quickly and efficiently.

Form popularity

FAQ

To file a Florida corporate tax return, you need to complete Form F-1120, the Florida Corporate Income/Franchise Tax Return. Make sure to include all necessary financial information and follow any specific instructions provided on the form. Submit your completed return to the Florida Department of Revenue by the deadline to avoid penalties. US Legal Forms offers resources that can guide you through the tax filing process, ensuring you meet all requirements accurately.

In Florida, you file a corporation with the Florida Division of Corporations, which is part of the Department of State. Depending on your preference, you can submit your filings online or send them by postal mail. Make sure you have all required information and documentation prepared to ensure a smooth filing process. Using a service like US Legal Forms can also help you determine the correct agency and provide you clear instructions for submission.

Your Florida corporate filings are legitimate if you have accurately completed and submitted the necessary documents through the appropriate channels. It is essential to ensure that you followed all state regulations. You can verify the legitimacy of your filings by checking with the Florida Department of State's Division of Corporations. If you need assistance or confirmation, consider using platforms like US Legal Forms to streamline your filing process.

Transferring ownership of a mobile home in Florida involves a few simple steps. First, you must fill out the appropriate title transfer form, which includes information about the buyer and seller. Next, you will need to sign the title and provide it to the new owner. For added convenience, US Legal Forms can provide templates for various documents, including those related to the Florida Corporate Ownership Statement, helping streamline your transfer process.

To fill out Florida Form 82040, begin by reading the instructions carefully to understand what information is needed. This form usually requires details about the owner, vehicle information, and any liens on the vehicle. Take your time to enter the information accurately to avoid delays. If you face challenges, US Legal Forms can help you with clear directions for completing the Florida Corporate Ownership Statement and ensure you meet all requirements.

To properly fill out a Florida title, start by locating the title document for your vehicle. Ensure that you fill in the necessary sections, such as the seller's and buyer's information, the odometer reading, and any other required details. Make sure to sign in the designated areas and date the form. If you're unsure, you can rely on resources like US Legal Forms, which provide guidance for completing documents like your Florida Corporate Ownership Statement.

Yes, a Florida LLC is required to file Articles of Organization to be formally established. This document lays the foundation for your business and ensures compliance with state law. Remember, when working on your Florida Corporate Ownership Statement, these Articles are essential as they provide crucial details about the ownership and structure of your LLC.

Yes, in Florida, a Business Ownership Information (BOI) report is mandatory for certain filings. This information must accurately reflect the ownership structure of your entity. When preparing your Florida Corporate Ownership Statement, you’ll want to ensure that your BOI is complete and compliant to avoid any legal issues.

Yes, Articles of Incorporation are also public records in Florida. This means that the information within these documents is accessible to the public. As you gather information for your Florida Corporate Ownership Statement, it's beneficial to know that these records can play a role in establishing the legitimacy of your business.

Yes, the owner of an LLC is considered public record in Florida. This means that anyone can access information about the LLC's owner through state records. It’s important to understand this transparency, especially when filing your Florida Corporate Ownership Statement, as it reflects ownership details that may be relevant for various legal and financial transactions.