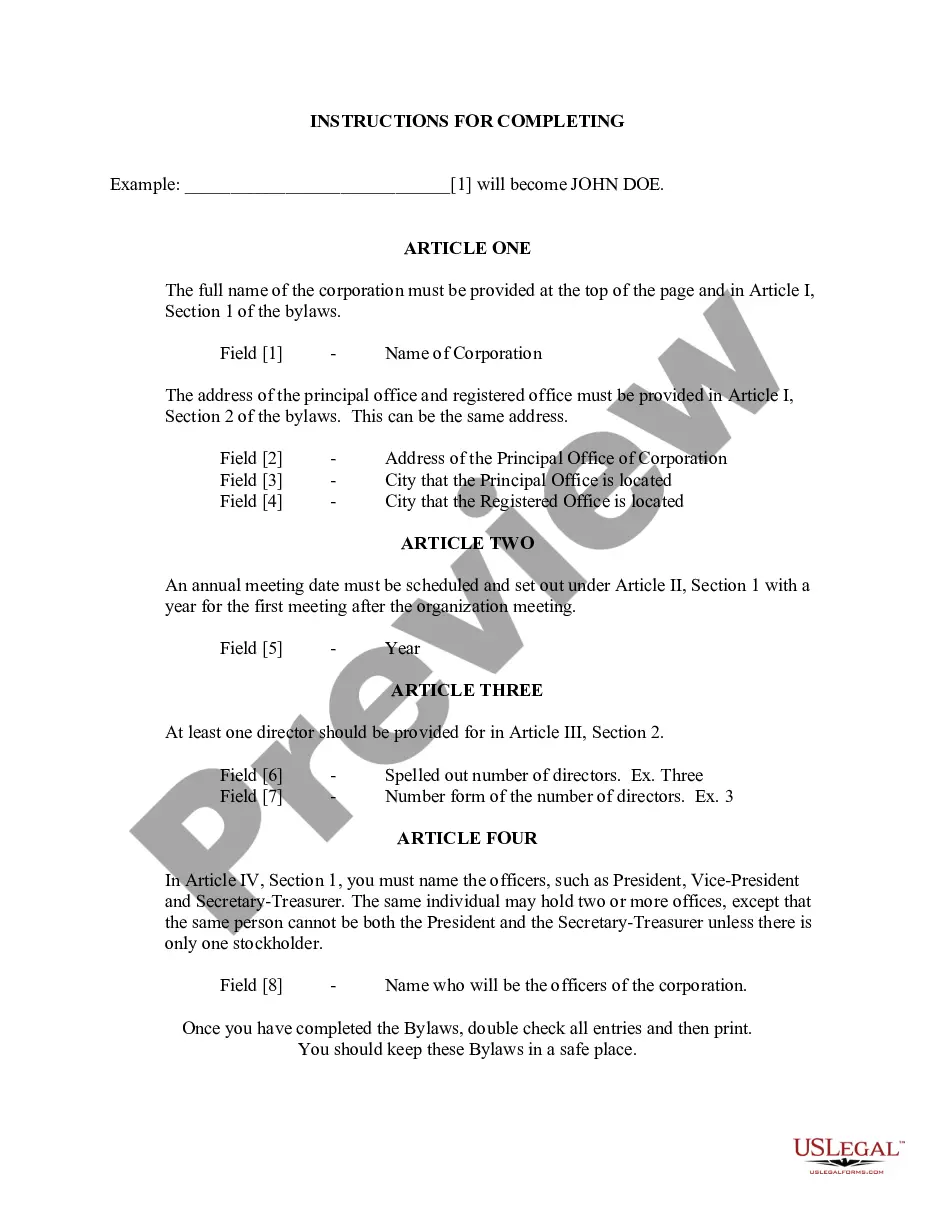

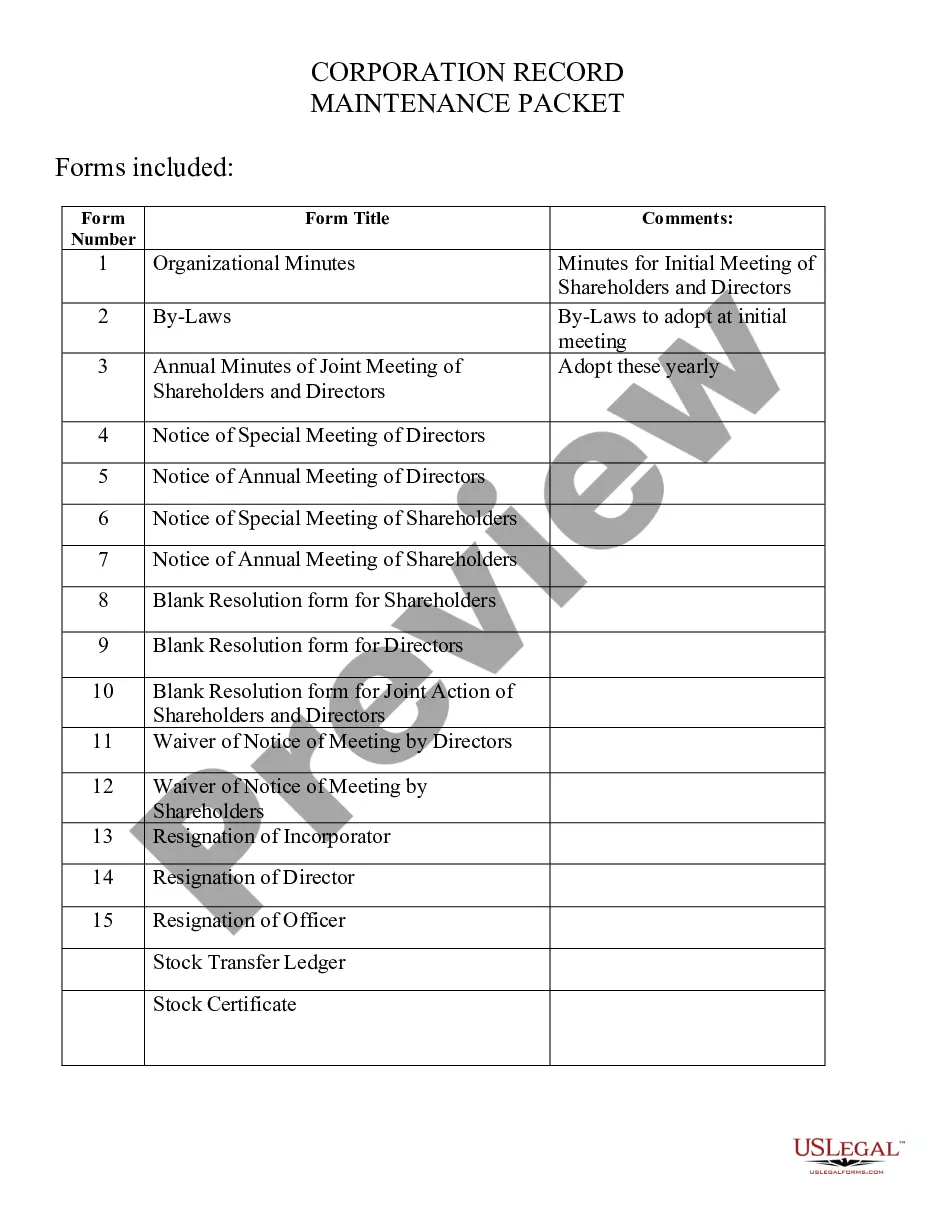

This Professional Corporations Package contains all forms and directions for filing needed in order to incorporate a Professional Corporation in your particular state. The forms included are as follows: articles on incorporation, by-laws, any other forms needed for creation and maintenance of the corporation.

Professional Corporation Package for Florida

Description

How to fill out Professional Corporation Package For Florida?

Among numerous paid and complimentary templates available online, you cannot be guaranteed their precision.

For instance, who created them or whether they possess the expertise necessary to fulfill your requirements.

Stay calm and utilize US Legal Forms! Acquire the Professional Corporation Package for Florida templates crafted by experienced lawyers and avoid the expensive and lengthy process of searching for an attorney and subsequently compensating them to draft a document for you that you can easily locate yourself.

Once you have subscribed and purchased your plan, you may utilize your Professional Corporation Package for Florida as frequently as needed or for as long as it remains valid in your area. Edit it with your preferred online or offline editor, complete it, sign it, and print it out. Achieve more for less with US Legal Forms!

- If you hold a subscription, Log In to your account and find the Download button adjacent to the document you seek.

- You will also have access to all your previously saved templates in the My documents menu.

- If you’re using our service for the first time, adhere to the steps below to quickly obtain your Professional Corporation Package for Florida.

- Ensure that the document you find is applicable in your region.

- Examine the template by reading the description and using the Preview feature.

- Hit Buy Now to initiate the purchasing process or find another template through the Search bar in the header.

- Select a pricing plan and set up an account.

- Process payment for the subscription using your credit/debit card or PayPal.

- Download the form in the required file format.

Form popularity

FAQ

Yes, Florida recognizes professional corporations, often referred to as P.C.s. These entities are designed specifically for licensed professions, allowing individuals to provide services in fields such as law, medicine, and accounting. By forming a professional corporation, you can benefit from limited liability while maintaining compliance with state regulations. To get started smoothly, consider our Professional Corporation Package for Florida, which provides the necessary resources and guidance.

A professional corporation qualifies if it is formed by licensed individuals who provide professional services, such as healthcare, legal, or financial services. These corporations must comply with specific state laws and regulations governing the practice of these professions. By selecting the Professional Corporation Package for Florida, you can ensure your corporation meets these qualifications and set your practice up for success.

The main difference between a Professional Limited Liability Company (PLLC) and a Limited Liability Company (LLC) in Florida lies in the types of services they provide. A PLLC is exclusively for licensed professionals, while an LLC can be formed for any business purpose. Choosing the Professional Corporation Package for Florida can help professionals determine the best organizational structure for their needs and ensure proper filing.

A professional corporation in Florida is a specific type of corporation formed by licensed professionals, including doctors, accountants, and attorneys. This structure helps protect individual members from personal liability for the corporation's debts and offers tax benefits. By utilizing a Professional Corporation Package for Florida, professionals can easily navigate the formation process and ensure compliance with state laws.

A corporation, or 'corp', serves as a general structure for businesses and can operate in various industries. In contrast, a professional corporation is specifically designed for licensed professionals, such as doctors or lawyers, to provide services in Florida. The Professional Corporation Package for Florida includes various benefits that cater to the unique needs of these licensed professionals, such as liability protections tailored for their industries.

Most states recognize Professional Limited Liability Companies (PLLCs), but there are a few exceptions. Some states do not have specific regulations for PLLCs, and instead allow professionals to form standard LLCs or professional corporations. It's essential to research the rules in each state where you plan to operate. Our Professional Corporation Package for Florida provides insights into this topic to ensure you are informed.

Florida does recognize professional corporations and has specific rules governing their formation and operation. These entities offer benefits such as limited liability protections for licensed professionals. By forming a professional corporation, you can ensure compliance with Florida's licensing laws. With our Professional Corporation Package for Florida, we can help you establish this entity effortlessly.

Yes, Florida allows Professional Limited Liability Companies (PLLCs), which are designed for licensed professionals. A PLLC combines the benefits of limited liability with the operational flexibility of an LLC. To form a PLLC, you must file Articles of Organization and adhere to specific professional regulations. Our Professional Corporation Package for Florida also covers the formation of PLLCs to ensure you meet all requirements.

The main difference between a corporation and a professional corporation lies in their purpose and regulations. A regular corporation can engage in any lawful business activity, while a professional corporation is restricted to specific licensed fields. Additionally, professional corporations have unique compliance rules that cater to professional licenses. Choose our Professional Corporation Package for Florida to understand these distinctions better.

Florida does recognize S-corporations, allowing eligible corporations to pass income directly to shareholders without being taxed at the corporate level. This structure provides tax benefits while maintaining limited liability for owners. To elect S-corp status, you need to file Form 2553 with the IRS. Our Professional Corporation Package for Florida includes guidance on how to manage this election.