Delaware Clauses Relating to Capital Withdrawals, Interest on Capital

Description

How to fill out Clauses Relating To Capital Withdrawals, Interest On Capital?

Choosing the best legitimate record design can be quite a battle. Naturally, there are tons of web templates accessible on the Internet, but how will you find the legitimate kind you will need? Use the US Legal Forms website. The services provides a large number of web templates, including the Delaware Clauses Relating to Capital Withdrawals, Interest on Capital, that you can use for enterprise and private demands. All of the varieties are checked by pros and meet state and federal requirements.

Should you be previously authorized, log in to your profile and click the Down load switch to have the Delaware Clauses Relating to Capital Withdrawals, Interest on Capital. Use your profile to look with the legitimate varieties you possess bought in the past. Check out the My Forms tab of the profile and get one more copy from the record you will need.

Should you be a new consumer of US Legal Forms, listed below are basic recommendations that you should comply with:

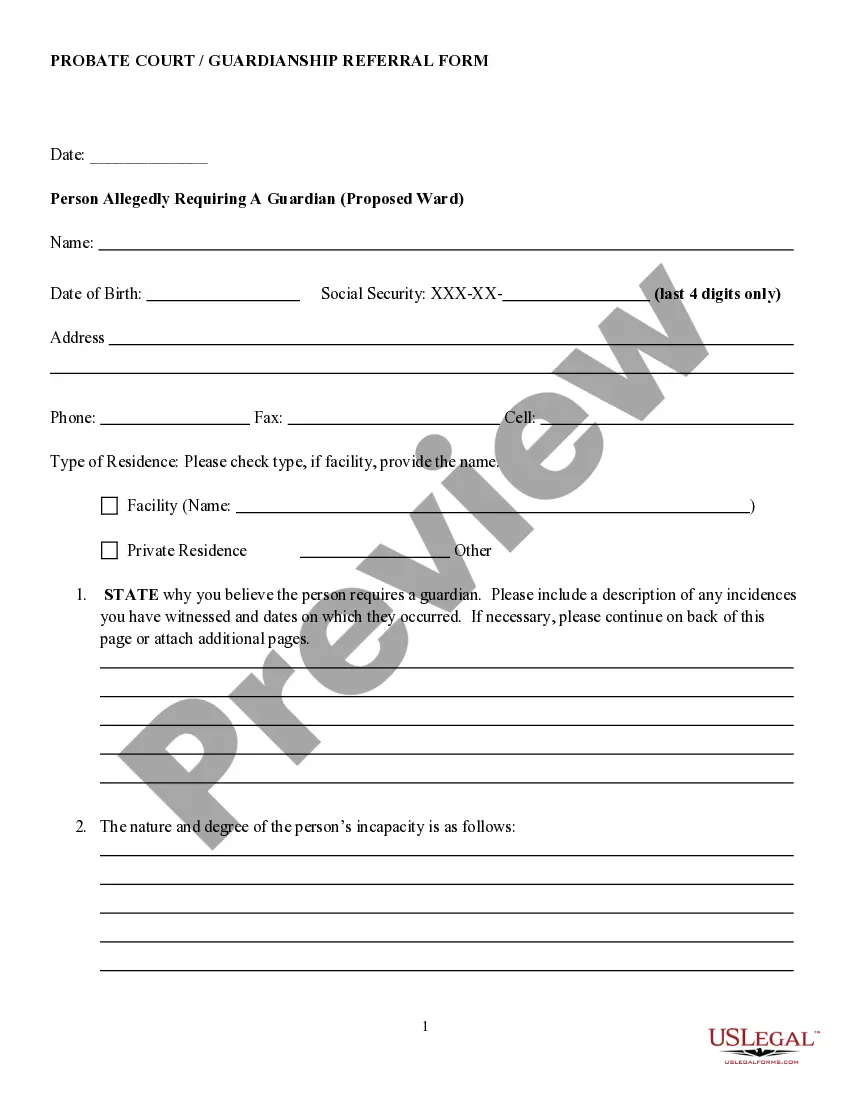

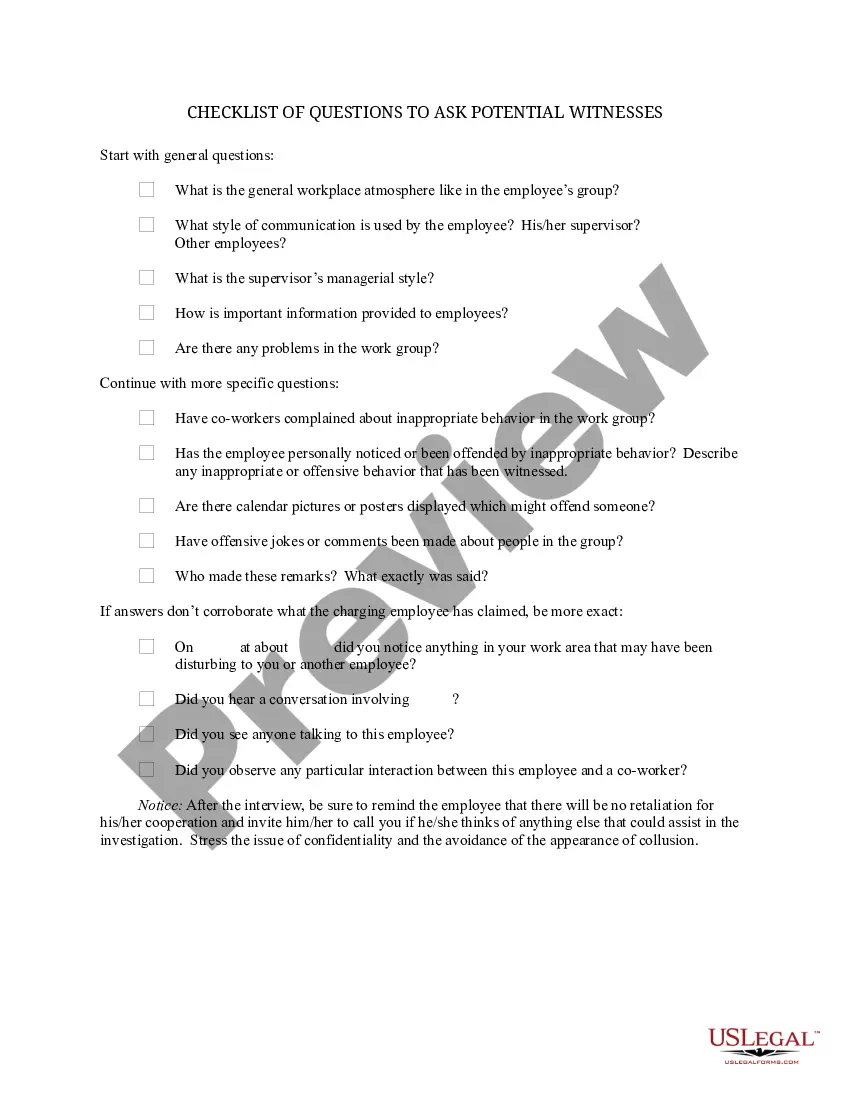

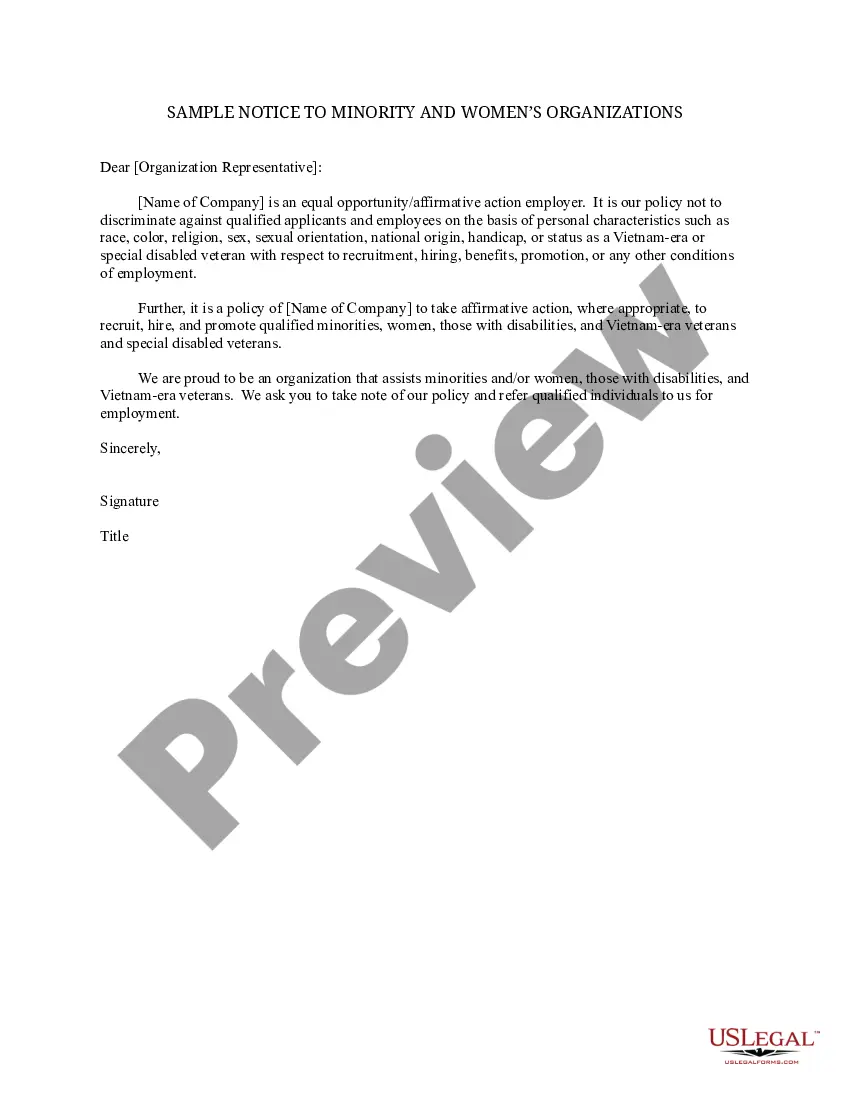

- Initially, make sure you have chosen the right kind to your city/county. It is possible to examine the form while using Review switch and study the form outline to make sure this is the best for you.

- When the kind does not meet your requirements, use the Seach field to obtain the proper kind.

- Once you are sure that the form is suitable, go through the Get now switch to have the kind.

- Select the prices plan you want and enter in the necessary information and facts. Create your profile and purchase an order making use of your PayPal profile or Visa or Mastercard.

- Opt for the submit formatting and down load the legitimate record design to your system.

- Complete, modify and print out and indication the attained Delaware Clauses Relating to Capital Withdrawals, Interest on Capital.

US Legal Forms may be the biggest catalogue of legitimate varieties for which you can find numerous record web templates. Use the service to down load skillfully-created files that comply with condition requirements.

Form popularity

FAQ

One of the most important sections in the operating agreement is the capital contribution section. A capital contribution section usually addresses what happens if members fail to contribute their portion of the initial start-up capital.

§ 272. Mortgage or pledge of assets. (a) The authorization or consent of stockholders to the mortgage or pledge of a corporation's property and assets shall not be necessary, except to the extent that the certificate of incorporation otherwise provides.

Unless otherwise provided in a partnership agreement, on any matter that is to be voted on, consented to or approved by limited partners, the limited partners may take such action without a meeting, without prior notice and without a vote if consented to or approved, in writing, by electronic transmission or by any ...

This clause should be used when one member contributed real property to the joint venture in exchange for membership interests and another member has contributed capital. The capitalized terms and section references used in this clause should be conformed to the relevant joint venture operating agreement.

The most common capital contribution is cash, but you can also contribute property, such as office space, vehicles, and equipment. It's also possible to contribute services to an LLC.

One of the most important sections in the operating agreement is the capital contribution section. A capital contribution section usually addresses what happens if members fail to contribute their portion of the initial start-up capital.

There are no minimum capital contribution requirements. Side Note: Pre-Filing Considerations. Before filing for the LLC, it is necessary that the members determine (a) what to name the LLC and (b) who will serve as the registered agent.

Example of Contributed Capital For example, a company issues 5,000 $1 par value shares to investors. The investors pay $10 a share, so the company raises $50,000 in equity capital. As a result, the company records $5,000 to the common stock account and $45,000 to the paid-in capital in excess of par.