This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

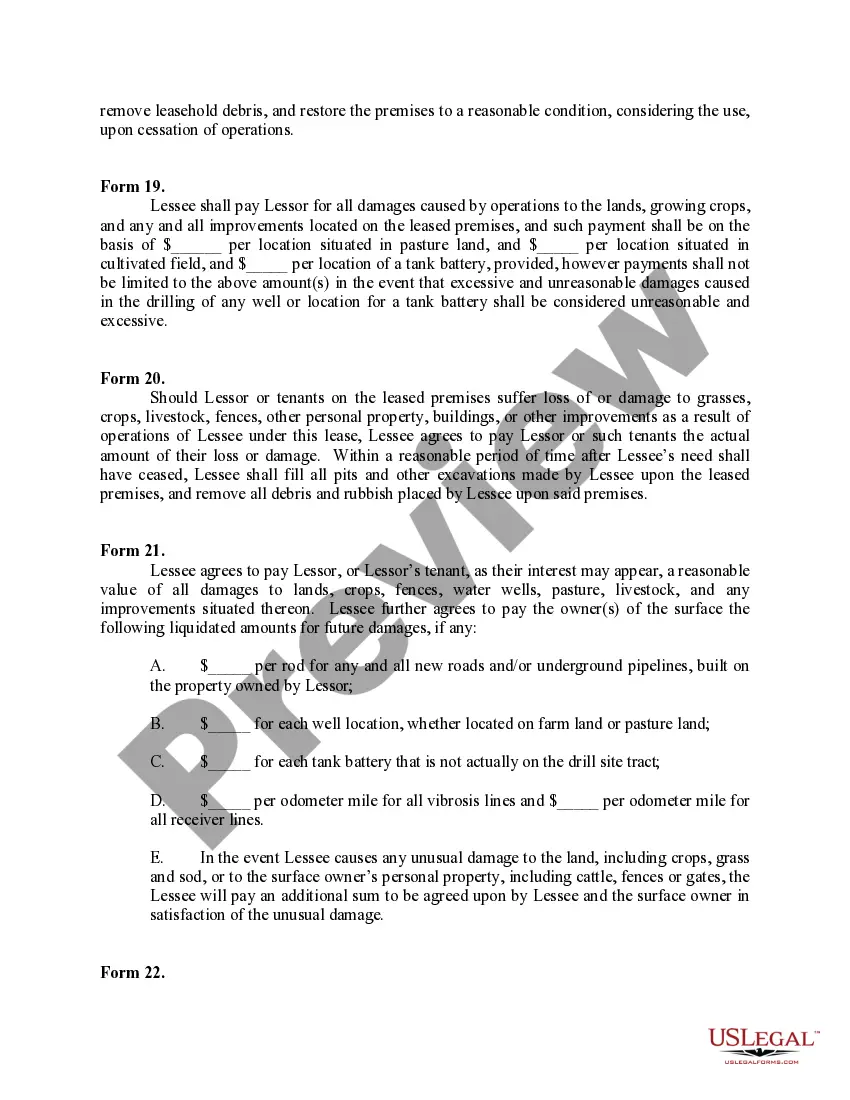

Delaware Surface Damage Payments

Description

How to fill out Surface Damage Payments?

Are you currently in the situation that you need documents for both enterprise or person uses virtually every working day? There are tons of authorized file templates available on the Internet, but locating versions you can trust is not effortless. US Legal Forms provides 1000s of develop templates, just like the Delaware Surface Damage Payments, which can be written to meet state and federal needs.

When you are already knowledgeable about US Legal Forms site and have a free account, simply log in. After that, it is possible to down load the Delaware Surface Damage Payments design.

Should you not come with an profile and want to begin to use US Legal Forms, follow these steps:

- Obtain the develop you will need and ensure it is for the right metropolis/county.

- Utilize the Preview key to review the shape.

- Read the information to ensure that you have chosen the proper develop.

- In case the develop is not what you are looking for, use the Research discipline to get the develop that meets your needs and needs.

- When you find the right develop, click Get now.

- Select the rates strategy you want, fill out the required information to create your bank account, and pay money for the order using your PayPal or bank card.

- Pick a hassle-free file file format and down load your backup.

Locate all the file templates you might have purchased in the My Forms menus. You can get a extra backup of Delaware Surface Damage Payments any time, if possible. Just click on the needed develop to down load or print out the file design.

Use US Legal Forms, by far the most considerable variety of authorized varieties, to save time and stay away from blunders. The services provides skillfully created authorized file templates which can be used for a variety of uses. Produce a free account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

Criminal Statutes of Limitations in Delaware A statute of limitations tells you the time frame when the prosecution must bring a charge for a crime. Murder, attempted murder, Class A felonies, and attempts to commit Class A felonies have no time limit.

Personal injury cases have a statute of limitations of two years, including medical malpractice, personal property damage, product liability, slander, and libel. A three-year limitation applies for breach of written contracts and two years for breach of spoken contracts.

This means that the LLC itself does not pay taxes and does not have to file a return with the State of Delaware. As the sole member of your LLC, you must report all profits (or losses) of the LLC on Schedule C and submit it with your Delaware personal income tax return (Form 200).

Form 200ES for personal, 1100T for Corps, and 1100P for S corps. Delaware follows the IRS standards for estimated payments. If you will owe $400 or more in tax for the current year, you are required to make 90% of the tax due, over quarterly payments.

LP/LLC/GP Tax Penalty for non-payment or late payment is $200.00. Interest accrues on the tax and penalty at the rate of 1.5% per month.