This form is used when the events giving rise to the termination of the Trust have occurred. Pursuant to the terms of a Will, Grantor executes this Deed and Assignment for the purposes of distributing to the beneficiaries of a Testamentary Trust, all rights, title, and interests in the Properties held in the name of that Trust, and all Properties owned by the Estate of the deceased, and the Testamentary Trust created under the Will of the deceased.

Delaware Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries

Description

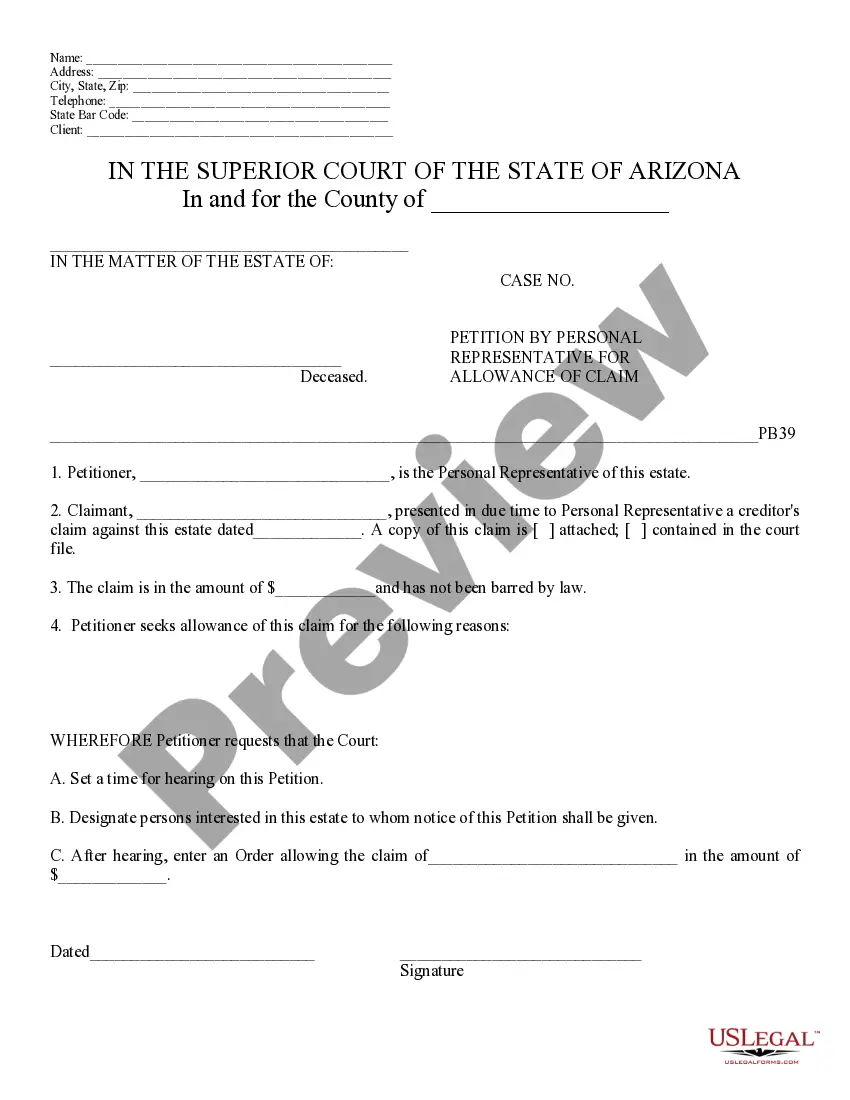

How to fill out Trustee's Deed And Assignment For Distribution By Testamentary Trustee To Trust Beneficiaries?

Choosing the best authorized document format could be a struggle. Naturally, there are tons of web templates available on the net, but how would you get the authorized kind you will need? Take advantage of the US Legal Forms site. The support offers thousands of web templates, for example the Delaware Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries, that you can use for organization and personal requirements. All the types are examined by professionals and fulfill state and federal specifications.

If you are previously listed, log in to your bank account and click on the Obtain button to have the Delaware Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries. Utilize your bank account to search from the authorized types you have ordered in the past. Go to the My Forms tab of the bank account and acquire an additional copy from the document you will need.

If you are a whole new user of US Legal Forms, allow me to share simple recommendations so that you can adhere to:

- Very first, ensure you have chosen the correct kind for your personal area/region. You are able to examine the shape while using Preview button and read the shape description to guarantee this is basically the right one for you.

- In the event the kind is not going to fulfill your needs, utilize the Seach discipline to obtain the correct kind.

- When you are positive that the shape would work, select the Acquire now button to have the kind.

- Select the prices plan you want and type in the essential info. Build your bank account and purchase the order utilizing your PayPal bank account or charge card.

- Choose the submit formatting and down load the authorized document format to your gadget.

- Comprehensive, modify and produce and indicator the obtained Delaware Trustee's Deed and Assignment for Distribution by Testamentary Trustee to Trust Beneficiaries.

US Legal Forms is definitely the greatest catalogue of authorized types that you can see numerous document web templates. Take advantage of the service to down load appropriately-manufactured files that adhere to state specifications.

Form popularity

FAQ

(a) As used in this section, the term ?qualified trustee? means any person authorized by the law of this State or of the United States to act as a trustee whose activities are subject to supervision by the Bank Commissioner of the State, the Federal Deposit Insurance Corporation or the Comptroller of the Currency of ... Subchapter V. Compensation of Trustees - Delaware Code Online delaware.gov ? title12 delaware.gov ? title12

Except where circumstances justify a longer period, an executor or administrator shall have 1 year from the date of letters for settling the estate of the decedent; and until the expiration of that time, the executor or administrator shall not be required to make distribution, nor be chargeable with interest upon the ...

A Delaware Statutory Trust is a real estate ownership structure where multiple investors each hold an undivided fractional interest in the holdings of the trust. The trust is established by a professional real estate company, referred to as a ?DST sponsor?, who first identifies and acquires the real estate assets. How a Delaware Statutory Trust Works | DST Investment re-transition.com ? investing-delaware-statut... re-transition.com ? investing-delaware-statut...

In short, under Delaware law, an excluded trustee has no duties, and also no liability, with respect to any power conferred exclusively on a non-excluded trustee. Trusts - Utilizing Delaware's Excluded Co-Trustee Statute, Section 3313A ... gfmlaw.com ? sites ? default ? files ? pdfs gfmlaw.com ? sites ? default ? files ? pdfs

At least one trustee must be a resident of Delaware, which can be satisfied by naming a Delaware trust company or by forming a Delaware corporation to act as the trustee (See 12 §3807). There is no Franchise Tax and no Delaware income tax on statutory trusts formed in Delaware. What is a Delaware Statutory Trust? | Harvard Business Services Harvard Business Services ? blog ? what-is-a-delaw... Harvard Business Services ? blog ? what-is-a-delaw...

The trust may further provide for the trustee to distribute a percentage of each beneficiary's share of the trust to the beneficiary every year on the anniversary of the settlor's death until the trust has no assets remaining in it, or it may provide for the trustee to make partial distributions of the trust's ...

§ 3807. Trustee in State; registered agent. (a) Every statutory trust shall at all times have at least 1 trustee which, in the case of a natural person, shall be a person who is a resident of this State or which, in all other cases, has its principal place of business in this State.

A grantor can appoint someone a trustee as long as the individual is at least 18 years old and is not likely to become bankrupt or mentally incompetent. Grantors can also be the trustee themselves, as long as the trust is a revocable living trust. This means the trust can be changed during the grantor's lifetime.