This form is to be used when a collection company is demanding full payment from you and you disagree with the balance. Use this form as your first letter of dispute.

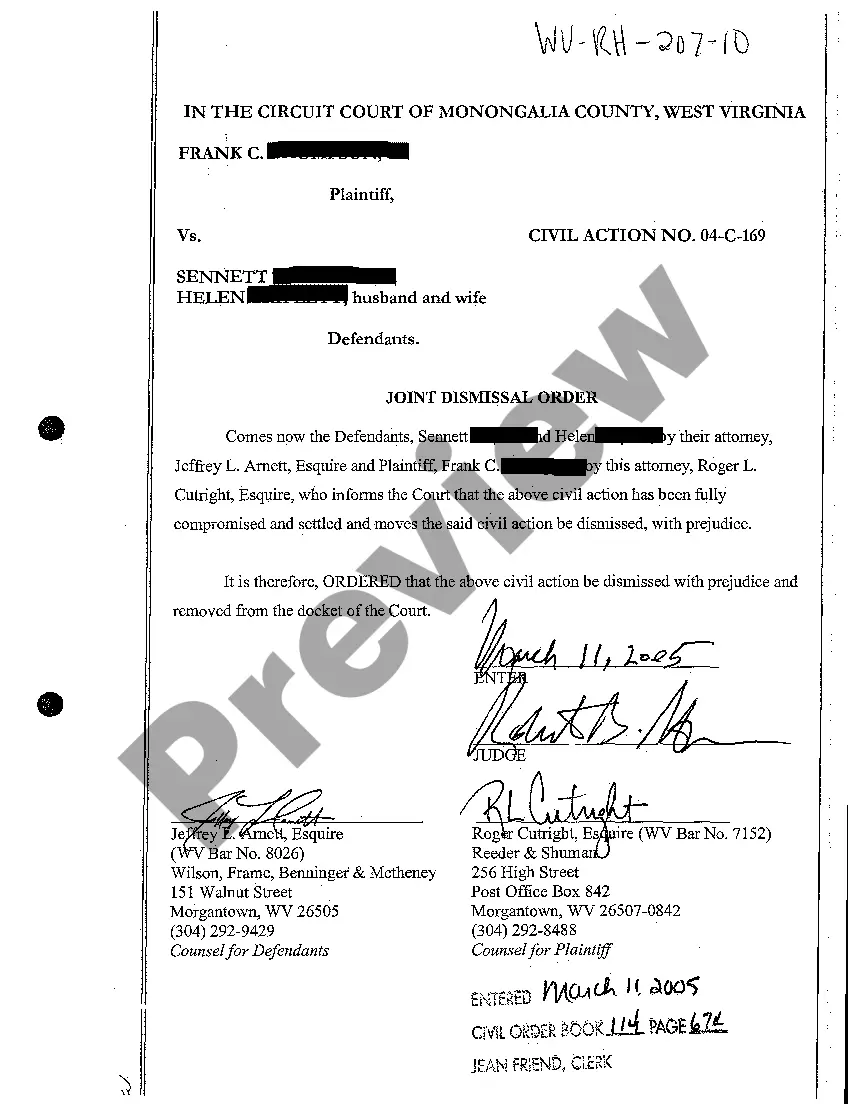

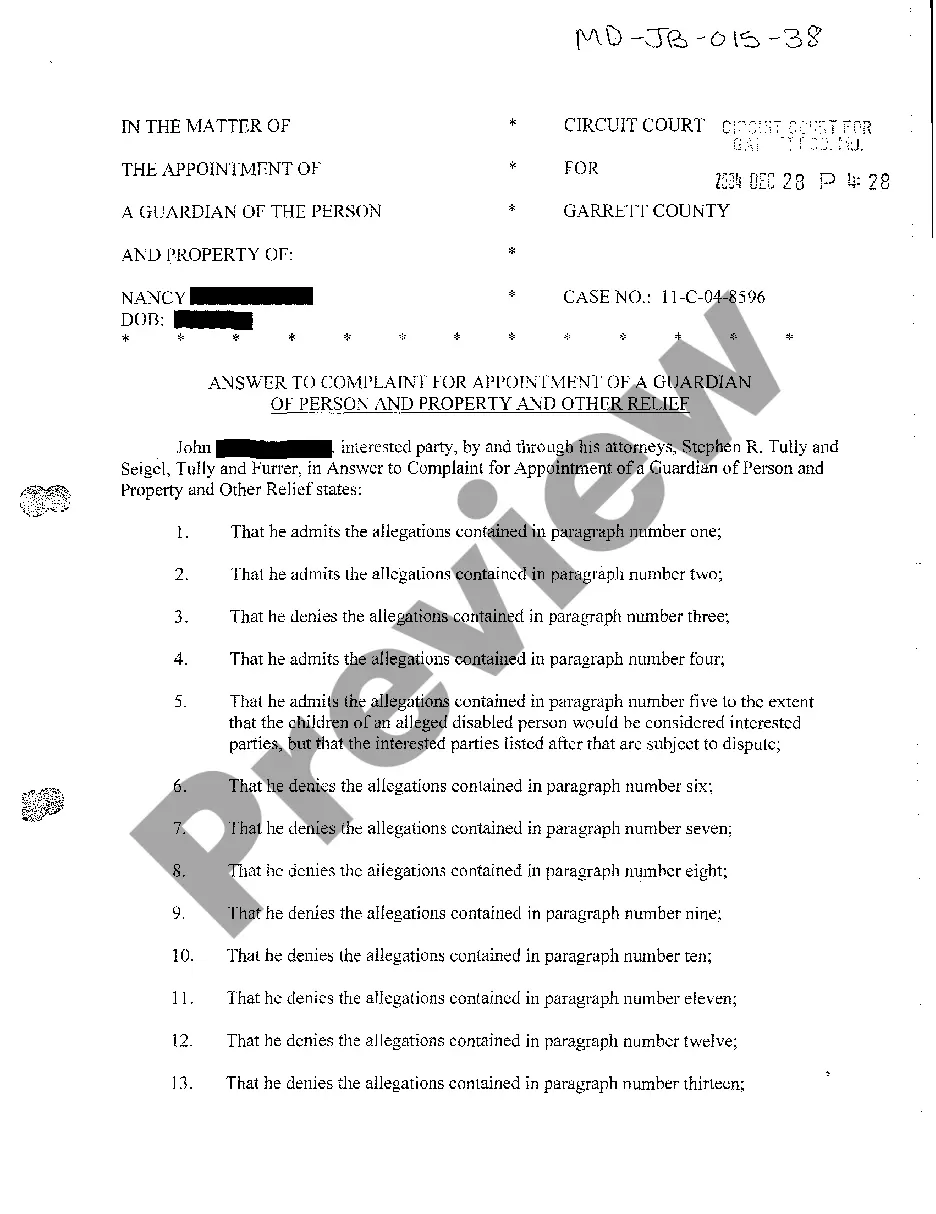

Delaware Letter of Dispute - Complete Balance

Description

How to fill out Letter Of Dispute - Complete Balance?

If you want to comprehensive, down load, or produce legitimate document web templates, use US Legal Forms, the most important collection of legitimate kinds, which can be found on the web. Take advantage of the site`s easy and convenient lookup to discover the documents you will need. Different web templates for enterprise and person purposes are sorted by types and suggests, or key phrases. Use US Legal Forms to discover the Delaware Letter of Dispute - Complete Balance within a couple of click throughs.

When you are presently a US Legal Forms customer, log in for your profile and click on the Obtain option to find the Delaware Letter of Dispute - Complete Balance. You can even access kinds you formerly downloaded inside the My Forms tab of your respective profile.

If you work with US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have chosen the form for your appropriate town/country.

- Step 2. Use the Preview solution to look over the form`s articles. Do not neglect to see the outline.

- Step 3. When you are not happy together with the develop, utilize the Search industry on top of the display to discover other types in the legitimate develop design.

- Step 4. When you have found the form you will need, go through the Acquire now option. Opt for the costs plan you like and include your accreditations to register for an profile.

- Step 5. Procedure the transaction. You may use your bank card or PayPal profile to complete the transaction.

- Step 6. Select the structure in the legitimate develop and down load it on your gadget.

- Step 7. Total, edit and produce or indication the Delaware Letter of Dispute - Complete Balance.

Each and every legitimate document design you acquire is your own property for a long time. You have acces to every develop you downloaded in your acccount. Click on the My Forms section and choose a develop to produce or down load once more.

Compete and down load, and produce the Delaware Letter of Dispute - Complete Balance with US Legal Forms. There are thousands of specialist and status-distinct kinds you can use to your enterprise or person demands.

Form popularity

FAQ

In Delaware, the statute of limitations on debt collection is four years for open credit card accounts, three years for written contracts and six years for promissory notes. For any time period, the clock begins ticking from the date of default, which is typically thirty days after the last payment was actually made.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Limitations on debt collection by state The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

A judgment in the Justice of the Peace Court is good for five years. Thereafter, court procedures may be used to attempt to collect a judgment only if the judgment is revived by scire facias. To revive a judgment by scire facias, the plaintiff should file a motion to revive the judgment.

You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep.

Once your application has been approved, the Department of Labor will send a Monetary Determination with information on your weekly benefit amount. After making your claim, it will take between two to three weeks to receive it. Delays may be caused if the state needs additional information before sending payment.

If you filed online, you should receive an email confirmation after you file your claim. In the first week you will receive three mailings: Notice of Financial Determination (UC-44F), UC Claim Confirmation Letter (UC-360) and the Delaware UC Handbook (UCP-1).

In California, the statute of limitations for consumer debt is four years. This means a creditor can't prevail in court after four years have passed, making the debt essentially uncollectable.

(302) 761-6576 The Delaware Unemployment Insurance Division provides a quick and easy way to claim your weekly unemployment insurance benefits check by telephone using a feature of the Information Hotline called TeleBenefits.