Delaware Visiting Professor Agreement - Self-Employed Independent Contractor

Description

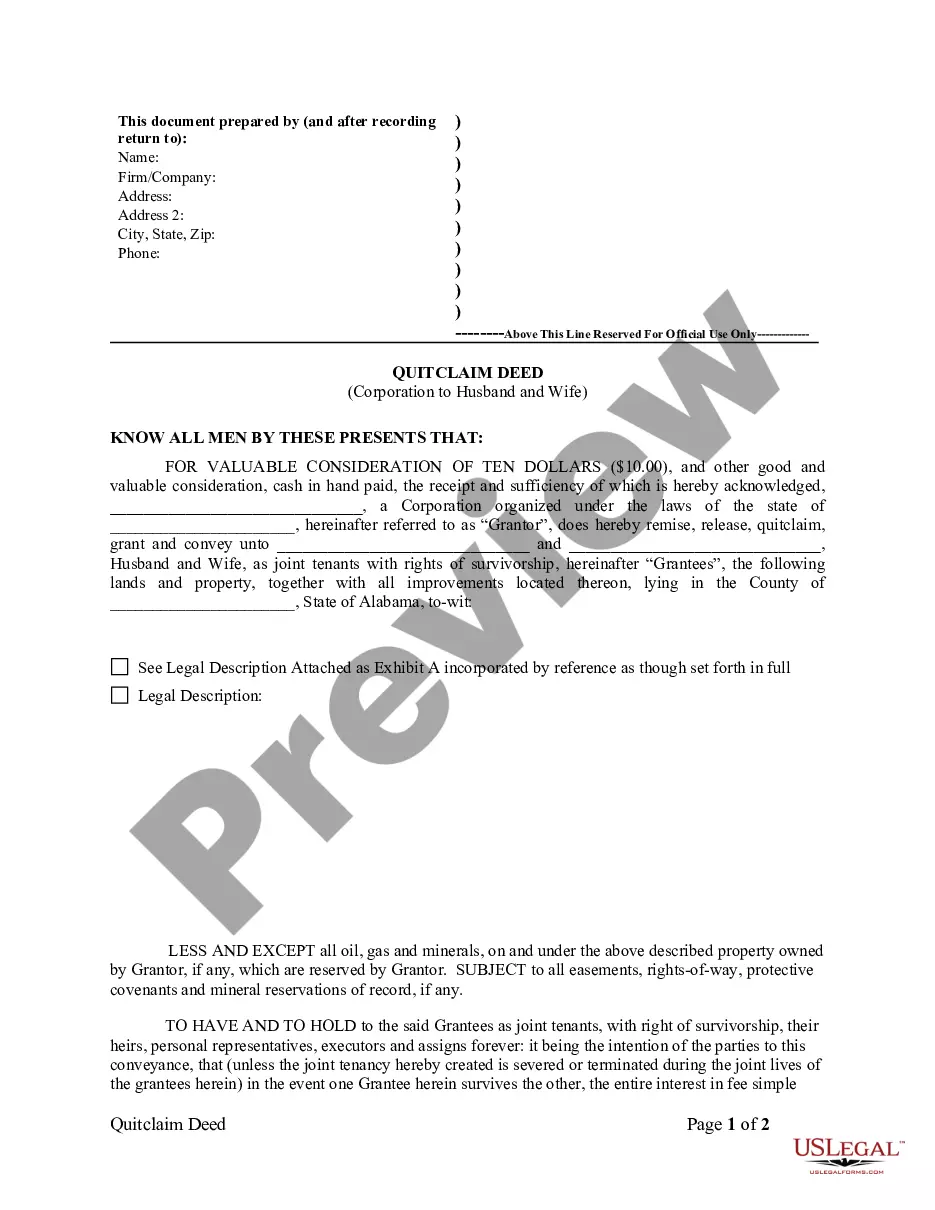

How to fill out Visiting Professor Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal form templates that you can download or print. By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Delaware Visiting Professor Agreement - Self-Employed Independent Contractor in just a few minutes.

If you hold a membership, Log In and download the Delaware Visiting Professor Agreement - Self-Employed Independent Contractor from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to help you get started: Ensure you have selected the correct form for your region/area. Click the Preview button to review the form's contents. Check the form details to confirm you have chosen the right form. If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does. If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose your preferred pricing plan and provide your information to register for an account. Process the payment. Use a Visa or Mastercard or PayPal account to complete the payment. Select the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded Delaware Visiting Professor Agreement - Self-Employed Independent Contractor. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- Access the Delaware Visiting Professor Agreement - Self-Employed Independent Contractor through US Legal Forms, one of the most extensive collections of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

Form popularity

FAQ

Creating an independent contractor agreement involves outlining the scope of work, payment terms, and duration of the engagement. Utilizing a Delaware Visiting Professor Agreement - Self-Employed Independent Contractor template can simplify this process significantly. Platforms like US Legal Forms offer customizable templates that ensure your agreement covers all necessary aspects while complying with state laws. This resource enables you to create a solid foundation for your contractual relationship.

Typically, the institution or hiring entity prepares the independent contractor agreement. In the case of a Delaware Visiting Professor Agreement - Self-Employed Independent Contractor, the institution will ensure it complies with relevant laws and includes key terms. However, it is advisable for the professor to review the agreement and consider legal counsel to ensure their interests are protected. This collaborative approach fosters clarity and mutual understanding.

Professors can either be employees or independent contractors, depending on their contract terms. A Delaware Visiting Professor Agreement - Self-Employed Independent Contractor clearly defines the relationship as one of independence, emphasizing the professor's autonomy. This distinction is crucial, as it determines benefits, tax obligations, and liability issues. Understanding this classification can help you navigate the complexities of academic employment.

To fill out an independent contractor agreement, start by entering the names and contact details of both parties. Clearly define the services you will provide, along with the duration of the agreement. As you draft the terms, specifically reference the Delaware Visiting Professor Agreement - Self-Employed Independent Contractor to clarify your role and expectations. Make sure to review the completed document carefully before both parties sign.

Writing an independent contractor agreement involves outlining key elements such as the scope of work, payment terms, and responsibilities. Begin with a clear title stating it as a Delaware Visiting Professor Agreement - Self-Employed Independent Contractor. It is crucial to include termination clauses and confidentiality agreements, if necessary, to protect both parties involved. Use templates from trusted sources like uslegalforms to ensure comprehensive coverage of all necessary details.

The new federal rule regarding independent contractors focuses on ensuring clarity in worker classification. It emphasizes the importance of maintaining independence in work-related decisions. For those entering into a Delaware Visiting Professor Agreement - Self-Employed Independent Contractor, understanding these rules is essential as they can impact how you structure your agreement and your relationship with the hiring institution.

Filling out an independent contractor form requires you to provide essential personal and business details. Start by listing your name, address, and tax identification number. Then, clearly state the nature of the services you provide under the Delaware Visiting Professor Agreement - Self-Employed Independent Contractor. Ensure that all sections of the form reflect your accurate information to prevent any complications.

To demonstrate that you are an independent contractor, you should gather relevant documentation that showcases your work arrangements. This includes contracts, invoices, and communication records with clients. The Delaware Visiting Professor Agreement - Self-Employed Independent Contractor can serve as a clear basis, outlining your responsibilities, control over work, and payment terms. Such documentation supports your classification and can help avoid any misclassification issues.

Yes, an independent contractor is generally considered self-employed. This means that the contractor operates their own business and is responsible for managing their own income and taxes. In the context of a Delaware Visiting Professor Agreement - Self-Employed Independent Contractor, this status allows you to enjoy greater flexibility and control over your professional engagements. If you need assistance in drafting a clear agreement for your independent contracting work, consider exploring US Legal Forms for comprehensive and customizable templates.