Delaware Subscription Agreement

Description

How to fill out Subscription Agreement?

If you need to full, acquire, or print legitimate file layouts, use US Legal Forms, the most important collection of legitimate types, which can be found on the Internet. Use the site`s easy and hassle-free search to discover the papers you will need. Different layouts for company and individual uses are categorized by classes and states, or keywords. Use US Legal Forms to discover the Delaware Subscription Agreement in just a few mouse clicks.

When you are currently a US Legal Forms buyer, log in in your account and click the Obtain button to find the Delaware Subscription Agreement. You may also accessibility types you previously downloaded from the My Forms tab of your own account.

If you are using US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape for the right area/nation.

- Step 2. Make use of the Review method to check out the form`s content. Do not forget to see the outline.

- Step 3. When you are not happy together with the develop, take advantage of the Look for field near the top of the monitor to get other models in the legitimate develop format.

- Step 4. After you have discovered the shape you will need, click on the Acquire now button. Select the pricing program you like and include your references to register to have an account.

- Step 5. Process the financial transaction. You can use your charge card or PayPal account to accomplish the financial transaction.

- Step 6. Pick the formatting in the legitimate develop and acquire it on your own system.

- Step 7. Full, edit and print or indication the Delaware Subscription Agreement.

Each legitimate file format you acquire is your own property forever. You may have acces to each develop you downloaded within your acccount. Go through the My Forms area and decide on a develop to print or acquire yet again.

Compete and acquire, and print the Delaware Subscription Agreement with US Legal Forms. There are thousands of skilled and state-particular types you may use for your personal company or individual requirements.

Form popularity

FAQ

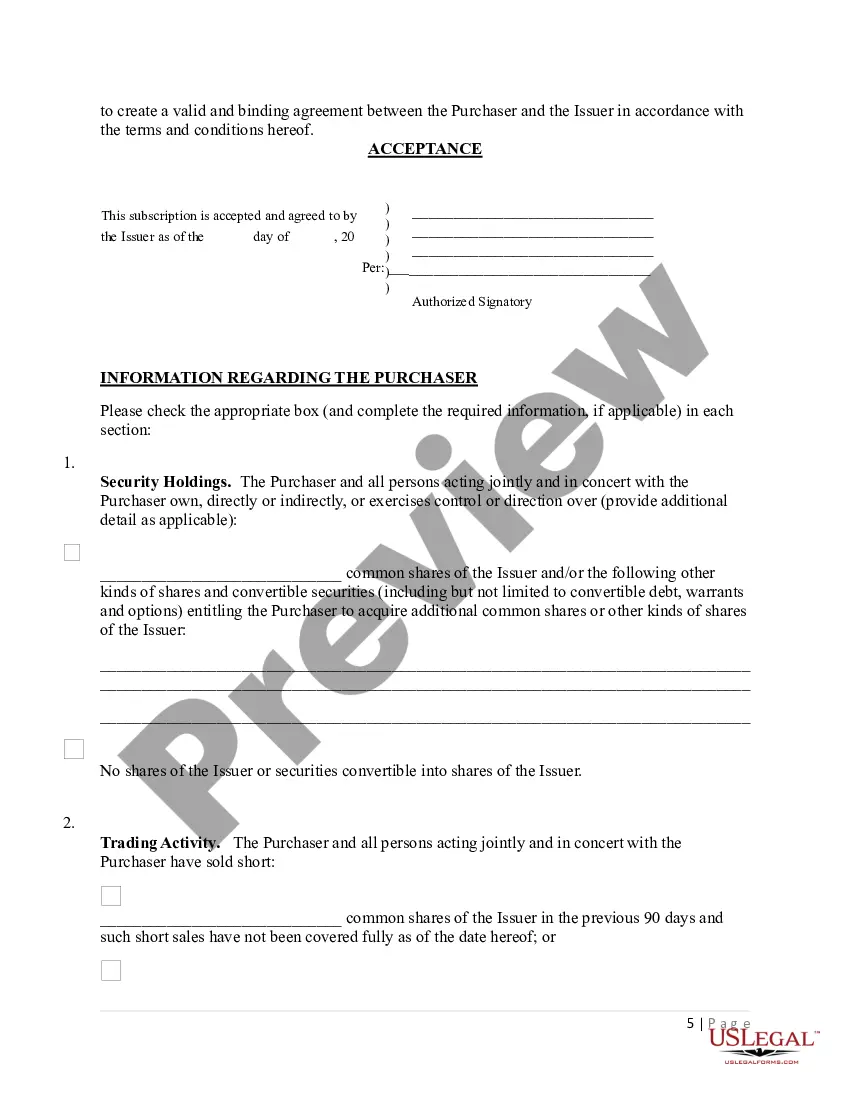

There are advantages as well as disadvantages of each agreement. A share purchase agreement differs from a share subscription agreement because a share purchase agreement has a seller that is not the business itself. In a subscription agreement, the business agrees to sell shares to a subscriber.

Initial Recognition: When the company receives the initial subscription payment (but not the full amount), it credits this to a ?Subscriptions Receivable? account and debits ?Cash?.

Definition. The term subscribed stock refers to common and preferred shares sold to investors and employees over time using a process that involves installment payments.

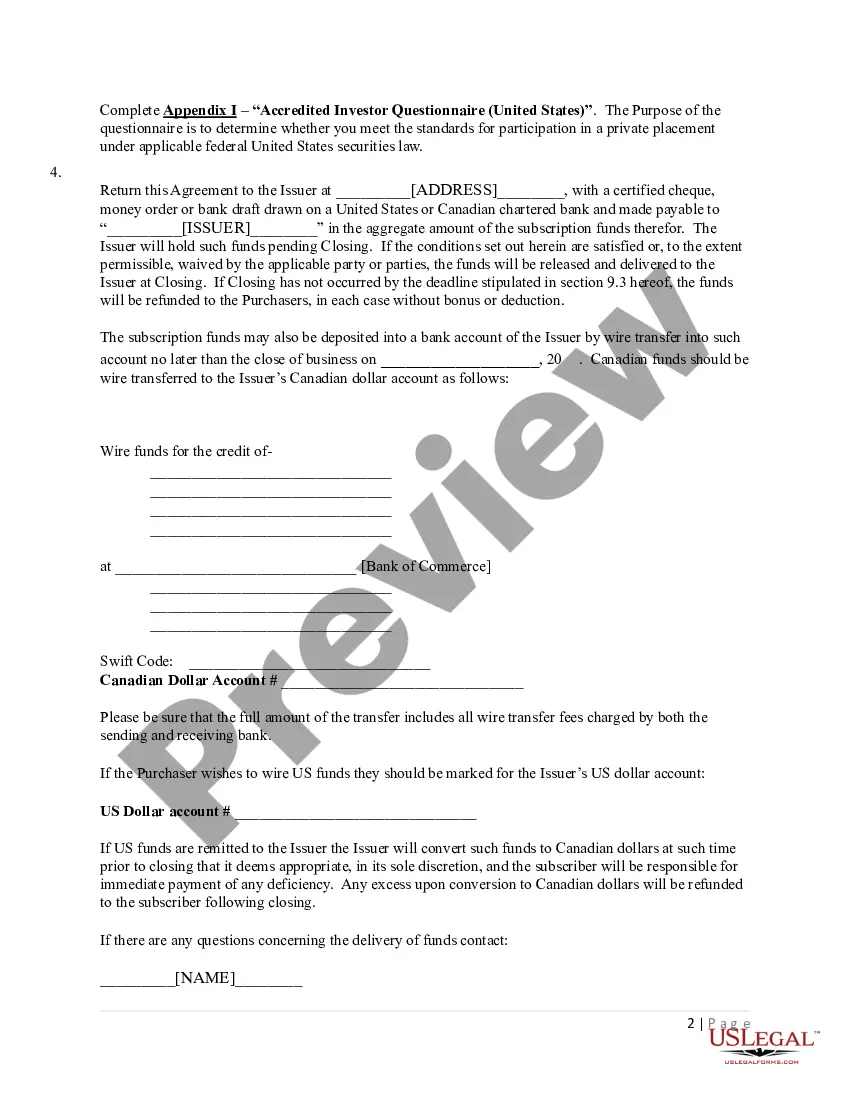

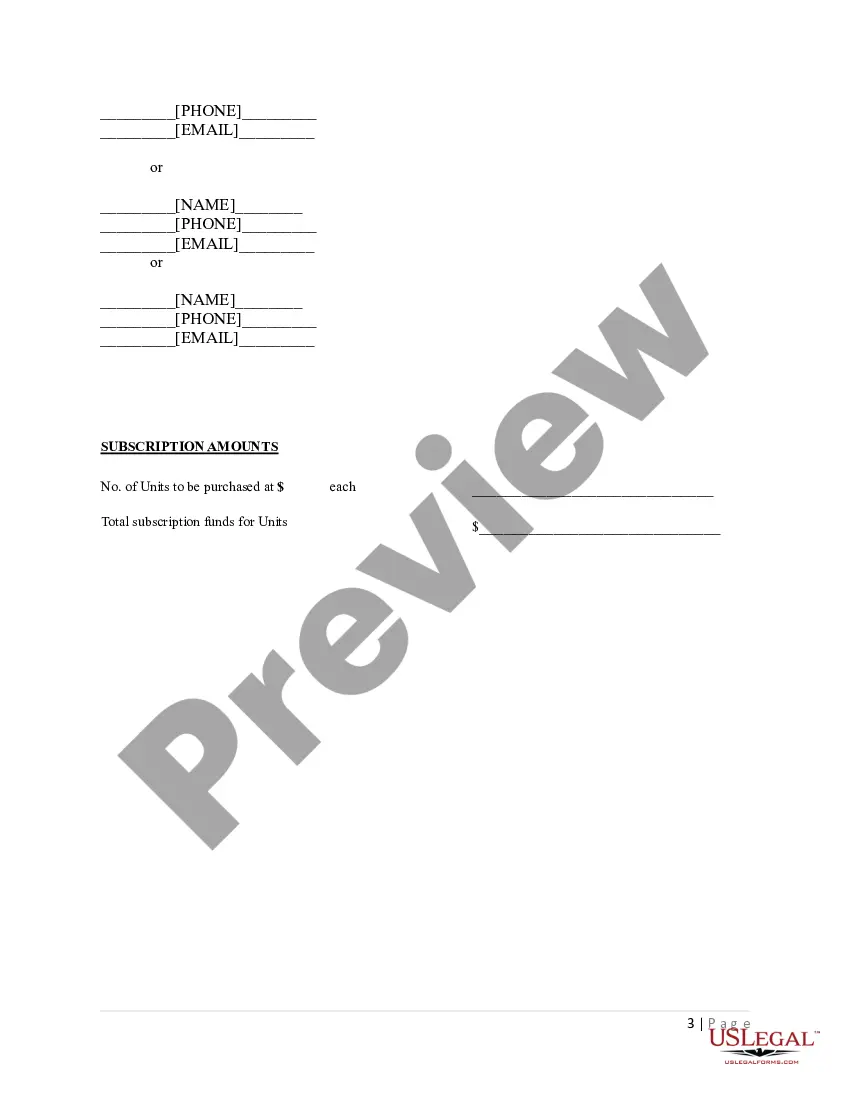

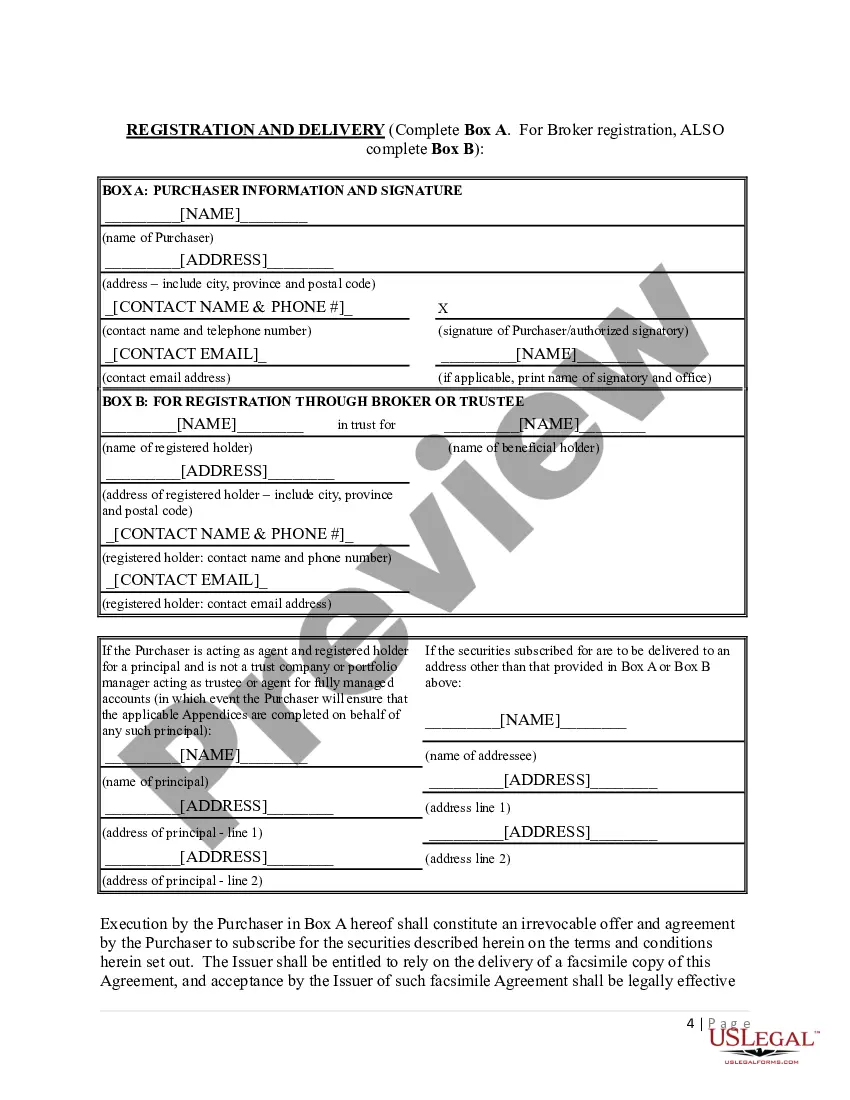

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

Subscription Receivable means a commitment from an investor to purchase capital stock of the Borrower.

Stock subscriptions are a mechanism for allowing employees and investors to consistently purchase shares of company stock over a long period of time, usually at a price that does not include a broker commission. Because there is no commission, the price at which shares are purchased represents a good deal for buyers.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.