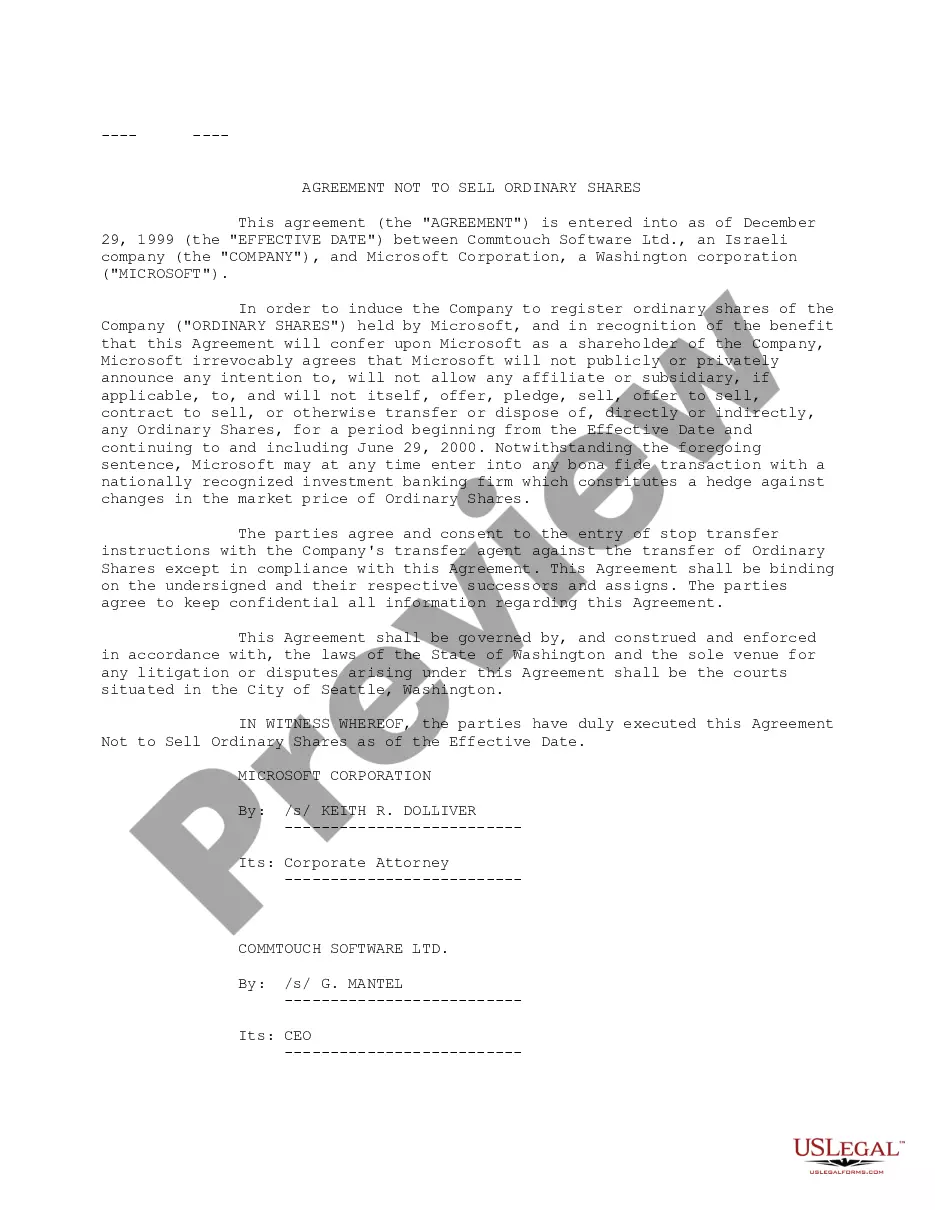

Delaware Joint Filing Agreement

Description

How to fill out Joint Filing Agreement?

Are you in a placement where you need files for possibly business or personal purposes just about every time? There are tons of legitimate file themes available on the net, but discovering types you can depend on is not easy. US Legal Forms offers a huge number of kind themes, much like the Delaware Joint Filing Agreement, which are written in order to meet federal and state specifications.

When you are already familiar with US Legal Forms website and possess your account, just log in. After that, it is possible to down load the Delaware Joint Filing Agreement design.

Should you not have an bank account and need to start using US Legal Forms, abide by these steps:

- Get the kind you require and ensure it is to the correct metropolis/county.

- Use the Review option to check the shape.

- Browse the description to actually have chosen the proper kind.

- In the event the kind is not what you`re looking for, use the Lookup field to find the kind that meets your needs and specifications.

- When you find the correct kind, simply click Get now.

- Select the prices plan you desire, submit the specified info to create your bank account, and purchase the order utilizing your PayPal or bank card.

- Choose a hassle-free file file format and down load your duplicate.

Locate all of the file themes you have bought in the My Forms food selection. You can obtain a further duplicate of Delaware Joint Filing Agreement anytime, if required. Just click the needed kind to down load or print the file design.

Use US Legal Forms, the most comprehensive collection of legitimate forms, to conserve time as well as steer clear of blunders. The services offers professionally created legitimate file themes that you can use for a selection of purposes. Generate your account on US Legal Forms and start creating your daily life a little easier.

Form popularity

FAQ

While you may have heard at some point that Social Security is no longer taxable after 70 or some other age, this isn't the case. In reality, Social Security is taxed at any age if your income exceeds a certain level.

Delaware Income Tax Brackets and Rates for All Filing Statuses For the portion of your Delaware taxable income that's at least:But less than:Your tax rate for the 2021 tax year is:$20,000$25,0005.20%$25,000$60,0005.55%$60,000?6.60%Source: Delaware Division of Revenue4 more rows

Annuities in Delaware are regulated and taxed differently than in other states. Notable differences include that Delaware charges a state tax on annuity premiums and also that they charge a state tax on annuity disbursements.

Under age 60, $9,400. Age 60 to 64, $12,200. Over age 65 OR Blind, $14,700. Over age 65 AND Blind, $17,200.

Non-Residents ? File a tax return if you have any gross income during the tax year from sources in Delaware. If your spouse files a married filing separate return and you had no Delaware source income, you do NOT need to file a Delaware return.

As a resident of Delaware, the amount of your pension and 401K income that is taxable for federal purposes is also taxable in Delaware. However, person's 60 years of age or older are entitled to a pension exclusion of up to $12,500 or the amount of the pension and eligible retirement income (whichever is less).

Delaware may be one of the smallest states, but its beautiful Atlantic Ocean coastline, favorable tax policies, and wellness amenities have made it a popular choice for retirees.

Delaware tax on retirement benefits: Delaware does not tax Social Security benefits or Railroad Retirement benefits. Retirees age 60 and older may exclude up to $12,500 of pension or retirement income from a qualified retirement plan in Delaware. This income includes but is not limited to: Interest income.