Delaware Checklist For Intellectual Property Audit

Description

How to fill out Checklist For Intellectual Property Audit?

You can spend hrs on the web attempting to find the legitimate file format which fits the federal and state needs you need. US Legal Forms gives 1000s of legitimate varieties which are examined by specialists. It is possible to down load or print the Delaware Checklist For Intellectual Property Audit from the support.

If you already possess a US Legal Forms account, you are able to log in and click on the Acquire key. Following that, you are able to full, change, print, or indicator the Delaware Checklist For Intellectual Property Audit. Every single legitimate file format you acquire is your own property eternally. To obtain another duplicate of the acquired form, go to the My Forms tab and click on the related key.

If you use the US Legal Forms internet site initially, keep to the easy recommendations under:

- Initial, make sure that you have selected the best file format for your county/city that you pick. Browse the form information to ensure you have chosen the correct form. If offered, use the Preview key to look throughout the file format too.

- In order to get another version in the form, use the Look for field to obtain the format that meets your requirements and needs.

- After you have found the format you need, simply click Acquire now to proceed.

- Select the costs program you need, type your qualifications, and register for a merchant account on US Legal Forms.

- Comprehensive the purchase. You may use your charge card or PayPal account to fund the legitimate form.

- Select the structure in the file and down load it to the device.

- Make modifications to the file if possible. You can full, change and indicator and print Delaware Checklist For Intellectual Property Audit.

Acquire and print 1000s of file web templates while using US Legal Forms website, which provides the most important assortment of legitimate varieties. Use skilled and condition-distinct web templates to tackle your business or person requirements.

Form popularity

FAQ

How to conduct an IP Audit Get buy-in from the relevant individuals. ... Create an IP Register for the specific review. Request and gather existing policies, agreements, registers (such as an IP register), information, and documents (such as an IP Strategy Document) that are relevant to an IP audit.

Audit Preparation Checklist Financial Documentation. Financial statements. General ledger with all transactions documented (covering fiscal year) ... Internal Control Documentation. Org charts. Personnel manual. ... Other Relevant Information. Major contracts with suppliers and/or customers. Investment activities summary.

IP audits can be of various types, such as general-purpose, event-driven, and limited-purpose audits, and vary with the client's needs. A general purpose audit is a regular audit conducted as a general review practice periodically.

The first stage of any audit procedure is to verify the current intellectual property assets held by the business. This process involves a few different things ? first, assessing the quantity and type of data held about the portfolio.

An ISO 9001 audit checklist helps the auditor to gather documentation and information about quality objectives, corrective action, internal issues, and customer satisfaction.

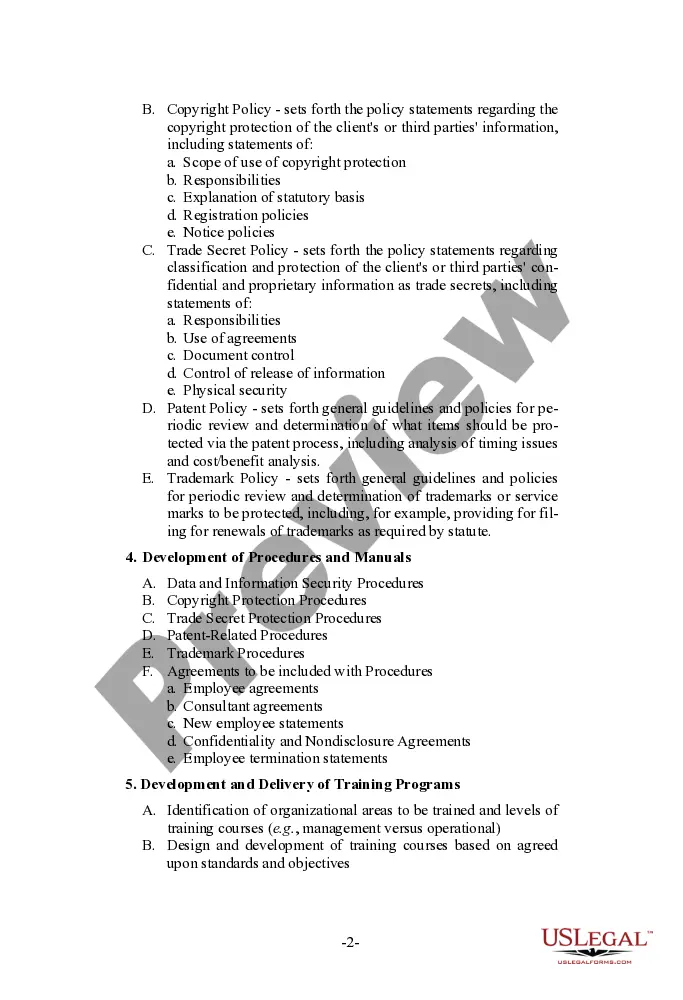

This check list identifies information helpful in evaluating the state of a Company's intellectual property portfolio, policies, and practices. A goal of any IP due diligence effort is to understand the Company's business and how the Company's IP protects and furthers that business.

In preparing for the IP Audit, the first step is to understand the goal of the IP Audit. This is followed by researching relevant data about the IP assets, a plan about the audit's scope, timeframe, and budget, and lastly, contracts that cover things like funding, licensing, R&D etc.

How to conduct an IP Audit Get buy-in from the relevant individuals. ... Create an IP Register for the specific review. Request and gather existing policies, agreements, registers (such as an IP register), information, and documents (such as an IP Strategy Document) that are relevant to an IP audit.