Delaware Extension of the expiration date of the company's outstanding warrants

Description

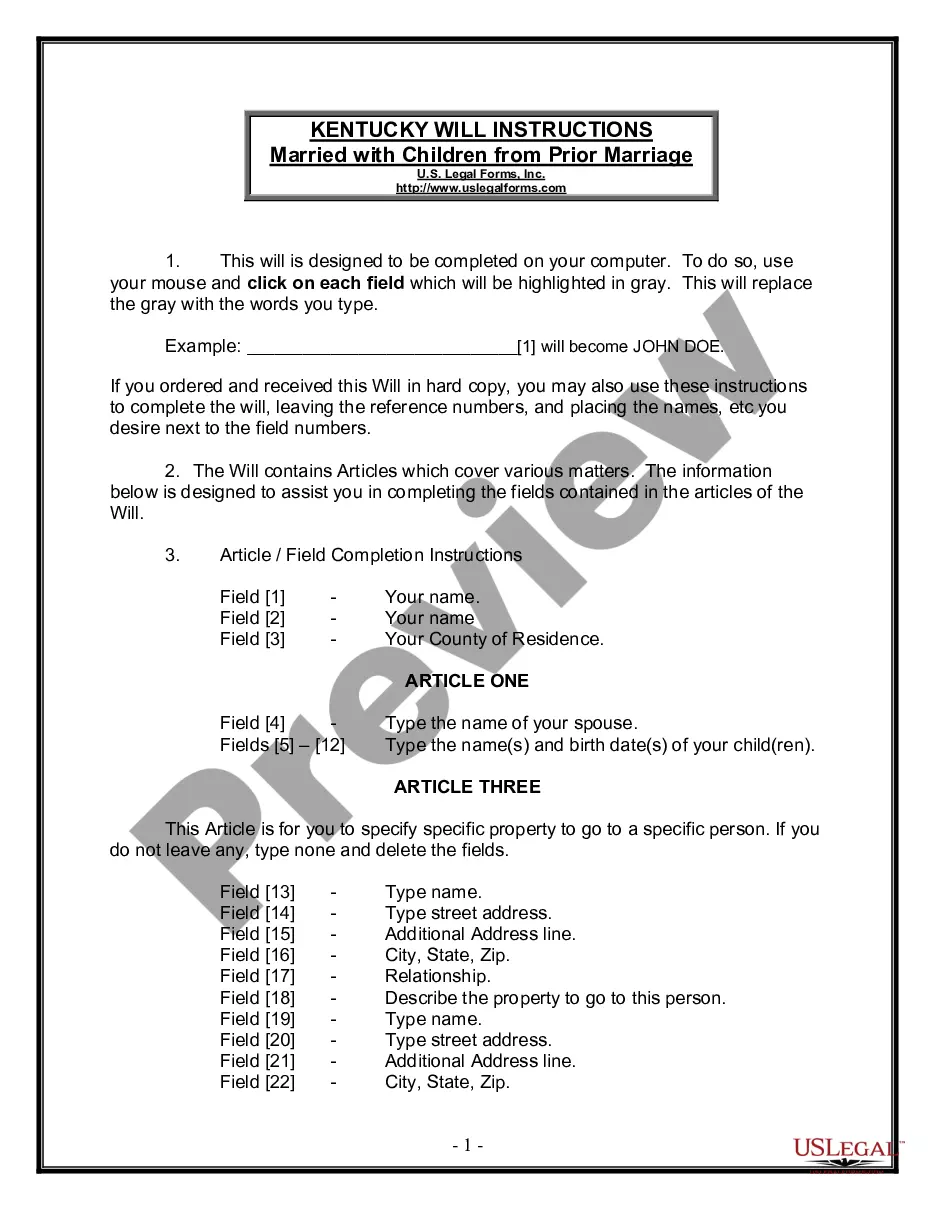

How to fill out Extension Of The Expiration Date Of The Company's Outstanding Warrants?

If you need to complete, obtain, or printing authorized document layouts, use US Legal Forms, the biggest collection of authorized types, which can be found on-line. Make use of the site`s simple and easy practical search to obtain the paperwork you will need. Numerous layouts for organization and person reasons are categorized by categories and claims, or keywords. Use US Legal Forms to obtain the Delaware Extension of the expiration date of the company's outstanding warrants in just a handful of clicks.

In case you are already a US Legal Forms buyer, log in for your bank account and then click the Down load switch to find the Delaware Extension of the expiration date of the company's outstanding warrants. You may also accessibility types you previously saved within the My Forms tab of your bank account.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the form for that correct area/land.

- Step 2. Make use of the Preview option to examine the form`s articles. Do not forget about to read the description.

- Step 3. In case you are not happy with all the kind, take advantage of the Look for industry towards the top of the display screen to locate other types from the authorized kind format.

- Step 4. When you have found the form you will need, go through the Get now switch. Opt for the pricing plan you favor and add your references to register for an bank account.

- Step 5. Approach the transaction. You may use your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Find the structure from the authorized kind and obtain it on the system.

- Step 7. Total, change and printing or sign the Delaware Extension of the expiration date of the company's outstanding warrants.

Each and every authorized document format you buy is the one you have for a long time. You may have acces to every single kind you saved in your acccount. Click the My Forms section and decide on a kind to printing or obtain yet again.

Compete and obtain, and printing the Delaware Extension of the expiration date of the company's outstanding warrants with US Legal Forms. There are millions of expert and express-particular types you may use for your personal organization or person requirements.

Form popularity

FAQ

?Settlement Date? means, in respect of a Warrant that is exercised hereunder, the third Trading Day immediately following the Exercise Date for such Warrant.

The exercise price, also called a strike price, is the price you agree to pay for each share a warrant includes. With a warrant, you could set the exercise price at the FMV of the stock at the time of issuing, or, for a non-compensatory warrant, a lower price, such as a penny per share.

On the day that the warrants are exercised (i.e., the exercise date), the collection of cash and the closing of the warrants outstanding account should be recorded. The total credit equals the sum of the cash received and the carrying value of the warrants.

The expiration date is the date on which the stock warrant expires. Once a stock warrant expires, it is no longer valid, and the holder loses the right to buy or sell the underlying stock at the exercise price.

The easiest way to exercise a warrant is through your broker. When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a dilutive effect. Warrants can be bought and sold on the secondary market up until expiry.

The intrinsic value of a call warrant is calculated as follows: Intrinsic value = (Underlying price ? Strike price) × Ratio. Only in one of these situations does the value of the warrant have intrinsic and temporary value at the same time.

When a warrant is exercised, the company issues new shares, increasing the total number of shares outstanding, which has a dilutive effect. Warrants can be bought and sold on the secondary market up until expiry.

Every warrant comes with a term, which is usually between two and 10 years. The expiration date, which marks the end of the term, is the date at which the warrant holder can no longer exercise the warrant for shares.

What is a ?net exercise?? A net exercise is the practice of ?tendering back to the company? some of the exercised shares to cover the exercise price of the option. In some cases, shares will be tendered to cover taxes as well.

Under an American-style stock warrant, the holder can exercise his right to buy or sell the shares at any time before the warrant expires. Under a European-style stock warrant, the holder can only exercise his rights on the specified day.