Delaware Resident Information Sheet

Description

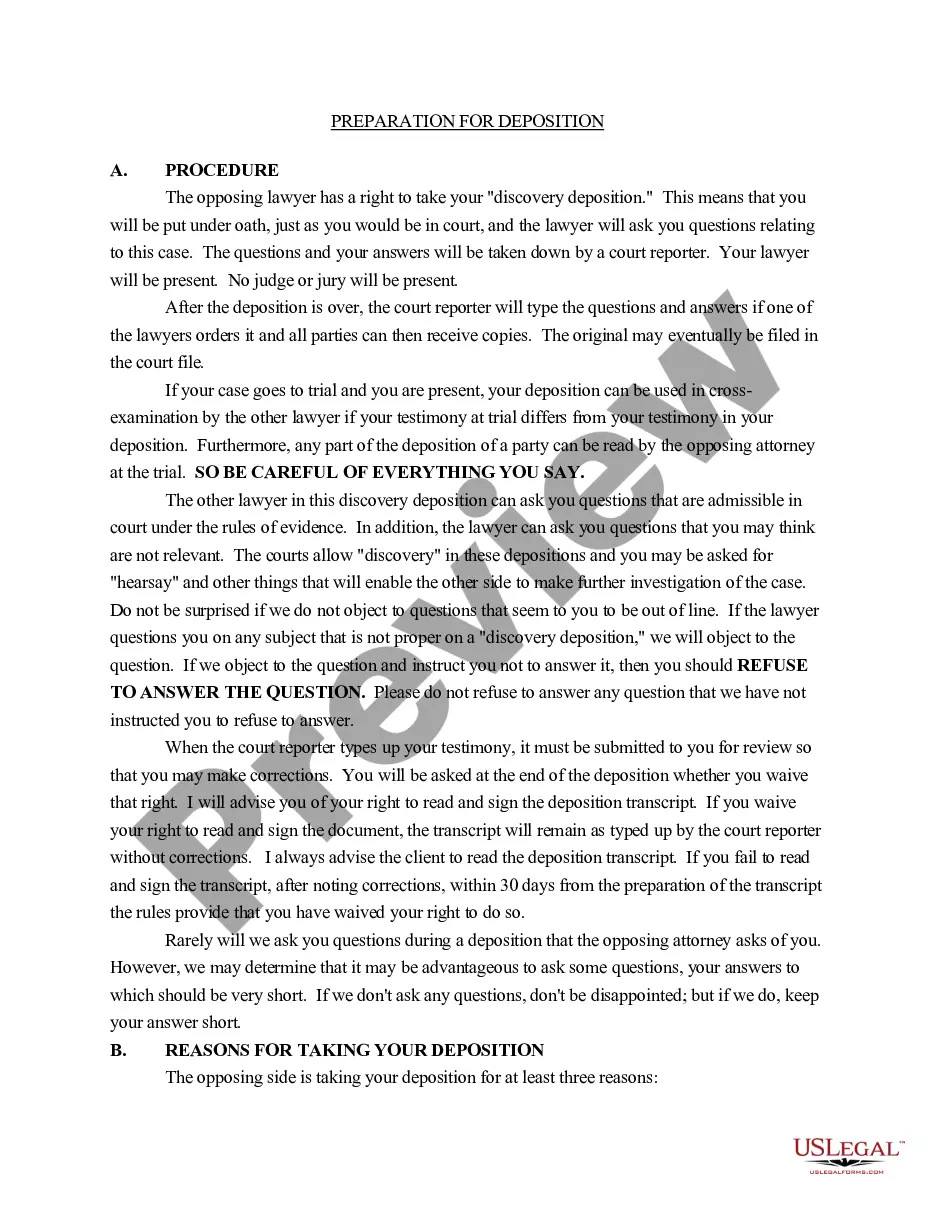

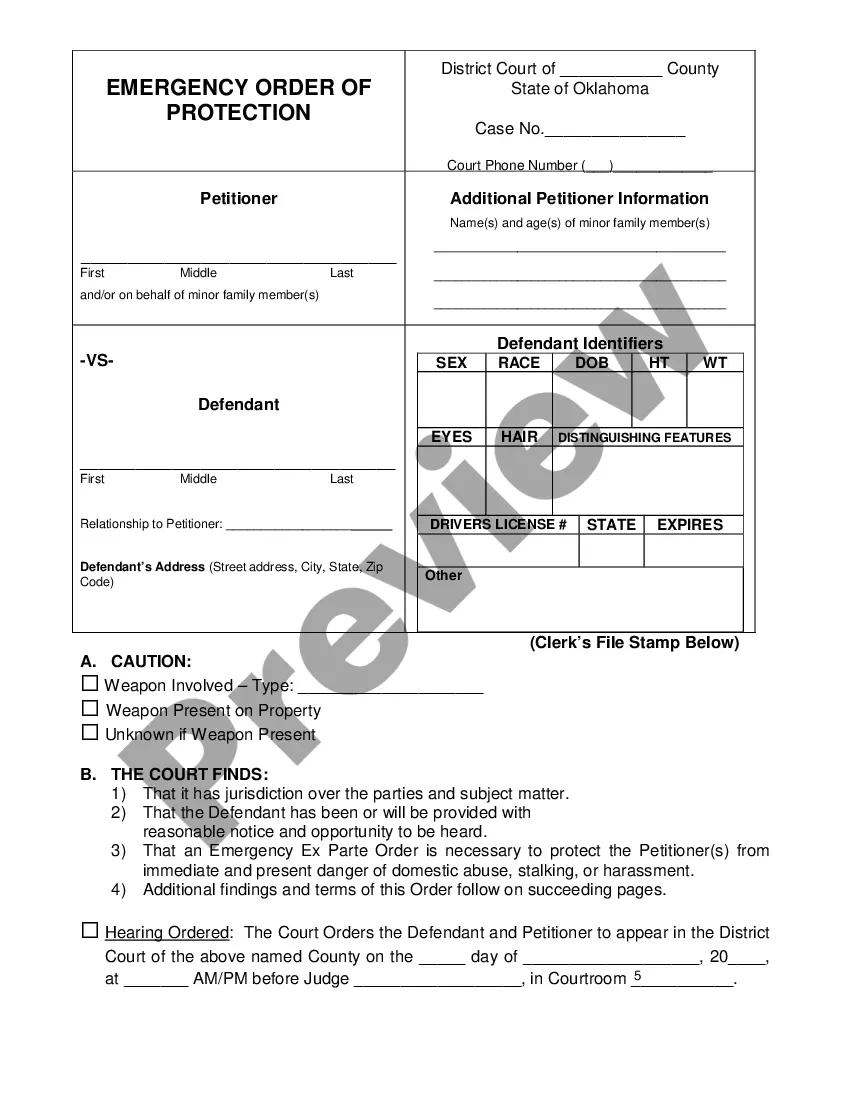

How to fill out Resident Information Sheet?

It is feasible to dedicate time on the web seeking the legal document template that meets the state and federal requirements you will require.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

You can easily download or print the Delaware Resident Information Sheet from this service.

If available, use the Review button to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Delaware Resident Information Sheet.

- Every legal document template you obtain is yours permanently.

- To acquire another copy of any obtained document, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your chosen county/region.

- Review the document details to confirm you have selected the right template.

Form popularity

FAQ

According to Delaware Instructions for Form 200-01, If you are a Full-Year Resident of Delaware, you must file a tax return for 2020 if, based on your Age/Status, and if your individual adjusted Delaware gross income (AGI) exceeds the limit. If you were: Single: Under age 60, $9,400.

Delaware has a graduated tax rate ranging from 2.2% to 5.55% on income under $60,000. The maximum income tax rate is 6.60% on income of $60,000 or over.

A. Yes, but 1099-MISC, 1099-NEC, and 1099-R information is required to be submitted directly to the Delaware Division of Revenue.

State filing is not required for Form 1099-NEC. Business owners in Alaska can file Form 1099-NEC with the IRS with Wave Payroll.

Participating states: Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Georgia, Hawaii, Idaho, Indiana, Kansas, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, South

Forms PIT-RES and PIT-NON are Forms used for the Tax Amendment. You can prepare a 2021 Delaware Tax Amendment on eFile.com, however you cannot submit it electronically. In comparison, the IRS requires a different Form - Form 1040X - to amend an IRS return (do not use Form 1040 for an IRS Amendment).

Yes, Delaware requires you to file. Non-Residents File a tax return if you have any gross income during the tax year from sources in Delaware.

Delaware Income Taxes The state of Delaware collects income taxes based on seven tax brackets, with rates ranging from 0% to 6.6%. Additionally, the city of Wilmington collects its own income tax, at a flat rate of 1.25%. For everyone who does not live or work in Wilmington, however, only the state tax is due.

Beginning with the 2020 tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractor.

Disadvantages of Registering in Delaware Although Delaware does not tax companies not doing business in the state, your home state likely will tax your company's income. You will need to register your business (and pay a filing fee) in your home state, and you may also have to file annual reports there.