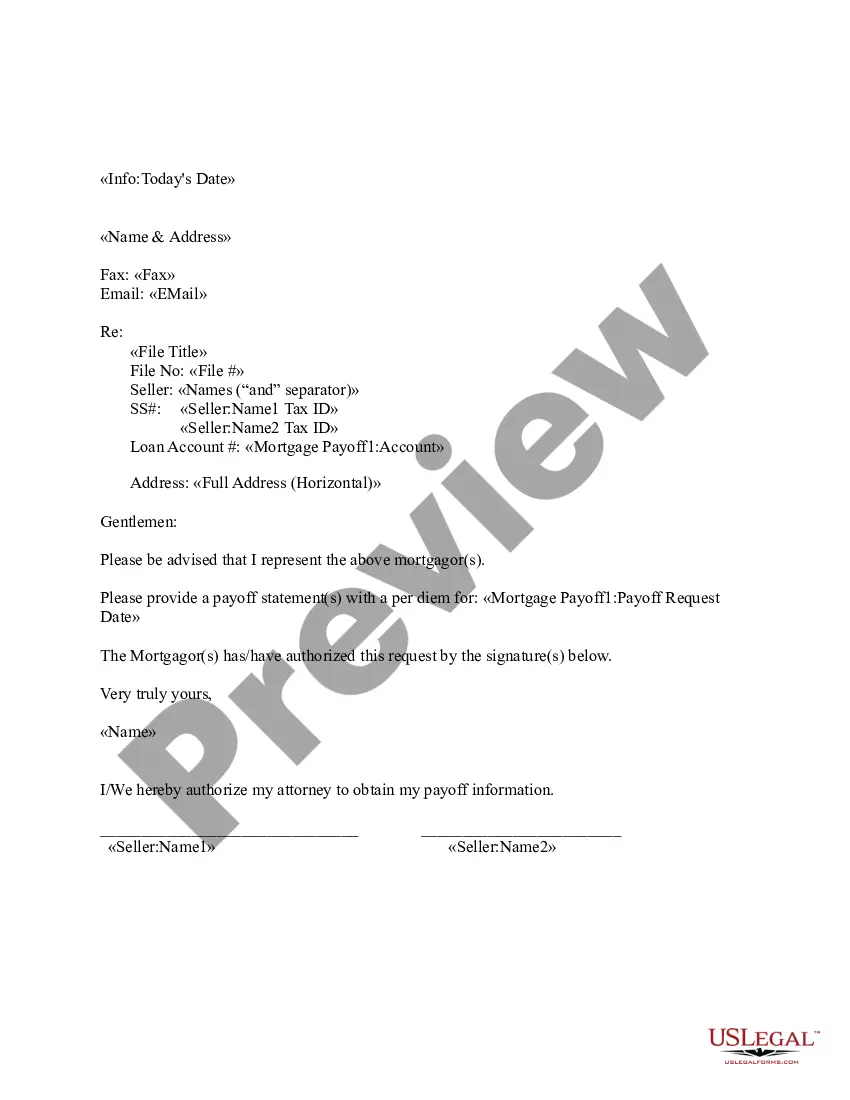

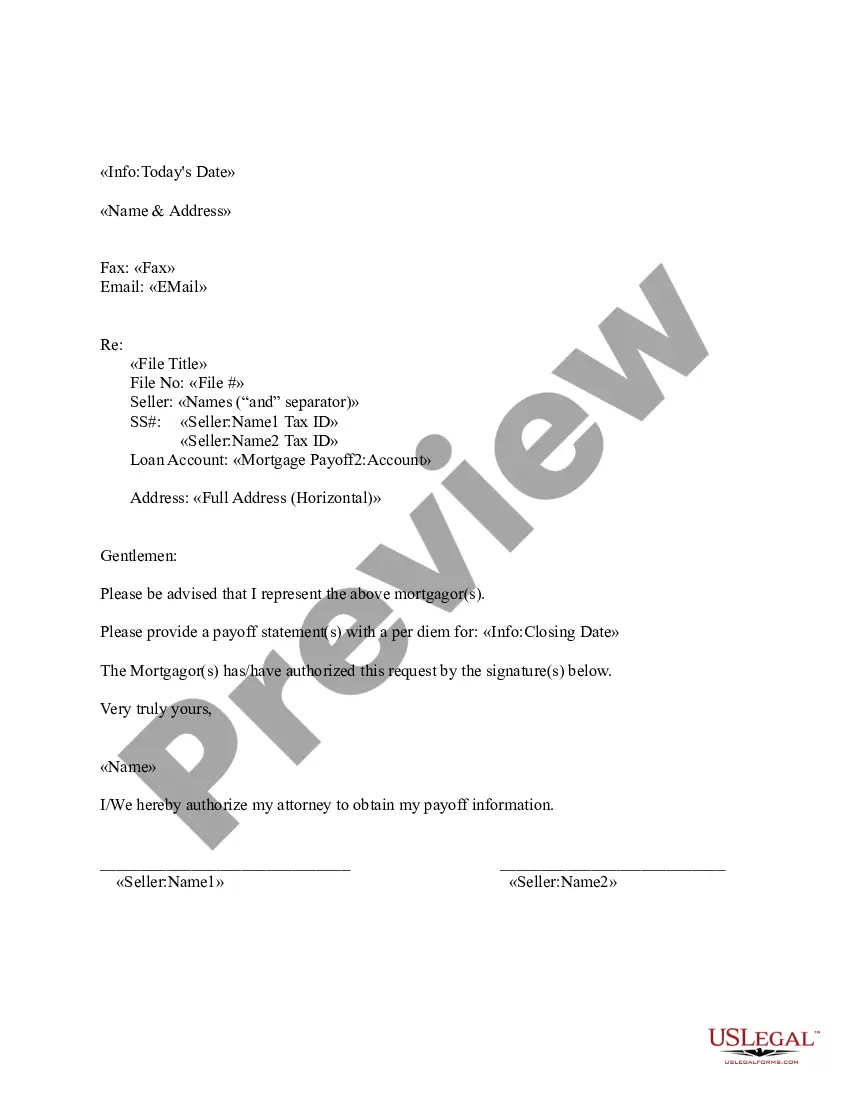

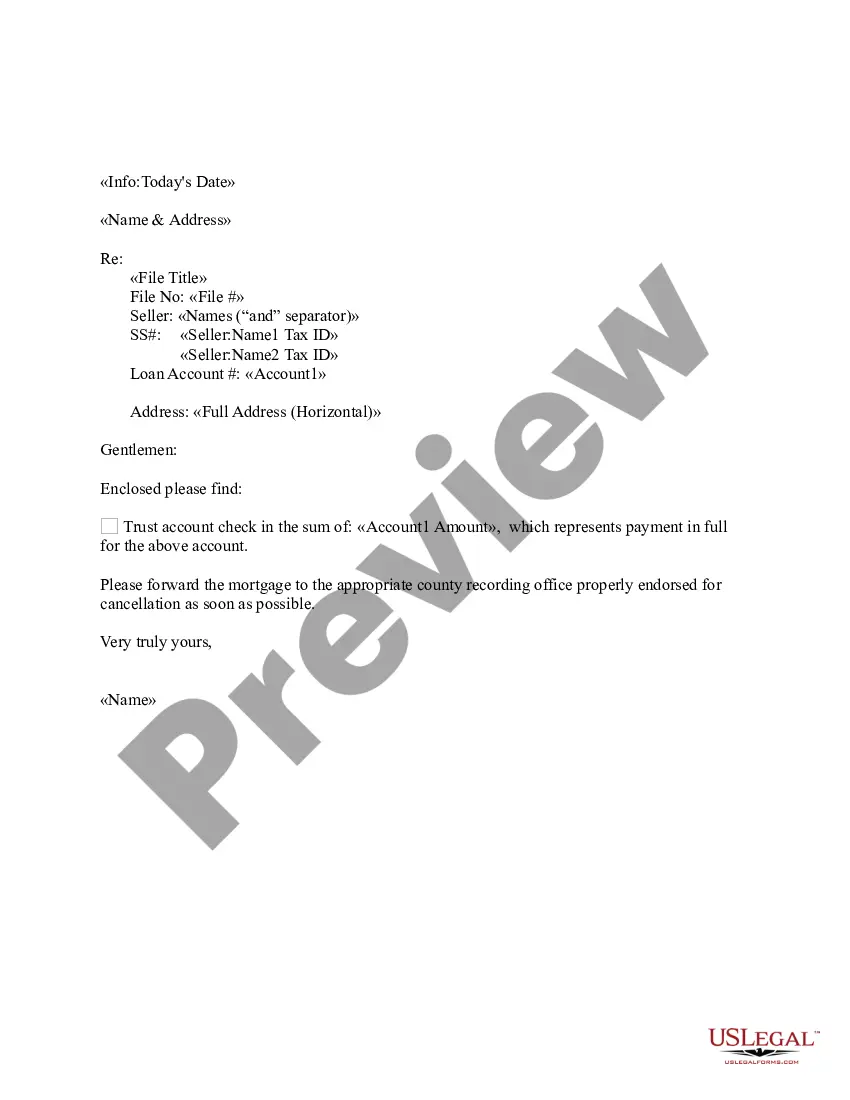

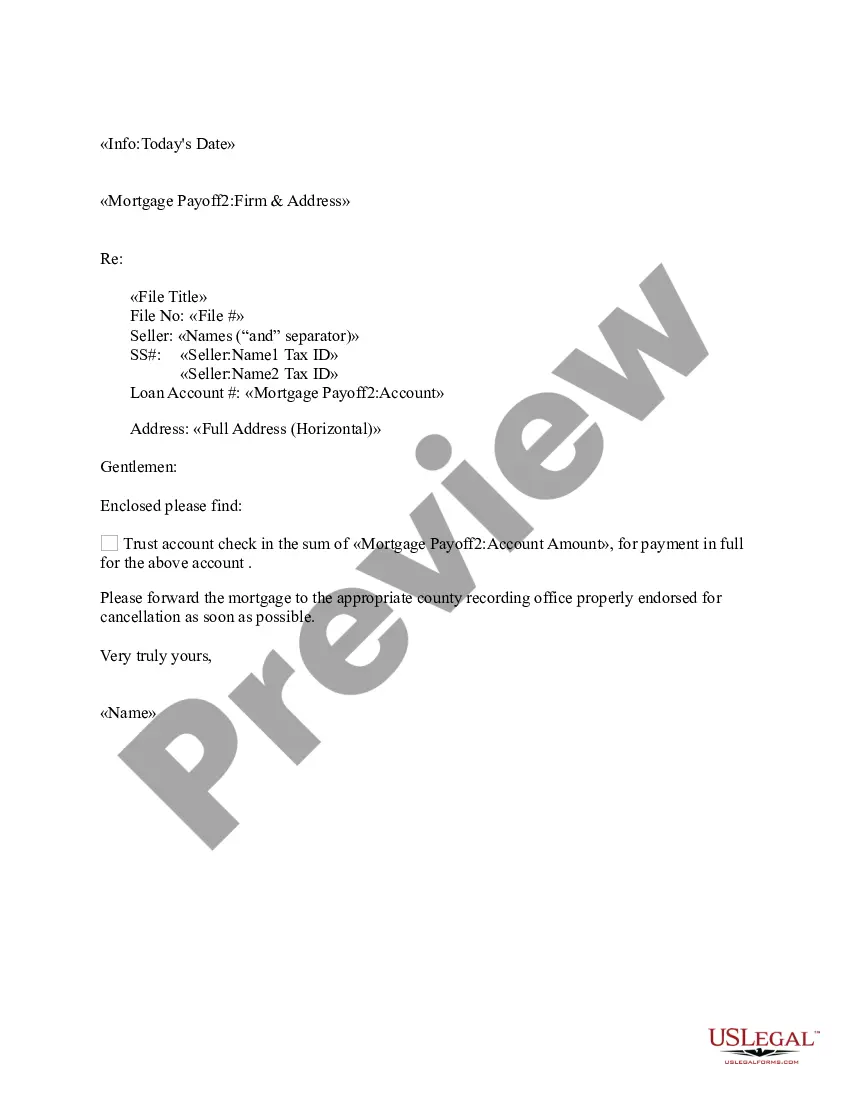

Delaware Sample Letter Requesting Payoff Balance of Mortgage

Description

How to fill out Sample Letter Requesting Payoff Balance Of Mortgage?

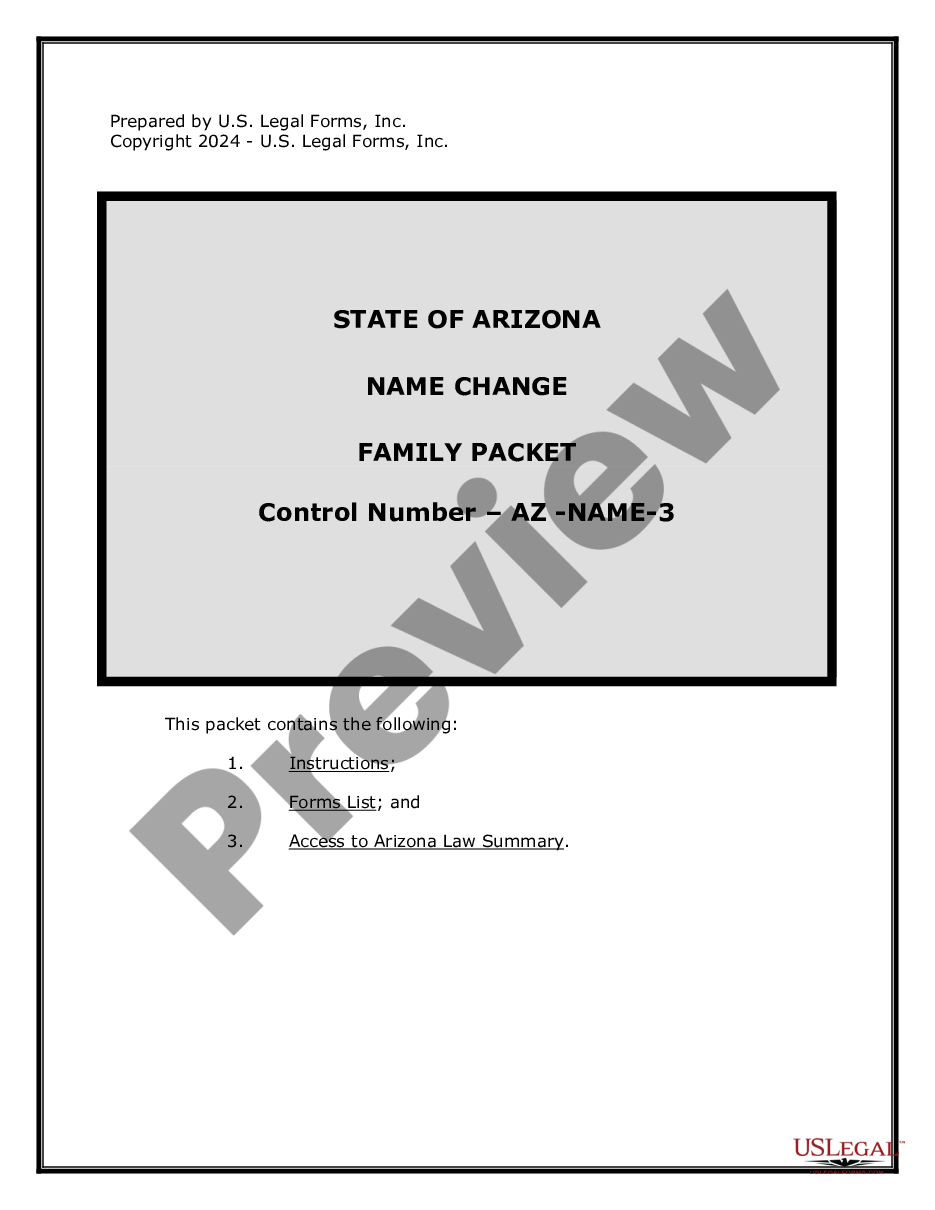

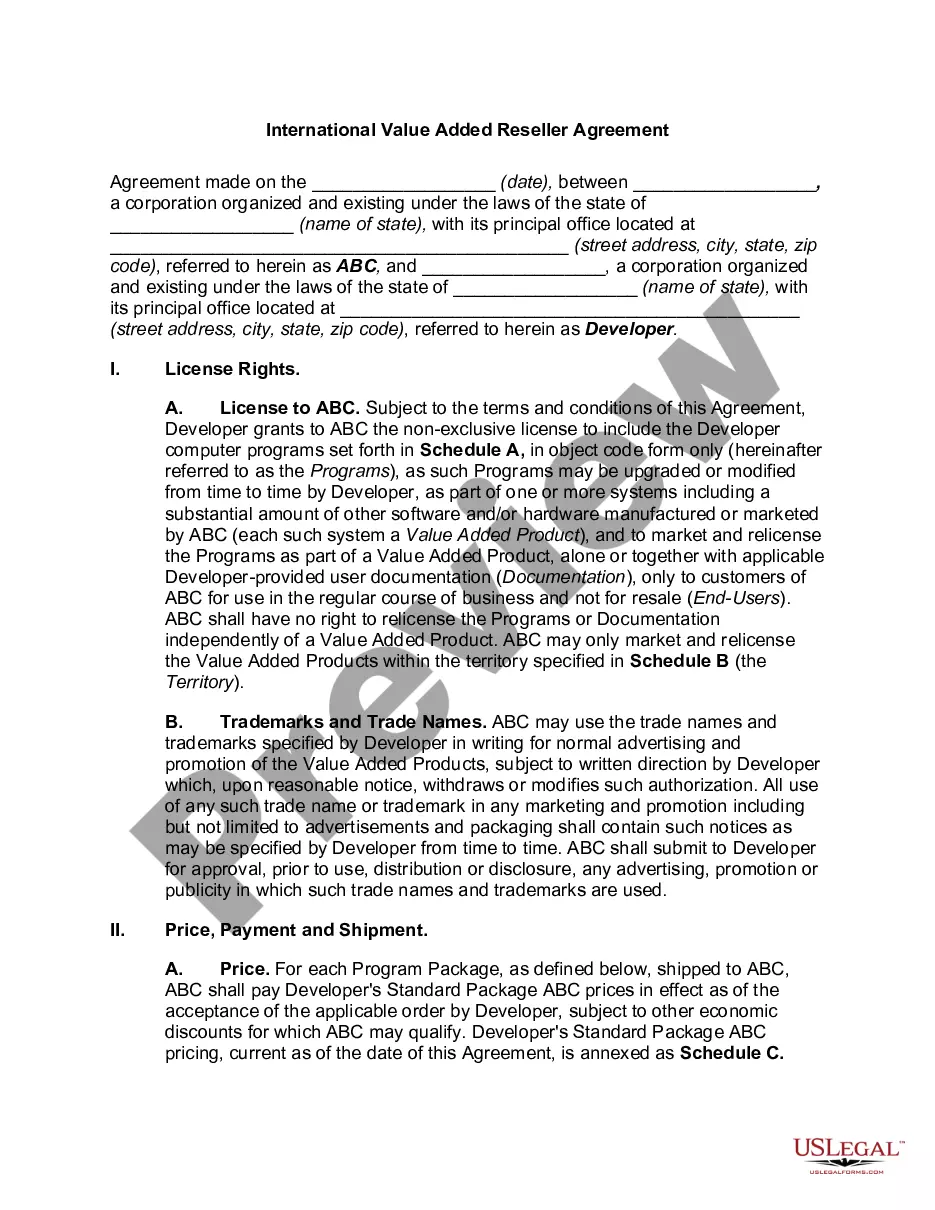

Choosing the right legitimate document template can be a battle. Obviously, there are tons of layouts accessible on the Internet, but how would you obtain the legitimate form you want? Use the US Legal Forms website. The assistance gives thousands of layouts, like the Delaware Sample Letter Requesting Payoff Balance of Mortgage, that can be used for organization and private requirements. All the forms are checked by specialists and meet state and federal specifications.

When you are currently authorized, log in to the account and click the Obtain key to find the Delaware Sample Letter Requesting Payoff Balance of Mortgage. Make use of account to search with the legitimate forms you possess acquired earlier. Visit the My Forms tab of the account and get one more backup in the document you want.

When you are a new end user of US Legal Forms, listed below are straightforward directions so that you can comply with:

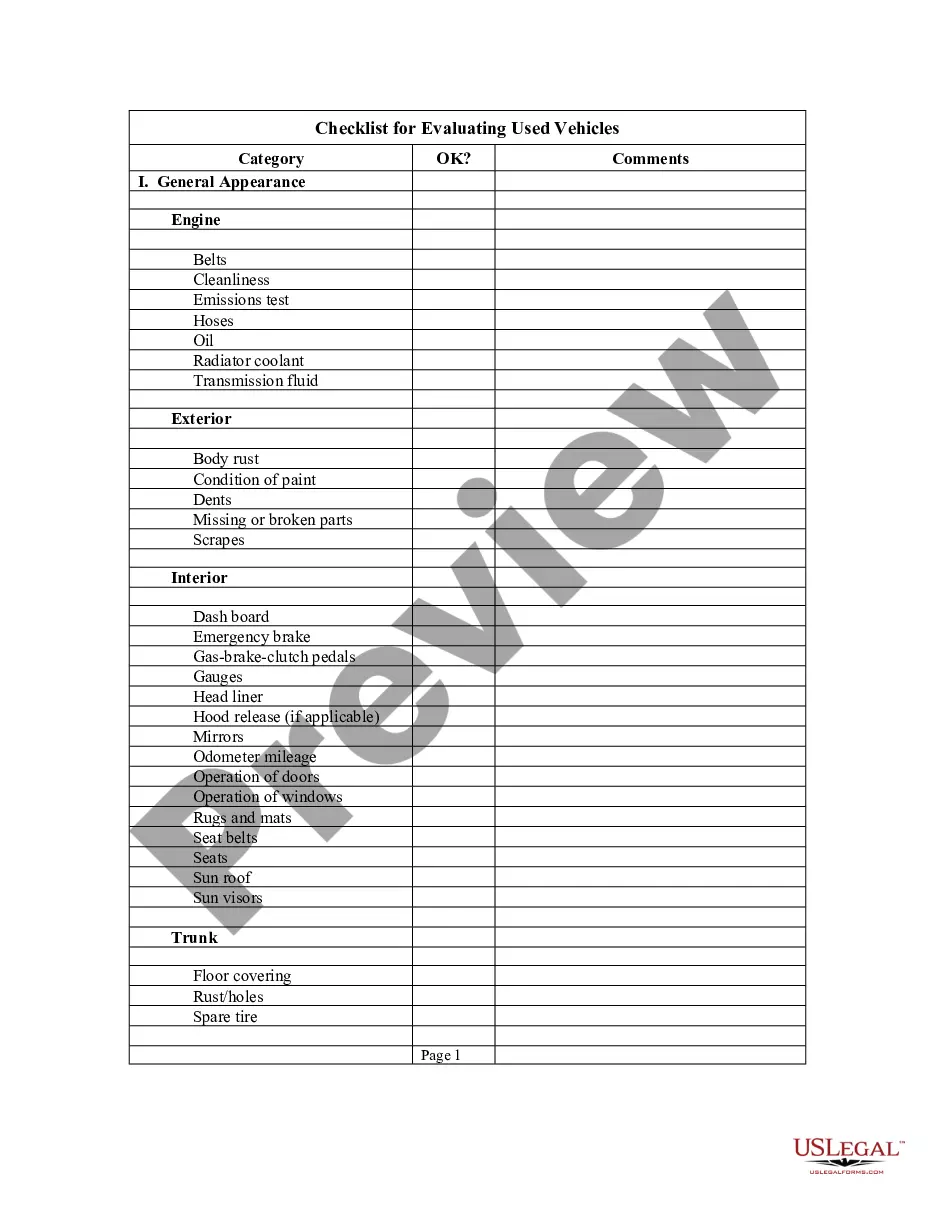

- First, be sure you have selected the appropriate form for your city/area. You are able to check out the shape making use of the Review key and browse the shape explanation to make certain it is the best for you.

- In the event the form fails to meet your needs, use the Seach discipline to find the appropriate form.

- Once you are certain that the shape is suitable, click on the Get now key to find the form.

- Pick the prices strategy you would like and enter the essential information. Create your account and buy an order with your PayPal account or credit card.

- Select the document format and acquire the legitimate document template to the system.

- Complete, edit and print out and signal the acquired Delaware Sample Letter Requesting Payoff Balance of Mortgage.

US Legal Forms is the most significant local library of legitimate forms that you can find different document layouts. Use the service to acquire expertly-made paperwork that comply with condition specifications.

Form popularity

FAQ

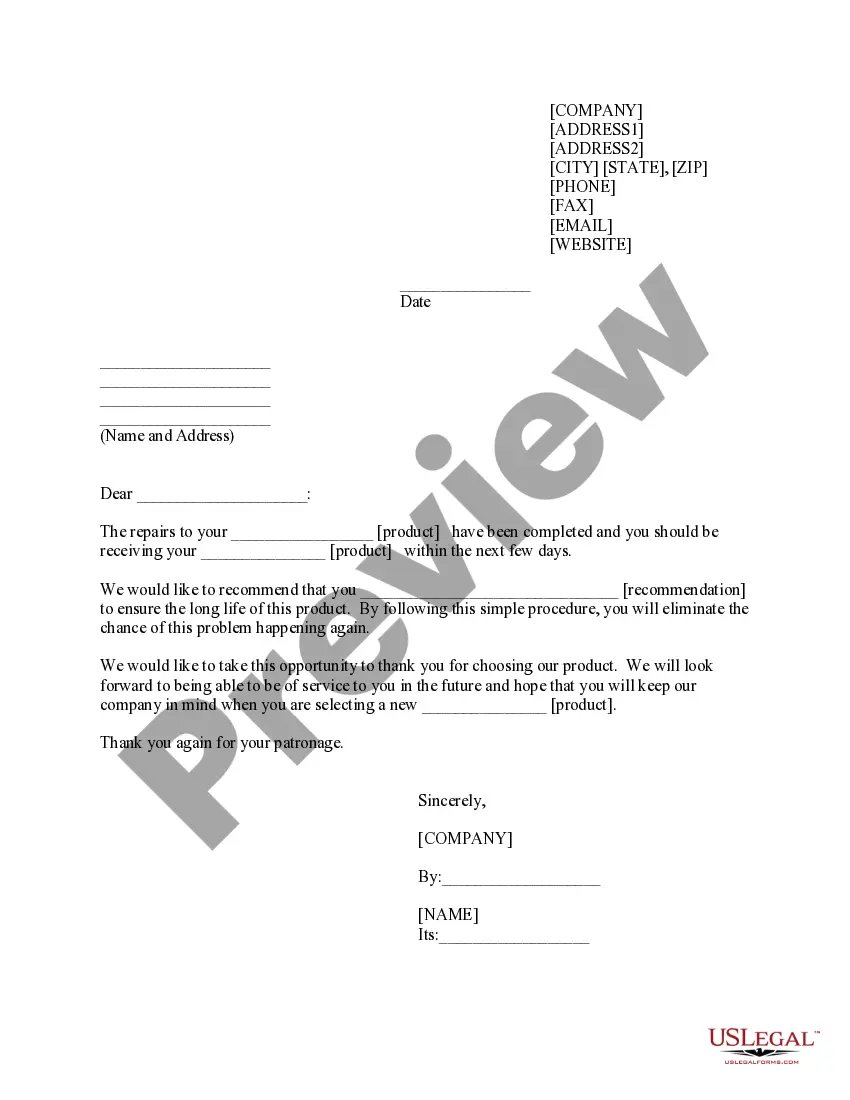

Include all relevant information in the payoff letter, including: Include the name of the loan or mortgage holder. Include the loan or mortgage number. Include the payment amount. Include the date you plan to make the payment. Include your name and address. Include your contact information.

Lenders can also send you a payoff letter after you have finished paying off a loan. This letter serves as confirmation that your loan has been repaid in full, and your account has been closed. It's most often requested so that customers can prove to other lenders that they have no other outstanding debts.

A payoff letter is a document that provides detailed instructions on how to pay off a loan. If you have the funds to pay off an installment loan early, request a payoff letter from your lender. It tells you the amount due, where to send the money, how to pay, and any additional charges due.

What is a 10-day payoff and where can I get it? A 10-day payoff statement is a document from your lender that gives us the payoff amount to purchase your vehicle, including 10 days worth of interest. We need this document in order to finalize your trade-in or sale.

Under federal law, the servicer must generally send you a payoff statement within seven business days of your request, subject to a few exceptions.

There's a process to getting the mortgage payoff statement. First, you'll need to contact your lender and let them know you want the information. Depending on your lender, you may have to sign in to an online account, call a helpline, or send a formal letter to start the request process.

A 10-day payoff refers to the time it takes for your new lender to pay off your old loans during a refinance.