Delaware Seller's Affidavit of Nonforeign Status

Description

How to fill out Seller's Affidavit Of Nonforeign Status?

US Legal Forms - one of many greatest libraries of legal kinds in the States - gives an array of legal record web templates it is possible to acquire or produce. Making use of the website, you can get 1000s of kinds for business and person reasons, sorted by groups, claims, or key phrases.You can find the most up-to-date versions of kinds such as the Delaware Seller's Affidavit of Nonforeign Status in seconds.

If you currently have a monthly subscription, log in and acquire Delaware Seller's Affidavit of Nonforeign Status in the US Legal Forms library. The Download option will appear on every form you see. You gain access to all previously acquired kinds from the My Forms tab of your respective bank account.

In order to use US Legal Forms the first time, listed below are straightforward recommendations to obtain started out:

- Make sure you have selected the proper form to your town/county. Select the Preview option to check the form`s content material. Read the form outline to actually have chosen the appropriate form.

- In the event the form doesn`t satisfy your demands, make use of the Search field near the top of the display to find the the one that does.

- If you are satisfied with the shape, confirm your choice by visiting the Get now option. Then, choose the pricing strategy you prefer and give your credentials to sign up for an bank account.

- Procedure the financial transaction. Make use of your bank card or PayPal bank account to finish the financial transaction.

- Choose the format and acquire the shape on your own system.

- Make modifications. Complete, revise and produce and indicator the acquired Delaware Seller's Affidavit of Nonforeign Status.

Each and every web template you included in your money does not have an expiration time and is also your own forever. So, in order to acquire or produce another backup, just proceed to the My Forms portion and click on in the form you want.

Obtain access to the Delaware Seller's Affidavit of Nonforeign Status with US Legal Forms, by far the most considerable library of legal record web templates. Use 1000s of professional and condition-specific web templates that fulfill your company or person demands and demands.

Form popularity

FAQ

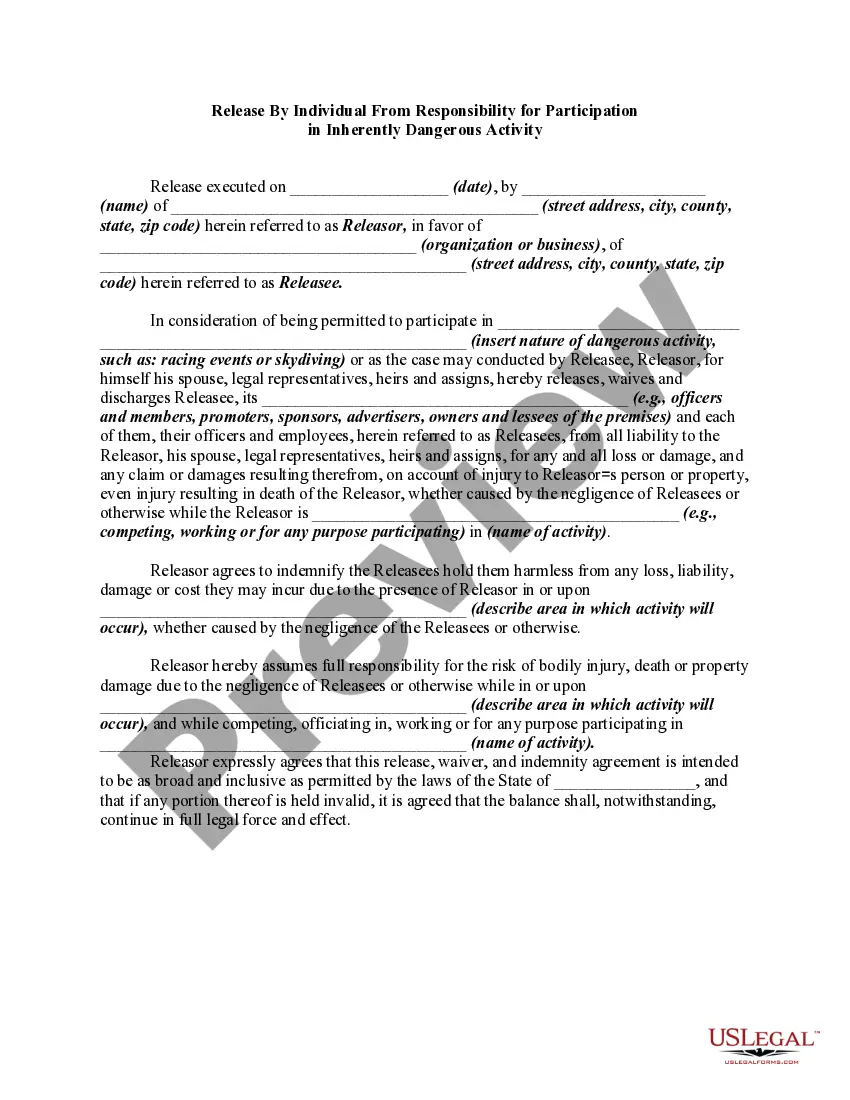

The Seller's Affidavit of Non-Foreign Status ( AS-14) is used to document the exemption if the Seller is not a NRA. This can be signed by a: US citizen; US green card holder; or. Non-citizen who meets the substantial presence test (based on the number of days actually present in the US).

Qualified Substitute is the Default. The seller will then manually complete Paragraph 3B and provide the form to the title or escrow company acting as the qualified substitute. The title or escrow company may use C.A.R. Form QS, or its own form, to satisfy its obligation to notify the buyer.

Certification of Non-Foreign Status FIRPTA is the Foreign Investment in Real Property Act. If you are selling real estate in the United States, the IRS requires certain disclosures to avoid non-U.S. Persons from escape U.S. Tax on the sale of U.S. Real Estate.

With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign.

The Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) establishes that persons purchasing U.S. real property interests from foreign individuals must withhold 10% of the gross amount realized on the transaction.