Delaware Sale of Assets of Corporation with No Necessity to Comply with Bulk Sales Laws

Description

How to fill out Sale Of Assets Of Corporation With No Necessity To Comply With Bulk Sales Laws?

Are you presently in a situation where you frequently require documentation for business or personal activities nearly every day.

There is a range of legal document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms provides a vast array of form templates, such as the Delaware Sale of Assets of Corporation without Necessity to Comply with Bulk Sales Laws, which are designed to fulfill federal and state requirements.

Once you find the correct form, click Get now.

Choose the pricing plan you want, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Delaware Sale of Assets of Corporation without Necessity to Comply with Bulk Sales Laws template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

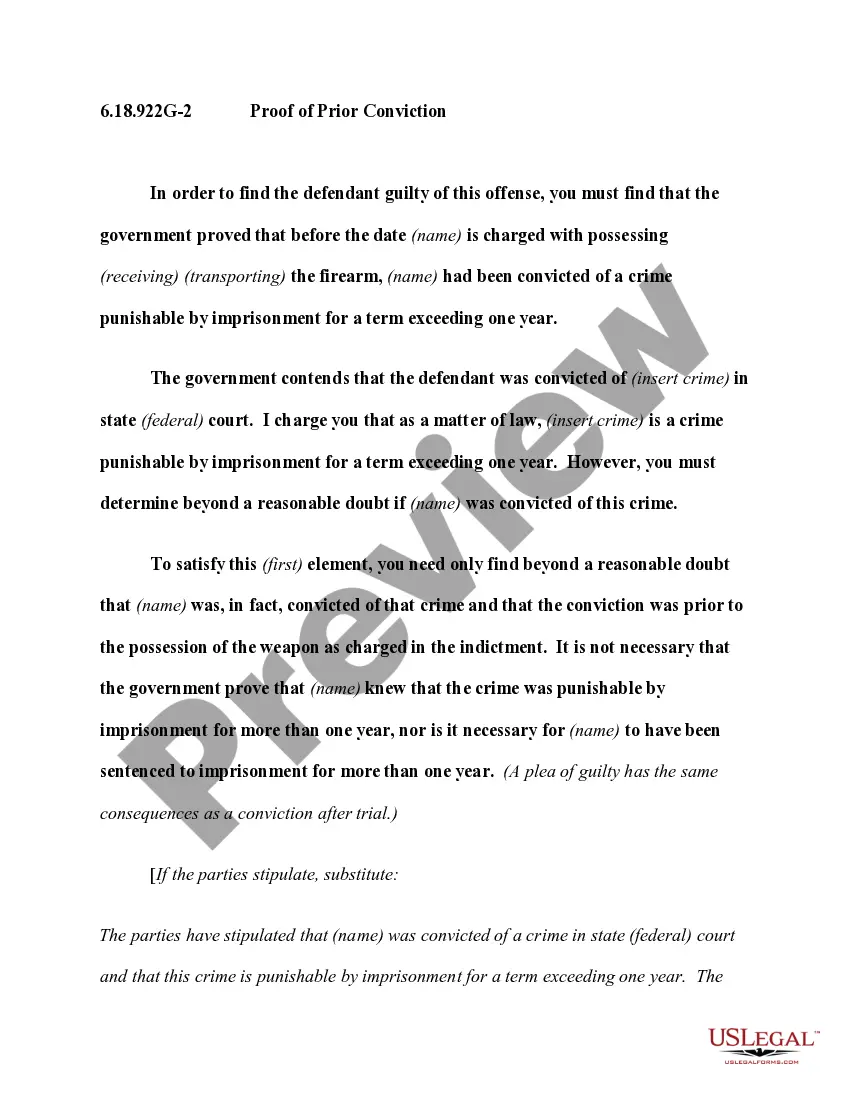

- Use the Preview button to review the document.

- Check the description to confirm you have chosen the correct form.

- If the form isn't what you require, use the Search field to locate the form that fits your needs.

Form popularity

FAQ

A bulk sales law is a federal or state law that guides the transfer of bulk sales (all of the business assets or inventory) from a business to a buyer (generally another business) that occurs outside of the ordinary course of the business.

A bulk transfer involves the transfer of two or more members from one pension plan to another pension plan. A corresponding payment will be made by the trustees of the transferring plan to the trustees of the receiving plan in respect of the assets and liabilities applicable to the members being transferred.

A bulk sale, sometimes called a bulk transfer, is when a business sells all or nearly all of its inventory to a single buyer and such a sale is not part of the ordinary course of business.

A bulk sale, sometimes called a bulk transfer, is when a business sells all or nearly all of its inventory to a single buyer and such a sale is not part of the ordinary course of business.

The bulk transfer law is designed to prevent a merchant from defrauding his or her creditors by selling the assets of a business and neglecting to pay any amounts owed the creditors. The law requires notice so that creditors may take whatever legal steps are necessary to protect their interests.

Under California law, a bulk sale is defined as a sale of more than half of a business' inventory and equipment, as measured by fair market value, that is not part of the seller's ordinary course of business. In order for the law to apply, the seller has to be physically located in California.

The key elements of a Bulk Sale are: any sale outside the ordinary course of the Seller's business. of more than half the Seller's inventory and equipment. as measured by the fair market value on the date of the Bulk Sale Agreement (Agreement).

To dissolve your domestic corporation in Delaware, you must provide the completed Certificate of Dissolution form to the Department of State by mail, fax or in person, along with the filing fee. Include a Filing Cover Memo with your name, address and telephone/fax number to enable them to contact you if necessary.

Steps to Cancel a Delaware LLCConsult the LLC Operating Agreement.Take a Member Vote.Appoint a Manager to Wind up the LLC's Affairs.Payoff Creditors, Current and Forseeable, before paying Members.Pay The Delaware Franchise Tax.Pay the LLC's members.File a Certificate of Cancellation.More items...

Delaware's General Corporation Law ("GCL") provides for voluntary dissolution through a stockholder vote at a stockholder meeting. Before the vote, your board of directors must adopt a resolution to dissolve, submit it to the stockholders, and call the stockholder meeting to vote on the matter.