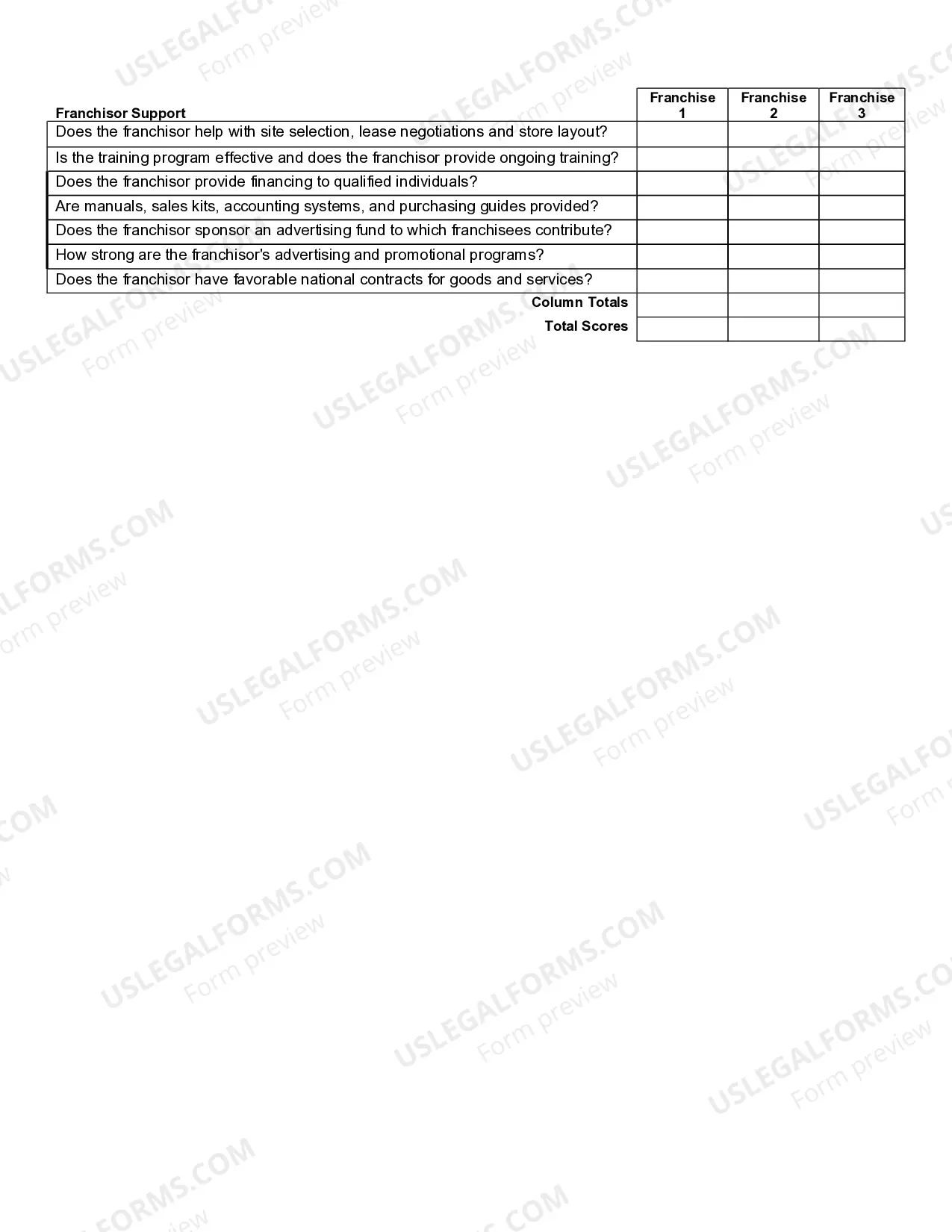

Delaware Franchise Comparison Worksheet

Description

How to fill out Franchise Comparison Worksheet?

If you have to complete, obtain, or printing legal record web templates, use US Legal Forms, the biggest collection of legal kinds, which can be found on-line. Make use of the site`s basic and handy search to get the paperwork you require. Numerous web templates for organization and specific purposes are categorized by types and says, or keywords. Use US Legal Forms to get the Delaware Franchise Comparison Worksheet within a number of mouse clicks.

In case you are presently a US Legal Forms client, log in to your accounts and then click the Down load key to obtain the Delaware Franchise Comparison Worksheet. Also you can accessibility kinds you formerly downloaded from the My Forms tab of the accounts.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have chosen the shape to the correct area/region.

- Step 2. Make use of the Preview option to examine the form`s content material. Never forget about to read through the information.

- Step 3. In case you are unhappy together with the develop, utilize the Look for discipline towards the top of the display to discover other types of the legal develop web template.

- Step 4. Once you have discovered the shape you require, select the Buy now key. Opt for the costs strategy you prefer and put your qualifications to sign up for an accounts.

- Step 5. Approach the transaction. You may use your Мisa or Ьastercard or PayPal accounts to complete the transaction.

- Step 6. Pick the format of the legal develop and obtain it on your own system.

- Step 7. Total, edit and printing or signal the Delaware Franchise Comparison Worksheet.

Each and every legal record web template you acquire is yours for a long time. You may have acces to every single develop you downloaded with your acccount. Go through the My Forms section and decide on a develop to printing or obtain once again.

Remain competitive and obtain, and printing the Delaware Franchise Comparison Worksheet with US Legal Forms. There are thousands of professional and status-specific kinds you can utilize for the organization or specific requirements.

Form popularity

FAQ

The minimum tax is $175.00 for corporations using the Authorized Shares method and a minimum tax of $400.00 for corporations using the Assumed Par Value Capital Method. All corporations using either method will have a maximum tax of $200.000.

A company with 1 to 5,000 authorized shares is assessed a flat rate of $225 franchise tax; a company with 5,001-10,000 authorized shares is assessed $300 franchise tax; and a company with 10,001 shares or more will be assessed a minimum of $450 franchise tax. Delaware Franchise Tax is due by March 1st of each year.

Failure to file the report and pay the required franchise taxes will result in a penalty of $200.00 plus 1.5% interest per month on tax and penalty.

If you don't pay the Delaware Franchise Tax and file the Annual Report for two straight years, the State of Delaware will administratively dissolve the Corporation.

Any corporation that is incorporated in Delaware (regardless of where you conduct business) must file an Annual Franchise Tax Report and pay Franchise Tax for the privilege of incorporating in Delaware. Franchise Taxes and annual Reports are due no later than March 1st of each year.

If you do not take some action to pay your tax bill, we may take any of the following actions: File a Notice of judgment; Serve a Notice of Warrant; Seize and sell your property (personal, real estate, and business property);

All Domestic and Foreign Limited Liability Companies, Limited Partnerships, and General Partnerships formed or registered in Delaware are required to pay an annual tax of $300.00. There is no requirement to file an Annual Report.

If you do not legally and officially cancel your LLC or dissolve your corporation, your company will continue to be held responsible for the annual Delaware Franchise Tax Fee as well as your annual Registered Agent Fee until either the Registered Agent resigns or until the State of Delaware voids the company.