Delaware Invoice Template for Waiting Staff

Description

How to fill out Invoice Template For Waiting Staff?

Have you ever found yourself in a circumstance where you need paperwork for either business or personal purposes on a daily basis.

There are numerous legal document templates accessible online, yet finding ones that you can trust is not easy.

US Legal Forms offers thousands of form templates, including the Delaware Invoice Template for Waiting Staff, which are designed to comply with federal and state regulations.

Once you obtain the correct form, simply click Acquire now.

Choose the payment plan you prefer, fill out the necessary information to create your account, and complete your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Delaware Invoice Template for Waiting Staff design.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

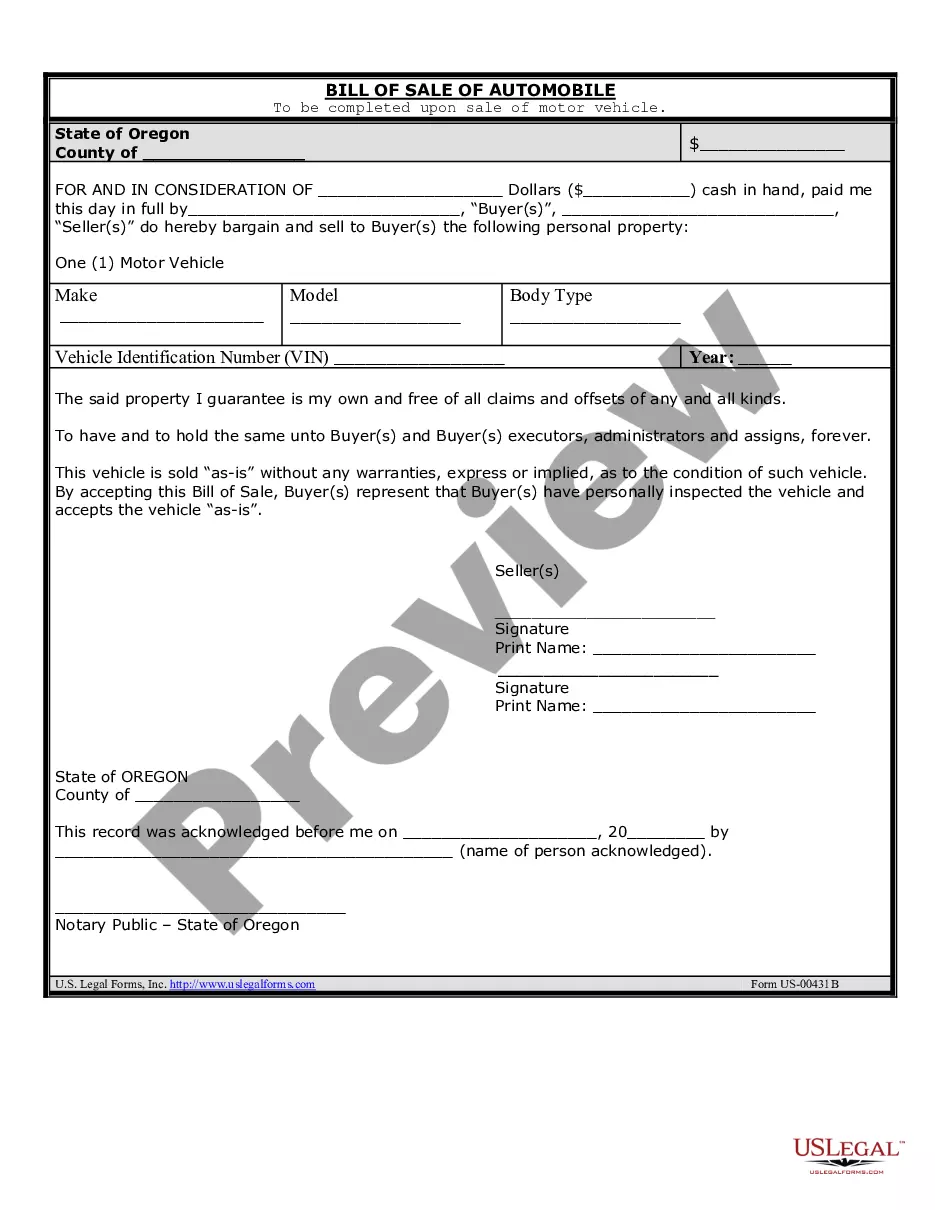

- Use the Review option to inspect the form.

- Check the description to ensure that you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

As an employee, creating an invoice requires a clear layout of your work details. Utilize a Delaware Invoice Template for Waiting Staff for a professional appearance. Include your employer's name, your services, hours worked, and payment terms. A well-designed invoice can help streamline your payment process.

To create an invoice that facilitates receiving payment, ensure it includes all crucial elements. Use a Delaware Invoice Template for Waiting Staff, adding details like client information, services rendered, and clear payment instructions. Highlight payment terms and methods to avoid confusion. A clear invoice encourages faster payments.

Using Excel to create an invoice can be more beneficial than Word, particularly for calculations and tracking. Excel allows you to create a Delaware Invoice Template for Waiting Staff that automatically calculates totals. This feature reduces the risk of errors while saving you time. Choose the format that best suits your workflow.

To create an employee invoice, use a Delaware Invoice Template for Waiting Staff to ensure you include all necessary information. Start by listing the employee's name, their services, and the hours worked. Be sure to include payment terms and your contact information. A well-structured invoice helps facilitate quicker payments.

To obtain a Delaware supplier ID, visit the Delaware Division of Revenue website. There, you can find the application process for acquiring this essential identification. This ID is crucial for businesses needing to invoice clients. Make sure to have your business information handy during the application.

The easiest way to make an invoice is to use a Delaware Invoice Template for Waiting Staff. Templates provide a clear structure, making it simple to fill in your details. You can customize it with your business logo and payment terms. This approach saves time and ensures accuracy.

If you earn income as waiting staff in Delaware, you are required to file Delaware state taxes if you meet the income threshold. Filing helps you comply with state laws and may even allow you to claim certain deductions. Using the Delaware Invoice Template for Waiting Staff can ensure you have a clear financial record, making tax filing more straightforward. Stay informed about your filing requirements to avoid any compliance issues.

Yes, you must file a state tax return in Delaware if your income meets certain criteria. Filing is essential to stay compliant and avoid penalties. By organizing your income with the Delaware Invoice Template for Waiting Staff, you can facilitate a smooth filing process. It is important to keep track of your earnings throughout the year, so you understand when you need to file.

In Delaware, you must file a tax return if your income exceeds a certain threshold, which for single filers is generally over $6,500. If you earn this amount while working as waiting staff, it is crucial to file your return. Using the Delaware Invoice Template for Waiting Staff can help categorize your income and expenses, making it easier to determine if you need to file. Regularly review your earnings to ensure you meet tax requirements.

The convenience of the employer rule in Delaware allows employers to withhold taxes based on the location of their business, rather than the employee's residence. This can simplify tax withholding for businesses that operate across state lines. For waiting staff, the Delaware Invoice Template for Waiting Staff can help you maintain precise records of your income and ensure compliance with tax obligations. Understand how this rule applies to your specific employment situation for better tax planning.