Delaware Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Acceptance Of Claim By Collection Agency And Report Of Experience With Debtor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

By using the website, you can access countless forms for business and personal purposes, categorized by type, state, or keywords. You can find the latest versions of forms such as the Delaware Acceptance of Claim by Collection Agency and Report of Experience with Debtor within moments.

If you possess an account, Log In and download the Delaware Acceptance of Claim by Collection Agency and Report of Experience with Debtor from the US Legal Forms repository. The Download button will be visible on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device.Make adjustments. Fill out, modify, and print the downloaded Delaware Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

Each template you add to your account has no expiration date and is yours permanently. Therefore, if you need to download or print another copy, simply go to the My documents section and click on the form you wish to access.

Gain access to the Delaware Acceptance of Claim by Collection Agency and Report of Experience with Debtor using US Legal Forms, the most comprehensive collection of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal requirements.

- Ensure that you have selected the correct form for your location/state.

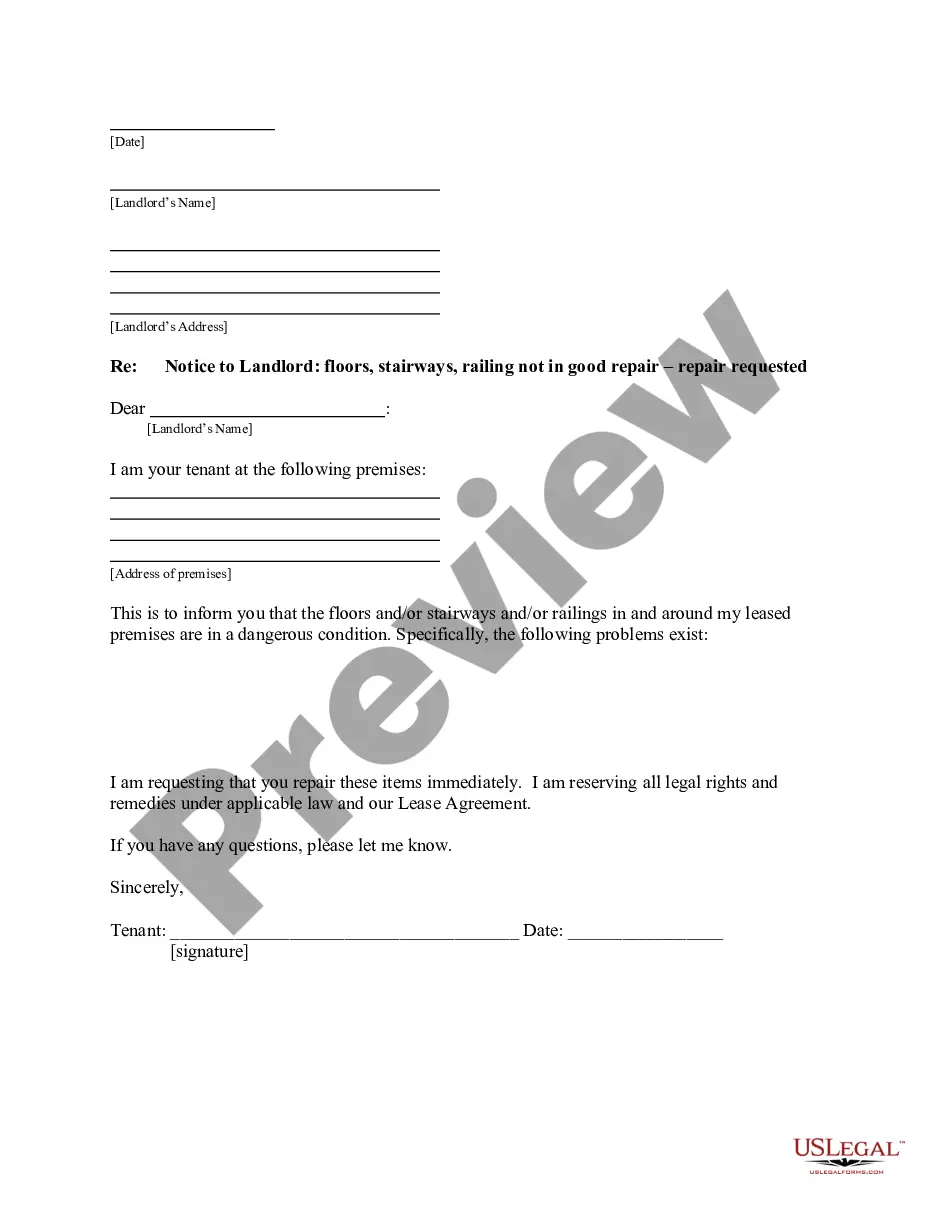

- Click the Preview button to review the contents of the form.

- Check the form description to confirm that you have selected the proper document.

- If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose the pricing plan that suits you and provide your information to register for an account.

Form popularity

FAQ

Yes, a debt collection agency must prove that you owe the debt when you dispute it. They are required to provide validation before pursuing collection actions against you. By invoking your rights under the laws related to Delaware Acceptance of Claim by Collection Agency and Report of Experience with Debtor, you can require creditors to furnish adequate proof of the debt before any collection efforts proceed.

When writing a letter to a collection agency for proof of debt, clearly state your request in the first sentence. Include your personal information and any account numbers related to the debt, followed by a concise request for documentation to validate the claim. Ensure to mention your rights under relevant laws, such as the Delaware Acceptance of Claim by Collection Agency and Report of Experience with Debtor, to reinforce your position.

The 777 rule refers to how debt collectors must follow the Fair Debt Collection Practices Act. This rule signifies that collectors are required to provide accurate and truthful information about debts. It also emphasizes that you have the right to request validation of the debt. Understanding the 777 rule can empower you when dealing with debt collectors, supporting the purpose of the Delaware Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

To write a letter requesting proof of debt, start by including your name, address, and the date at the top. Next, address the letter to the collection agency, and politely state your intention to dispute the debt. Ask for specific details regarding the debt, including the original creditor and any documentation that proves you owe the amount claimed. Using such a letter aligns with your rights under the Delaware Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

The 777 rule for debt collection refers to a guideline where a creditor can report debts to credit agencies only after a certain period following an acceptance of a claim by a collection agency. In the context of Delaware Acceptance of Claim by Collection Agency and Report of Experience with Debtor, this rule emphasizes the importance of proper reporting practices. It ensures that consumers are not unfairly penalized for debts that may not accurately reflect their repayment history. Understanding this rule can help individuals negotiate better outcomes when dealing with debt collectors.

To verify your debt, contact the collection agency directly and request that they provide proof of the debt. You have the right to receive documentation that validates the amount owed, the original creditor, and other relevant details. Be sure to document your conversations and follow up in writing if necessary. Utilizing platforms like US Legal Forms can assist you in creating effective communication templates, ensuring you address issues related to Delaware Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

To ask a debt collector to validate your debt, you should send a written request for validation, specifying the details of the debt. This request must be sent within 30 days of the first contact by the collector. Ensure you keep a copy of your request for your records. Using a service like US Legal Forms can simplify this process, helping you draft a clear and formal validation request under the guidelines of Delaware Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

To file a claim against a debt collector, start by documenting all communication and collect evidence of any violations of the Fair Debt Collection Practices Act. You can submit a complaint to the Consumer Financial Protection Bureau or your state's attorney general's office. Additionally, consider consulting with legal professionals or platforms like USLegalForms to navigate the process smoothly and ensure your rights are protected.

An example of a violation of the Fair Debt Collection Practices Act is when a collector calls at odd hours, like late at night, or threatens legal action that they have no intention of pursuing. Violations also occur when collectors falsely represent themselves or their authority. If you believe a collector has violated the FDCPA, it’s essential to document the incident and consider seeking assistance.

In simple terms, the Fair Debt Collection Practices Act is a law that ensures debt collectors treat consumers fairly. It restricts how and when they can contact you, as well as what they can say. Knowing this law gives you tools to recognize when a collection agency may be violating your rights.