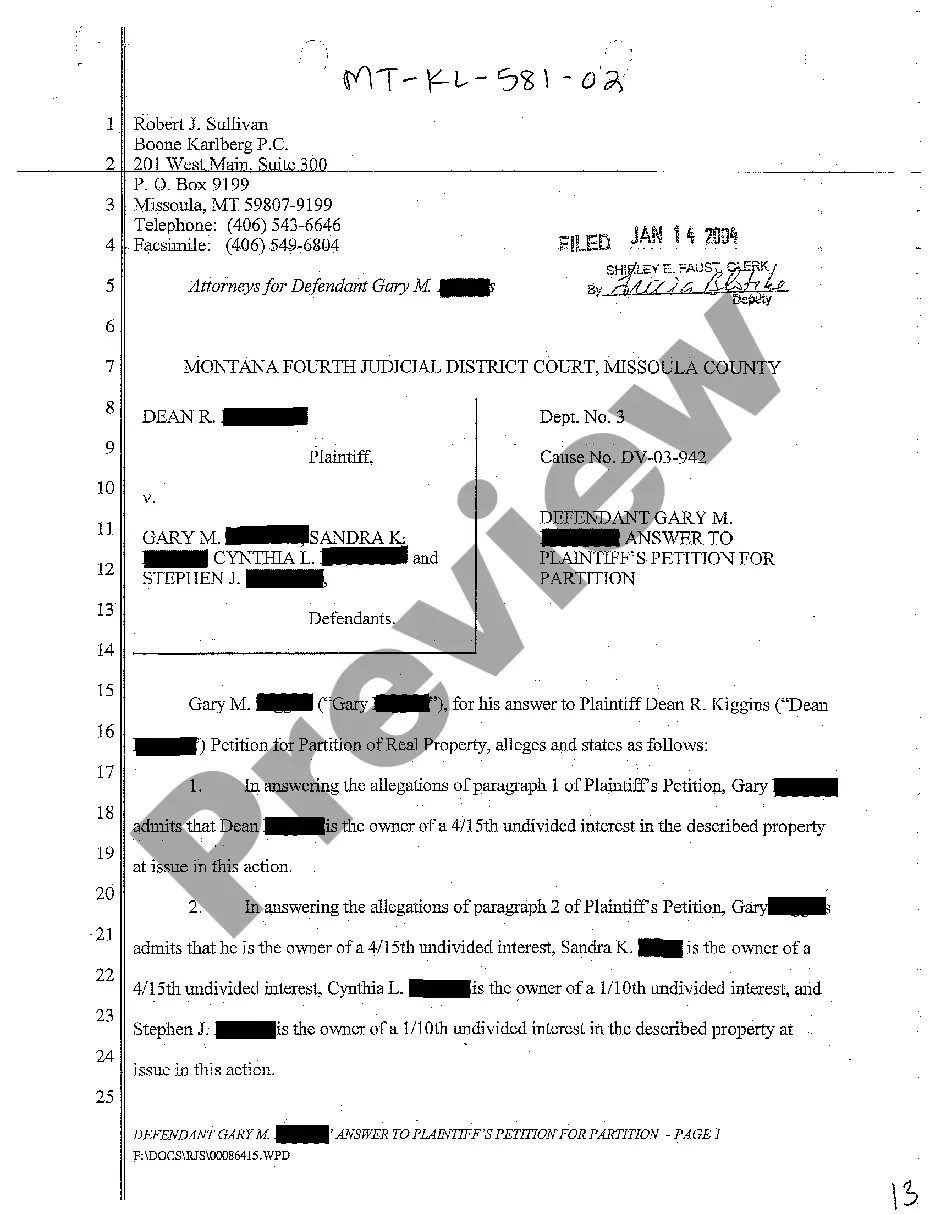

Delaware Receipt Template for Cash Payment

Description

How to fill out Receipt Template For Cash Payment?

If you need to finish, retrieve, or print sanctioned document templates, utilize US Legal Forms, the most comprehensive selection of legal forms available online.

Employ the site's straightforward and convenient search to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get it now button. Choose the pricing plan you prefer and enter your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Delaware Receipt Template for Cash Payment. Each legal document template you purchase belongs to you for years. You have access to every form you acquired in your account. Visit the My documents section and select a form to print or download again.

- Utilize US Legal Forms to obtain the Delaware Receipt Template for Cash Payment in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to receive the Delaware Receipt Template for Cash Payment.

- You can also access forms you have previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to check the form's content. Don’t forget to read the information.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to find other varieties of the legal form template.

Form popularity

FAQ

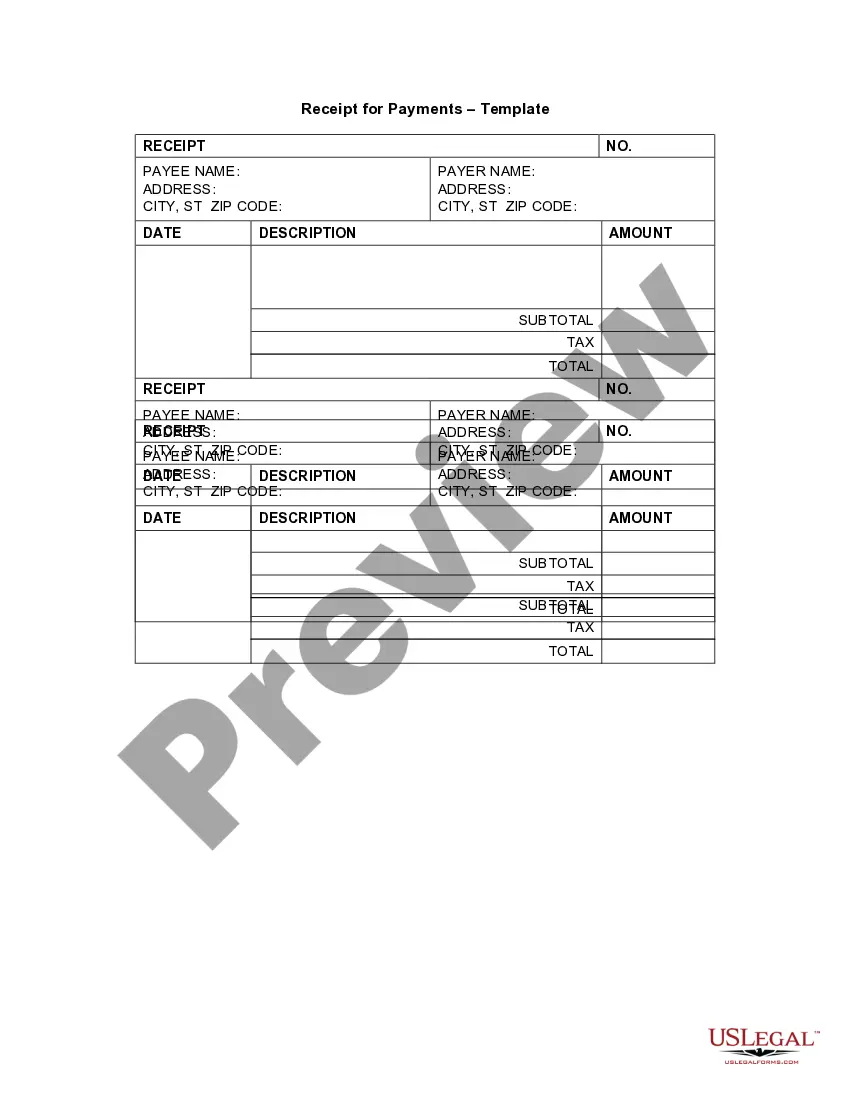

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.

If you operate a nonprofit organization, you must report gross receipts as your total income, rather than gross sales, as your income is most likely not sales-driven. For-profit businesses generally have sales income, which includes sales of services as well as goods.

According to Delaware's Division of Revenue, any company that is engaged in business in the state must have a business license and pay GRT. You must pay the tax if you sell goods or provide services in Delaware. Depending on the business's activity, gross receipts tax rates can range from 0.0945% to 0.7468%.

The basic components of a receipt include:The name and address of the business or individual receiving the payment.The name and address of the person making the payment.The date the payment was made.A receipt number.The amount paid.The reason for the payment.How the payment was made (credit card, cash, etc)More items...

Every case is different, but here are some potential ways to prove you paid for something with cash:Save Receipts. This seems like a no-brainer... and it is.Cashier's Checks or Money Orders.Bank Statements and ATM Receipts.Find a Witness.

People report the payment by filing Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or BusinessPDF. A person can file Form 8300 electronically using the Financial Crimes Enforcement Network's BSA E-Filing System. E-filing is free, quick and secure.

To find your gross receipts for personal income, add up your sales. Then, subtract your cost of goods sold and sales returns and allowances to get total income. The better your financial records are, the easier the process will be.

Doing Business in Delaware Delaware does not impose a state or local sales tax, but does impose a gross receipts tax on the seller of goods (tangible or otherwise) or provider of services in the state.

You may now file your gross receipts tax returns online and make a payment via credit/debit card or by Automated Clearing House (ACH) transaction from your checking account by visiting revenue.delaware.gov and clicking the link File Gross Receipts Tax. You will need either your Federal Employer Identification Number

Add up your total sales to get gross receipts. If you've kept good records, it should be simple. Then subtract the cost of goods sold, as well as sales returns and allowances, to get your total income.