Whether a trust is to be revocable or irrevocable is very important, and the trust instrument should so specify in plain and clear terms. This form is a partial revocation of a trust (as to specific property) by the trustor pursuant to authority given to him/her in the trust instrument. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee

Description

How to fill out Partial Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Partial Revocation By Trustee?

If you need to total, acquire, or print valid document templates, utilize US Legal Forms, the finest variety of legal forms available online.

Take advantage of the site's straightforward and convenient search feature to find the documents you need. Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Employ US Legal Forms to find the Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee with just a few clicks.

Every legal document template you purchase belongs to you for years. You can access every form you downloaded in your account.

Stay competitive and acquire, and print the Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee with US Legal Forms. There are millions of professional and state-specific forms available for your personal or business needs.

- If you are currently a US Legal Forms user, Log In to your account and click the Download button to obtain the Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

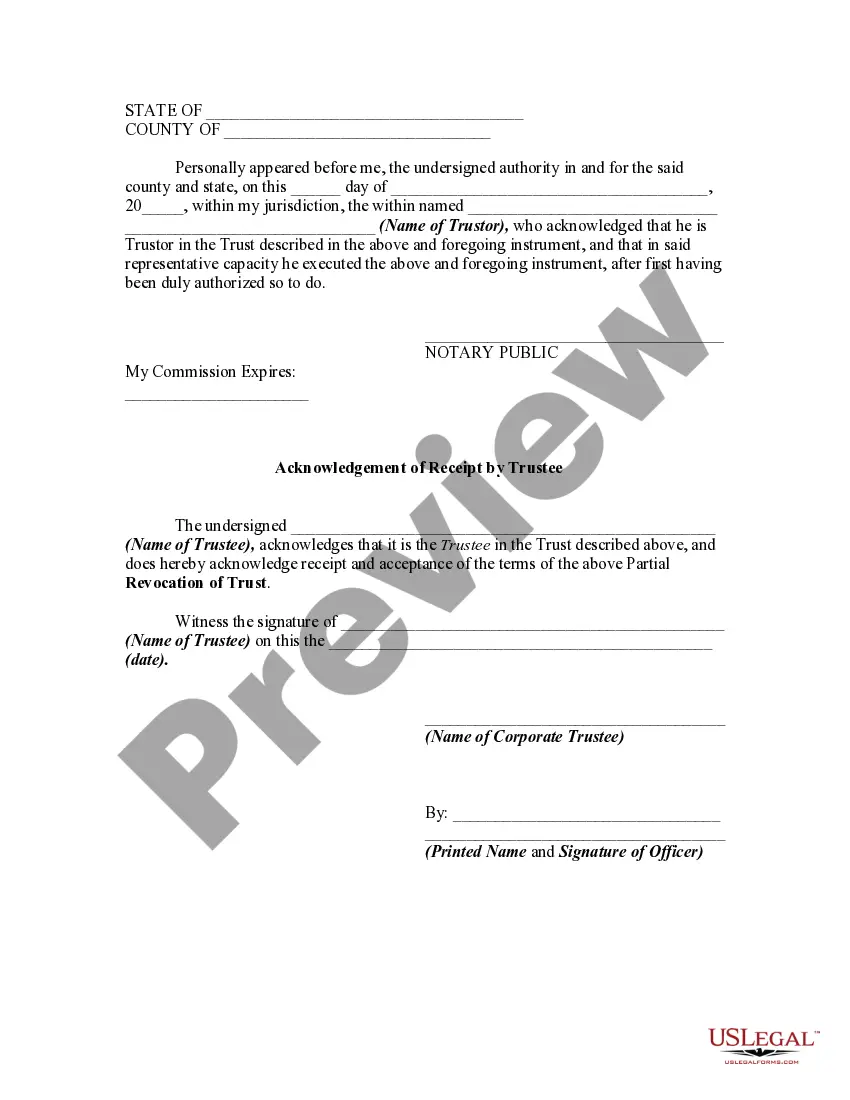

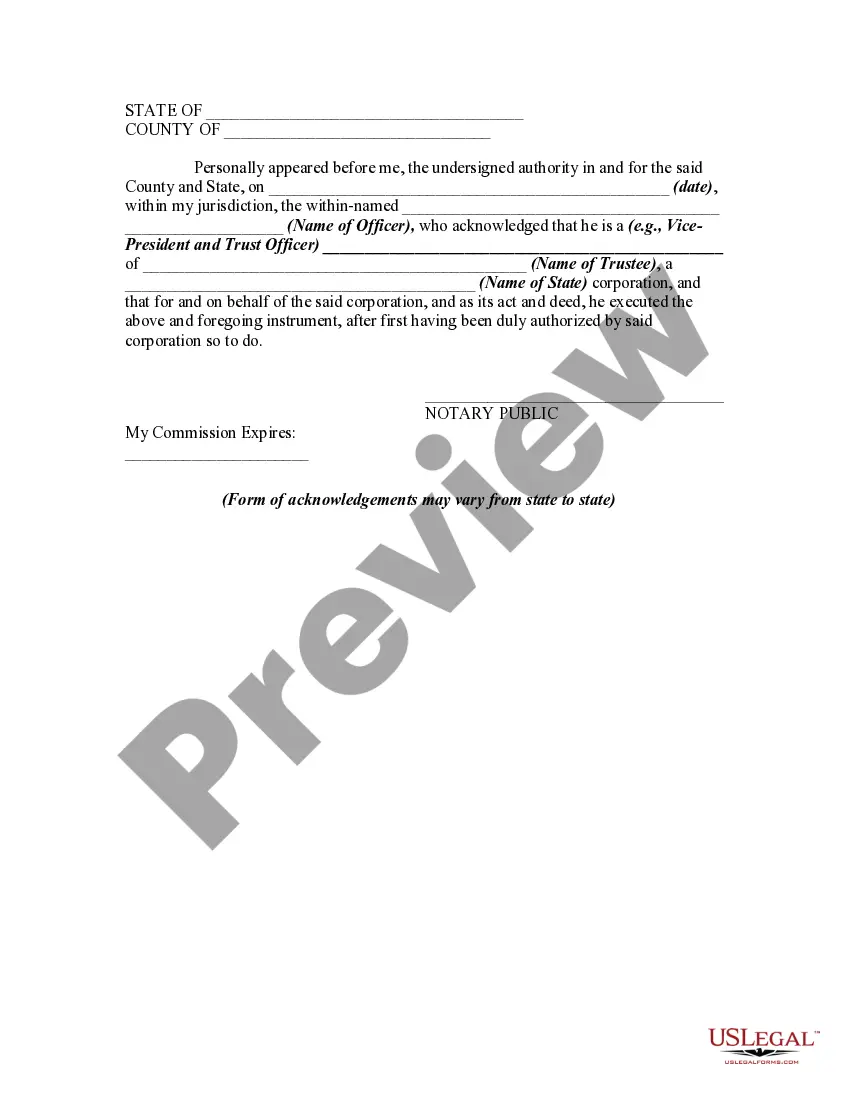

- Step 2. Use the Review option to examine the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of your legal form template.

- Step 4. Once you have found the form you need, select the Purchase now button. Choose the pricing plan you prefer and provide your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Download the format of your legal form and save it on your device.

- Step 7. Complete, edit, and print or sign the Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee.

Form popularity

FAQ

In Delaware, a trust does not need to be notarized to be valid. However, having a Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee notarized can add a layer of security and clarity. Notarization helps ensure that all parties involved recognize the legitimacy of the trust modifications. If you are unsure about the requirements, consider using US Legal Forms as a reliable source to navigate this process efficiently.

The Delaware Whistleblower Protection Act protects individuals who report violations of law or public policy from retaliation. This law underscores the importance of transparency and accountability in organizations. In the context of trust management, particularly regarding the Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, this act fosters an environment where trustees can act in the best interest of beneficiaries, without fear of repercussions. This legal framework encourages ethical behavior in fiduciary responsibilities.

The Delaware Voluntary Payment Doctrine allows recipients to recover payments made that were not legally owed. This principle can relate to trust management where distributions may be questioned. When considering Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, understanding how this doctrine can impact trust distributions is important. It ensures that all financial transactions are legitimate and justifiable.

Delaware Code 3313 specifically addresses the partial revocation process in trust management. It defines how trustees must handle notifications regarding the revocation, safeguarding the interests of all involved. The Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee are essential parts of this code, providing a structure that promotes transparency and adherence to legal requirements. Understanding this code is vital for trust administrators and beneficiaries alike.

Revocation of trust refers to the legal action where a trust creator decides to cancel a trust entirely or in part. This process often requires official documentation and notification to the involved parties. Specifically, the Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee highlights the necessary formalities for such actions. Proper execution of this process ensures that the trust’s assets are managed according to the new directives.

Delaware Code 3313 outlines the procedures for the partial revocation of a trust in Delaware. This legal framework provides clarity on how a trustee must acknowledge the receipt of a notice regarding such revocation. Understanding Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee is crucial for both trustees and beneficiaries. This ensures that all parties are aware of changes to the trust and supports compliance with state laws.

Creating a revocable trust in Delaware involves drafting a trust document that outlines the terms, appointing a trustee, and transferring assets into the trust. This type of trust allows the settlor to make changes or revoke the trust during their lifetime. Engaging with uslegalforms can simplify this process and ensure the trust complies with Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee requirements.

Revocation of trust refers to the legal act of canceling or terminating a trust, which returns control of the assets to the settlor. This process allows settling personal affairs regarding asset management. The Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee offers a structured way to achieve this safely and effectively.

A trust can be deemed null and void for several reasons, such as failure to meet legal requirements during its creation or if the trust's purpose is illegal. Additionally, the dissatisfaction of the settlor regarding the trust's terms can lead to a revocation. Individuals considering action, such as Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee, should seek legal advice to ensure compliance.

The decanting statute for trusts in Delaware allows trustees to transfer assets from one trust to another, providing flexibility in trust management. This statute is designed to protect the intent of the original trust while adapting to changing circumstances. The Delaware Partial Revocation of Trust and Acknowledgment of Receipt of Notice of Partial Revocation by Trustee plays a crucial role in executing this process legally.