In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

Delaware Security Agreement with Farm Products as Collateral

Description

How to fill out Security Agreement With Farm Products As Collateral?

Are you currently in a situation where you frequently require documents for either business or personal purposes.

There are numerous legal document templates accessible on the web, but finding reliable ones is not straightforward.

US Legal Forms offers a vast array of template options, including the Delaware Security Agreement with Farm Products as Collateral, specifically designed to comply with federal and state regulations.

Choose a suitable document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Delaware Security Agreement with Farm Products as Collateral anytime, if needed. Just click on the desired template to download or print the document format.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Subsequently, you can download the Delaware Security Agreement with Farm Products as Collateral template.

- If you do not possess an account and wish to start using US Legal Forms, follow these instructions.

- Identify the template you need and verify it is for the correct city/state.

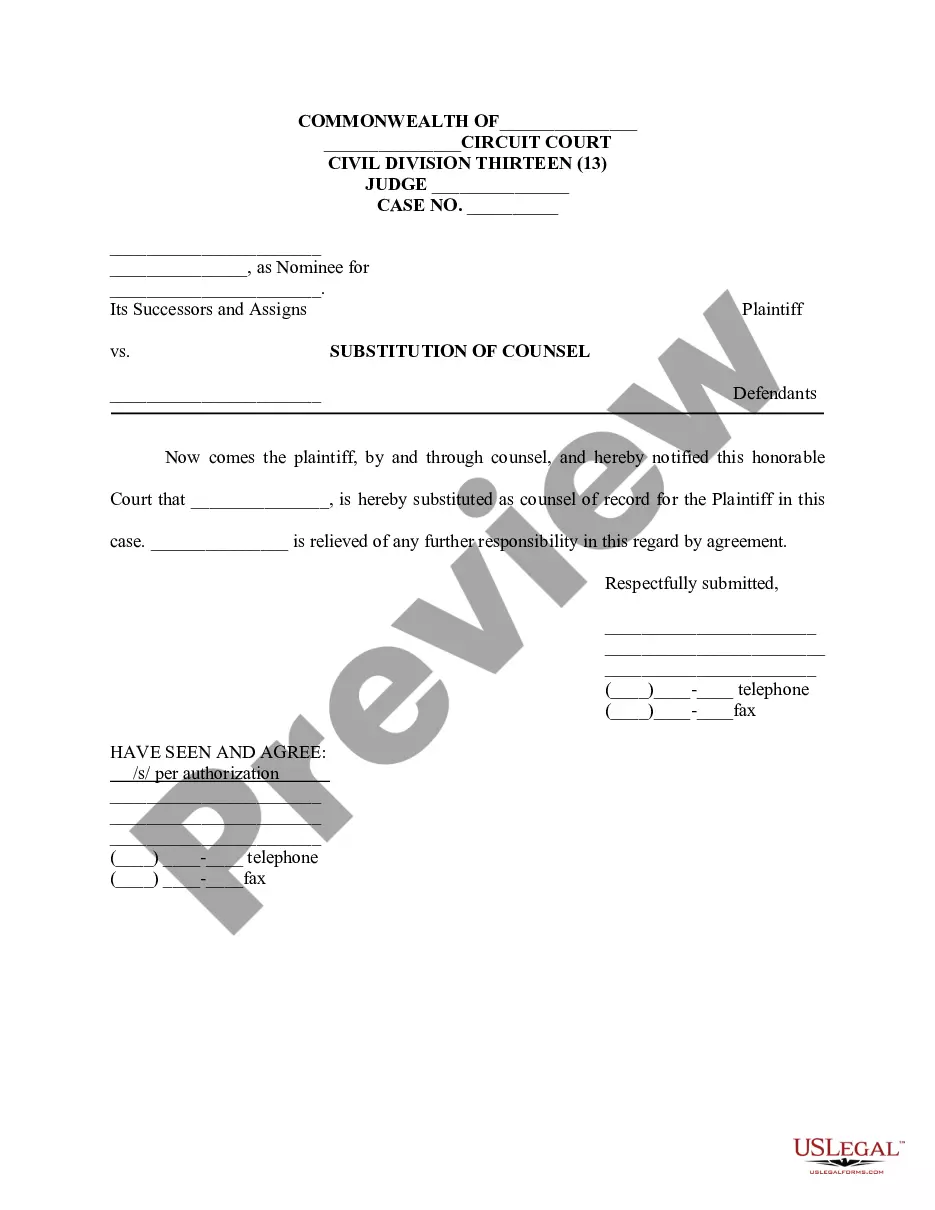

- Utilize the Review button to examine the document.

- Read the description to ensure you have chosen the correct template.

- If the template is not what you are seeking, use the Search bar to find the document that fulfills your needs and specifications.

- Once you find the right template, click Get now.

- Select the payment plan you prefer, provide the required details to create your account, and process your order using PayPal or credit card.

Form popularity

FAQ

To perfect collateral effectively, it is essential to follow the outlined legal steps specific to the type of collateral you possess. In the context of a Delaware Security Agreement with Farm Products as Collateral, ensure that your financing statement is correctly completed and filed according to Delaware's requirements. This step secures your interest and protects it against competing claims. Using resources provided by uslegalforms can simplify your journey toward securing your interests.

Perfecting collateral typically involves filing a financing statement or taking possession of the collateral, depending on the type. With a Delaware Security Agreement with Farm Products as Collateral, you must ensure that all necessary forms are completed and filed with the Delaware Secretary of State. Perfection provides you with legal protection and priority in the event of debtor default. Uslegalforms offers guided templates to help facilitate this process accurately.

Perfecting uncertificated stock requires establishing control over the stock directly with the issuer. In a Delaware Security Agreement with Farm Products as Collateral, this might necessitate a written agreement outlining your secured party status and a change in records with the issuer. Without establishing control, your security interest may not be enforceable. Our platform can help you draft and file the necessary documentation to ensure proper perfection.

To perfect a security interest in uncertificated stock under a Delaware Security Agreement with Farm Products as Collateral, you must obtain control over the stock. This often involves notifying the issuer and changing the records to reflect your secured status. Control is pivotal because it enables you to enforce the security interest effectively. Engaging with legal resources or services can help streamline this process and ensure compliance with state laws.

A perfected interest in collateral signifies that a creditor has a legally established right to the collateral, ensuring their claim is prioritized over others. In the context of a Delaware Security Agreement with Farm Products as Collateral, this means that the secured creditor can enforce their rights against the farm products in the event of default. Perfection often involves proper filing or registration with the appropriate state authority. This helps protect your interests and ensures you have a reliable legal claim.

For a security interest to attach, several key factors must be present. Firstly, a valid security agreement must exist, defining the terms of the security arrangement, particularly related to farm products as collateral. Additionally, the secured party must provide value to the debtor, and the debtor must have rights in the collateral. These elements combine to ensure the security interest is both legitimate and enforceable.

Creating a security interest requires a few essential elements. You'll need a written security agreement, where both parties agree on the terms involving the collateral, which in this case comprises farm products. Furthermore, you need to give value, meaning the secured party must provide something of worth, and the debtor has to possess rights to the collateral to make the arrangement legally binding.

To create a valid security interest, you need to follow specific steps outlined in a Delaware Security Agreement with Farm Products as Collateral. Start by drafting a written security agreement that describes the collateral and both parties' rights. Next, provide value in exchange for the security interest and ensure that the debtor has the authority to pledge the collateral. Meeting these criteria establishes a legally enforceable interest that protects the lender.

To create a security interest under a Delaware Security Agreement with Farm Products as Collateral, you must satisfy three key requirements. First, there must be a valid security agreement that outlines the rights and obligations of the parties involved. Second, the secured party must give value in exchange for the security interest. Finally, the debtor must have rights in the collateral, ensuring that they legally possess the farm products used as collateral.

In Delaware, a UCC filing is generally valid for five years from the date of filing. This duration applies to a Delaware Security Agreement with Farm Products as Collateral and secures the lender's interest in the collateral for that period. To maintain the security interest beyond five years, a lender may need to file for continuation, ensuring ongoing protection of their investment.