This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

Delaware Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

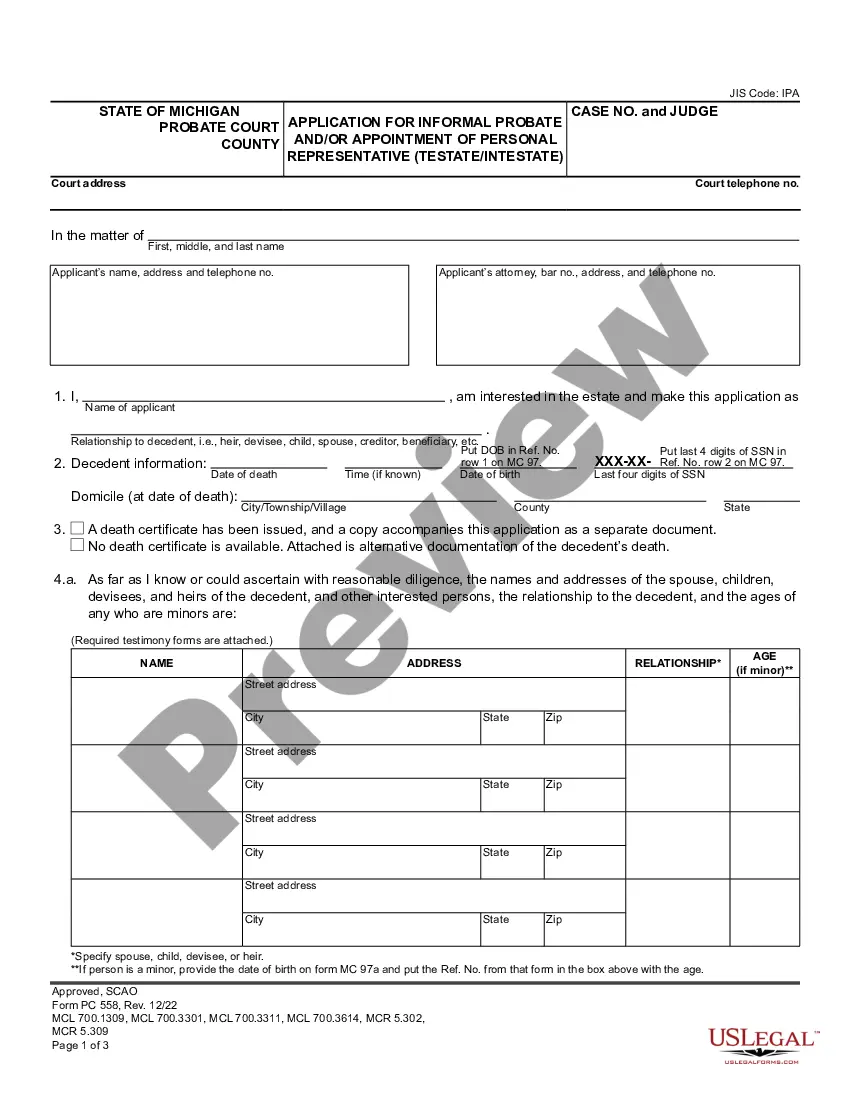

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

Finding the appropriate legal document format can be a challenge. It's obvious that there are numerous templates accessible online, but how will you locate the legal form you need? Utilize the US Legal Forms website. The platform offers a vast array of templates, including the Delaware Application for Release of Right to Redeem Property from IRS After Foreclosure, which can be utilized for both business and personal purposes. All documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Obtain button to access the Delaware Application for Release of Right to Redeem Property from IRS After Foreclosure. Use your account to browse through the legal forms you may have previously acquired. Navigate to the My documents tab of your account and download another copy of the document you require.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Preview button and read the form description to confirm that it is indeed the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click on the Purchase now button to obtain the form. Choose the pricing plan you prefer and enter the necessary details. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, edit, print, and sign the acquired Delaware Application for Release of Right to Redeem Property from IRS After Foreclosure.

This service simplifies the process of obtaining legal documents, making it accessible for everyone.

- US Legal Forms is the largest collection of legal forms where you can find various document templates.

- Utilize the service to download professionally crafted documents that meet state requirements.

- Explore multiple formats for your legal needs.

- Access expert-reviewed templates for your assurance.

- Ensure compliance with legal standards effortlessly.

- Find forms suitable for both personal and business use.

Form popularity

FAQ

A foreclosure does not automatically eliminate an IRS lien. The IRS retains its claim against the property even after foreclosure, which means you need to address the lien separately. To resolve this issue, you can file a Delaware Application for Release of Right to Redeem Property from IRS After Foreclosure, ensuring that any outstanding debts are managed effectively. Services like USLegalForms can assist you in navigating this process, helping you understand your rights and obligations.

To obtain a lien release from the IRS, you need to file a Delaware Application for Release of Right to Redeem Property from IRS After Foreclosure. This process involves submitting necessary documentation and, if applicable, paying any outstanding tax debts. Once the IRS processes your application and confirms the debt is settled, they will issue a lien release. Utilizing platforms like USLegalForms can simplify this process, providing you with guidance and necessary forms.

The statute of limitations on Delaware state taxes generally allows the state three years to assess any unpaid taxes. This period begins from the date you filed your tax return. However, if you did not file a return, the statute of limitations may not apply, and the state can pursue tax collection indefinitely. If you are dealing with issues related to the Delaware Application for Release of Right to Redeem Property from IRS After Foreclosure, it’s essential to understand these timelines, as they can impact your financial decisions.

Foreclosure redeemed means that the previous owner has successfully reclaimed their property after a foreclosure by paying off the outstanding debts. This process restores ownership rights and eliminates any tax claims against the property. To ensure a smooth redemption, consider the Delaware Application for Release of Right to Redeem Property from IRS After Foreclosure available on US Legal Forms.

The right to redeem property after a foreclosure allows the former owner to reclaim their property by paying the total amount owed, including taxes and fees. This right is often time-sensitive, requiring prompt action to take advantage of it. The Delaware Application for Release of Right to Redeem Property from IRS After Foreclosure can help you navigate this critical process effectively.

The IRS 7 year rule refers to the guideline stating that federal tax liens typically expire after seven years if the owed taxes remain unpaid. However, this period can vary based on specific circumstances. Understanding this rule is crucial, and using the Delaware Application for Release of Right to Redeem Property from IRS After Foreclosure can provide clarity on your situation.

After foreclosure, the federal tax lien remains attached to the property until the debt is settled. Even if the property is sold, the IRS's claim can still affect future ownership. To understand your options and potentially release this lien, consider leveraging the Delaware Application for Release of Right to Redeem Property from IRS After Foreclosure through US Legal Forms.

To obtain a lien payoff from the IRS, you must request a payoff amount directly from the IRS, typically through Form 668-Z. This form requires details about your debt and the property involved. Completing the Delaware Application for Release of Right to Redeem Property from IRS After Foreclosure can assist you in understanding the process and ensuring that you receive accurate information.

The IRS right of redemption allows property owners to reclaim their property after a foreclosure sale by paying off the owed taxes and associated penalties. This process ensures that taxpayers can maintain ownership of their property even after a tax foreclosure. To navigate this complex process, consider using the Delaware Application for Release of Right to Redeem Property from IRS After Foreclosure through US Legal Forms.