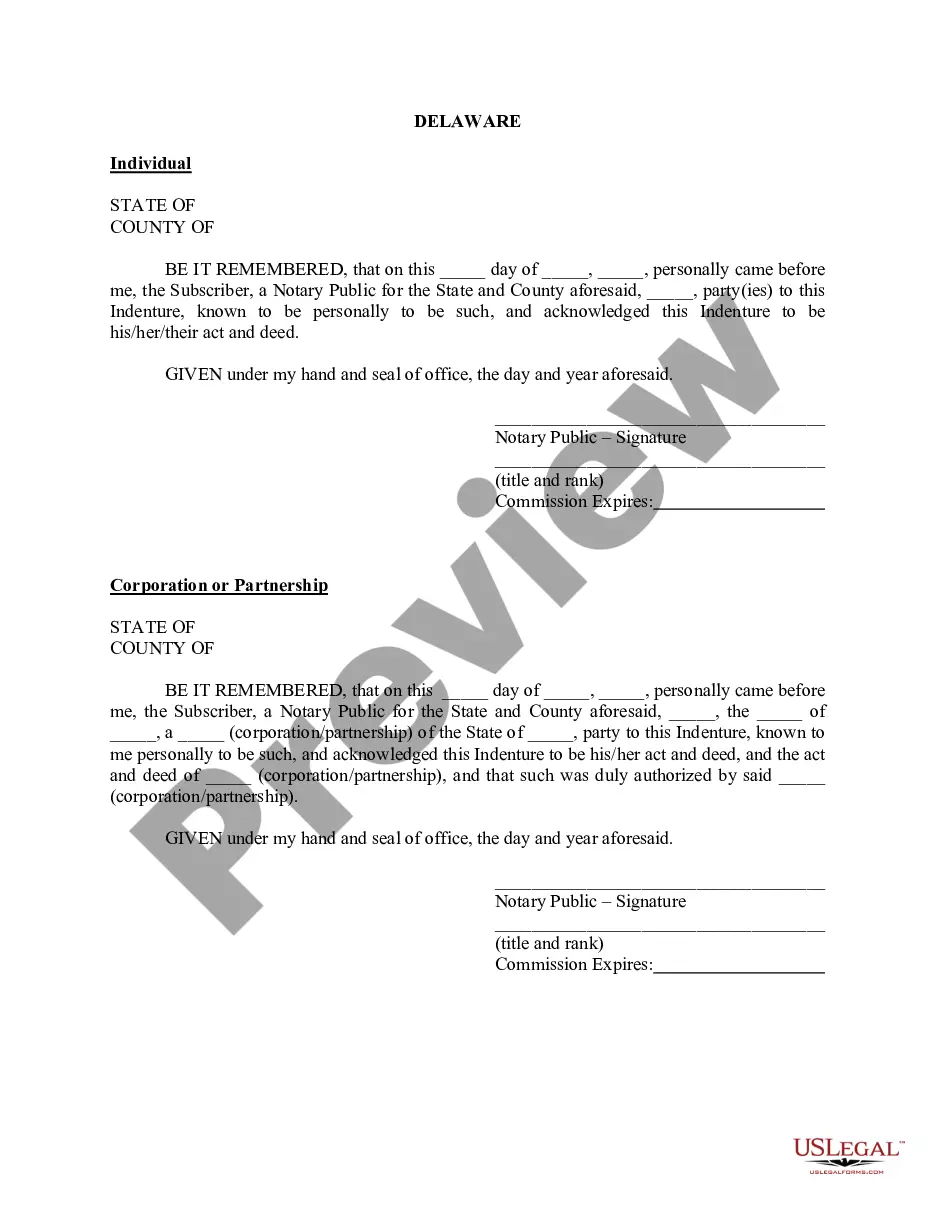

Delaware Oil and Gas Acknowledgement

Description

How to fill out Delaware Oil And Gas Acknowledgement?

The larger quantity of documents you need to prepare - the more anxious you become.

You can find a vast selection of Delaware Oil and Gas Acknowledgement templates online, yet you are uncertain which of them to trust.

Eliminate the complexity and make locating samples easier with US Legal Forms. Obtain precisely composed forms that are crafted to meet state standards.

Locate each template you receive in the My documents menu. Just navigate there to create a new duplicate of your Delaware Oil and Gas Acknowledgement. Even when preparing professionally drafted forms, it is still wise to consider consulting your local attorney to review the completed sample to ensure that your document is filled out correctly. Achieve more for less with US Legal Forms!

- Verify if the Delaware Oil and Gas Acknowledgement is acceptable in your state.

- Confirm your selection by reviewing the description or by utilizing the Preview mode if available for the chosen document.

- Click Buy Now to initiate the registration process and select a pricing plan that meets your needs.

- Enter the required information to create your account and complete your order with PayPal or a credit card.

- Choose a suitable file format and acquire your copy.

Form popularity

FAQ

Yes, you can conveniently file your Delaware state taxes online through the Delaware Division of Revenue's website. This online filing streamlines the process and minimizes paperwork, which is beneficial for anyone involved in the oil and gas sector, especially when dealing with Delaware Oil and Gas Acknowledgement. Additionally, US Legal Forms offers resources to assist you with tax forms and filing requirements, ensuring you stay compliant and informed. Experience the ease of online services to manage your tax obligations.

The processing time for a Certificate of Formation in Delaware typically ranges from a few days to a couple of weeks. However, using a platform like US Legal Forms can significantly speed up the process. By leveraging our resources and expertise in the Delaware Oil and Gas Acknowledgement, you can ensure your application is accurately prepared and submitted without unnecessary delays. Quick and correct submissions lay the groundwork for your oil and gas ventures.

Certain types of income, such as interest from government bonds and some types of capital gains, may not be taxed in Delaware. Understanding these exceptions is important for managing your finances, particularly in the context of oil and gas investments. By familiarizing yourself with these aspects, you align yourself with the principles of the Delaware Oil and Gas Acknowledgement and optimize your tax strategy.

Section 1909 of Delaware Title 30 addresses the gross receipts tax and outlines what transactions are taxable. It is essential for businesses in the oil and gas industry to understand this section, as it impacts their financial obligations. By studying this legislation, you can better navigate Delaware's tax landscape and fulfill requirements associated with the Delaware Oil and Gas Acknowledgement.

Businesses generating gross receipts from sales within Delaware must file a gross receipts tax return. This includes companies in the oil and gas sector, which need to be particularly diligent about understanding their tax obligations. Filing accurately helps maintain your business's good standing in the state, as outlined in the Delaware Oil and Gas Acknowledgement.

All corporations doing business in Delaware must file a corporate tax return, regardless of where they are incorporated. This includes any entity receiving income from oil and gas operations. Proper filing helps you avoid penalties and ensures compliance with Delaware laws, including the Delaware Oil and Gas Acknowledgement.

You can find your Delaware tax ID number by checking your business registration documents or by visiting the Delaware Division of Revenue website. If you can't locate these documents, you might contact their office for assistance. Knowing your Delaware tax ID is crucial for compliance in matters such as the Delaware Oil and Gas Acknowledgement.

To file a Delaware annual report, you must complete the necessary forms available on the Delaware Division of Corporations website. Typically, corporations and LLCs need to submit their reports by March 1st each year. This report ensures that you remain in good standing within the state. Make sure to review the Delaware Oil and Gas Acknowledgement for any specific requirements related to your industry.

Yes, Delaware does tax royalty income. If you receive payments from oil, gas, or mineral extraction, that income is subject to Delaware taxes. It is important to understand your tax obligations when dealing with royalties in the state. Utilizing the Delaware Oil and Gas Acknowledgement can help you stay compliant with state regulations.

The Energy Policy Act aims to establish a comprehensive energy framework to promote energy independence and conservation. Its primary focus is on facilitating energy efficiency, renewable energy development, and affordability. By understanding this act, you can appreciate its impact on energy policies, including aspects related to the Delaware Oil and Gas Acknowledgement.