Delaware Self-Procured Insurance

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

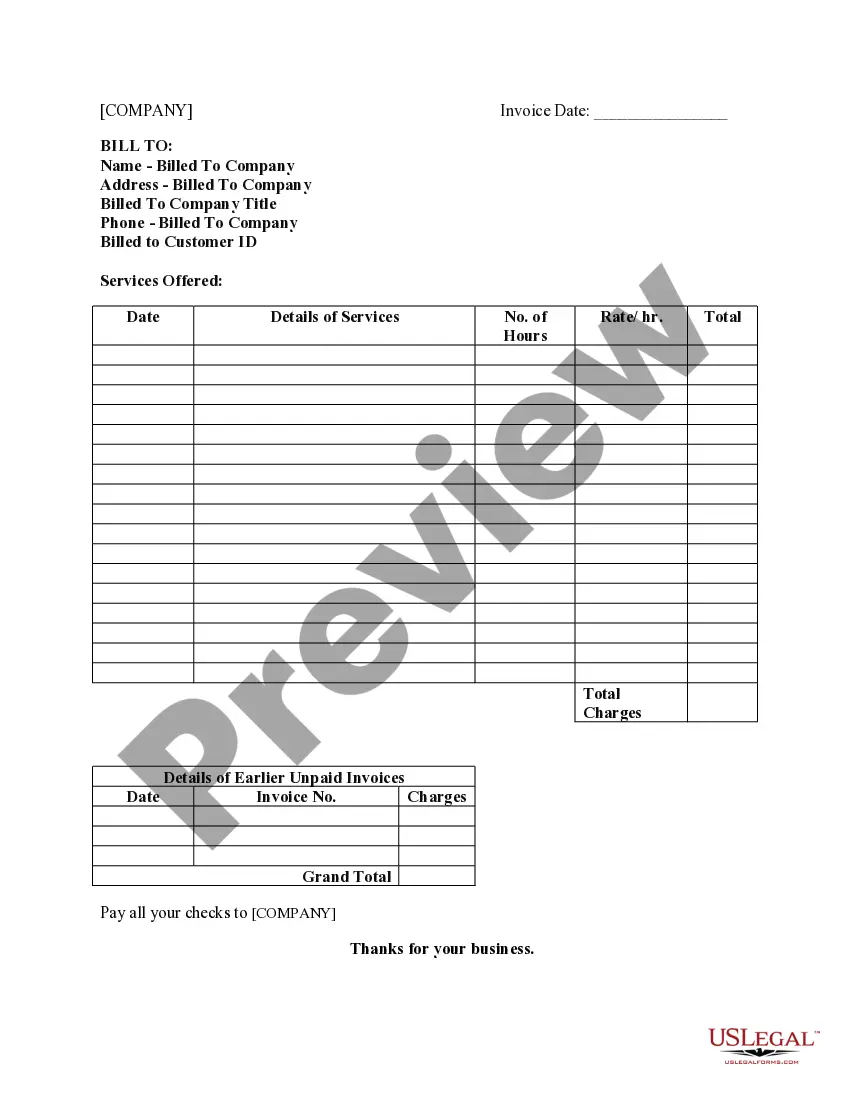

How to fill out Delaware Self-Procured Insurance?

How much time and resources do you frequently allocate to creating official documentation.

There’s a better chance of obtaining such forms than employing legal professionals or investing hours searching the internet for an appropriate template.

An additional advantage of our service is that you can access previously acquired documents that you securely store in your profile in the My documents tab. Retrieve them at any time and re-complete your paperwork as often as necessary.

Save time and energy completing official documentation with US Legal Forms, one of the most trusted online services. Join us today!

- Review the form content to confirm it aligns with your state requirements. To do so, read the form description or utilize the Preview option.

- If your legal template does not satisfy your requirements, find another one using the search tab at the top of the page.

- If you are already subscribed to our service, Log In and download the Delaware Self-Procured Insurance. If not, continue to the subsequent steps.

- Click Buy now once you locate the correct blank. Choose the subscription plan that best fits you to access our library’s full service.

- Register for an account and pay for your subscription. You can complete the transaction using your credit card or through PayPal - our service is absolutely secure for that.

- Download your Delaware Self-Procured Insurance onto your device and fill it out on a printed hard copy or electronically.

Form popularity

FAQ

Having an insurance license is highly beneficial for those looking to establish a career in the insurance industry. With a license, you can offer various coverage options, including Delaware Self-Procured Insurance, which allows for tailored solutions to meet specific needs. This can enhance your credibility and expand your client base, making the effort of obtaining a license worthwhile. Additionally, licensed professionals often enjoy better earning potential and job security.

To obtain your insurance license in Delaware, you need to complete specific educational requirements and pass a licensing exam. Once you achieve a passing score, submit your application along with any required fees to the Delaware Department of Insurance. As you pursue your license, consider how Delaware Self-Procured Insurance can play a crucial role in your insurance offerings, providing unique benefits for businesses and individuals alike.

Yes, it is illegal to drive without insurance in Delaware. The state requires all drivers to have a minimum level of coverage to legally operate a vehicle. Without this coverage, drivers not only face penalties, but they also risk being financially unprotected in case of an accident. Delaware Self-Procured Insurance can provide a tailored solution for those looking to meet this legal requirement while ensuring they have adequate protection on the road.

Independently insured refers to a situation where an individual or organization secures their own insurance policy separate from any general insurance coverage offered by another entity. With Delaware Self-Procured Insurance, you can independently choose the insurance package that meets your specific needs. This approach often provides customized coverage options that can be more beneficial than standard policies.

In Delaware, the law requires drivers to carry liability insurance, which includes coverage for bodily injury and property damage. Delaware Self-Procured Insurance allows you to choose the level of coverage according to your budget and driver needs. It's essential to ensure that your insurance meets the minimum state requirements while providing adequate protection.

Procuring insurance means obtaining a suitable policy from an insurance provider. When you engage in Delaware Self-Procured Insurance, you take active steps to find coverage that aligns with your specific risks and needs. This approach offers flexibility and allows you to negotiate terms that may benefit you financially in the long run.

No, you cannot register a car in Delaware without insurance. The state requires proof of insurance as part of the vehicle registration process. By utilizing Delaware Self-Procured Insurance, you can secure the appropriate coverage prior to registration, ensuring you meet all legal requirements and avoid legal complications.

Yes, in Delaware, it is mandatory to have insurance on your trailer if you plan to use it on public roads. Delaware Self-Procured Insurance can provide the necessary coverage tailored to trailers, helping you comply with state laws. Ensure that your insurance policy reflects the type of trailer you own and its intended use to avoid penalties.

Insurance procurement refers to the process of obtaining insurance coverage from a provider. In the context of Delaware Self-Procured Insurance, it highlights the ability to select and acquire your own insurance policy tailored to specific needs. This process allows individuals or businesses to have more control over their coverage options and costs, ensuring they meet legal requirements.

Yes, proof of insurance is a key requirement for registering a car in Delaware. You must show proof that your insurance meets state minimum requirements before you can complete the registration process. This is designed to ensure that all drivers have adequate coverage on the road. For those looking for flexible insurance solutions, Delaware Self-Procured Insurance may be a valuable option to consider.